Stay Informed and Stay Ahead: Market Watch, June 26th, 2024.

Mid-Week Wall Street Markets

Key Takeaways

+ NASDAQ, S&P 500, Dow rose; 8 sectors fell, with Consumer Discretionary leading/ Energy lagging. Top industry Air Freight & Logistics.

+ May new home sales remain weak, missing forecasts and falling behind last month. Explore Friday’s PCE reports here.

+ Bond yields increased across the board, Tesla bulls dominate, Large Cap Growth up, Crude oil and Bitcoin stable.

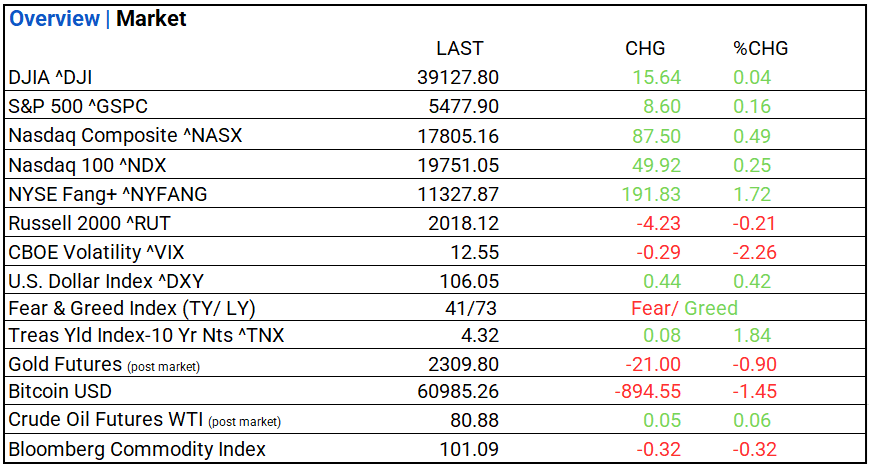

Summary of Market Performance

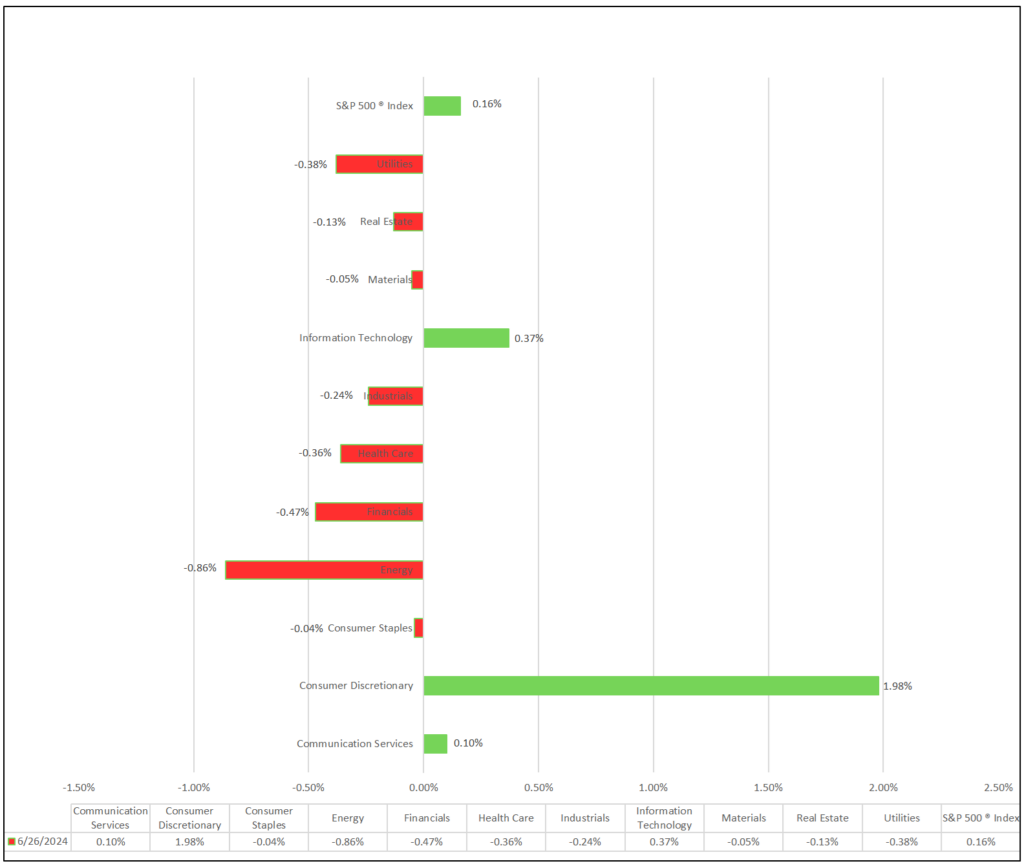

Indices & Sectors Performance:

- Today, the Dow, NASDAQ, and S&P 500 rose. Eight of eleven sectors declined, with Consumer Discretionary leading and Energy lagging. Top industries: Air Freight & Logistics (+6.42%), Automobiles (+3.93%), and Broadline Retail (+3.82%).

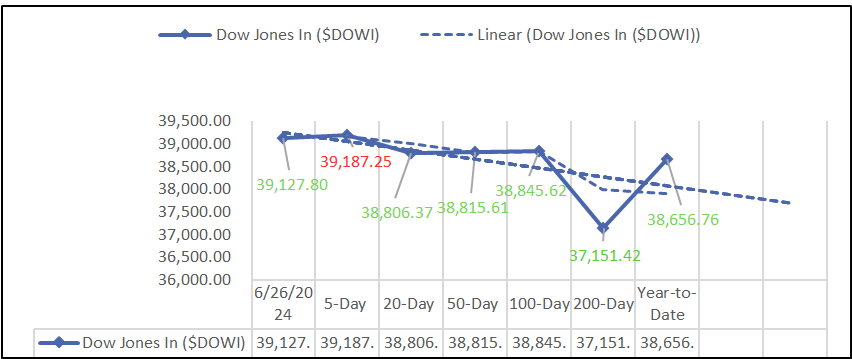

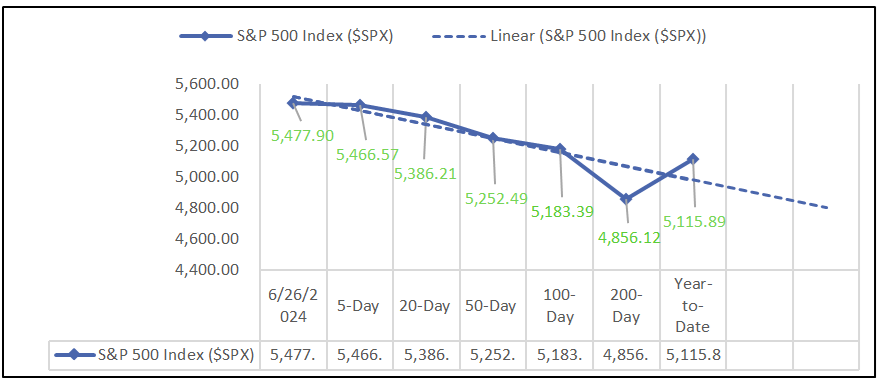

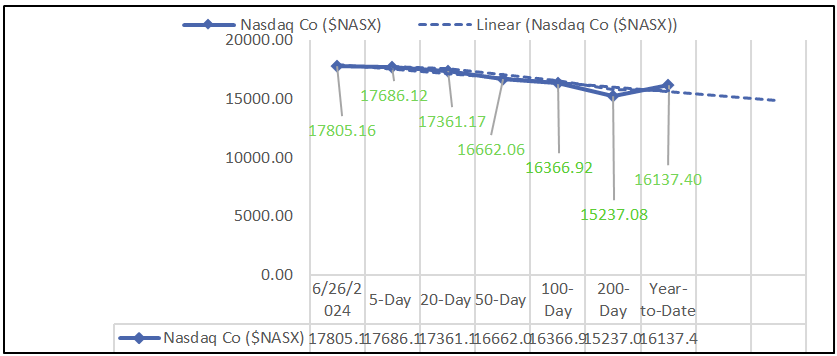

Chart: Performance of Major Indices

Moving Average Analysis:

S&P 500 Sectors:

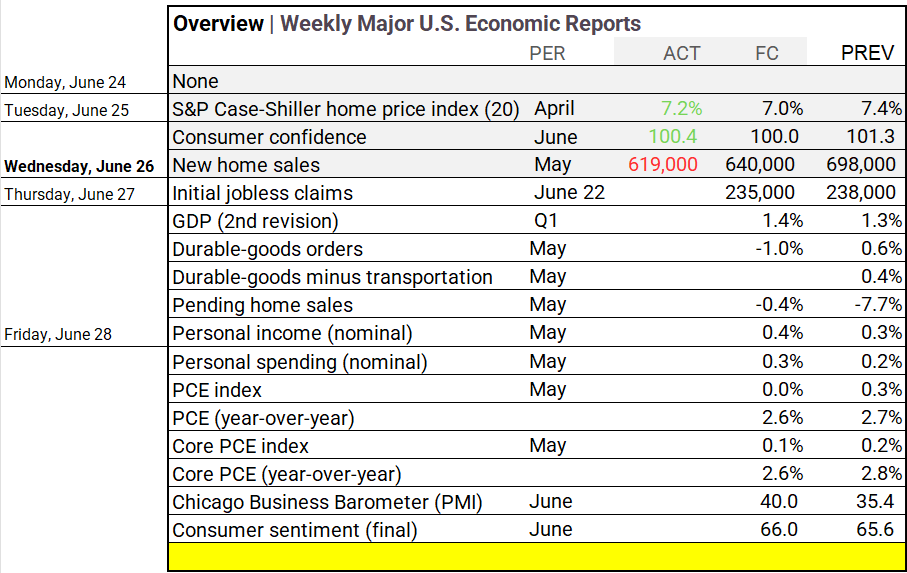

Economic Highlights:

- May new home sales remain weak, missing forecasts and falling behind last month.

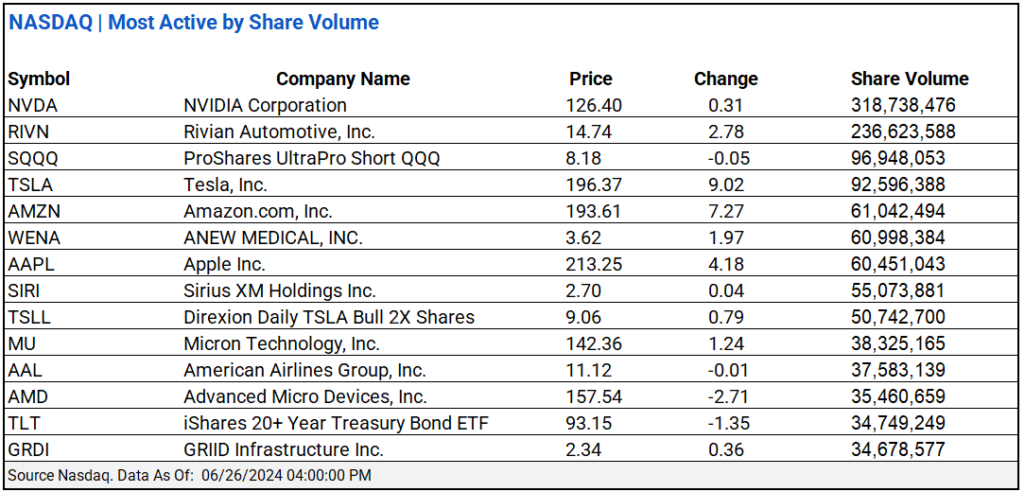

NASDAQ Global Market Update:

- Today’s Nasdaq had mixed sentiment: 4.95B shares traded, 79 new highs, 185 new lows, and an A/D ratio of 0.88. NVIDIA (318M) and Rivian (236M) led active share volumes.

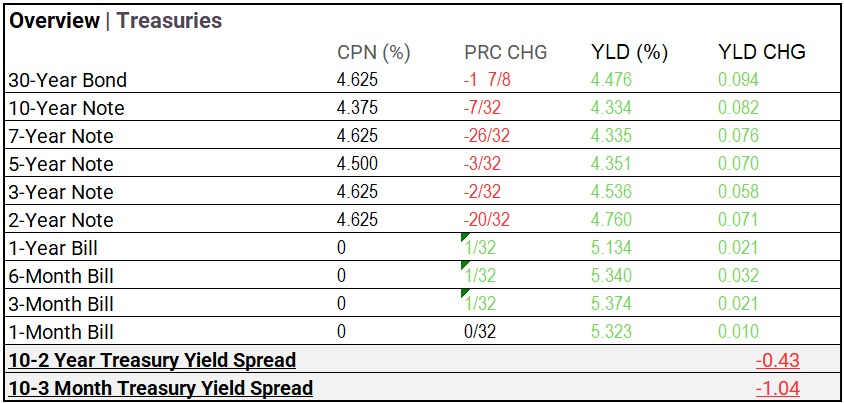

Treasury Markets:

- Bond yields increased across the board, with notable rises in the 30-year (4.476%) and 10-year (4.334%) notes.

Market Trends:

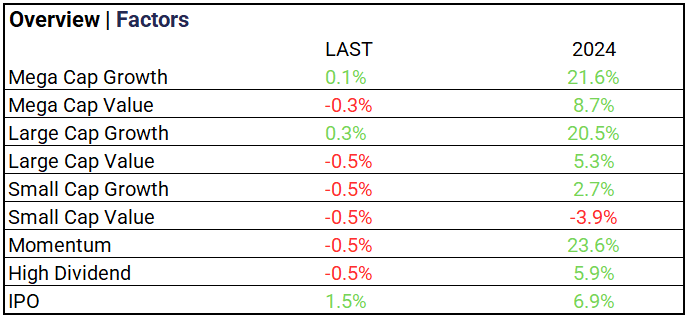

- IPO sector rose 1.5%, while most other categories saw declines. Large Cap Growth up 0.3%, others mostly negative.

Currency & Volatility:

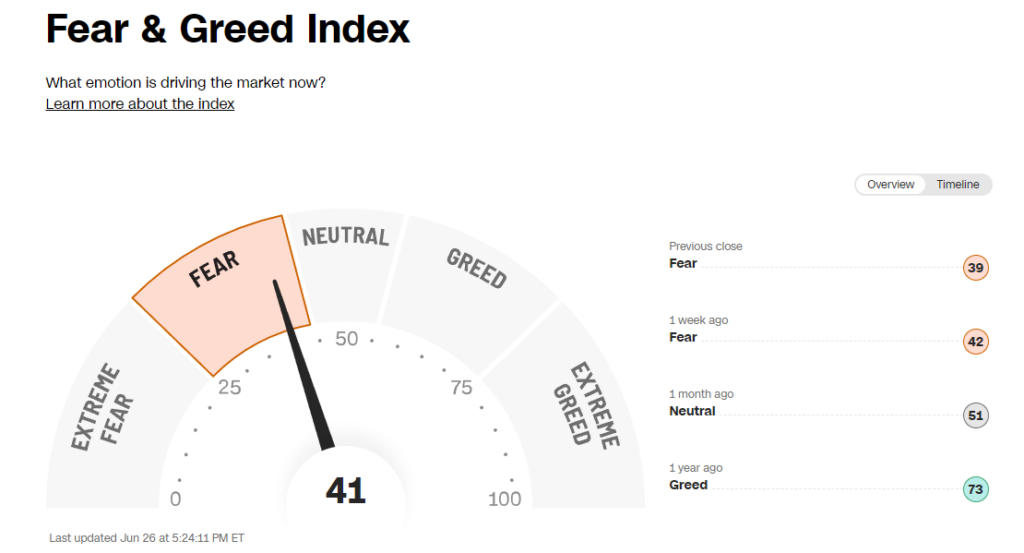

- VIX declined; Fear & Greed Index stays in fear territory during election year, down from Greed last year.

Commodities & ETFs:

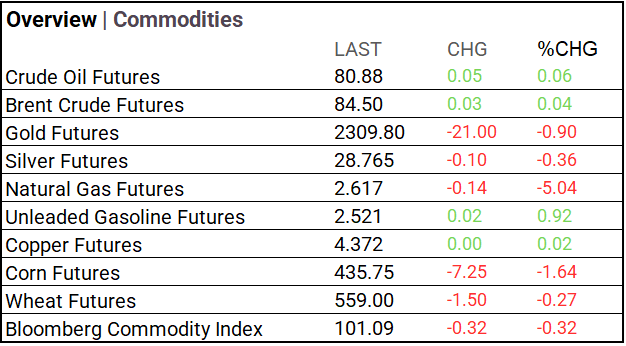

- Commodity markets: Crude oil stable, gold down, natural gas plunges, while corn and wheat see moderate declines.

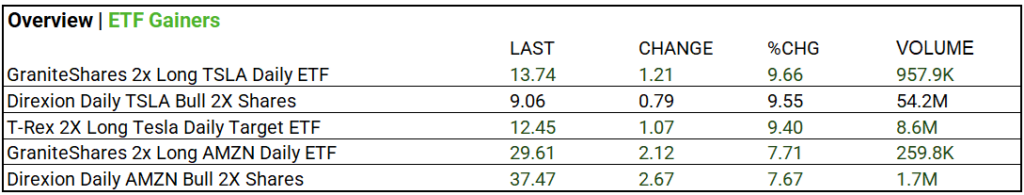

- ETF’s: Tesla bulls dominate, Direxion Daily TSLA Bull 2X Shares up 9.55% with significant 54.2M volume.

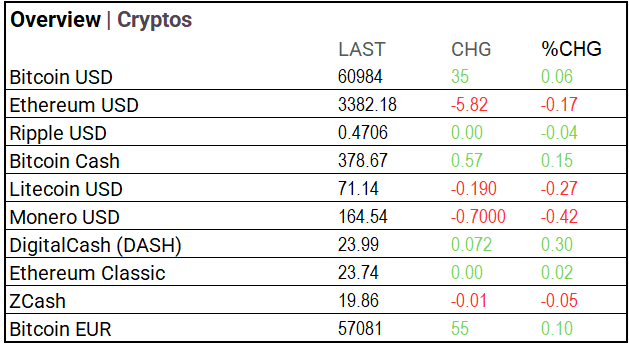

Cryptocurrency Update:

- Bitcoin stable at $60,984 (+0.06%), Ethereum dips to $3,382 (-0.17%).

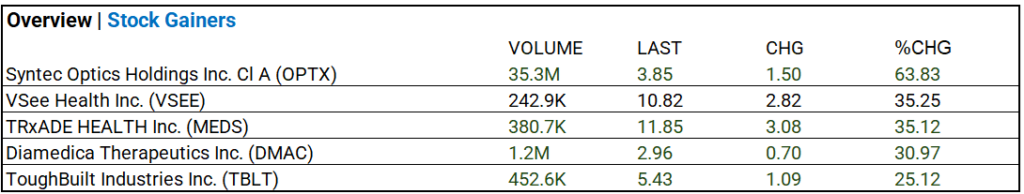

Stocks:

- Syntec Optics (OPTX) headlines: 35.3M volume, $3.85 (+1.50%, 63.83% change).

Notable Earnings:

- Significant outperformance: Micron (MU) met forward guidance but saw after-hours pullback, indicating analyst recalibration may be warranted.

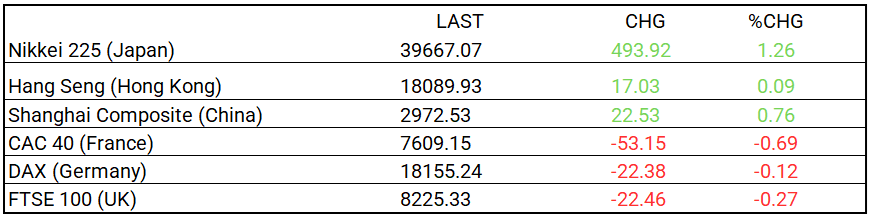

Global Markets Summary:

- Asia rises: Nikkei leads, up 1.26%. Europe falls, with France’s CAC 40 lagging at -0.69%.

In the NEWS:

Central Banking and Monetary Policy:

- Canada Inflation Picks Up in May, Rising 2.9% – Wall Street Journal

- Economists Raise China Growth Forecasts as Exports Improve – Bloomberg

Business:

- Southwest Airlines Cuts Revenue Outlook – Wall Street Journal

- Rivian’s 30% Rally Still Leaves a $138 Billion Valuation Hole – Bloomberg

China:

- US House panels consider how to counter China security threats and ‘unfair’ trade practices – South China Morning Post