MARKETS TODAY June 28th, 2023 (Vica Partners)

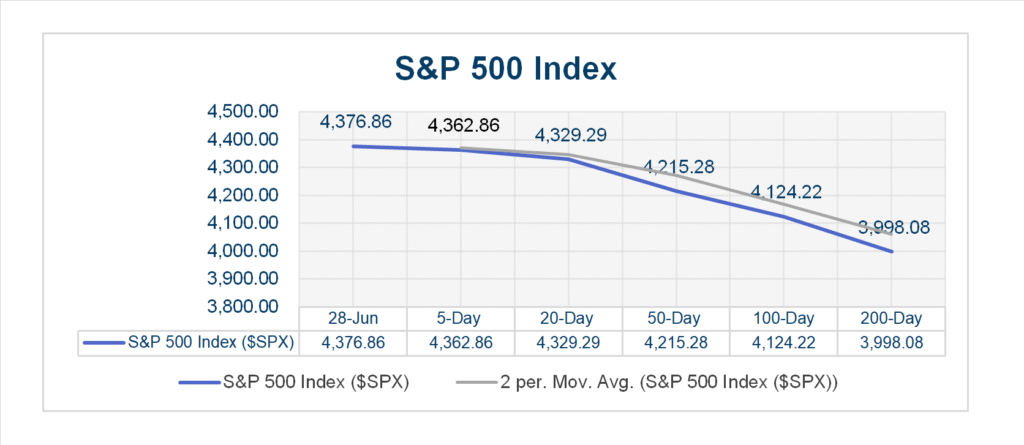

Overnight/US Premarket, Asian markets finished mixed, Japan’s Nikkei 225 +2.02%, Hong Kong’s Hang Seng +0.12%, China’s Shanghai Composite 0.00%. European markets finished higher, France’s CAC 40 +0.98%, Germany’s DAX +0.64%, London’s FTSE 100 +0.52%. S&P futures were trading at 0.1% below fair-value.

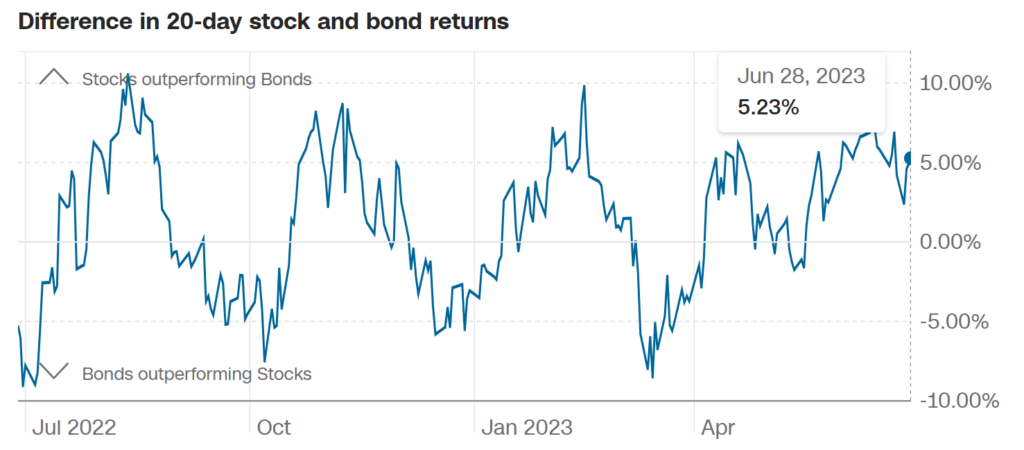

Today US Markets finished mixed, S&P 500 -0.14%, DOW -0.04%, NASDAQ +0.27%. 7 of 11 of the S&P 500 sectors declining: Energy +1.02% outperforms/ Utilities -1.48% lags. On the upside, NYSE FANG+, Russell 2k, Small Cap Growth, IPO’s, U.S. Dollar Index, and Shorter Term Treasuries. In economic news, Advanced Retail Inventories miss, Advanced Wholesale Inventories in-line.

Takeaways

- Semiconductor ETF (SOXX) <0.77%> on China restrictions news

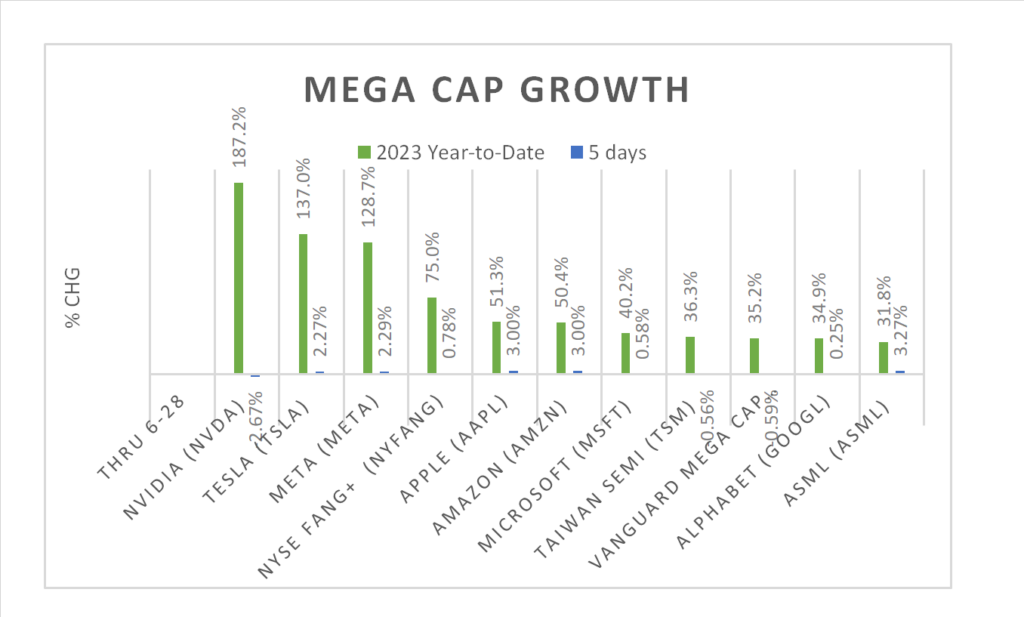

- NYSE Fang+ ^NYFANG gains 0.90%

- 7 of 11 of the S&P 500 sectors lower: Energy +1.02% outperforms/ Utilities -1.48% lags

- IPO’s +1.5%, Small Cap Growth +0.5%

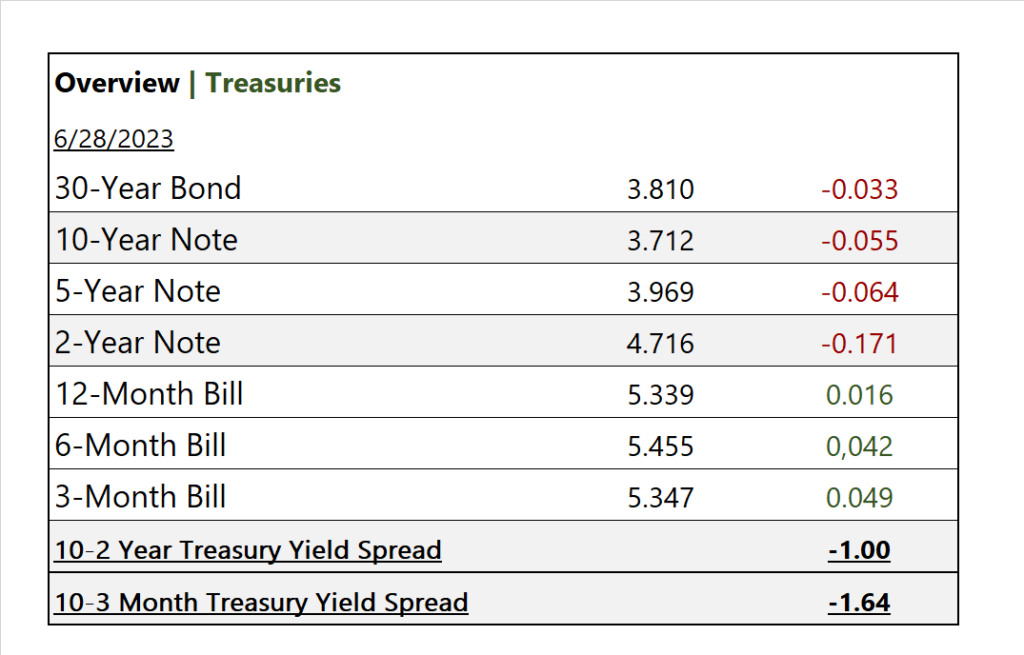

- Shorter term Treasury yields rise

- S. Dollar Index +up

- Micron (MU), General Mills (GIS) with earnings beats

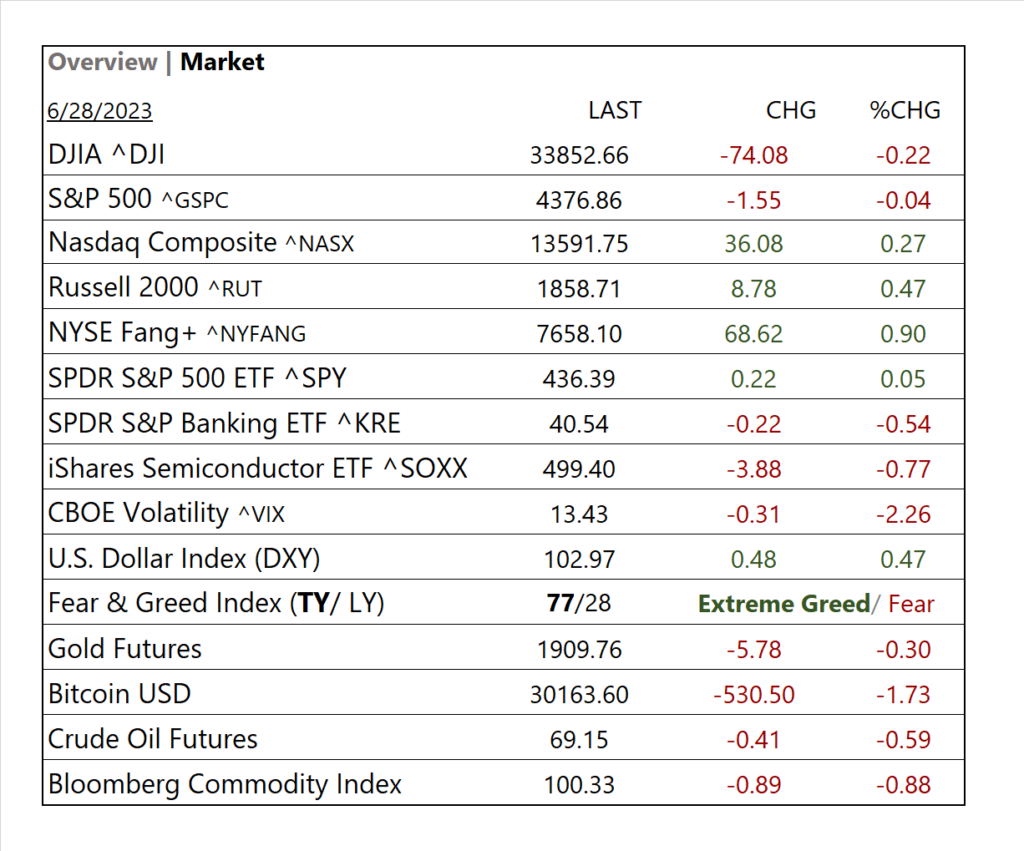

Pro Tip: Safe Haven Demand shows the difference between Treasury bond and stock returns over the past 20 trading days. Bonds generally do better in bear markets.

SAFE HAVEN DEMAND

Sectors/ Commodities/ Treasuries

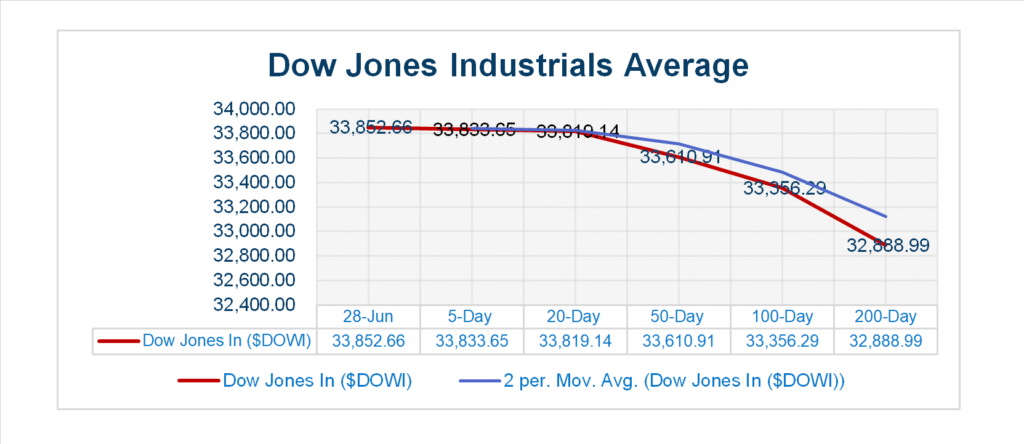

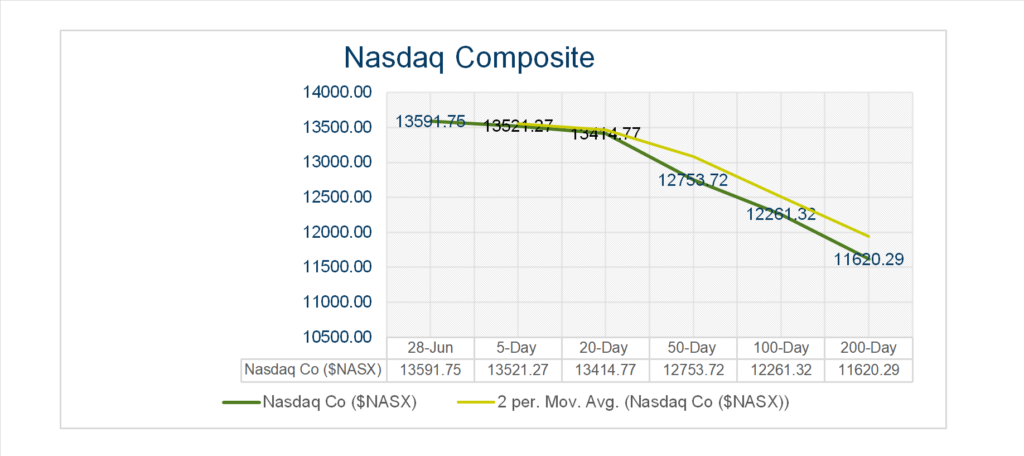

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 7 of 11 of the S&P 500 sectors lower: Energy +1.02%, Communication Services +0.80% outperform / Utilities -1.48%, Materials -0.68%, lag.

Factor/ Mega Cap

US Treasuries

Notable Earnings Today

- +Beat: Micron (MU), General Mills (GIS), Roivant Sciences (ROIV),

- – Miss: National Beverage (FIZZ), Concentrix (CNXC)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom Inc (AVGO), Intel (INTC)

Economic Data

US

- Advanced U.S. trade balance in goods. act -91.1B, prior $97.1B

- Advanced retail inventories; period May, act 0.8%, fc 0.2%, prior 0.3%

- Advanced wholesale inventories; period May, act -0.1%, fc -0.1%, prior -0.3%

News

Company News/ Other

- Nvidia Warns of Lost Opportunities if U.S. Bans AI Chip Exports to China – WSJ

- Visa to Buy Brazilian Payments Provider Pismo for $1 Billion – Bloomberg

Energy/ Materials

- China on Track to Blow Past Xi’s Clean Power Goal Five Years Early – Bloomberg

Central Banks/Inflation/Labor Market

- Powell and Central Bankers See More Tightening as Economies Withstand Hikes – Bloomberg

- Banks Ace Stress Tests, Clearing First Hurdle for Payouts – Bloomberg

China/ International

- Will Beijing’s new ‘umbrella law’ deepen uncertainty for foreign companies in China? – SCMP