MARKETS TODAY May 30th, 2023 (Vica Partners)

Last Friday, US Markets finished broadly higher, S&P 500 +1.30%, DOW +1.00 and the Nasdaq +2.19%. 8 of 11 of the S&P 500 sectors higher: Information Technology +2.68% outperformed/ Energy -0.37% lagged. Gold, Oil and the Bloomberg Commodity Index gained. In economic news, multiple releases points to resilience of overall economic activity.

Overnight/US Premarket, Asian markets finished higher, , Japan’s Nikkei 225 +0.30%, Hong Kong’s Hang Seng +0.24% and China’s Shanghai Composite +0.09%. US futures were trading at 0.3% above fair value. European markets finished lower today, London’s FTSE 100 -1.38%, France’s CAC 40 -1.29% and Germany’s DAX -0.27%.

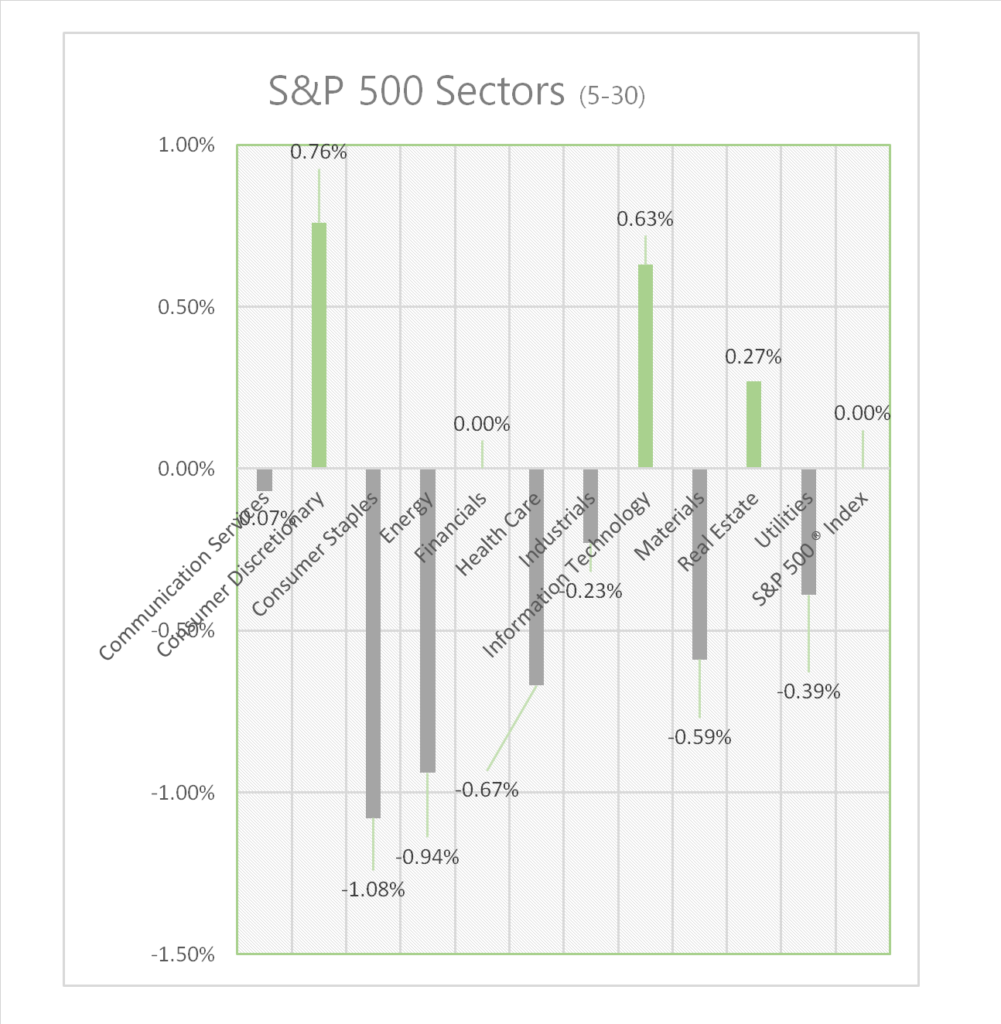

Today US Markets finished mixed, S&P 500 +0.00%, DOW -0.15% and the Nasdaq +0.32%. 7 of 11 of the S&P 500 sectors lower: Consumer Staples -1.08% underperforms/ Consumer Discretionary +0.76% outperforms. On the upside, FANG+, Gold, Oil and Bitcoin. In economic news, S&P Case-Shiller April home price index narrowly beat forecast, Consumer Confidence Index misses forecast and declines to 6 month low.

Takeaways

- Hedges and Traders options to better cover Tech rally

- Economic news reflects cooling

- NYSE Fang+ ^NYFANG+ >+1.5%

- 7 of 11 of the S&P 500 sectors lower: Consumer Staples -1.08% underperforms/ Consumer Discretionary +0.76% outperforms

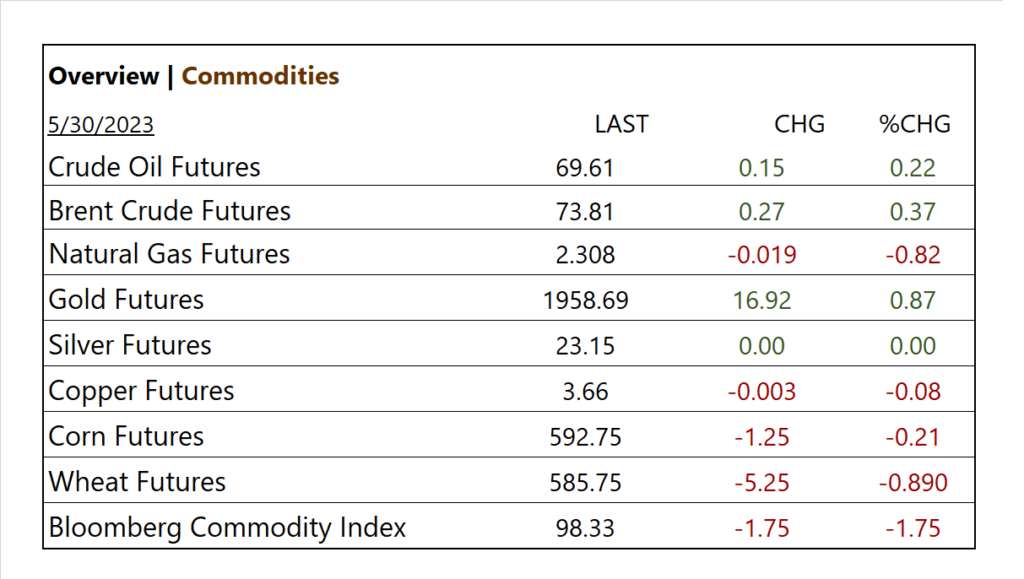

- Gold, Bitcoin and Oil up

- HP Inc (HPQ) and Hewlett Packard (HPE) earning misses

Pro Tip: The “last trading day of the month window dressing effect” is a tendency for stock prices stock prices to experience higher-than-average returns on the last trading day of the month. This is where fund managers adjust their portfolios at the end of the month to present a more opportunistic picture/ as they sell underperforming stocks and buying outperforming stocks.

Now back to the BIG market story…

Sectors/ Commodities/ Treasuries

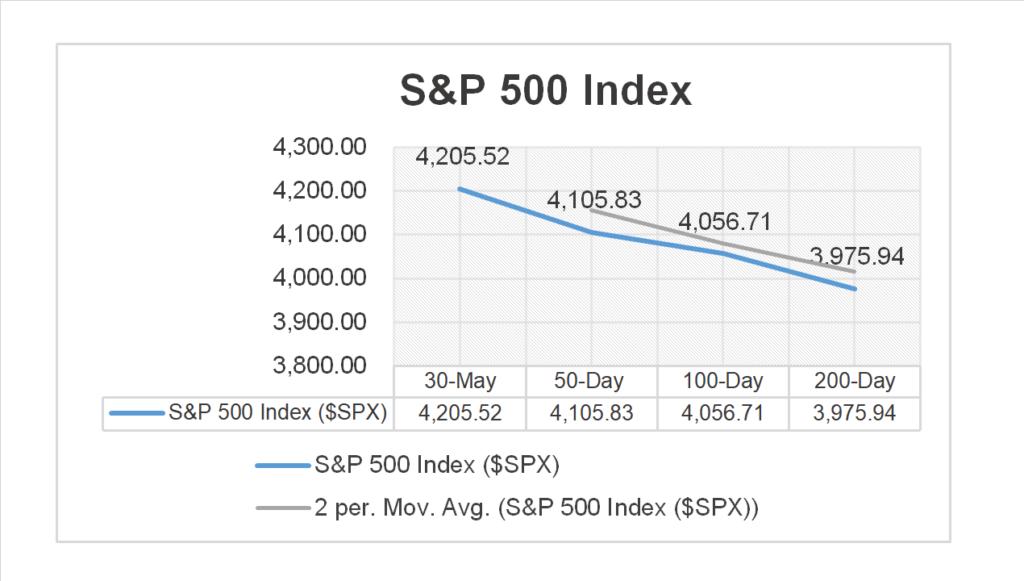

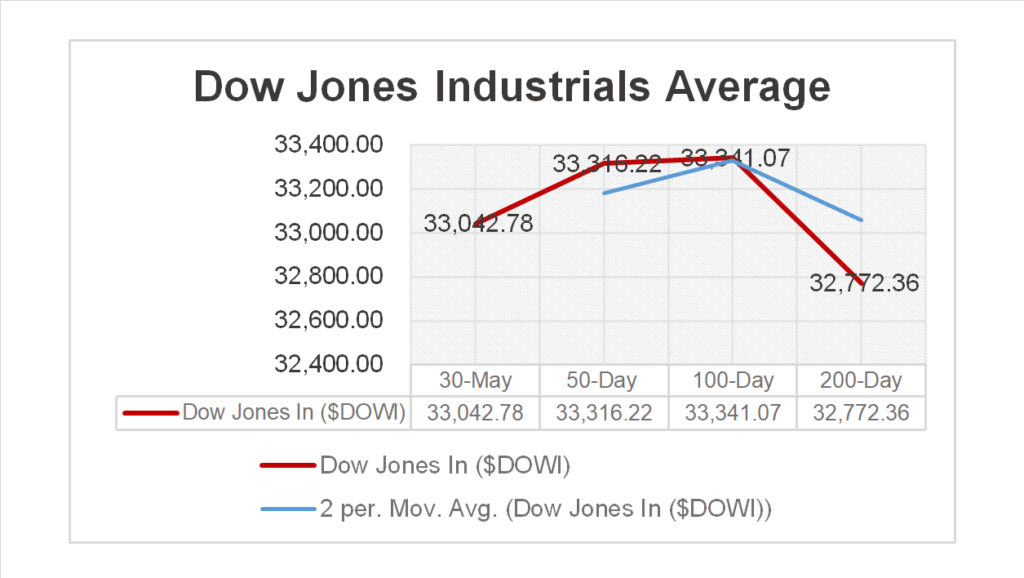

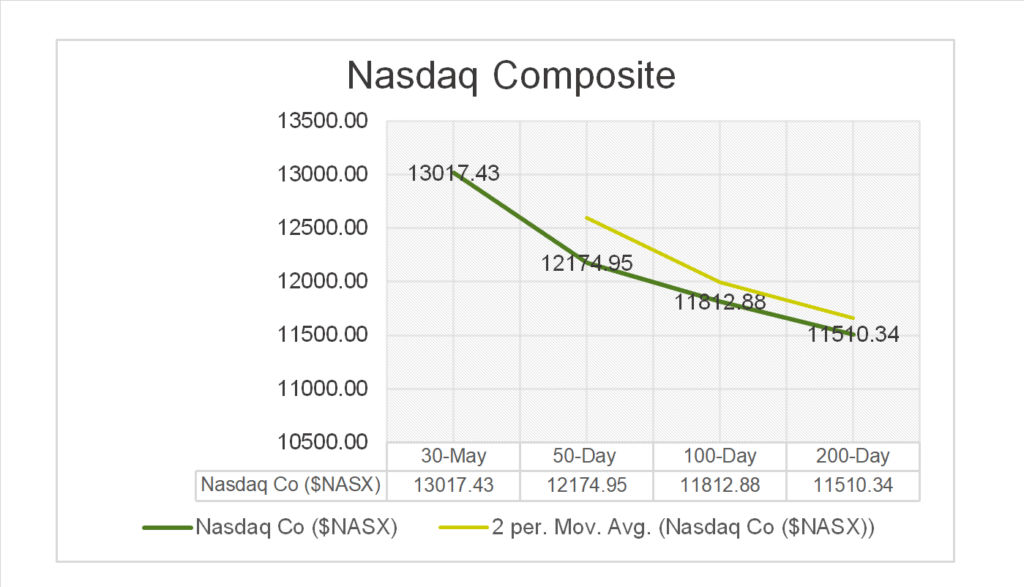

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 7 of 11 of the S&P 500 sectors lower: Consumer Staples -1.08%, Energy -0.94% underperform/ Consumer Discretionary +0.76%, Information Technology +0.63% outperform.

Commodities

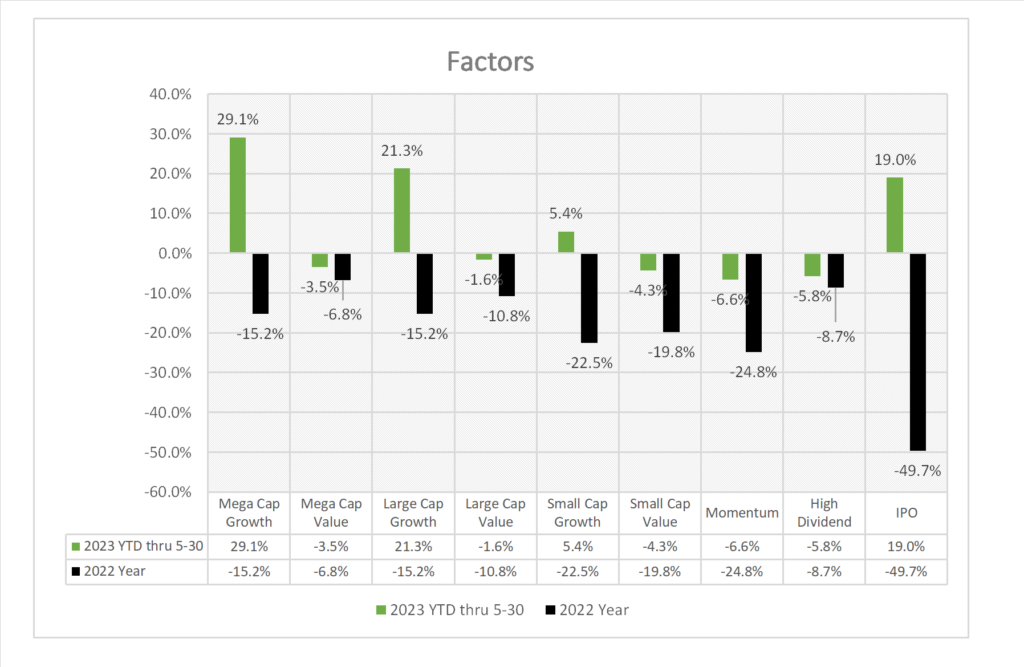

Factors (YTD)

US Treasuries

Notable Earnings Today

- +Beat: Box Inc (BOX), Ambarella (AMBA)

- – Miss: Singapore Telecommunications PK (SGAPY), HP Inc (HPQ), Hewlett Packard (HPE), U-Haul Holding (UHAL), Skyline (SKY)

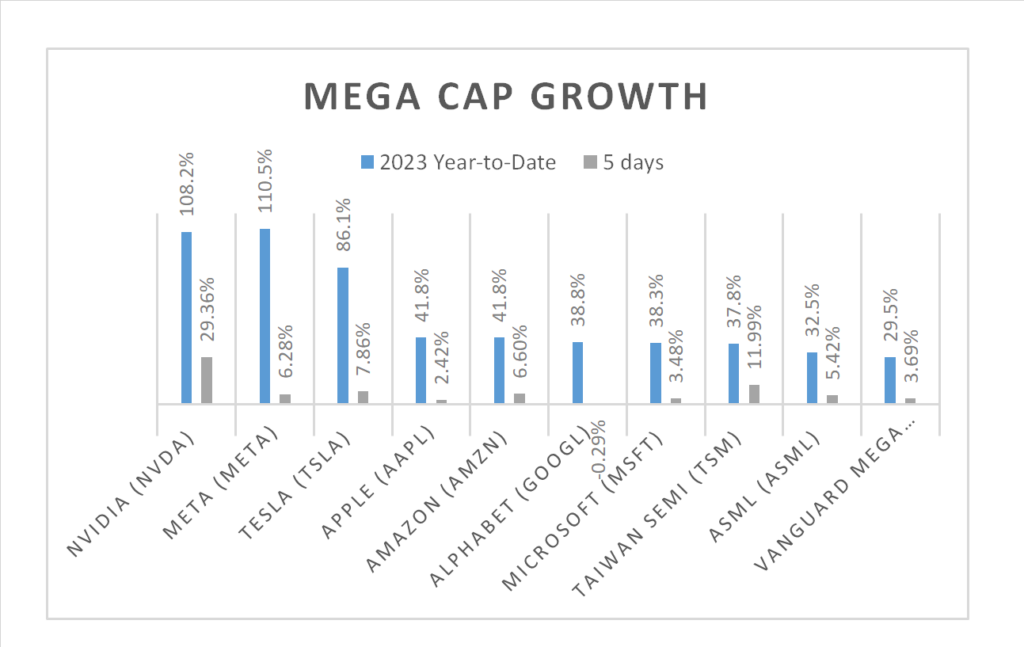

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML)

Economic Data

US

- S&P Case-Shiller home price Index YOY; period April, act -1.1%, fc -1.6%, prev. 0.4%

- Consumer confidence; period May, act 102.3, fc 103.7, prev. 103.7

News

Company News

- Once Mighty Intel Struggles to Escape ‘Mud Hole’ – WSJ

- Ford Hands Tesla a Big Win in VHS Versus Betamax-Like Battle – Bloomberg

Energy/ Materials

- Saudi Arabia, Russia Ties Under Strain Over Oil-Production Cuts – WSJ

- Oil Holds Deep Slump on Weak Demand Signals Ahead of OPEC+ Meet – Bloomberg

Central Banks/Inflation/Labor Market

- Fed’s Barkin Says He’s Seeking Evidence Demand Is Coming Down – Bloomberg

- US CONSUMER CONFIDENCE – Conference- Board

China

- China’s Fading Recovery Reveals Deeper Economic Struggles – WSJ