Stay Informed and Stay Ahead: Market Watch, May 22nd, 2024.

Wall Street Mid-Week Market Recap Edition

Market Highlights & Analysis: Indices, Sectors, and More…

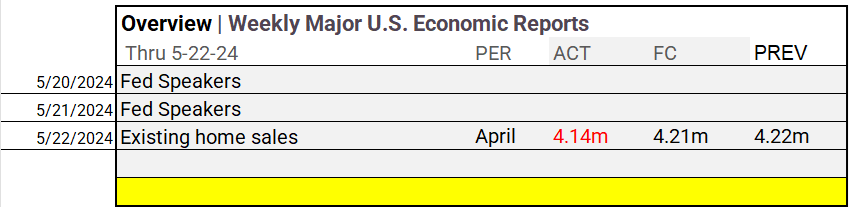

- Economic Data: April existing home sales soft at 4.14M, missing the 4.21M consensus.

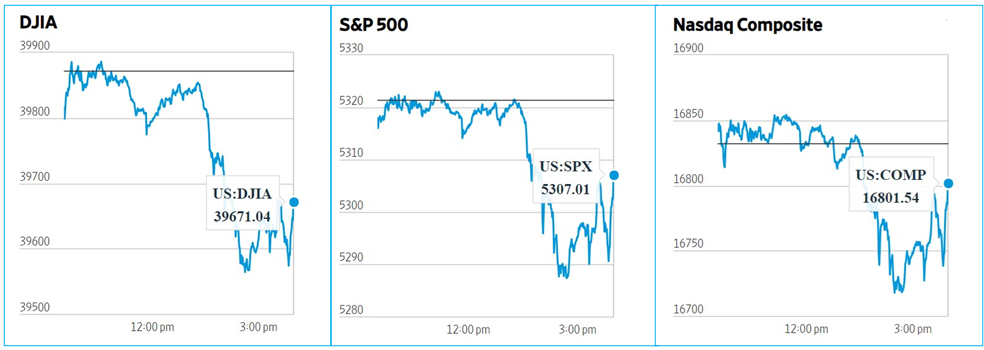

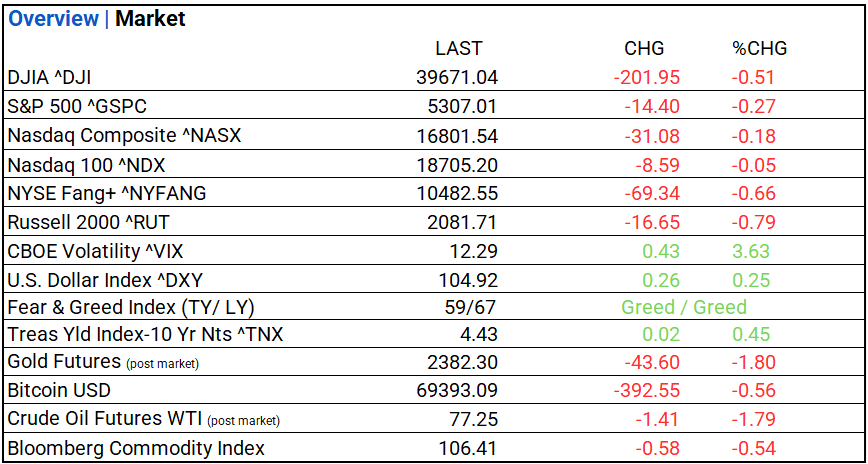

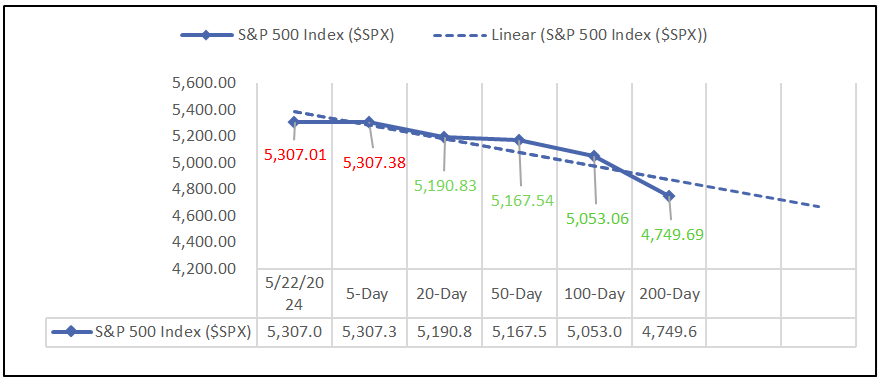

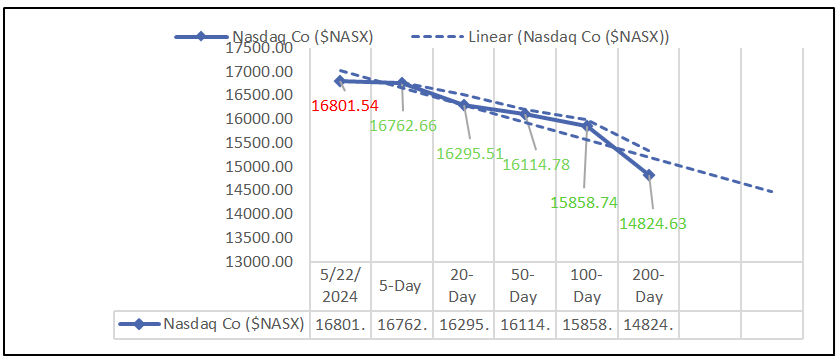

- Market Indices: DJIA (-0.51%), S&P 500 (-0.27%), Nasdaq Composite (-0.18%).

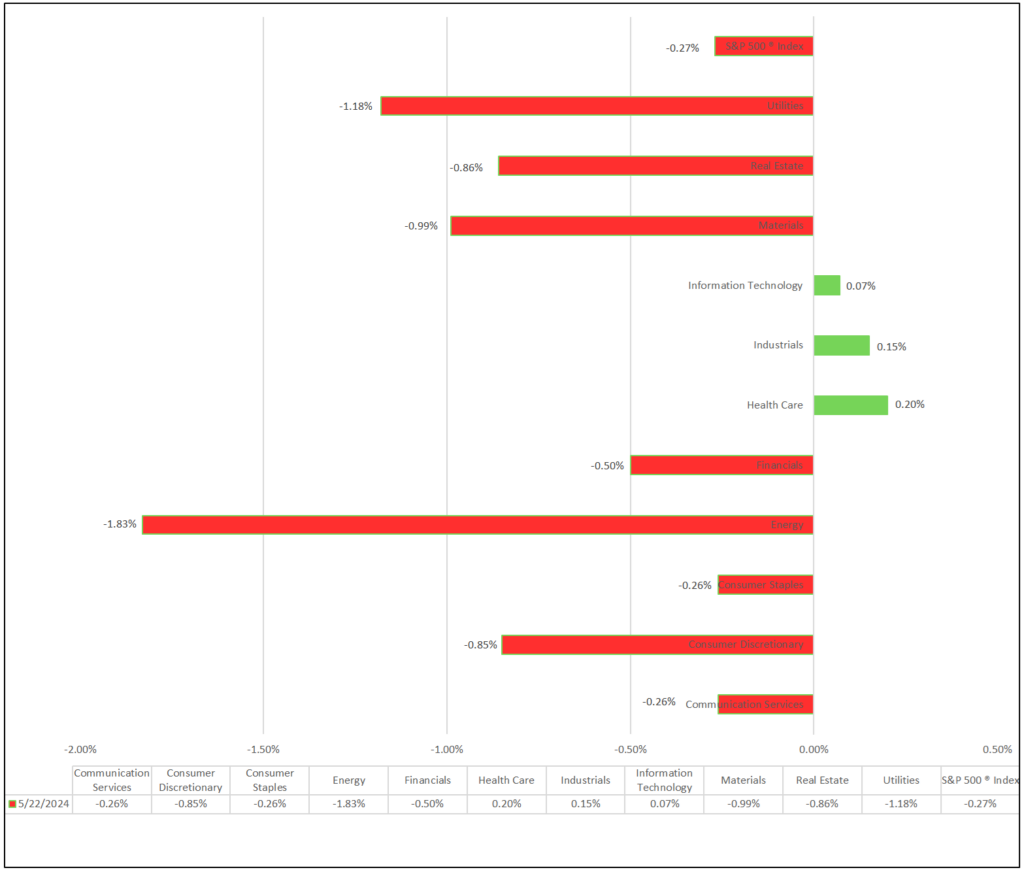

- Sector Performance: 8 of 11 sectors lower; Health Care (+0.20%) leading, Energy (-1.83%) lagging. Top industry: Ground Transportation (+1.26%).

- Factors: Broad-based declines with IPOs and large-cap value stocks remaining nearly flat.

- Treasury Markets: Bond yields were mostly flat, with the 2-Year Note slightly outperforming.

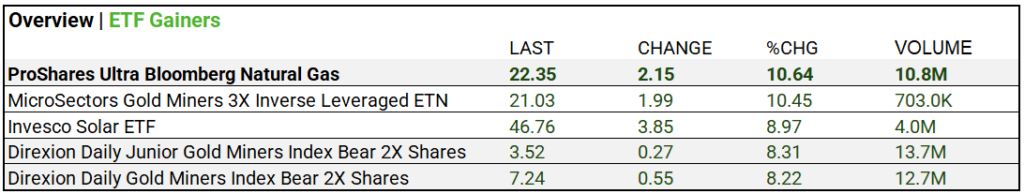

- Commodities: Natural Gas outperforms; big bets against Gold.

- ETFs: ProShares Ultra Bloomberg Natural Gas (+10.64%) with 10.8M volume.

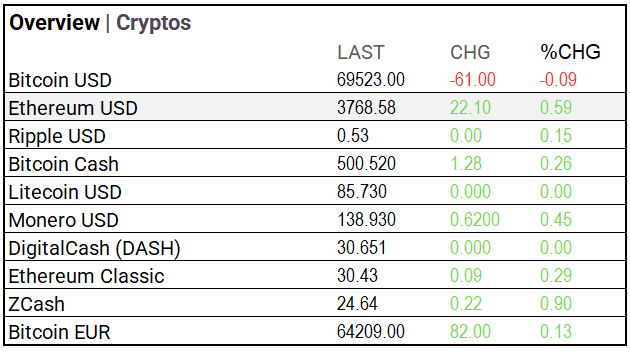

- Cryptos: Bitcoin down 0.09%, Ethereum up 0.59%, mixed performance among other cryptocurrencies.

US Market Snapshot: Key Metrics:

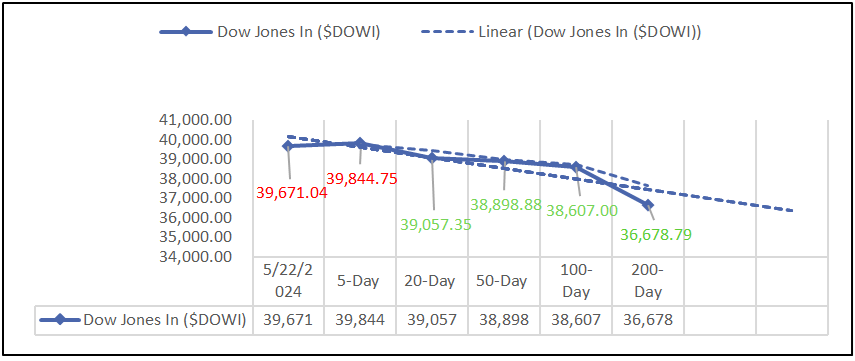

Moving Averages: DOW, S&P 500, NASDAQ:

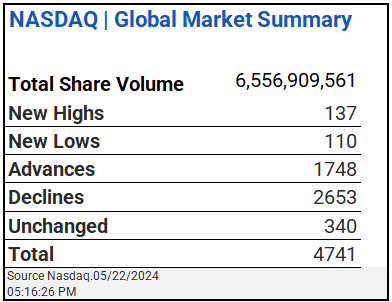

NASDAQ Global Market Summary:

Sectors:

- 8 of 11 sectors lower; Health Care (+0.20%) leading, Energy (-1.83%) lagging. Top industries: Ground Transportation (+1.26%), Professional Services (+0.83%), and Diversified Telecommunication Services (+0.81%).

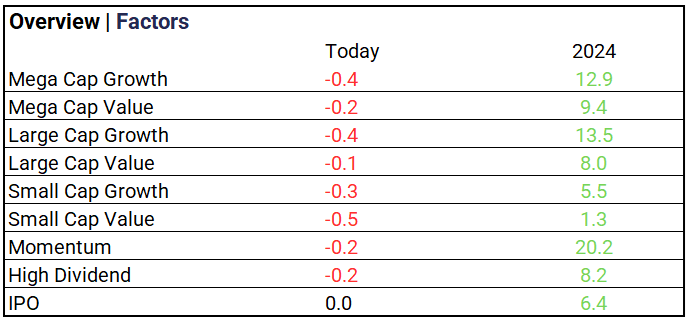

Factors:

- Broad-based losses with IPOs and large-cap value stocks remaining nearly flat. Momentum stocks up 20% year-to-date.

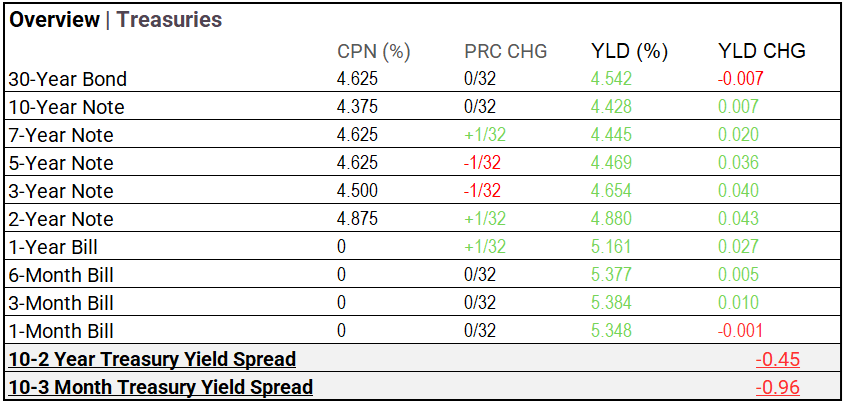

Treasury Markets:

- Bond yields were mostly flat, with the 2-Year Note slightly outperforming.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 104.92 (+0.26, +0.25%)

- CBOE Volatility ^VIX: 12.29 (+0.43, +3.63%)

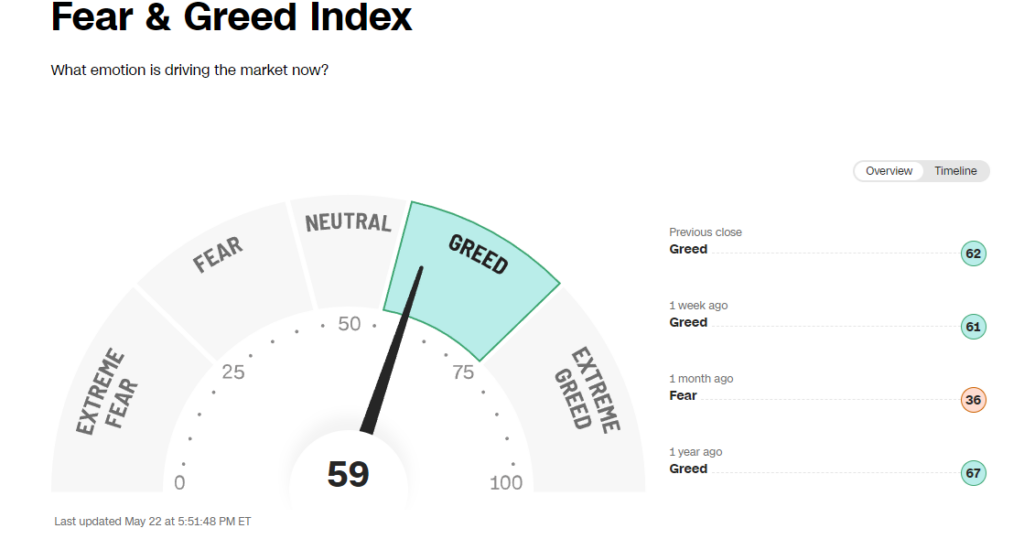

- Fear & Greed Index: 59/TY 67/LY (Greed/ Greed)

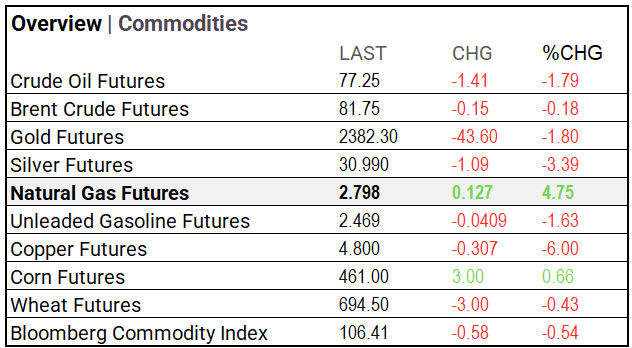

Commodity Markets:

- Natural Gas break-out!

ETF’s:

- Biggest volume gainers: ProShares Ultra Bloomberg Natural Gas (+10.64%) with 10.8M volume. Options activity is bearish on Gold with >25M volume.

Cryptos:

- Bitcoin down 0.09%, Ethereum up 0.59%, mixed performance among other cryptocurrencies.

US Economic Data:

- April existing home sales are soft at 4.14M, missing the 4.21M consensus.

Notable Earnings Today:

- BEAT: NVIDIA (NVDA), PDD Holdings DRC (PDD), Analog Devices (ADI).

- MISSED: TJX (TJX), Synopsys (SNPS), Target (TGT), Snowflake (SNOW).

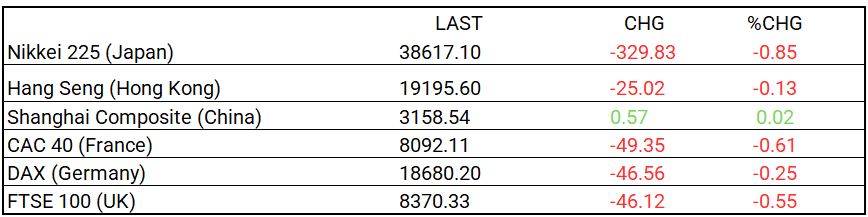

Global Markets Summary: Asian & European Markets:

Central Banking and Monetary Policy, Noteworthy:

- Home Sales Fell Again in April After High Mortgage Rates Damped Activity – Wall Street Journal

- Fed Minutes Show Officials Rally Around Higher-for-Longer Rates – Bloomberg

Business:

- DuPont to Break Into Three Smaller Companies, Joining Other Storied Peers – Wall Street Journal

- Target Sales Decline as Discretionary Spending Remains Tepid – Bloomberg

China:

- Taiwan’s prized semiconductors not unbreakable ‘silicon shield’ they once were as mainland China, West develop own bargaining chips – South China Morning Post