Stay Informed and Stay Ahead: Market Watch, July 3rd, 2024.

Mid-Week Wall Street Markets

Key Takeaways

+ NASDAQ and S&P 500 rose, DOW moderately declines. Information Tech led gains, while Health Care lagged. Top industries Automobile Parts and Semiconductors.

+ June ADP employment jobless claims rose while factory orders and ISM services index showing softening, suggesting a contracting economy.

+ Bond yields fell. NASDAQ’s A/D ratio was 1.40. Large Cap and Mega Cap Growth outperform. Silver and Copper jump. NVIDIA and Tesla, Inc. led in active trading.

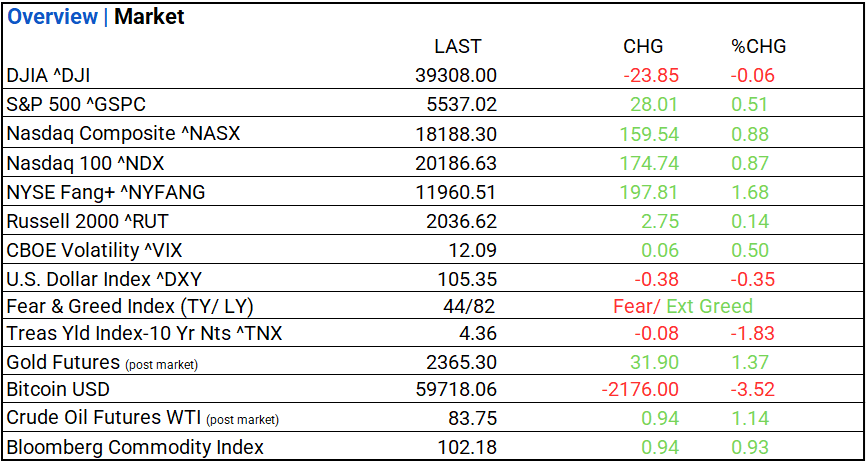

Summary of Market Performance

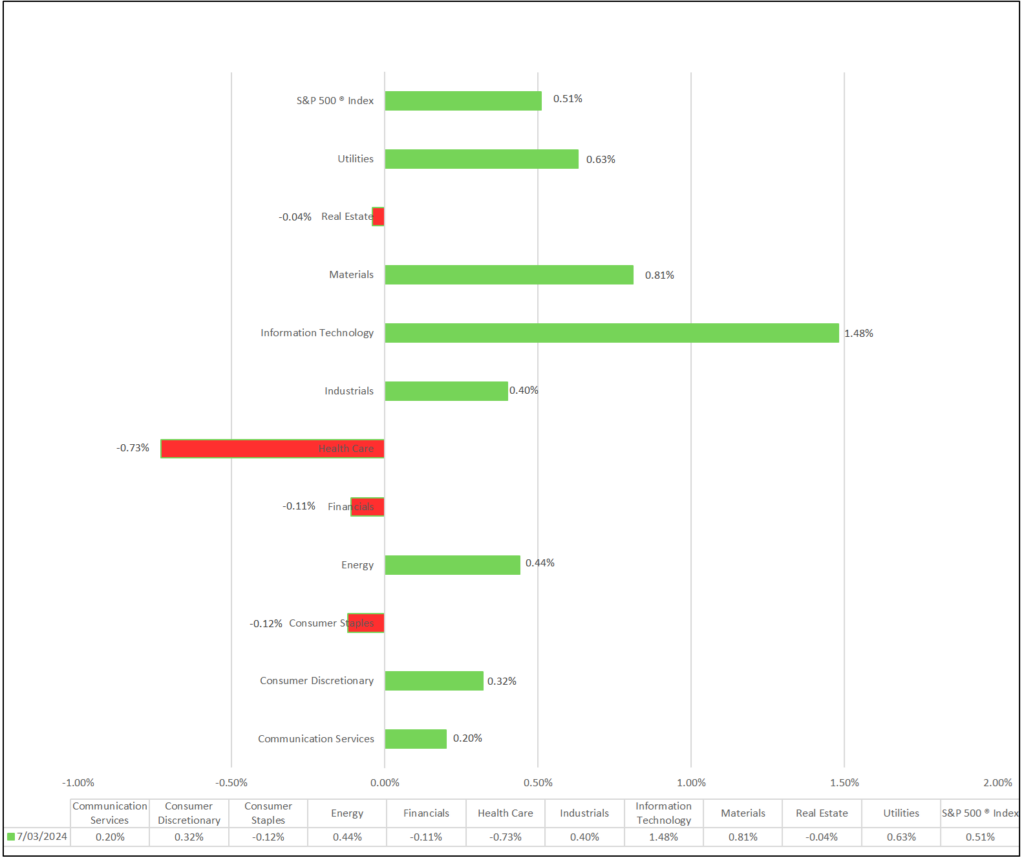

Indices & Sectors Performance:

- Today, major US stock indices— NASDAQ, S&P 500—up, DOW—off. Among eleven sectors, seven gained, with Information Tech leading and Health Care trailing. Top performing industries were Automobiles and Semiconductor & Semiconductor Equipment.

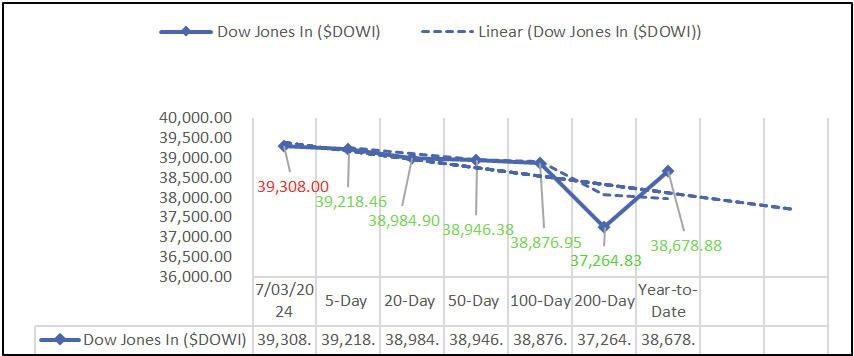

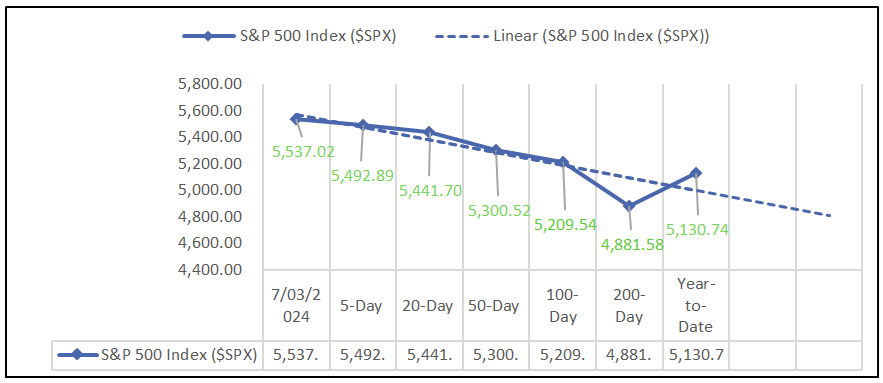

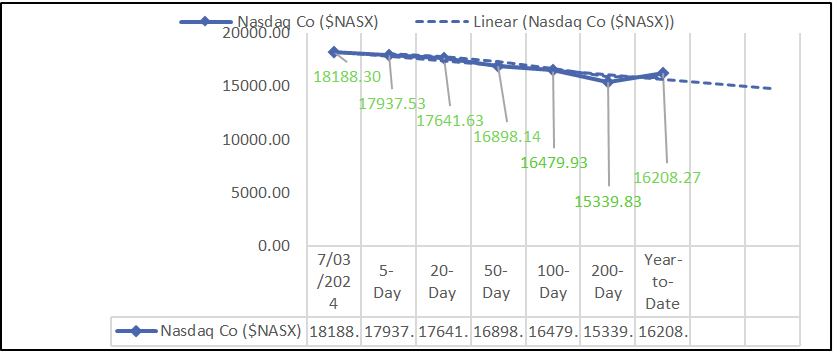

Chart: Performance of Major Indices

Moving Average Analysis:

S&P 500 Sectors:

- Among eleven sectors, seven gained, with Information Tech leading and Health Care trailing.

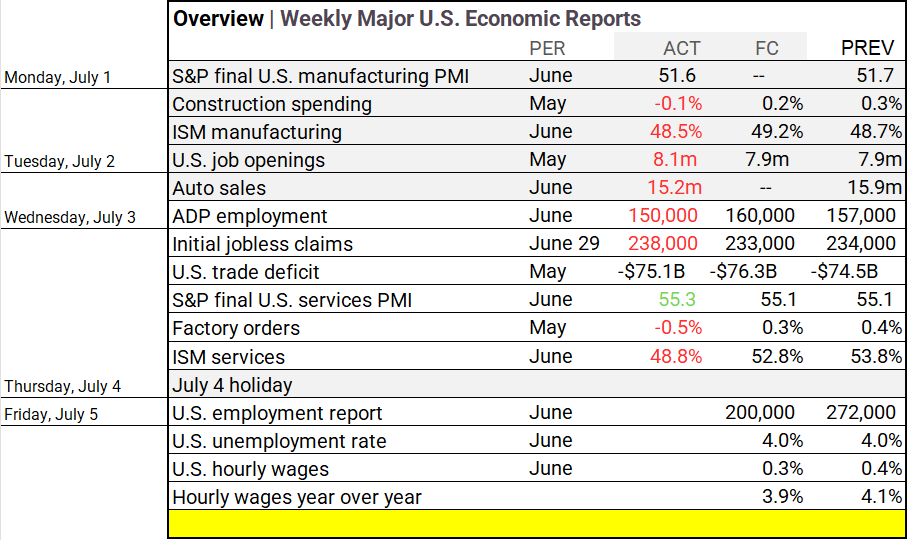

Economic Highlights:

- June ADP employment was soft at 150,000, initial jobless claims rose to 238,000, services PMI finalized at 55.1, while factory orders and ISM services index declined.

NASDAQ Global Market Update:

- Today’s NASDAQ showed positive sentiment with a total share volume of 3.33 billion, 147 new highs, 111 new lows, and an advance/decline ratio of 1.40. NVIDIA Corporation and Tesla, Inc. led in active trading.

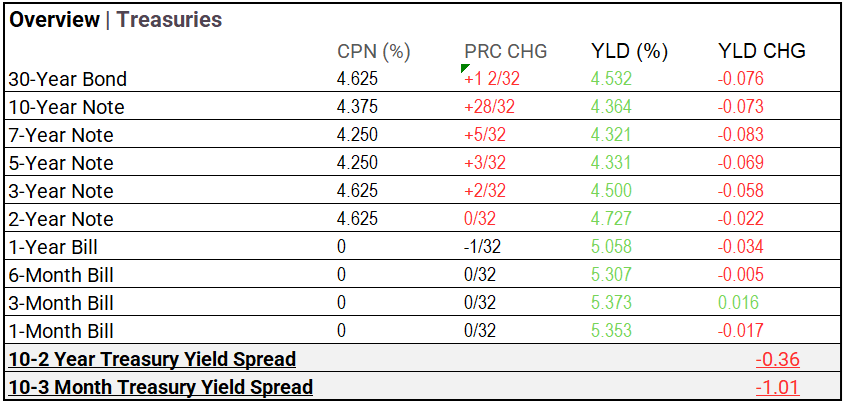

Treasury Markets:

- Bond yields fell, notably with the 30-year bond reaching 4.532% (down by 0.076%) and the 10-year note at 4.364% (down by 0.073%).

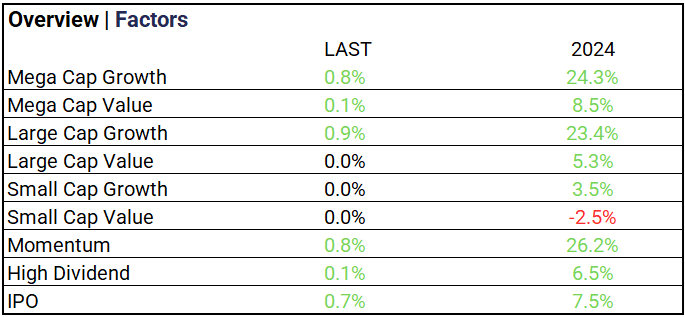

Market Factors:

- Large Cap Growth increased by 0.9%, Mega Cap Growth and Momentum rose by 0.8%, IPO sector rose by 0.7% with most other categories remaining flat or seeing slight increases.

Currency & Volatility:

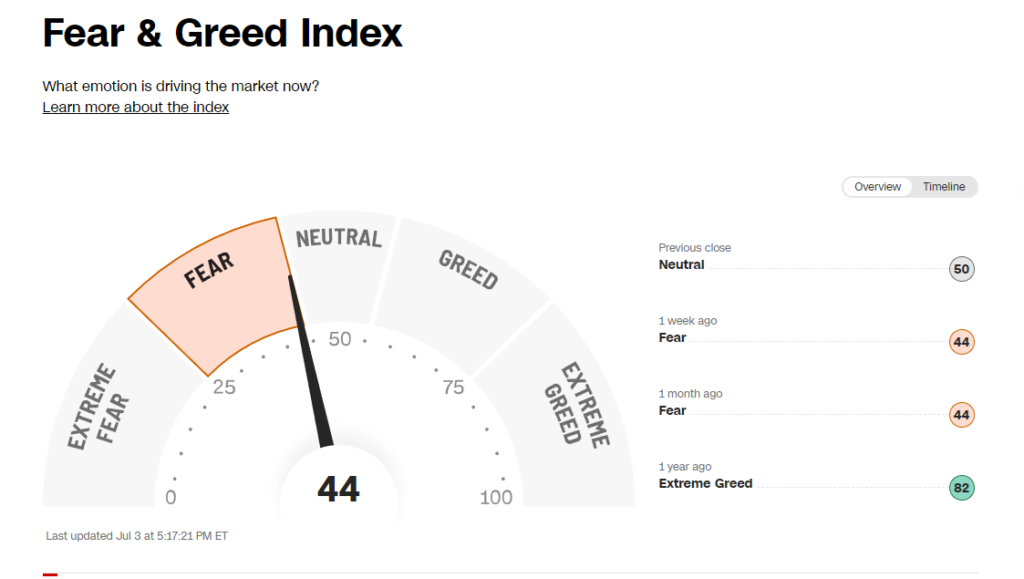

- The VIX moderately rose 12.09, reflecting moderate volatility. The Fear & Greed Index remains at 44 from 82 last year, signaling a shift from Extreme Greed to Fear during this election year.

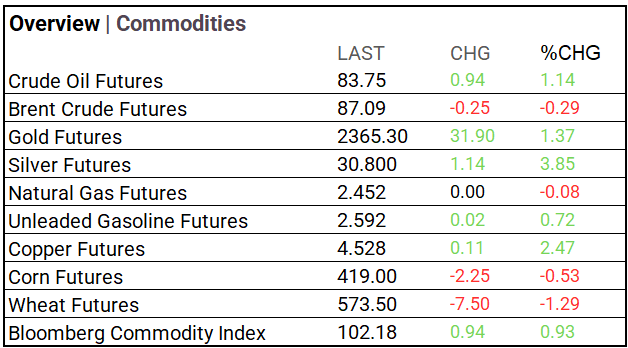

Commodities & ETFs:

- Commodity markets: Silver and Copper jumps, Crude oil and gold rose, while Brent crude and corn futures fell.

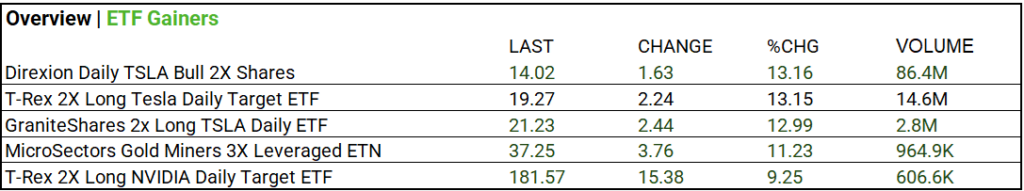

- ETFs: Direxion Daily TSLA Bull 2X Shares rose 13.16% to 14.02 (up 1.63) on high volume of 86.4M.

Cryptocurrency Update:

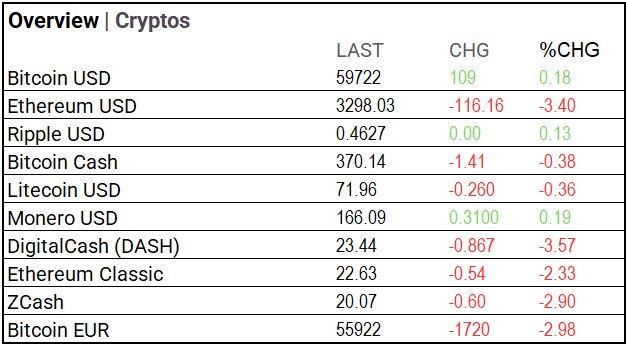

- Bitcoin held steady at $59,722 (+0.18%), while Ethereum dipped to $3,298.03 (-3.40%).

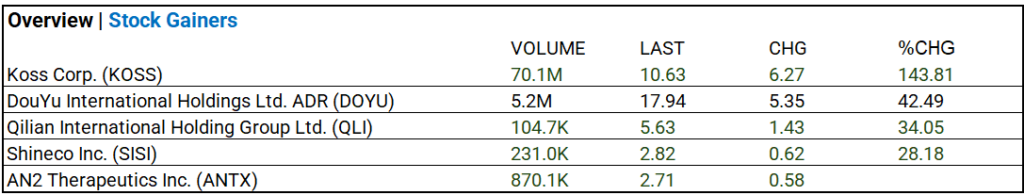

Stocks:

- Koss Corp. (KOSS) traded 70.1M shares at $10.63, up 6.27%, reflecting a 143.81% change in value.

Notable Earnings:

- Constellation Brands A (STZ) misses on revenue.

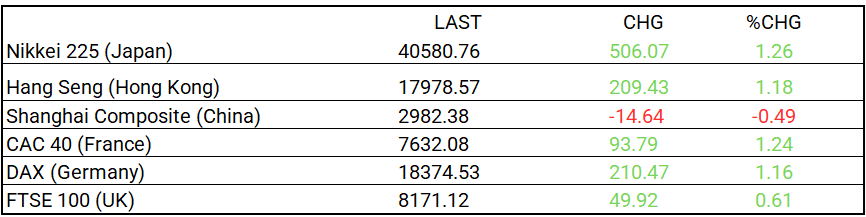

Global Markets Summary:

- Asia mixed: Nikkei leads with a 1.26% gain. Europe rises, with the CAC 40 leading up 1.24%.

In the NEWS

Central Banking, Monetary Policy & Economics:

- U.S. Crude Oil Inventories Fall More Than Expected – Wall Street Journal

- Fed Sought More Evidence of Cooling Inflation, June Minutes Show – Bloomberg

Business:

- Saks Owner to Buy Neiman Marcus—With Help From Amazon – Wall Steet Journal

- BYD Seals EV Pact With Leasing Firm Ayvens to Expand in Europe – Bloomberg

China:

Explainer | Did China’s economy ‘lose some momentum’ in June?: 4 takeaways from PMI data – South China Morning Post