Stay Informed and Stay Ahead: Market Watch, June 21st, 2024.

Late-Week Wall Street Markets

Key Takeaways

+ Dow rose; NASDAQ and S&P 500 fell. Six sectors gained, led by Consumer Discretionary; Technology lagged. Top industry: Leisure Products.

+ June, U.S. service and manufacturing sectors exceeded expectations, showing growth while leading economic indicators signaled potential slowdown.

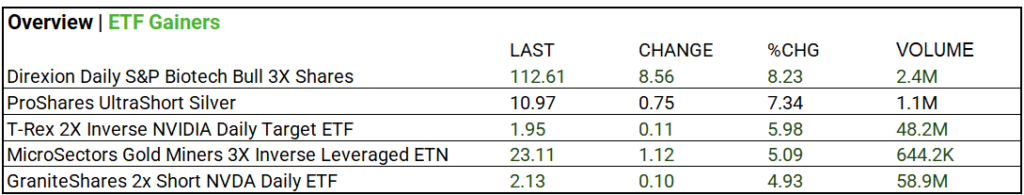

+NVIDIA ETFs favored shorts, small caps led gains, bond prices remained steady, and oil prices dropped universally.

Summary of Market Performance

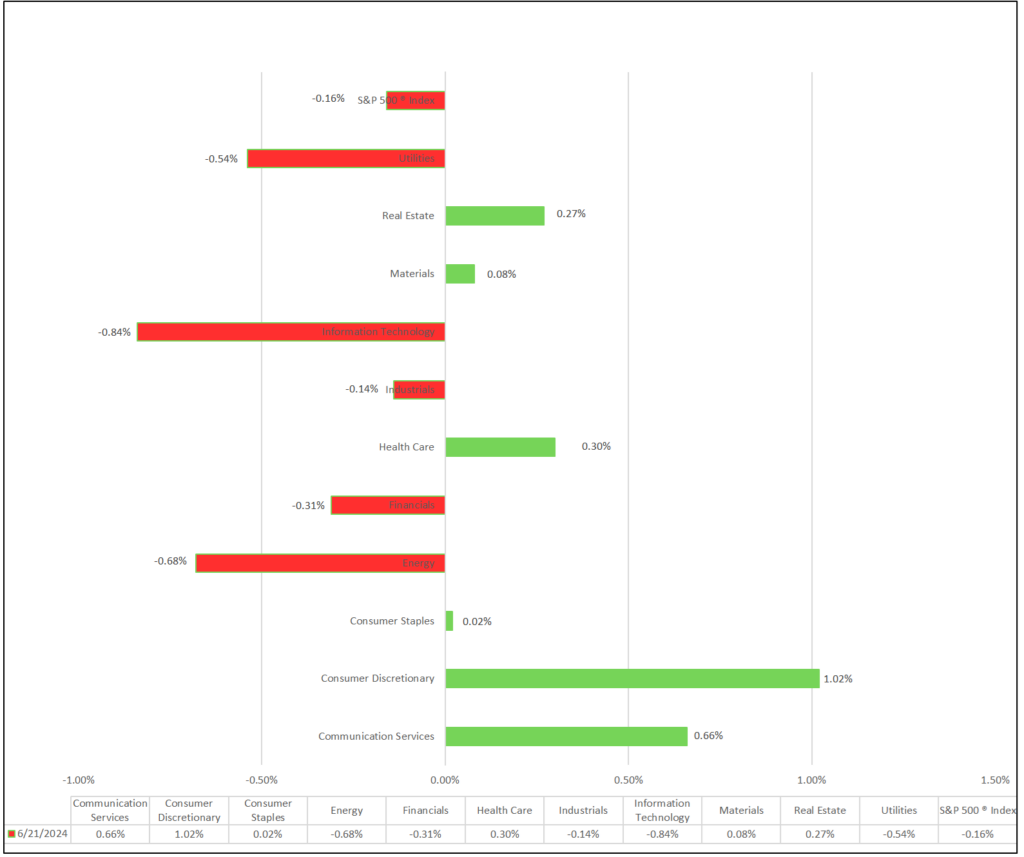

Indices & Sectors Performance:

- Today, the Dow Jones Industrial Average rose, while the NASDAQ and S&P 500 declined. Among sectors, six out of eleven saw gains, with Consumer Discretionary leading and Information Technology lagging. Top-performing industries included Leisure Products (+2.70%), Automobile Components (+1.95%), and Broadline Retail (+1.59%).

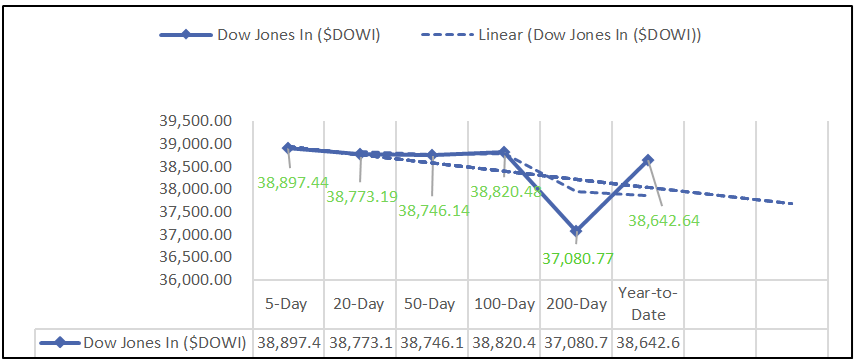

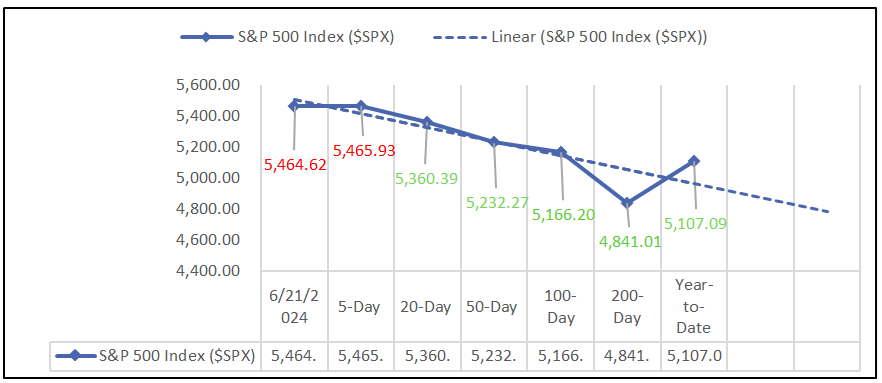

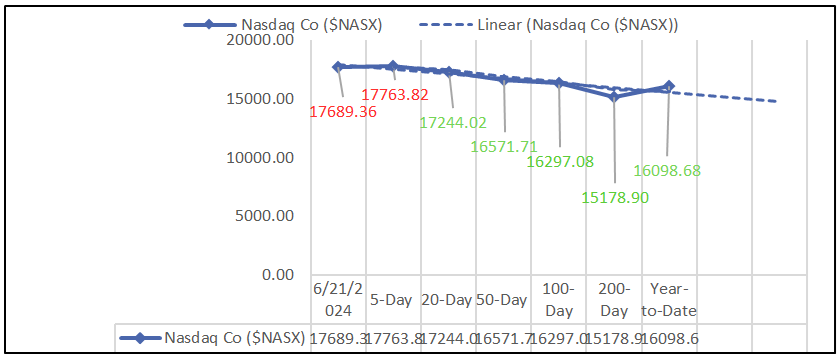

Moving Average Analysis:

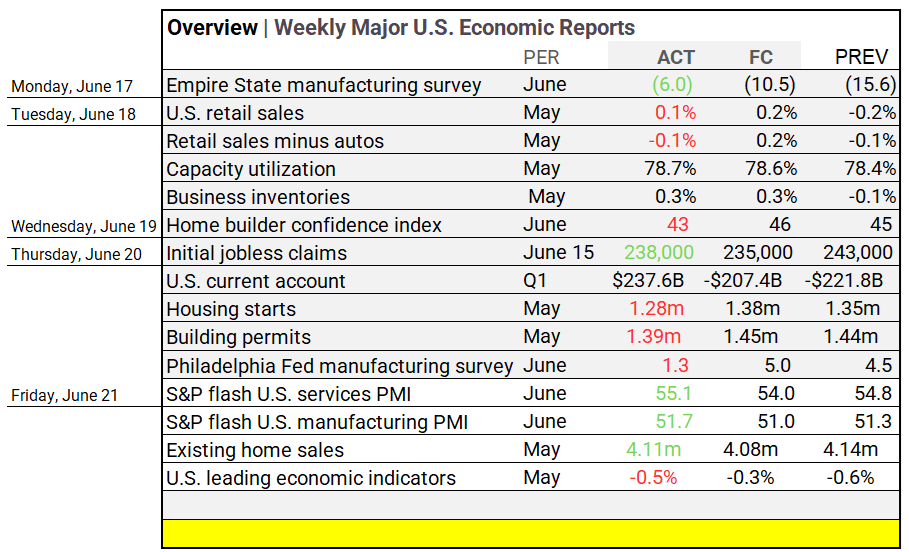

Economic Highlights:

- In June, the U.S. service and manufacturing sectors performed better than expected, showing growth. However, existing home sales in May were slightly lower than expected, and leading economic indicators declined more than forecasted, indicating potential economic slowdown concerns.

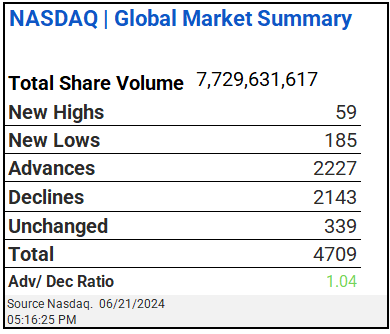

NASDAQ Global Market Update:

- Today’s Nasdaq had mixed sentiment: 7.73B shares traded, 59 new highs, 185 new lows, and an A/D ratio of 1.04. NVDA closed lower on 390.3M shares; SQQQ traded higher with 114.0M shares.

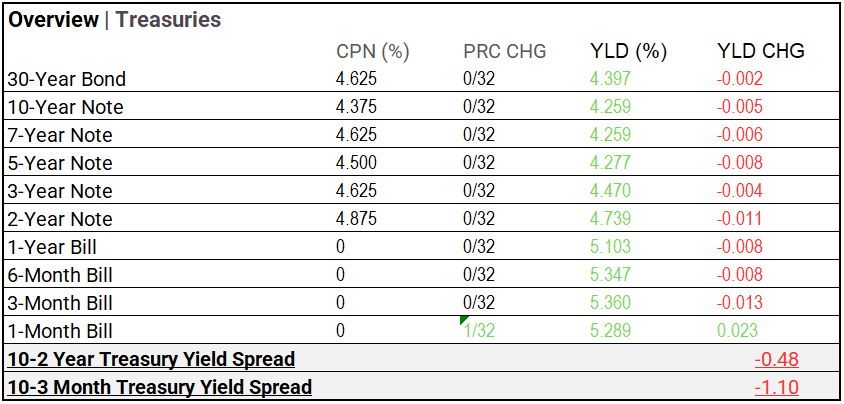

Treasury Markets:

- Bond prices remained stable with minimal yield changes: the 30-Year Bond yield held at 4.397%, the 10-Year Note at 4.259%. Shorter-term notes and bills saw slight yield decreases, except the 1-Month Bill, which rose to 5.289% with a +1/32 price change.

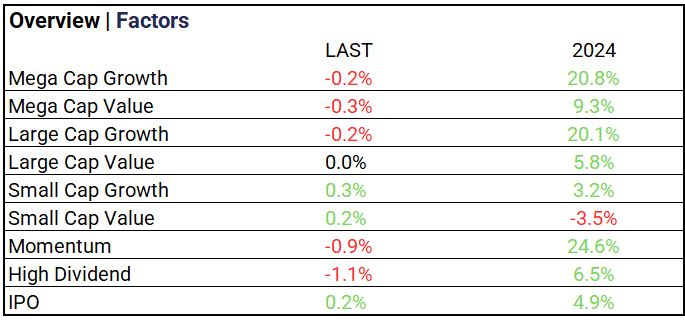

Market Trends:

- Small caps led gains, with mega-cap growth declining and momentum stocks experiencing significant losses.

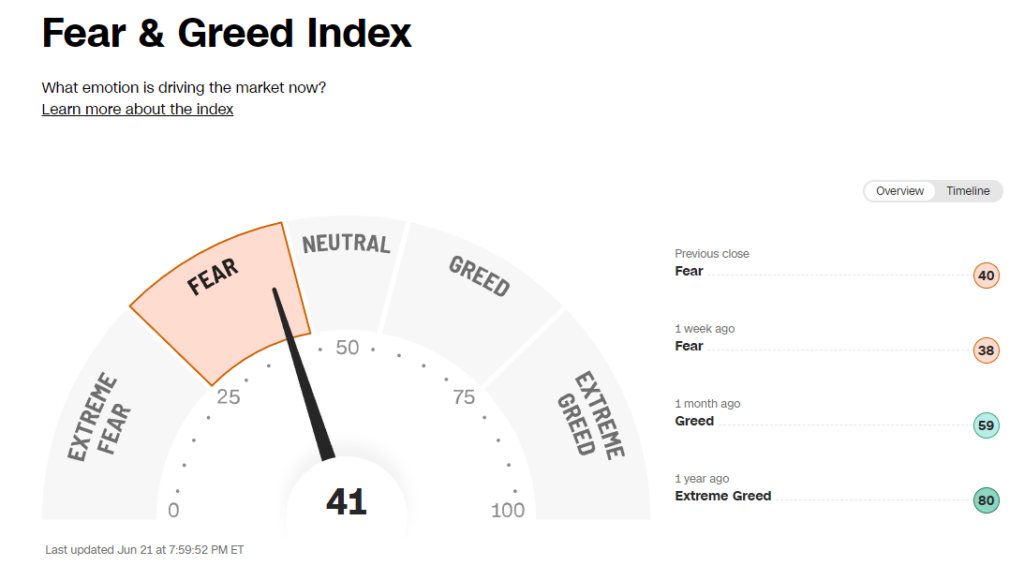

Currency & Volatility:

- The VIX saw a moderate decline, contrasting with the Fear & Greed Index showing surprising fear during an election year, previously at extreme greed.

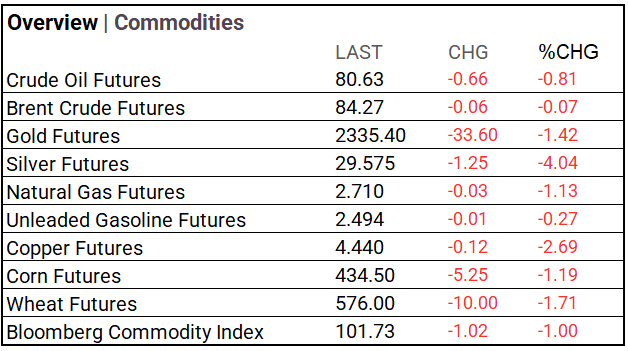

Commodities & ETFs:

- Oil prices across the board fell, while both silver and copper experienced significant declines.

- NVIDIA ETFs saw shorts prevail: T-Rex 2X Inverse NVIDIA Daily Target ETF rose 5.98% on 48.2 million shares, GraniteShares 2x Short NVDA Daily ETF gained 4.93% with 58.9 million shares traded.

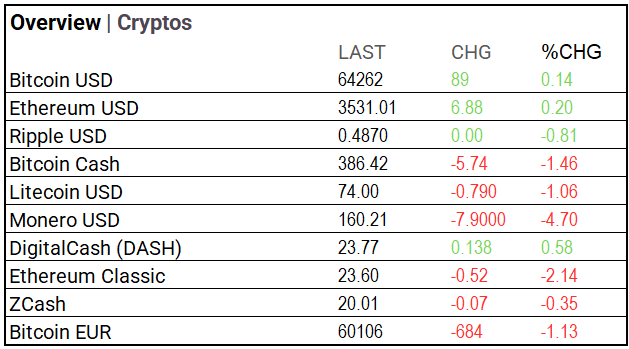

Cryptocurrency Update:

- Bitcoin experienced a significant downtrend this week, dropping by $2,342.00 (3.52%) over the past five days.

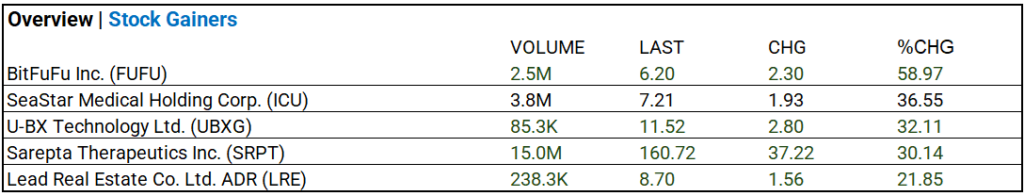

Stocks:

- Sarepta Therapeutics Inc. (SRPT) increased by 30.14% to $160.72 on 15.0 million shares traded.

Notable Earnings:

- Misses: FactSet Research (FDS), CarMax (KMX)

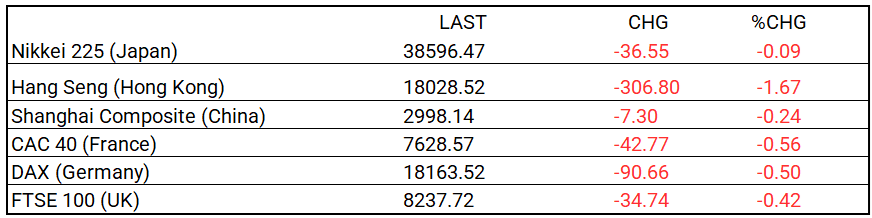

Global Markets Summary:

- Global markets experienced declines as Hong Kong’s Hang Seng fell sharply by 1.67% to 18,028.52, leading European markets to follow suit with losses.

In the NEWS

Central Banking and Monetary Policy:

- Home Prices Hit a Record High – Wall Street Journal

- US Services Activity Expands by Most in More Than Two Years – Bloomberg

Business:

- Inside CVS’s Strategy to Improve the Pharmacy Experience – Wall Street Journal

- SpaceX Demand Propels Telecom Equipment Maker’s Profit Forecast – Bloomberg

China:

- China is rolling out the red carpet for venture capital in tech – and foreign funds are welcome – South China Morning Post