“Empowering Financial Success” Vica Partners Financial Group

MARKETS TODAY – September 5th, 2023 (Vica Partners)

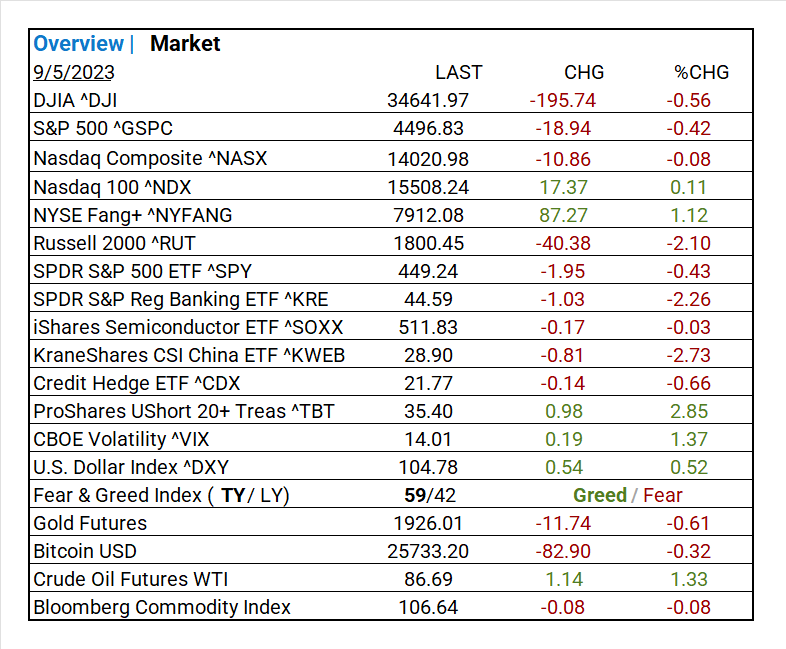

Global Markets Snapshot

- Asian markets displayed a mixed performance during the latest closing session. Japan’s Nikkei 225 advanced by 0.30%, whereas Hong Kong’s Hang Seng declined, dragging down China’s Shanghai Composite by 2.06% and 0.71% respectively.

- S&P futures commenced trading slightly below the fair value, with a decrease of 0.13%.

- European markets concluded the day with losses. France’s CAC 40 slipped by 0.34%, Germany’s DAX dipped by the same percentage, and London’s FTSE 100 recorded a 0.20% decrease.

US Markets Today

- The US stock markets ended the day in negative territory. The DOW registered a 0.08% decline, the S&P 500 was down by 0.42%, and the NASDAQ declined by 0.56%. Notably, 8 out of the 11 sectors within the S&P 500 posted losses. However, there were standout performances in the Automobiles sector, which saw a notable gain of 4.03%, and the Software sector, which increased by 1.11%. Additionally, the NYFANG+ Index exhibited a positive movement with a 1.12% increase. Furthermore, the Energy Select Sector SPDR Fund (^XLE) and the ProShares UltraShort 20+ Treasury ETF (^TBT) also recorded gains of 0.53% and 2.85%, respectively.

US Economic Highlights

- In economic news, there was a decline in factory orders during July, as new orders for durable goods produced in the United States saw a 2.1% decrease compared to June. This decline followed four consecutive months of increasing orders.

Key Takeaways

- Factory orders in the US declined in July but surpassed expectations.

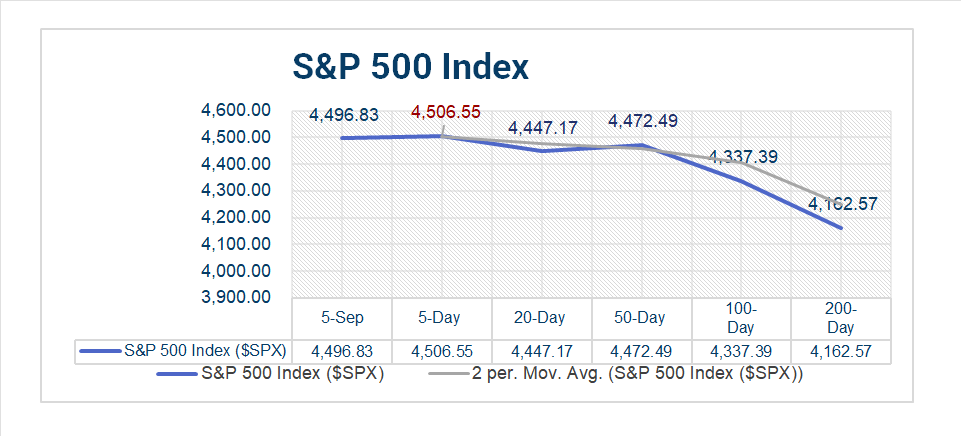

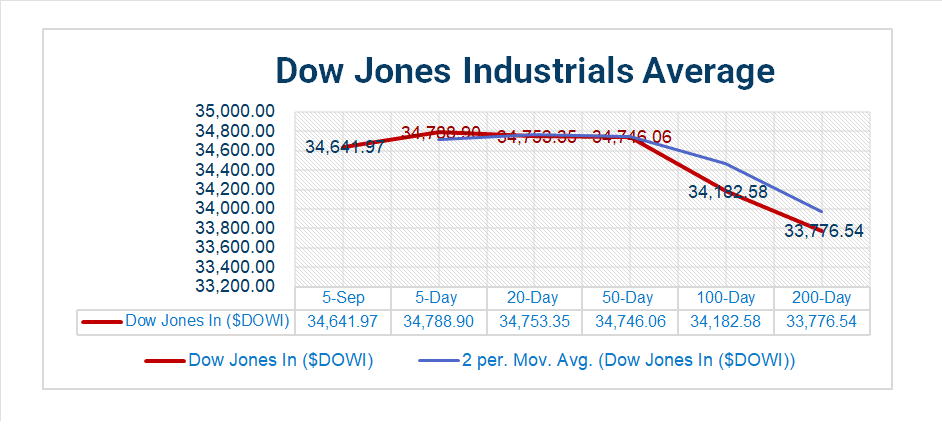

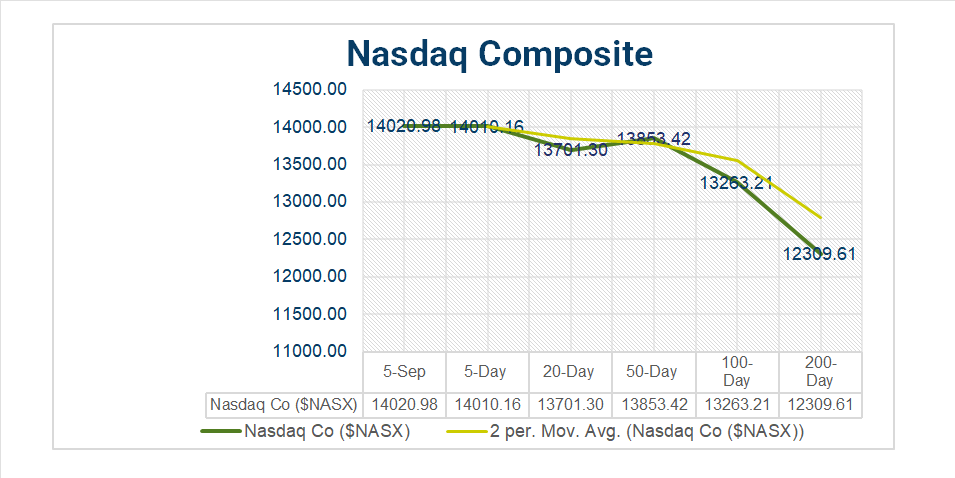

- Among the major indices, only the NASDAQ showed positive momentum, staying above its 5 through 200-day moving averages.

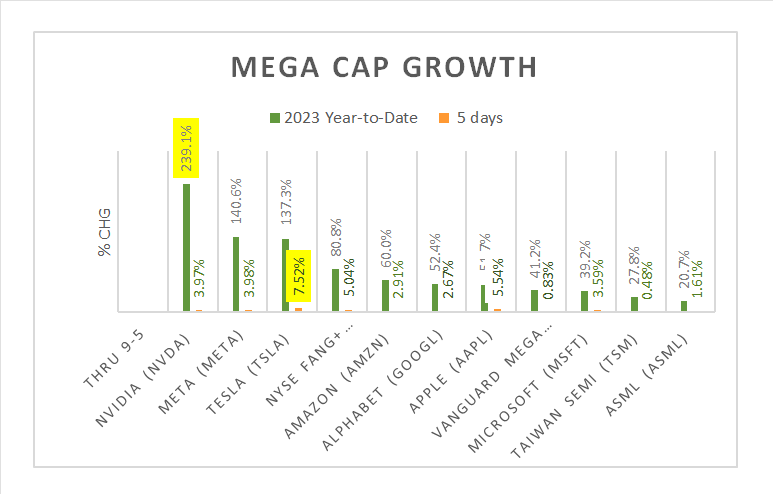

- The NYSE Fang+ index (^NYFANG) posted a gain of 1.12%.

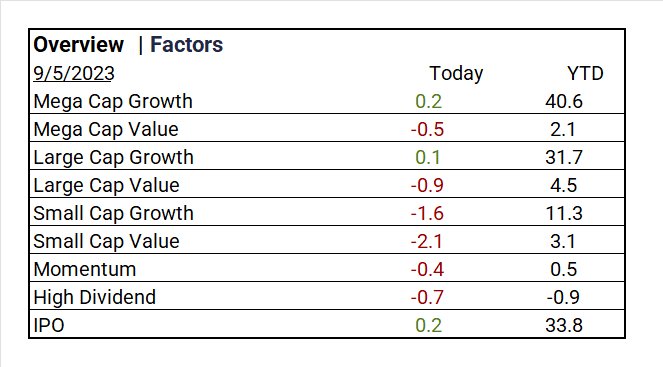

- Mega Cap Growth stocks outperformed.

- Top performers of the day included the Automobiles sector (+4.03%), Software sector (+1.11%), and Energy Equipment & Services sector (+0.75%).

- The Energy Select Sector SPDR Fund (^XLE) recorded a modest gain of 0.53%.

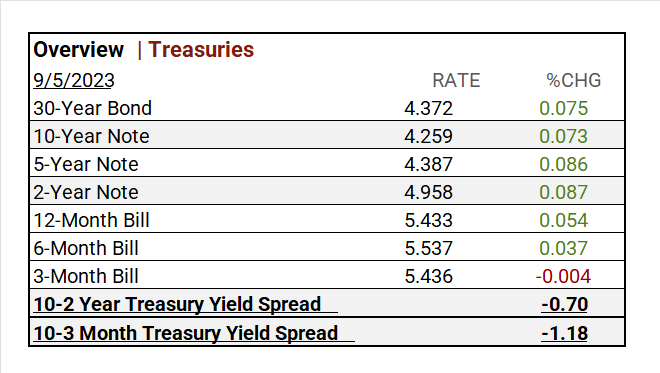

- Treasury yields saw an increase across the yield curve.

- The ProShares UltraShort 20+ Treasury ETF (^TB) experienced a notable rise of 2.85%.

- The US Dollar Index (^DXY) once again demonstrated its strength.

- Both Crude Oil Futures WTI and the Bloomberg Commodity Index witnessed gains, with oil futures reaching their highest level in approximately a year.

- Gitlab (GTLB) and Brady (BRC) reported solid earnings beats.

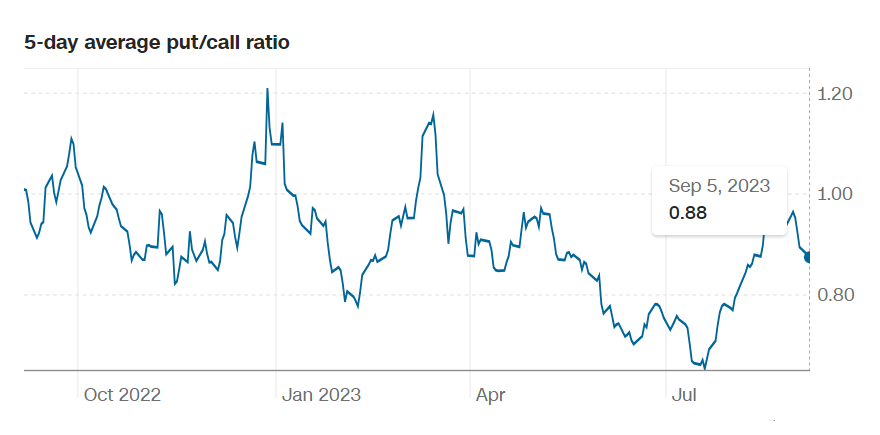

Pro Tip: When the put-to-call ratio is on the rise, it typically indicates that investors are becoming increasingly apprehensive. A ratio exceeding 1 is commonly interpreted as a bearish signal.

Indices, Sectors, Factors, and Treasuries

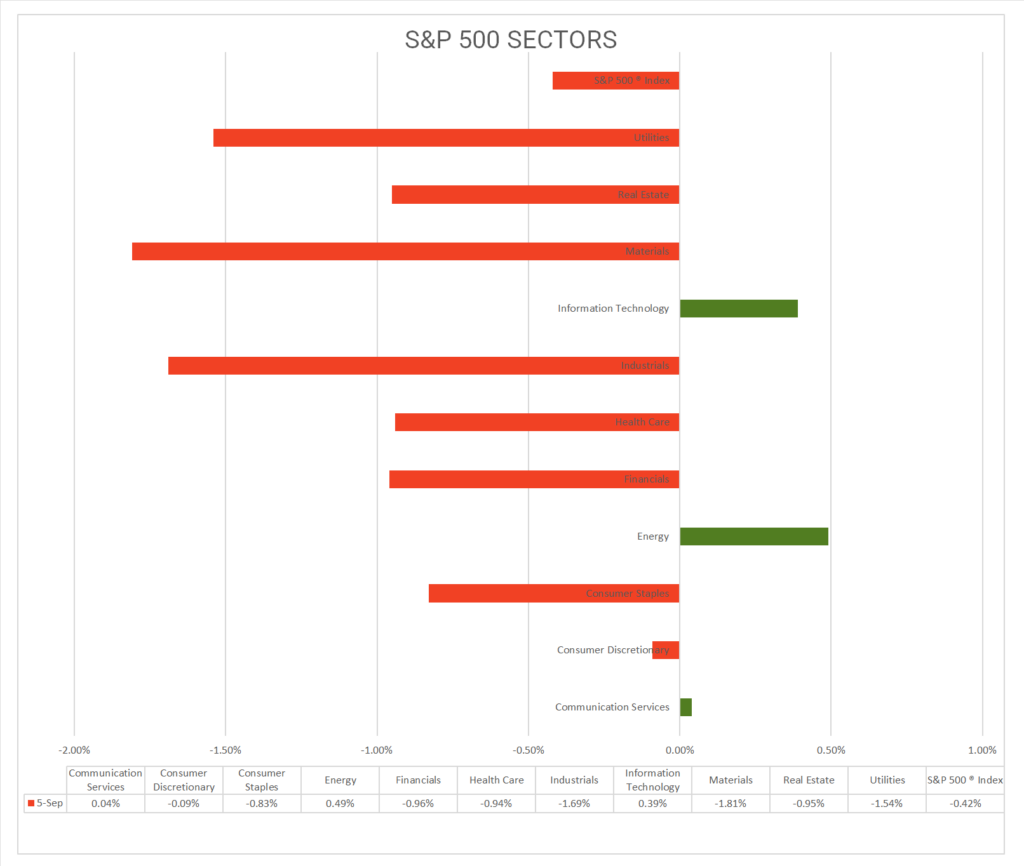

S&P Sectors

- Among the 11 S&P 500 sectors, 8 experienced declines, with Energy leading the way with a gain of +0.49%, while Materials lagged significantly at -1.81%.

- Noteworthy industries that performed well on the day included Automobiles (+4.03%), Software (+1.11%), Energy Equipment & Services (+0.75%), and Entertainment (+0.65%).

As of September 1, 2023

- In terms of performance over the past month, the Energy sector emerged as the leader with a gain of +3.35%.

- Year-to-date (YTD) leaders in the S&P 500 included Information Technology (+44.01%), Communication Services (+43.36%), and Consumer Discretionary (+33.02%).

- S&P 500 had posted a substantial gain of 17.40%.

Factors

US Treasuries

Earnings

- In Q1 ’23, 79% of companies beat analyst estimates by an average of 6.5%.

- The Q2 Forecast predicted a decline of <7.2%> in S&P 500 EPS, with Fiscal year 2023 EPS remaining flat YoY.

- Q2 Seasonal Actuals are yet to be reported.

Notable Earnings Today

- +Beat: Ashtead Gro (ASHTY), Zscaler (ZS), Gitlab (GTLB), Healthequity Inc (HQY), Ascendis Pharma AS (ASND), Asana (ASAN), Brady (BRC), AeroVironment (AVAV)

- -Miss:

Economic Data

US

- Factory orders (July): -2.1% (Previous 2.3%, Forecast -2.3%)

“Navigating September 2023: Vica Partners Insights”

- Our aim with this report is to provide you with a comprehensive overview of the prevailing trends that are shaping financial markets.

Key Trends

- Growth stocks tend to perform well during economic optimism.

- ^NYFANG new defensive’s Index as “bigger allows for more capital to scale”

- AI and Semiconductor Equipment will continue to outperform.

- Market had a Factor regression from Growth to Value stocks in the past 45 days.

- Energy is August Sector leader and look for further ’23 opportunity here.

- Health Care and Materials undervalued.

- Current economic signals are mixed with deflation concerns.

- August/September historically have lower ROI.

“Vica Partners: Navigating the Economic Landscape – 2023 Economic Forecast

- As of September 2023, the Federal Reserve no longer predicts a recession. However, Vica Partners disagrees and forecasts a potential recession starting as early as Q4 ’23 and extending into ’24. This projection is based on factors including Fed tightening, rising oil prices, overvalued stock markets, and a strong dollar. Vica Partners believes that market bottoms typically occur amid negative news and deflationary signals. Rising interest rates and their impact on the real estate market, coupled with historical highs in consumer debt, are significant concerns. Vica Partners also notes the shift from Growth to Value stocks and the moderation of the Information Technology sector correction occurred.

Key Points

- The Federal Reserve’s power to control inflation is limited, and traditional economic principles may not be effective in today’s highly automated global economy.

- A 2% inflation target may not be realistic today, and a base rate exceeding 3% could fund wage increases, energy transition, operational efficiency improvements, and protection against deflation.

News

Company News/ Other

- BYD, China’s Tesla, Is Coming for the World – WSJ

- Saudi Telecom Buys $2.25 Billion Stake in Spain’s Telefonica – Bloomberg

- Warner Bros. Cuts Profit Outlook as Hollywood Strikes Drag On – WSJ

- Baidu teases Ernie 4 large language model after China approves ChatGPT-style chatbots for public use – SCMP

Energy/ Materials

- Dominion Sells Natural Gas Utilities to Enbridge for $9.4 Billion – WSJ

- Saudi Move Boosting Oil Prices Raises Political Risk for Biden – Bloomberg

Real Estate

- What’s Worse Than Record High Rent? Record High Rent, Plus Fees. – WSJ

- JPMorgan Sees City of London Office Values Falling 20% This Year – Bloomberg

Central Banks/Inflation/Labor Market

- Labor Is a Terrible Guide to Inflation, but Nobody Wants to Admit It – WSJ

- ECB Says Consumer Inflation Expectations Edged Up in July – Bloomberg

- Fed’s Waller Says Central Bank Can ‘Proceed Carefully’ With Rate Hikes – Bloomberg

Asia/ China

- As US tech war reshuffles value chains, China seen as having work to do to engineer hi-tech manufacturing edge – SCMP