MARKETS TODAY August 22nd, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished higher, Hong Kong’s Hang Seng gained 0.95% while Japan’s Nikkei 225 up 0.92% and China’s Shanghai Composite up 0.88%. S&P futures opened trading at 0.35% above fair value.

European markets finished higher, Germany’s DAX gained 0.66% while France’s CAC 40 up 0.59% and London’s FTSE 100 up 0.18%.

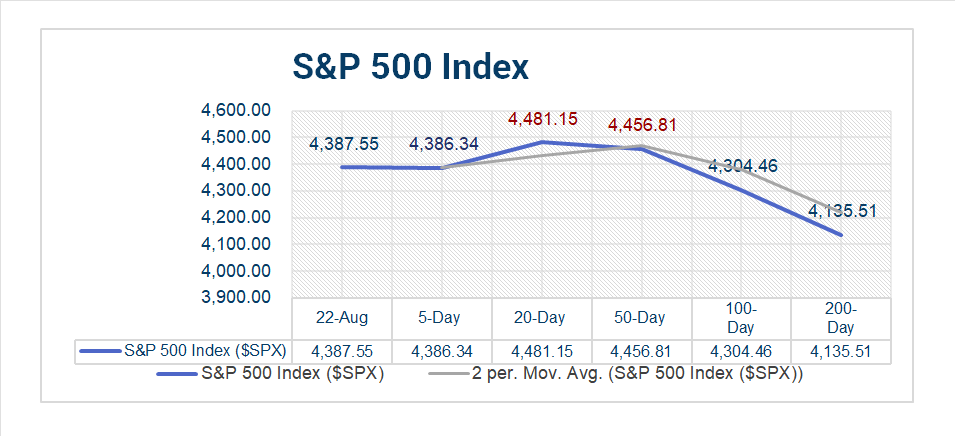

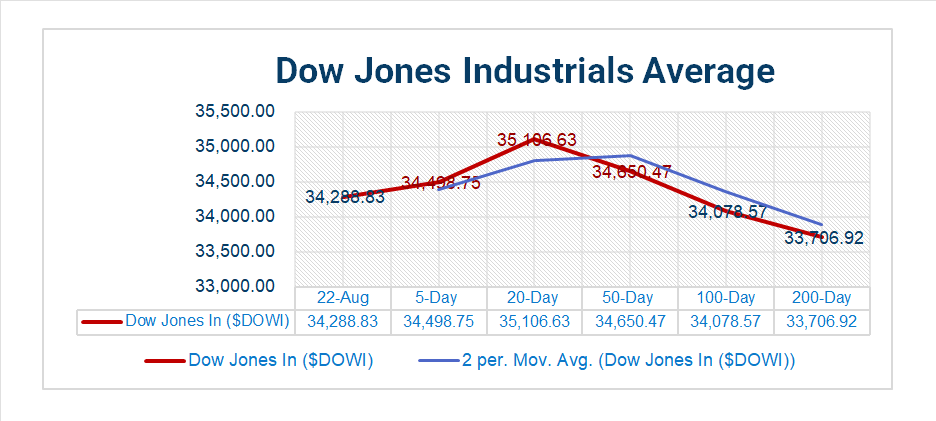

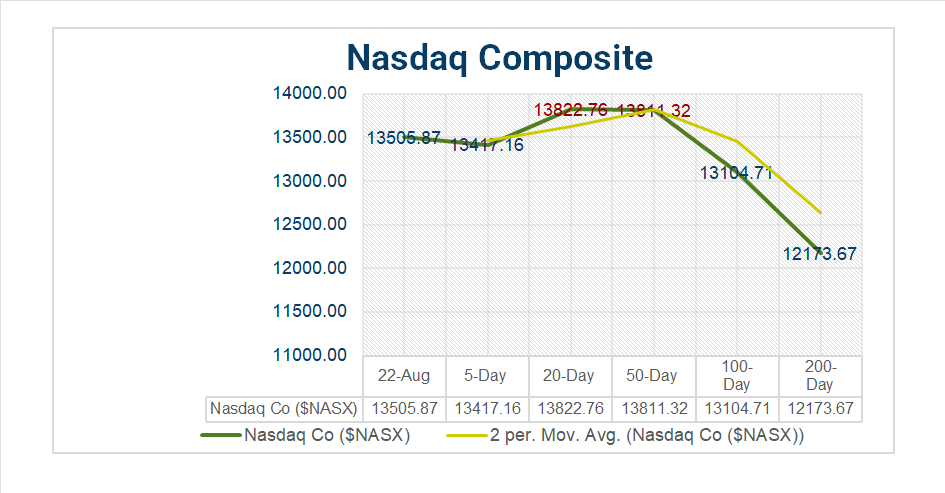

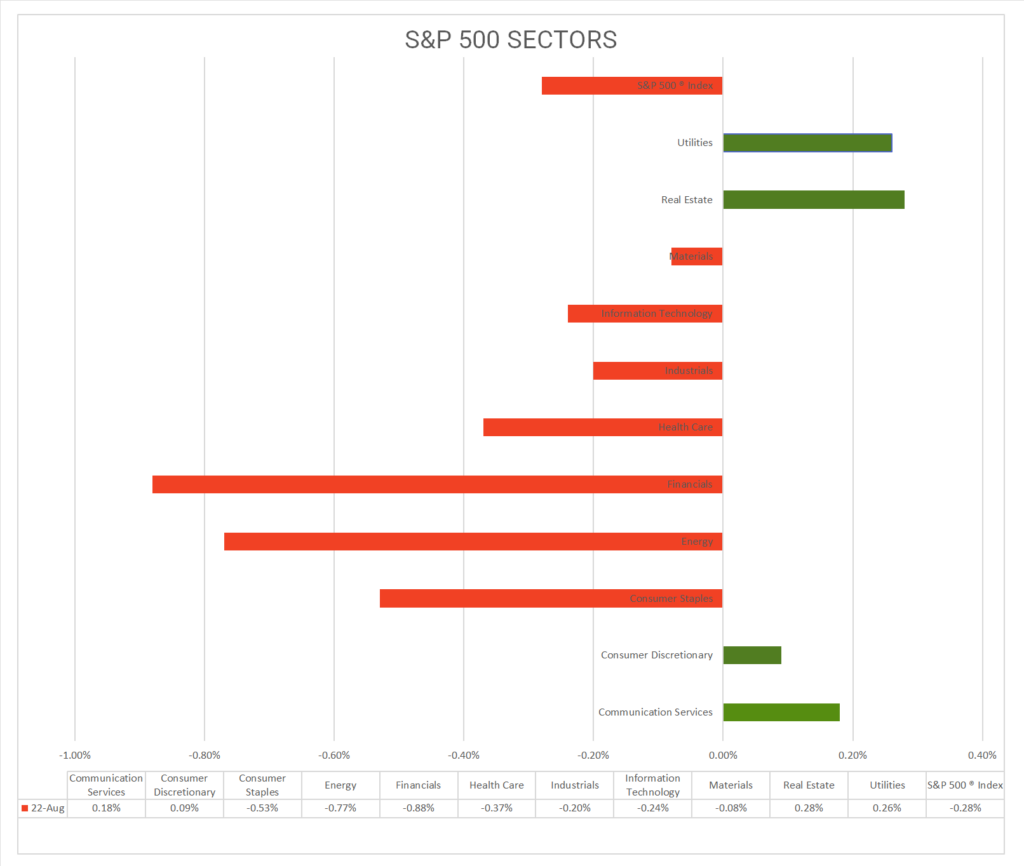

Today US Markets finished mixed, the NASDAQ up 0.06% while the S&P 500 was off 0.28% and DOW lost 0.51%. 7 of 11 S&P 500 Sectors declining: Real Estate +0.28% outperforms/ Financials -0.88% lags. Trending Industries: Leisure Products, Construction & Engineering, Household Durables, Construction Materials. On the upside, KraneShares CSI China Tech ETF ^KWEB, Credit Hedge ETF ^CDX, U.S. Dollar Index ^DXY, <5 Year Treasuries, Gold Futures.

In US economic news, existing homes sales in July missed forecast on low inventory and higher rates.

Takeaways

- US Monday rally drive gains in Asian and European markets today

- Existing homes sales in July missed forecast on low inventory & higher rates

- Nasdaq Composite ^NASX rises 0.06%

- 7 of 11 S&P 500 Sectors declining: Real Estate +0.28% outperforms/ Financials -0.88% lags

- Trending Industries: Leisure Products +7.05%, Construction & Engineering +1.50% Household Durables +0.98%, Construction Materials +0.91%

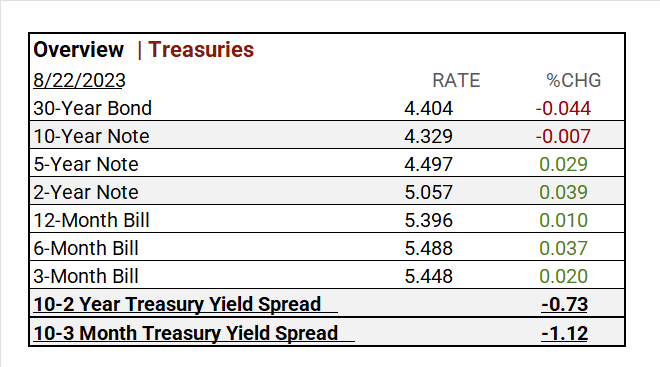

- Shorter Term <5 Year Treasury Yields rise

- US. Dollar Index ^DXY and Gold gains

- KraneShares CSI China Tech ETF (KWEB) bullish in options market

- Lowe’s (LOW), Medtronic (MDT), Baidu (BIDU) with solid earnings beats

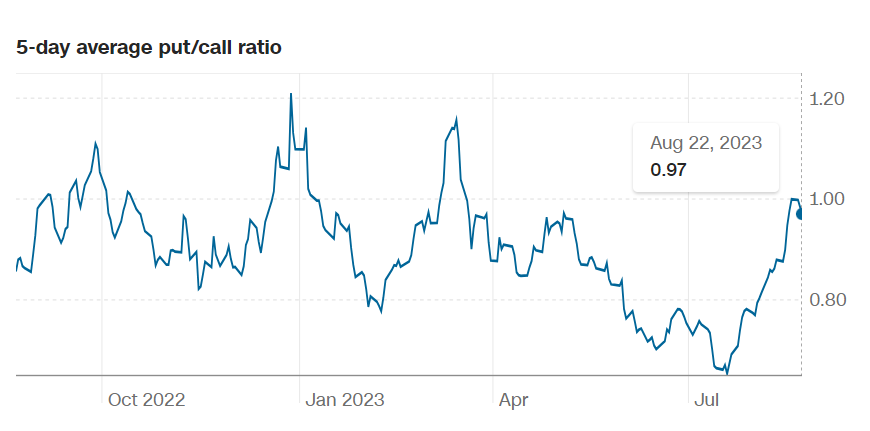

Pro Tip: The 5-day average put/call ratio indicates when the ratio of puts to calls is rising, it is a sign that investors are growing cautious. A ratio above 1 is considered pessimistic.

Sectors/ Commodities/ Treasuries

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 7 of 11 S&P 500 sectors declining: Real Estate +0.28% outperforms/ Financials -0.88% lags.

- Trending “on the Day”: Leisure Products +7.05%, Construction & Engineering +1.50% Household Durables +0.98%, Construction Materials +0.91%

- *1 Month Leaders: Energy +4.91%, Communication Services +1.59%

- *YTD Leaders: Communication Services +38.33%, Information Technology +37.50%, Consumer Discretionary +29.13%

- *S&P 500 +14.59% *as of Aug-21-2023

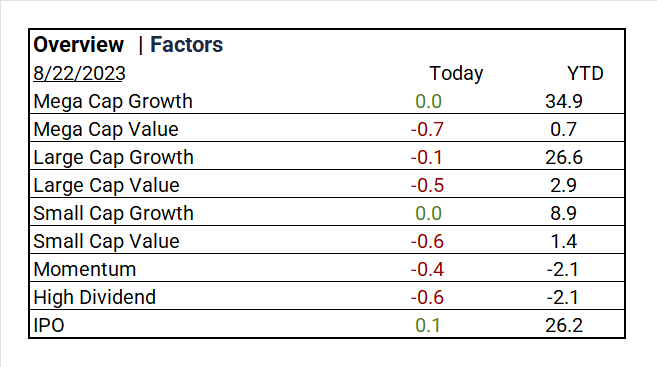

Factors

US Treasuries

Earnings

Q2 ’23 Top Line Top Line

- Q1 ’23 Actual: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 Forecast: S&P 500 EPS was expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

Q2 Seasonal Actual (TBA)

Notable Earnings Today

- +Beat: Lowe’s (LOW), Medtronic (MDT), Baidu (BIDU), Toll Brothers (TOL), Miniso (MNSO, iQIYI (IQ), Macy’s Inc (M), Urban Outfitters (URBN), Qifu Tech DRC (QFIN)

- – Miss: Dick’s Sporting Goods (DKS), Coty Inc (COTY), BJs Wholesale Club (BJ), Premier Inc (PINC), Canadian Solar Inc (CSIQ)

Economic Data

US

- Existing home sales July: act 4.07m, fc 4.15 m, prior 4.16m

Vica Partner Guidance August ’23, (updated 8-22)

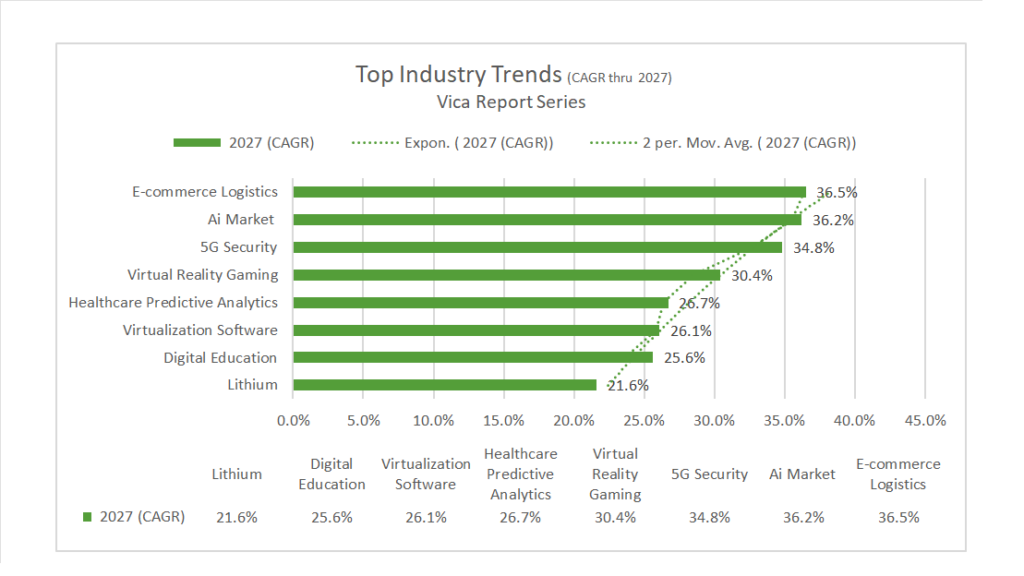

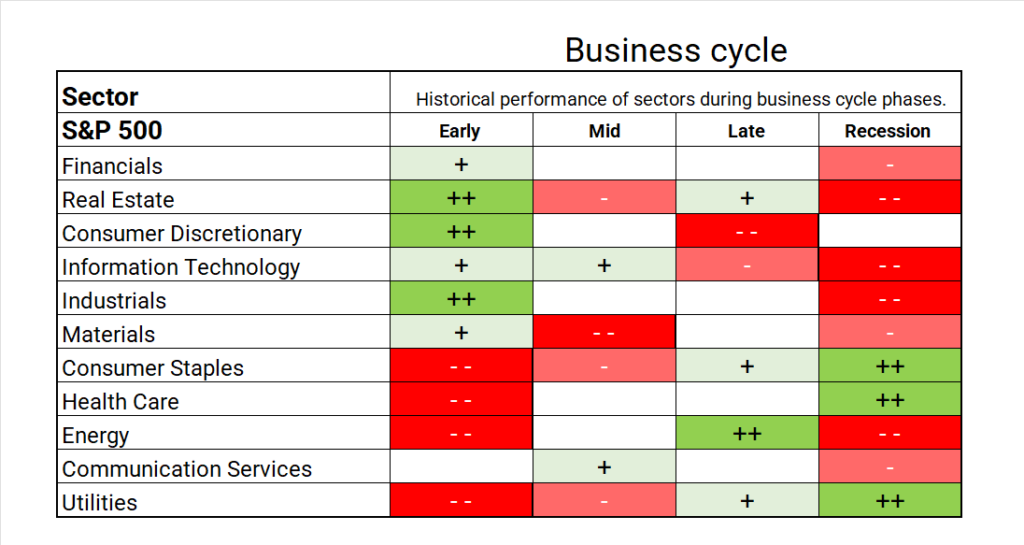

- Q3+/4: highlighting: the Energy sector which is typical in a mature/ late business cycle. Expect continued Q4 sector shifts to Defensives, Health Care and Utilities.

- Trending Industries: Communication Services/ 1. Media Consumer Discretionary/ 1. Broadline Retail 2. Specialty Retail Consumer Staples/ 1. Consumer Staples Distribution & Retail Energy/ 1. Energy Equipment & Services, 2. Oil, Gas & Consumable Fuels Financials/ 1. Insurance Health Care/ 1. Pharmaceuticals 2. Biotechnology Industrials/ 1. Construction & Engineering Information Technology/ 1. Communications Equipment Materials/ 1. Containers & Packaging Utilities/ 1. Gas Utilities

- Cautionary Industries: Consumer Discretionary/ 1. Automobiles 2. Automobile Components Consumer Staples/ 1. Personal Care Products Financials/ 1. Consumer Finance Health Care/1. Health Care Equipment & Supplies Industrials/ 1. Passenger Airlines Materials/ 1. Construction Materials Real Estate/ 1. Real Estate Management & Development 2. Specialized REITs 3. Hotel & Resort REITs Utilities/ 1. Independent Power and Renewable Electricity Producers

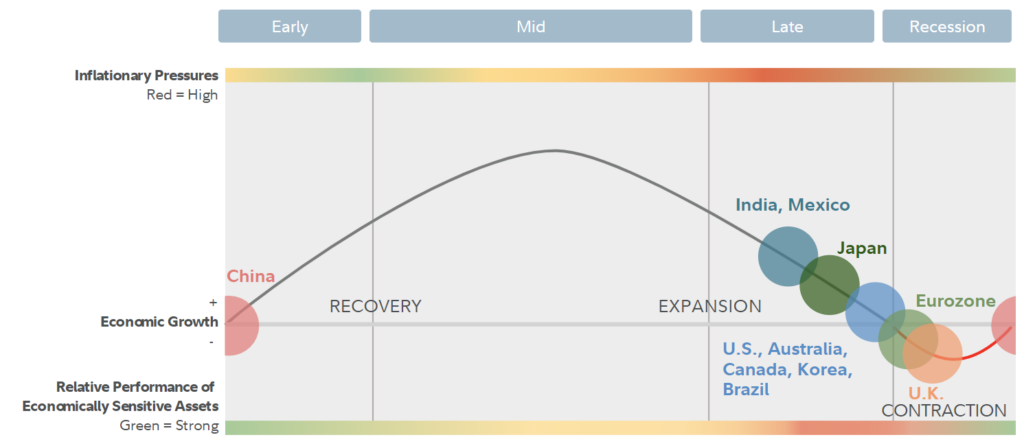

- General: Continued shift from Growth to Value. Materials and Real Estate remains volatile on China deflation. Credit default swap (CDS) to pick-up through Q4/Q1. >20 Year Treasuries price erosion.

- Longer Term: NASDAQ 100^NDX/FANG+ ^NYFANG companies will continue to outperform “BIG allows you to invest at scale”. TOP Sector outperform includes AI and Semiconductor Equipment. Look for strong CAGR growth from Chinese Mega Cap Tech. Other: key materials Lithium and Uranium. Real Estate with focus on Builders in anticipation of ’25 cycle growth.

- Company: we continue to emphasize longer term positions *quality and strength of balance sheet for all investments. * Strong Mega Cap longer support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML). **Select Value – United Health Care (UNH), Centene (CNC), Elevance Health, Inc. (ELV), Sociedad Quí Min de Chile (SQM), Vale (VALE), Alpha Metallurgical Resources (AMR), Merck & Co Inc (MRK), Lilly Eli & Co N(LLY), Coca Cola Co (KO), D.R. Horton (DHI) Toyota Motor (TM).

The Federal Reserve as of August 2023 was no longer predicting Recession: To quote Investor Jeremy Grantham “the Federal Reserve record on predicting recessionary cycles is guaranteed to be wrong!

So why don’t we support the soft-landing scenario…

- Vica forecasts that the US will have a Recession, starting as early as Q4 ’23 and deep into ’24: the combination to date of Fed tightening, surging oil prices, stock market overvaluations and a strong dollar will shortly give us our bottom.

- Market bottoms are made on bad news and with deflationary signals: economic reports are currently mixed and arguably too much focus placed on product prices and weekly jobs. Our biggest concern is rising interest rates and the depressing slow-moving effect it has on the Real Estate market. And… all with Consumer debt rising to historical highs.

- Current S&P 500 Sector Metrics support contraction: strong trends in the Energy sector indicate the US is in a late business cycle (see chart below).

- A correction in excessive market asset valuations: the current shift from Growth to Value stocks and the Information Technology sector pullback are both underway.

Pundits can all agree that the Fed has never called any recession in-kind.

Realignment is needed …

- The Federal Reserve has limited power in controlling inflation: applying old school economic principles is ineffective in a highly automated and expanding global economy. By simply raising rates to counter jobs (1.6 jobs available for every job seeker) will NOT moderate on demands.

- A 2% inflation target is not realistic today: perhaps a >3% base rate could help fund a) appropriated wages for skilled workers and training b) an executable and efficient energy transition c) improving operational efficiencies across the economy d) and most importantly (look at China today) protection from deflation!

News

Company News/ Other

- Nvidia options show traders positioned for outsized share move after earnings – Reuters

- Dick’s Sporting Goods, Macy’s Flash Warning Signs on U.S. Consumer Spending – WSJ

- Luxury Builder Toll Brothers Beats Estimates for Home Orders – Bloomberg

Energy/ Materials

- Nickel Firm Eyes Texas for $400 Million EV Battery-Metal Plant – Bloomberg

- Petrobras Gets Help From Brazil’s Attorney General to Explore the Amazon – Bloomberg

Real Estate

- A Bright Spot in Commercial Real Estate: Retail Shops – WSJ

Central Banks/Inflation/Labor Market

- US Existing-Home Sales Slide on Higher Rates, Lean Inventory – Bloomberg

- How Hard Should the Fed Squeeze to Reach 2% Inflation? – WSJ

- FDIC to Propose New Regulations for Midsize Lenders Next Week – Bloomberg

Asia/ China

- China’s underwhelming rate cuts aimed to ‘protect bank profit margins’ – South China Morning Post