Stay Informed and Stay Ahead: Market Watch, January 30th, 2024.

Market Highlights & Analysis: Indices, Sectors, and More…

- Economic Data: November saw a 5.4% increase in the S&P Case-Shiller Home Price Index, December job openings reached 9.0 million, and January’s consumer confidence rose to 114.8 from December.

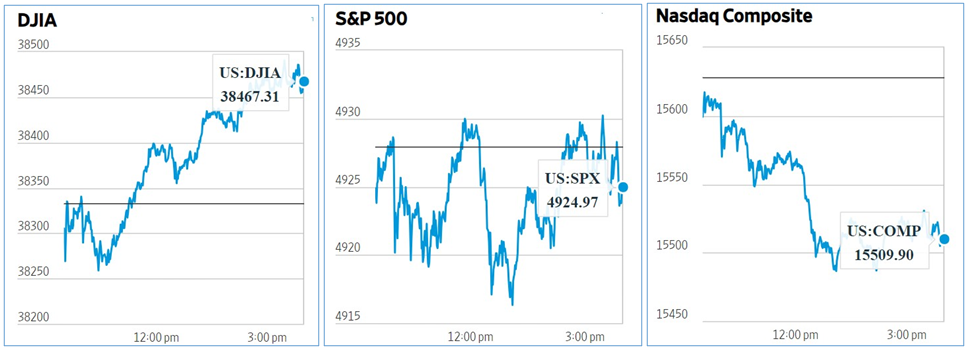

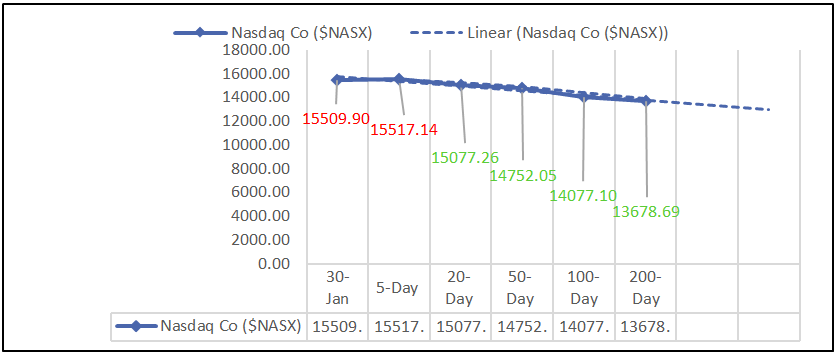

- Market Indices: DJIA (+0.35%), S&P 500 (-0.06%), Nasdaq Composite (-0.76%).

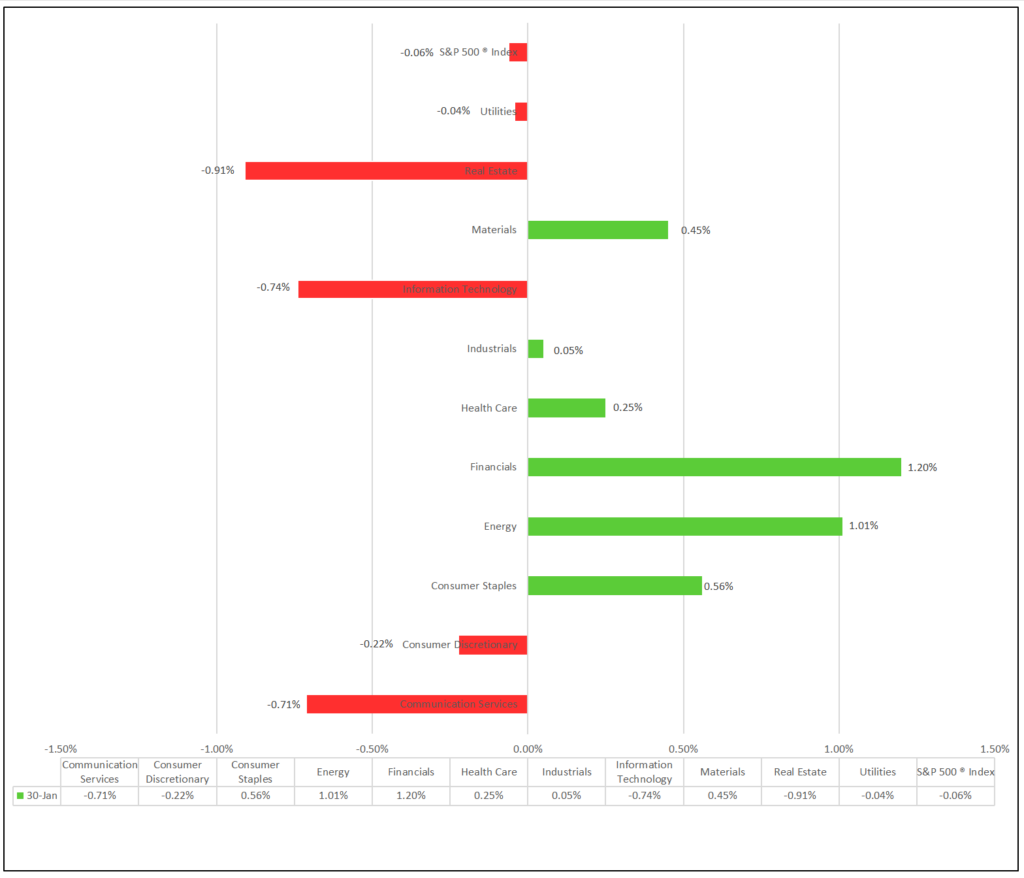

- Sector Performance: 6 of 11 sectors higher; Financials (+1.20%) leading, Real Estate (-0.91%) lagging. Top industry: Banks (+2.13%).

- Factors: Mega Cap and Large Cap Value led, IPOs lag.

- Treasury Markets: Stable treasury yields precede Wednesday’s federal reserve interest-rate policy announcement.

- Commodities: Gold, Bitcoin, Crude Oil, and the Bloomberg Commodity Index experienced gains.

- ETFs: Direxion Daily Semiconductor Bear 3X Shares surged 4.28% with significant trading volume, reaching 94.2 million shares.

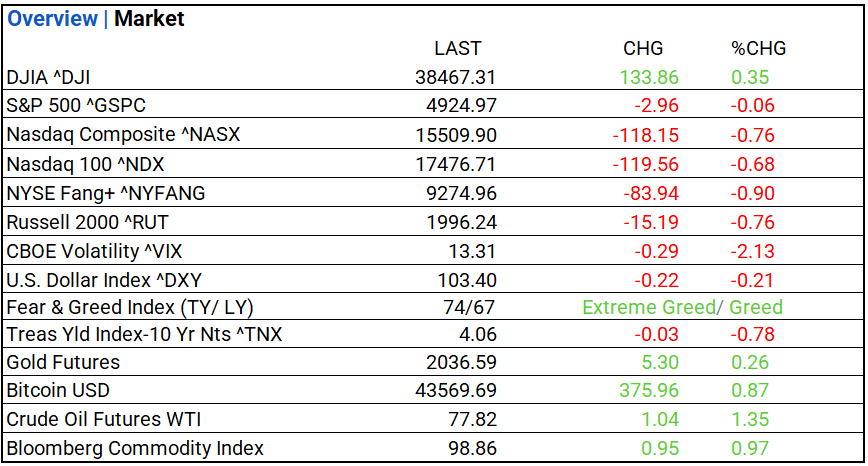

US Market Snapshot: Key Stock Market Indices:

- DJIA ^DJI: 38,467.31, 133.86, 0.35%

- S&P 500 ^GSPC: 4,924.97, -2.96, -0.06%

- Nasdaq Composite ^NASX: 15,509.90, -118.15, -0.76%

- Nasdaq 100 ^NDX: 17,476.71, -119.56, -0.68%

- NYSE Fang+ ^NYFANG: 9,274.96, -83.94, -0.90%

- Russell 2000 ^RUT: 1,996.24, -15.19, -0.76%

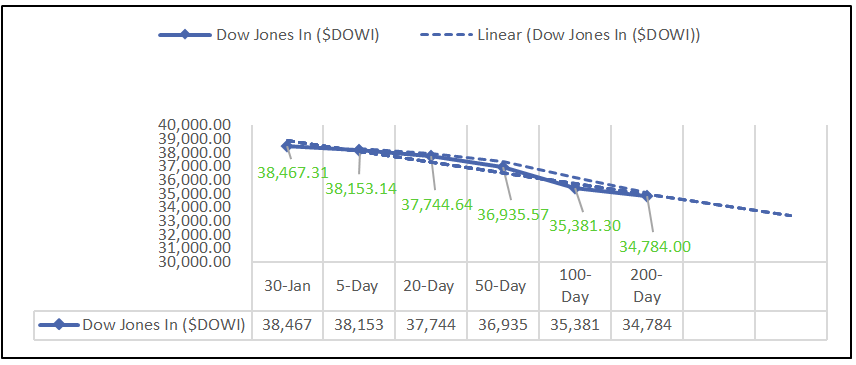

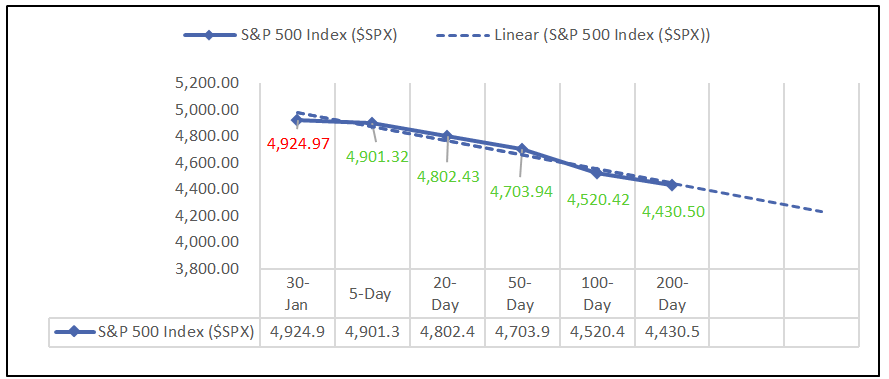

Moving Averages: DOW, S&P 500, NASDAQ:

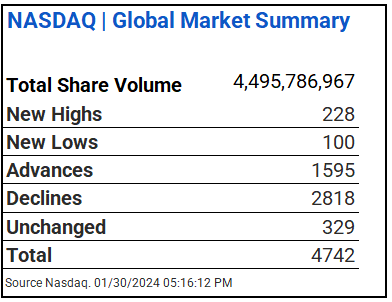

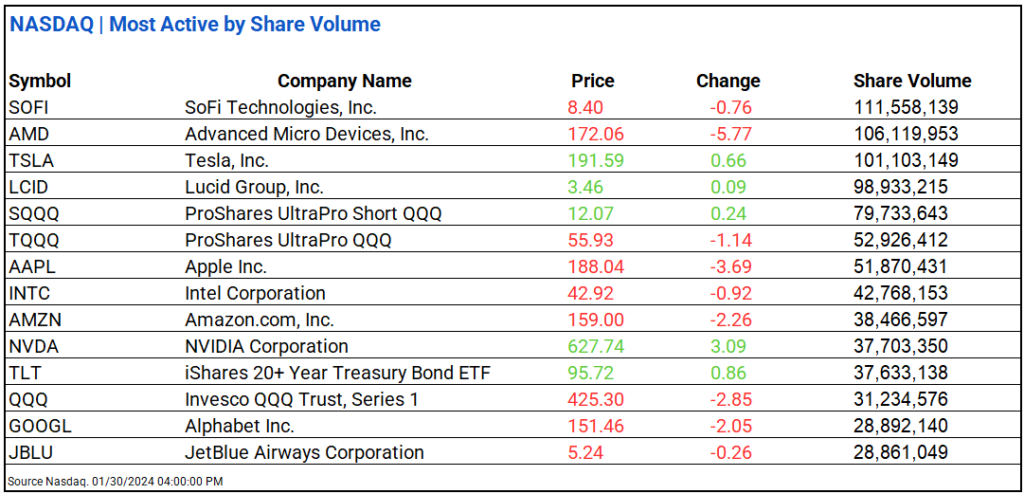

NASDAQ Global Market Summary:

Sectors:

- 6 of 11 sectors higher; Financials (+1.20%) leading, Real Estate (-0.91%) lagging. Top industries: Banks (+2.13%), Metals & Mining (+2.10%), Life Sciences Tools & Services (+2.07%), and Oil, Gas & Consumable Fuels (+1.57%).

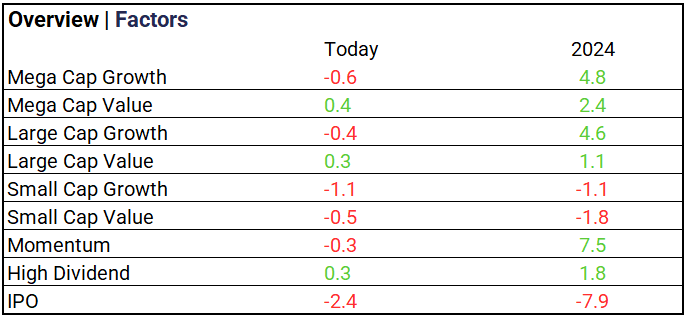

Factors:

- Mega Cap and Large Cap Value lead on the day, Momentum +7.5% YTD.

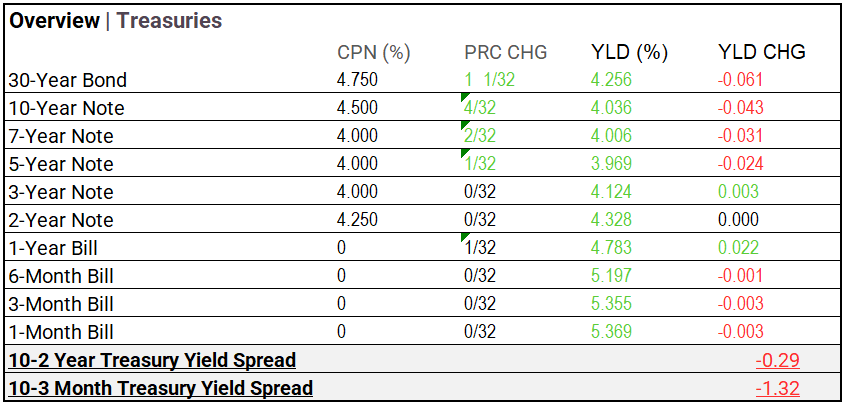

Treasury Markets:

- Stable treasury yields precede Wednesday’s federal reserve interest-rate policy announcement. Shorter-term notes showed minor fluctuations today.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 103.40 (-0.22, -0.21%)

- CBOE Volatility ^VIX: 13.31 (-0.29, -2.13%)

- Fear & Greed Index: 74/LY 67 (Extreme Greed/ Greed)

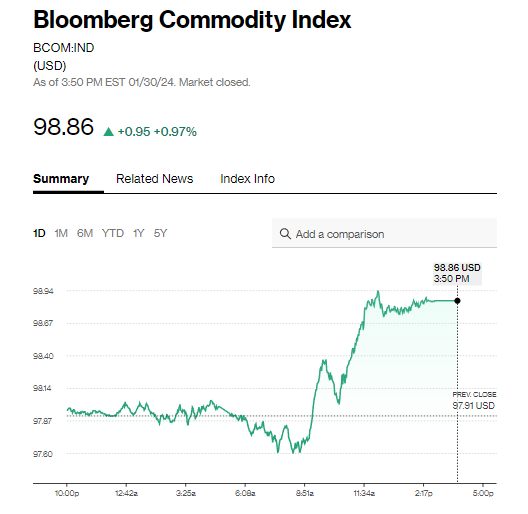

Commodity Markets:

- Gold Futures: $2,036.59, +$5.30, +0.26%

- Bitcoin USD: $43,569.69, +$375.96, +0.87%

- Crude Oil Futures WTI: $77.82, +$1.04, +1.35%

- Bloomberg Commodity Index: 98.86, +$0.95, +0.97%

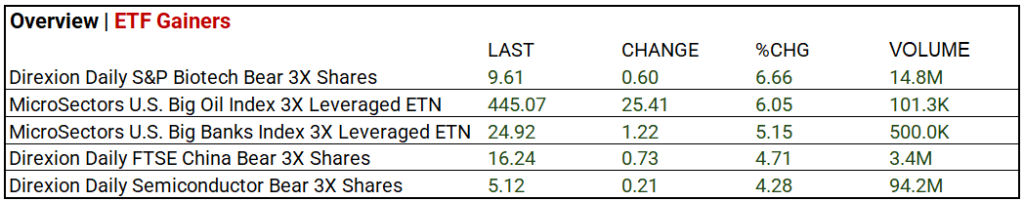

ETF’s:

- Direxion Daily S&P Biotech Bear 3X Shares +6.66% on volume of 14.8 million. Direxion Daily Semiconductor Bear 3X Shares +4.28% on large volume, 94.2 million.

US Economic Data:

- S&P Case-Shiller Home Price Index (20 cities) Nov. 5.4% (fc: 5.7%, prior: 4.9%)

- Job Openings Dec. 9.0 million (fc: 8.8 million, prior: 8.9 million)

- Consumer Confidence Jan. 114.8 (fc: 115.0, prior: 108.0)

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT: Microsoft (MSFT), Alphabet C (GOOG), AMD (AMD), Danaher (DHR), Pfizer (PFE), Stryker (SYK), Mondelez (MDLZ), Chubb (CB), HCA (HCA), Marathon Petroleum (MPC), General Motors (GM), MSCI (MSCI), MPLX LP (MPLX), Corning (GLW), Komatsu (KMTUY), Central Japan Railway Co (CJPRY).

- MISSED: United Parcel Service (UPS), Starbucks (SBUX), BBVA ADR (BBVA), Sysco (SYY), Johnson Controls (JCI), Electronic Arts (EA), Canon ADR (CAJPY).

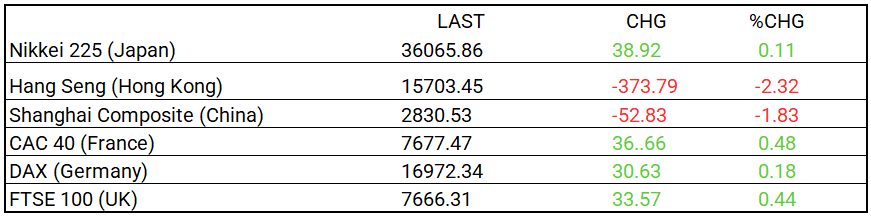

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): 36,065.86, +38.92, +0.11%

- Hang Seng (Hong Kong): 15,703.45, -373.79, -2.32%

- Shanghai Composite (China): 2,830.53, -52.83, -1.83%

- CAC 40 (France): 7,677.47, +36.66, +0.48%

- DAX (Germany): 16,972.34, +30.63, +0.18%

- FTSE 100 (UK): 7,666.31, +33.57, +0.44%

Central Banking and Monetary Policy, Noteworthy:

- Where Are Interest Rates Headed? What to Expect From the Fed Meeting – WSJ

- Home-Price Growth Accelerated in November – WSJ

- US Job Openings Rise to Three-Month High But Fewer Workers Quit – Bloomberg

Energy:

- Gas-Addicted Europe Trades One Energy Risk for Another – Bloomberg

- LNG Exports Shouldn’t Be the Next Keystone Campaign – Bloomberg

China:

- China’s manufacturing activity rebounds slightly in January, but remains in contraction – SCMP