Stay Informed and Stay Ahead: Market Watch, August 27th, 2024.

Late-Week Wall Street Markets

Key Takeaways

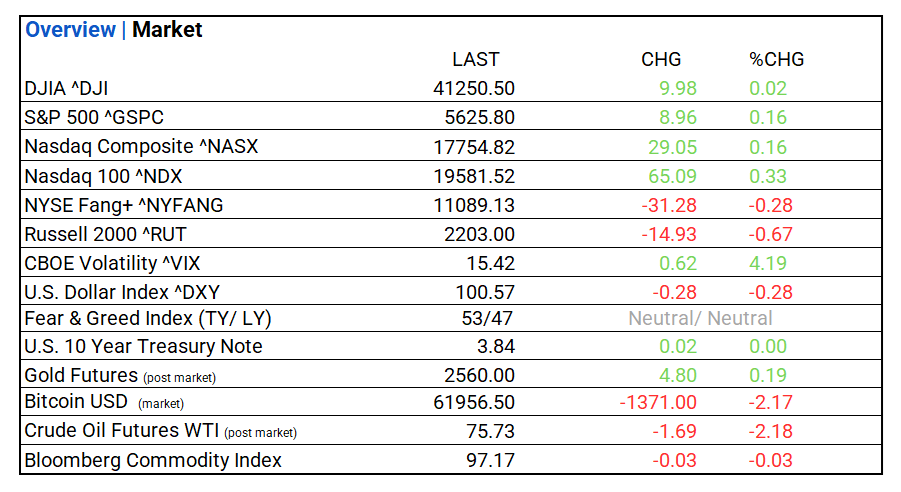

- Markets: DOW, S&P 500, and NASDAQ moderately gain. Info Tech leads, Energy lags. Top industry: Hotels Restaurants & Leisure.

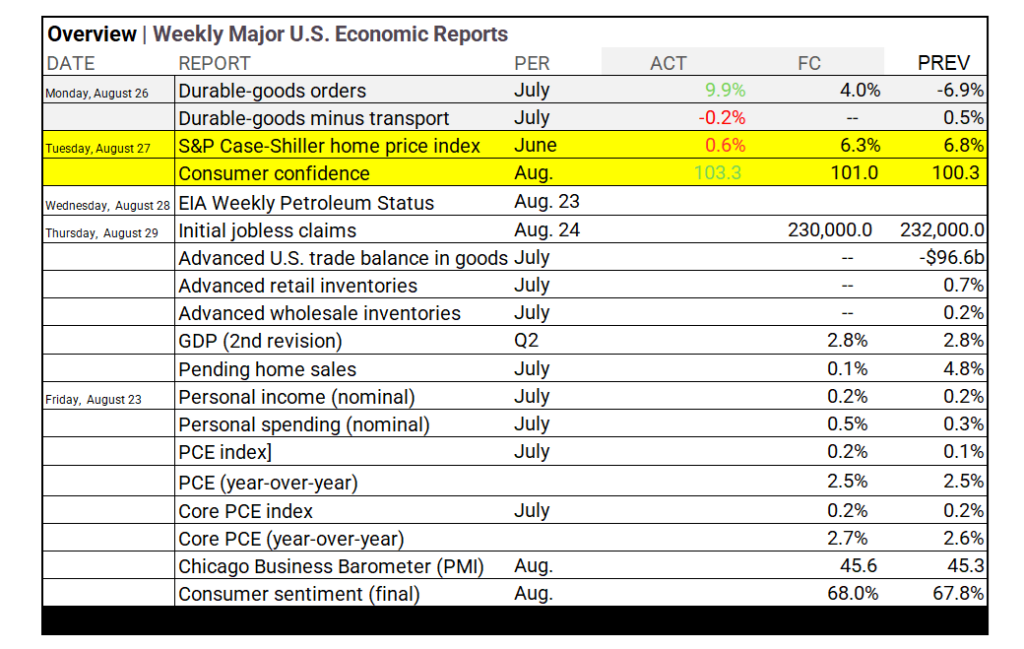

- Economic Reports: The S&P Case-Shiller index rose 0.6% in June; August consumer confidence hit 103.3.

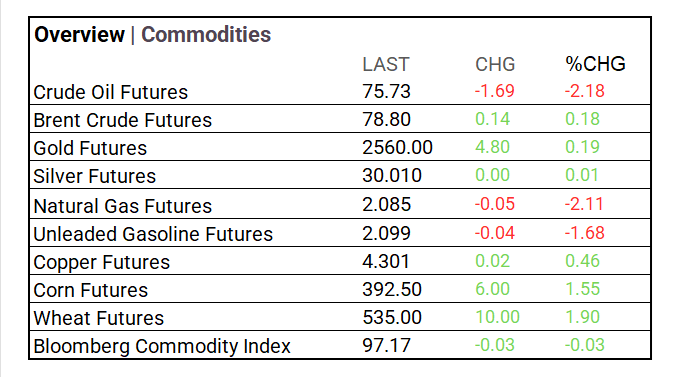

- Yields & Commodities: Treasury yields: 30-year up 0.020% to 4.128%, 10-year up 0.021% to 3.839%. Crude Oil down -2.18% to $75.73, Gold up +0.19% to $2,560.00.

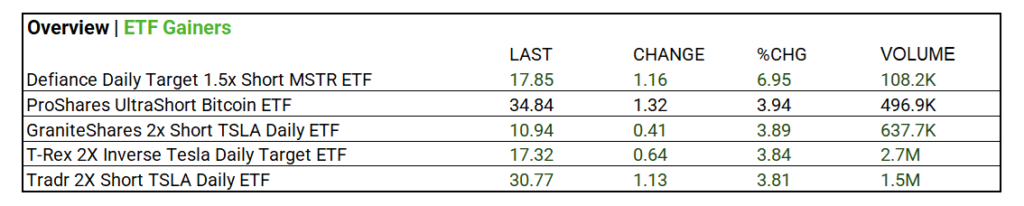

- Crypto & ETFs: Bitcoin down -0.18% to $61,973, Ethereum fell -4.20% to $2,576.96. Inverse performance of Tesla’s daily returns T-Rex 2X up 3.84% to $17.32, Tradr 2X up 3.81% to $30.77.

Market Summary

Indices & Sectors Performance:

- DOW, S&P 500, and NASDAQ rose moderately. 6 of 11 sectors advanced, Information Technology leads, Energy lags. Hotels Restaurants & Leisure (+1.51%), Semiconductor & Semiconductor Equipment (+ 1.27%), and Financial Services Industry (+1.09%) leading.

Technical:

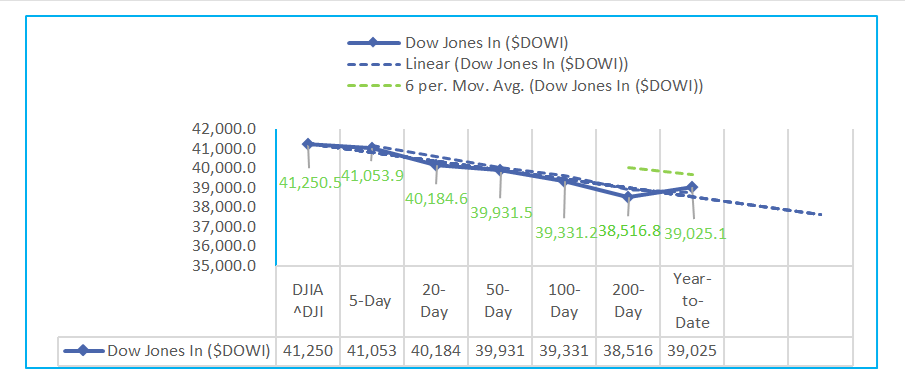

- The DOW shows steady growth with a 1.02% gain over 5 days, increasing to 6.90% over 50 days and a strong 20.93% over 200 days, while year-to-date performance is up 9.45%, supported by consistent trading volumes across periods.

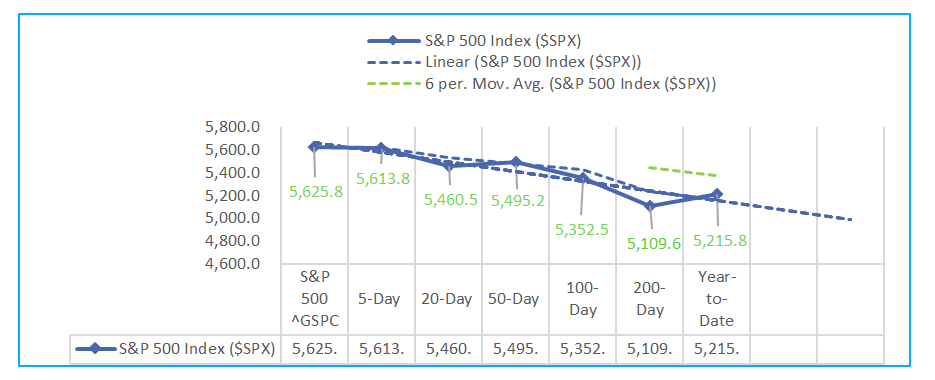

- S&P 500 has a strong consistent growth across all periods, with short-term gains of 0.51%, medium-term gains around 3.5%, and long-term strength with a 28.36% increase over 200 days, reflecting strong market momentum and significant year-to-date performance of 17.95%.

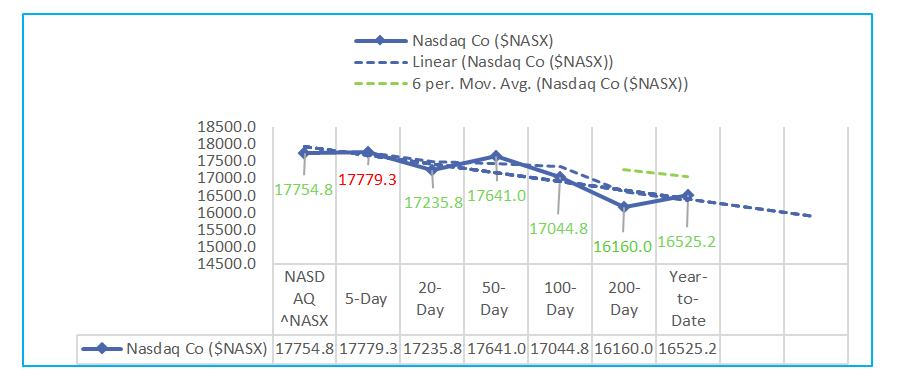

- The NASDAQ shows mixed performance, with a short-term decline of -0.35% over 5 days, but gains of 3.54% over 20 days, 10.63% over 100 days, and a strong 30.07% increase over 200 days, reflecting an 18.28% year-to-date rise.

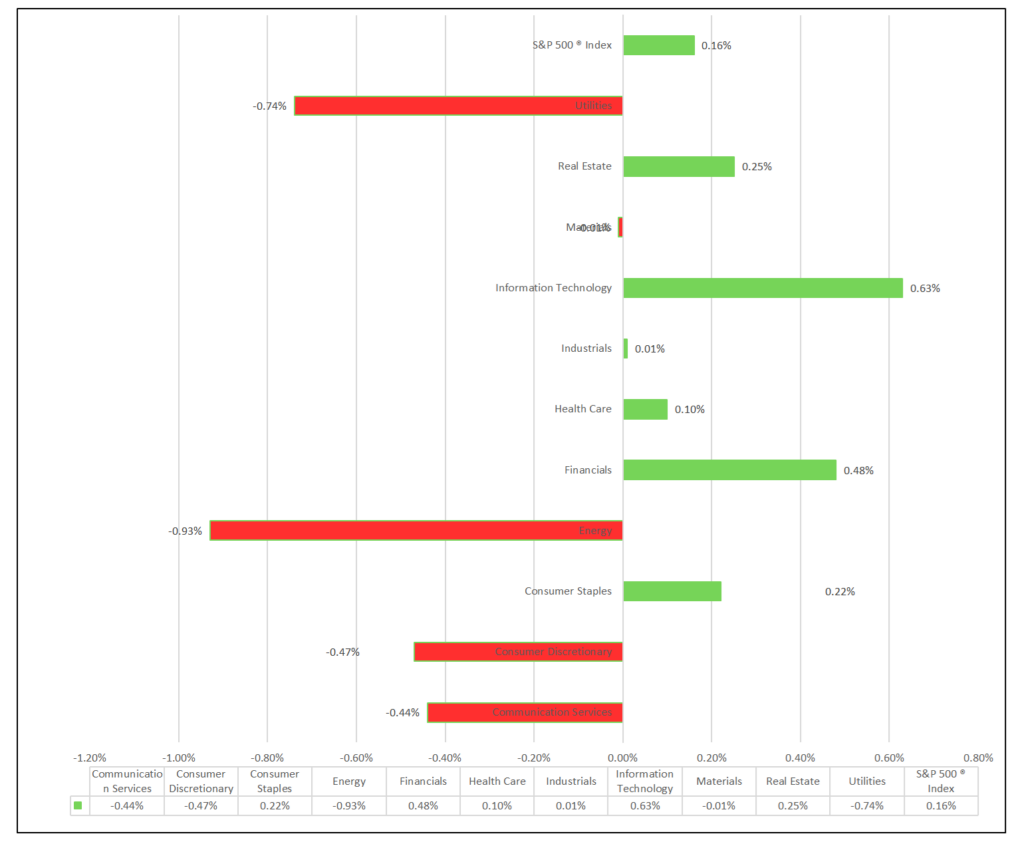

Sectors:

- Sector performance is mixed, with Financials (+0.48%) and Information Technology (+0.63%) leading gains, while Energy (-0.93%) and Utilities (-0.74%) show the biggest declines. Overall, the S&P 500 Index was 0.16%, reflecting moderate market activity.

Economic Highlights:

- The S&P Case-Shiller home price index rose 0.6% in June, below the expected 6.3%. Consumer confidence in August improved to 103.3, surpassing both the forecast (101.0) and the previous month’s figure (100.3).

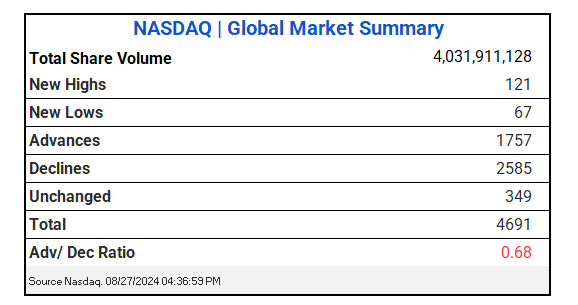

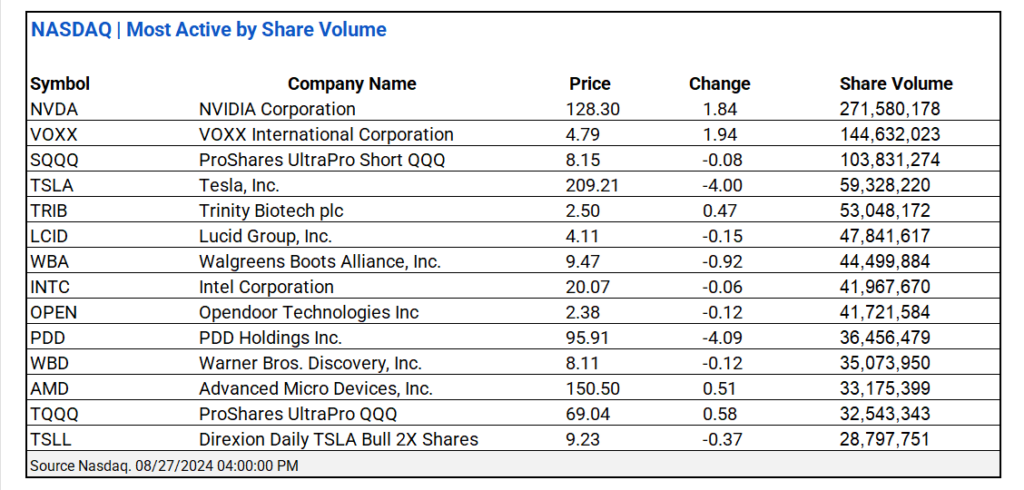

NASDAQ Global Market Update:

- NASDAQ saw 4.03B shares traded with a 0.68 advance/decline ratio. NVIDIA ^NVDA and VOXX International Corporation ^VOXX led actives.

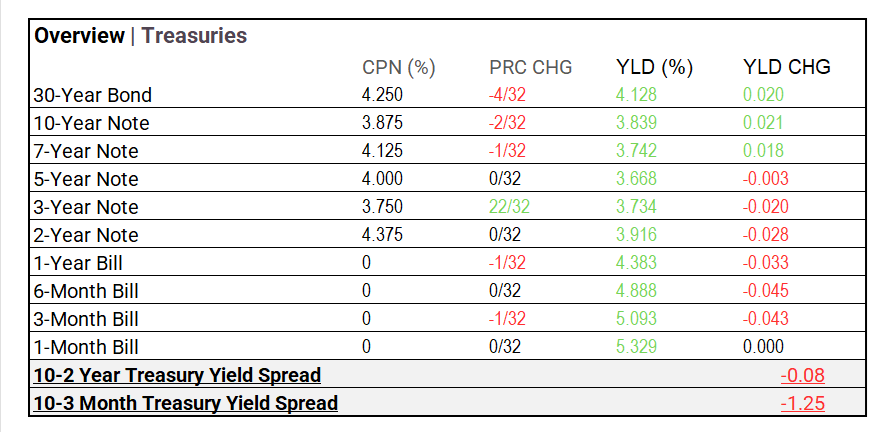

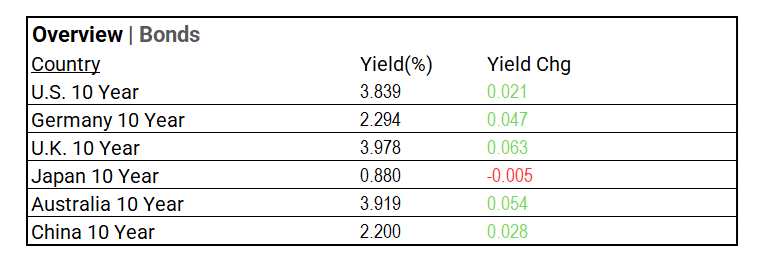

US Treasuries & Bond Markets:

- Treasury yields show mixed movement: the 30-year bond rose by 0.020% to 4.128%, while the 10-year note increased by 0.021% to 3.839%. Short-term yields declined, with the 2-year down 0.028% and the 3-month bill dropping 0.043% to 5.093%.

- Bonds: the U.S. 10-year yield rose to 3.839%, U.K. 10-year increased to 3.978%, and Germany’s 10-year reached 2.294%. Japan’s 10-year yield fell slightly to 0.880%.

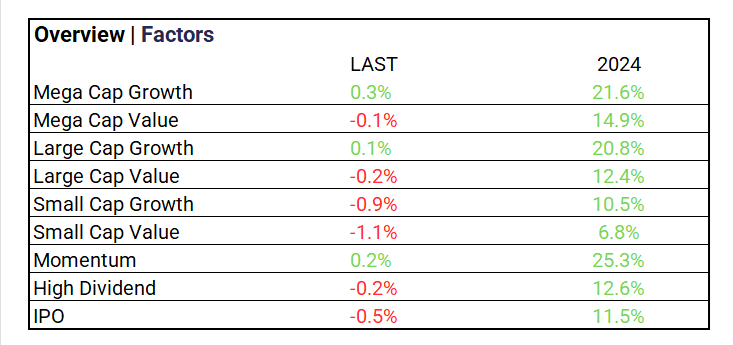

Market Factors:

- Mega Cap Growth leads at +0.3%, while Small Cap Value lags at -1.1%.

Volatility:

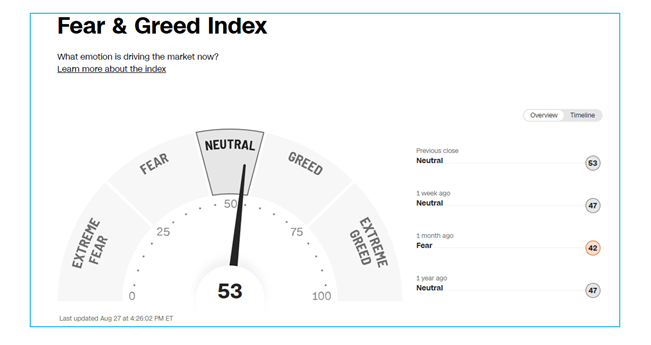

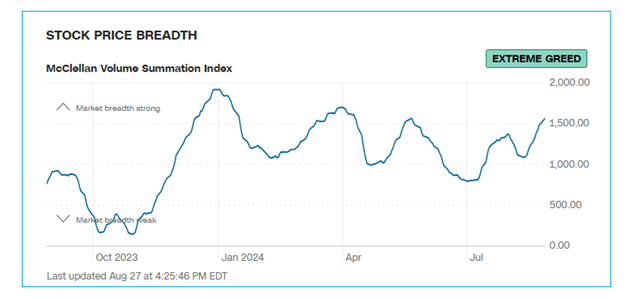

- VIX at 15.42 (+4.19%); Fear & Greed Index remains in “Neutral”, MCV Index “Extreme Greed”.

Commodities & ETFs:

- Commodities: Crude Oil Futures fell -2.18% to $75.73, Brent Crude rose +0.18% to $78.80, and Gold increased +0.19% to $2,560.00. Natural Gas dropped -2.11% to $2.085, Unleaded Gasoline fell -1.68% to $2.099, and Copper was up +0.46% to $4.301. Corn and Wheat rose +1.55% and +1.90% respectively. The Bloomberg Commodity Index edged down -0.03% to 97.17.

- ETF volume gainers: T-Rex 2X Inverse Tesla Daily Target ETF rose 3.84% to $17.32 with 2.7M shares traded. Tradr 2X Short TSLA Daily ETF increased 3.81% to $30.77 with 1.5M shares traded.

Cryptocurrency & Currency:

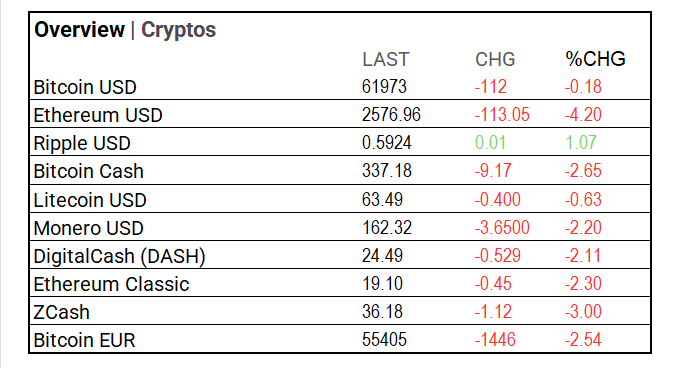

- Crypto’s: Bitcoin is down -0.18% to $61,973, while Ethereum fell -4.20% to $2,576.96. Ripple rose +1.07% to $0.5924. Bitcoin Cash, Litecoin, Monero, DigitalCash, Ethereum Classic, and ZCash all experienced declines. Bitcoin EUR decreased -2.54% to €55,405.

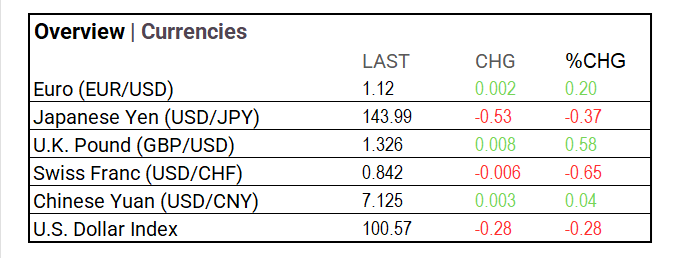

- Currencies: The Euro rose to 1.12 (+0.20%), the U.K. Pound increased to 1.326 (+0.58%), and the Chinese Yuan gained to 7.125 (+0.04%). The Japanese Yen fell to 143.99 (-0.37%), the Swiss Franc dropped to 0.842 (-0.65%), and the U.S. Dollar Index decreased to 100.57 (-0.28%).

Stocks:

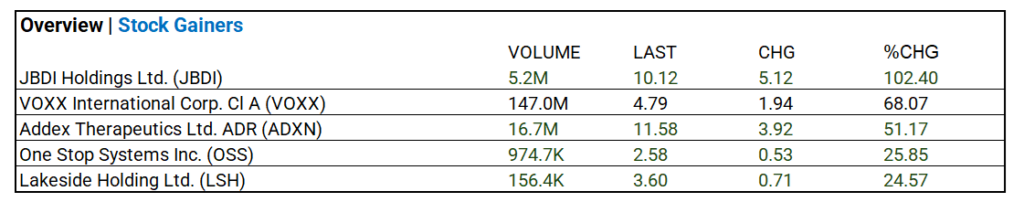

- VOXX International Corp. Cl A (VOXX) surged 68.07% to $4.79 with 147.0M volume.

Notable Earnings:

- SentinelOne (S), Box Inc (BOX), and Nordstrom (JWN) beat estimates. Bank of Nova Scotia (BNS), and Bank of Montreal (BMO) missed.

Global Markets Summary:

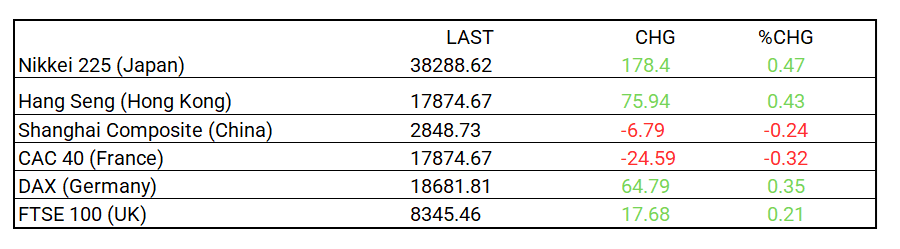

- Asian indices: Japan’s Nikkei 225 rose 0.47% to 38,288.62, Hong Kong’s Hang Seng increased 0.43% to 17,874.67, and China’s Shanghai Composite fell -0.24% to 2,848.73. European indices: France’s CAC 40 dropped -0.32%, Germany’s DAX was up 0.35%, and the UK’s FTSE 100 gained 0.21%.

Strategic Investment Adjustments:

- Focus on long-duration bonds with leveraged ETFs like ZROZ (PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF) and EDV (Vanguard Extended Duration Treasury Index ETF) to gain on potential rate cuts. Nasdaq/Tech and growth sectors show strong long-term potential. Diversify with Russell 2000 ETFs and bank index ETFs. Election years historically boost market performance. Top Small-Cap ETFs Poised to Benefit: Vanguard Small-Cap Growth ETF (VBK), iShares Russell 2000 Growth ETF (IWO), iShares S&P Small-Cap 600 Growth ETF (IJT).

fed-rate-cuts-on-long-duration-treasury-etfs-performance

small-cap-etfs-key-opportunities-for-fall-2024

In the NEWS

Central Banking, Monetary Policy & Economics:

- Weak German Consumer Confidence Adds to Economic Woes – WSJ

- Asian Stocks to Slip as US Holds Breath for Nvidia: Markets Wrap – Bloomberg

Business:

- Walmart to Offer Logistics Outside Its Own Marketplace Sales – WSJ

- Nordstrom Gives More Optimistic Outlook With Rack Outperforming – Bloomberg

China:

- China’s central bank, ministries pledge green finance support for dense economic zone – SCMP