MARKETS TODAY August 29th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished higher, Hong Kong’s Hang Seng up 1.95%, China’s Shanghai Composite up 1.20% and Japan’s Nikkei 225 up 0.18%. S&P futures opened trading at 0.01% below fair value.

European markets finished higher, London’s FTSE 100 up 1.72%, Germany’s DAX up 0.88% and France’s CAC 40 up 0.67%.

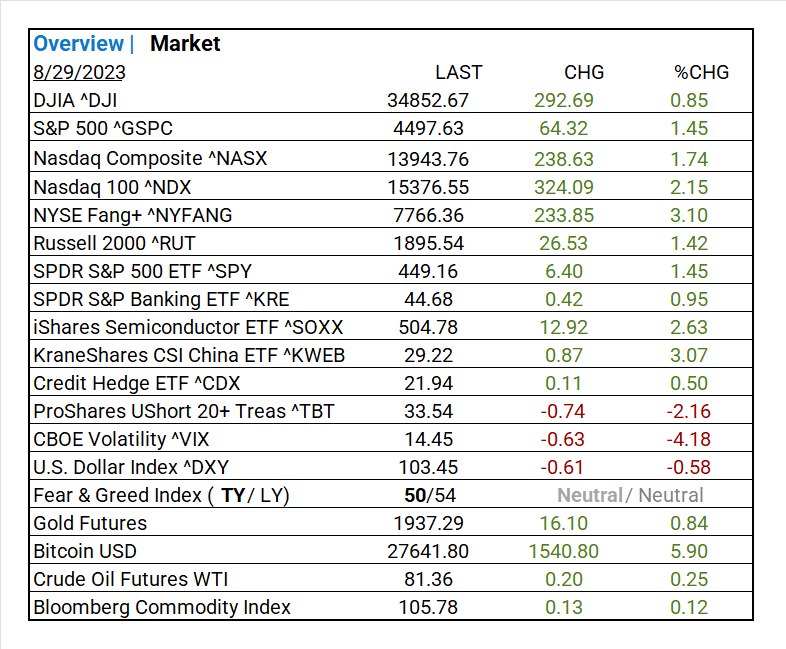

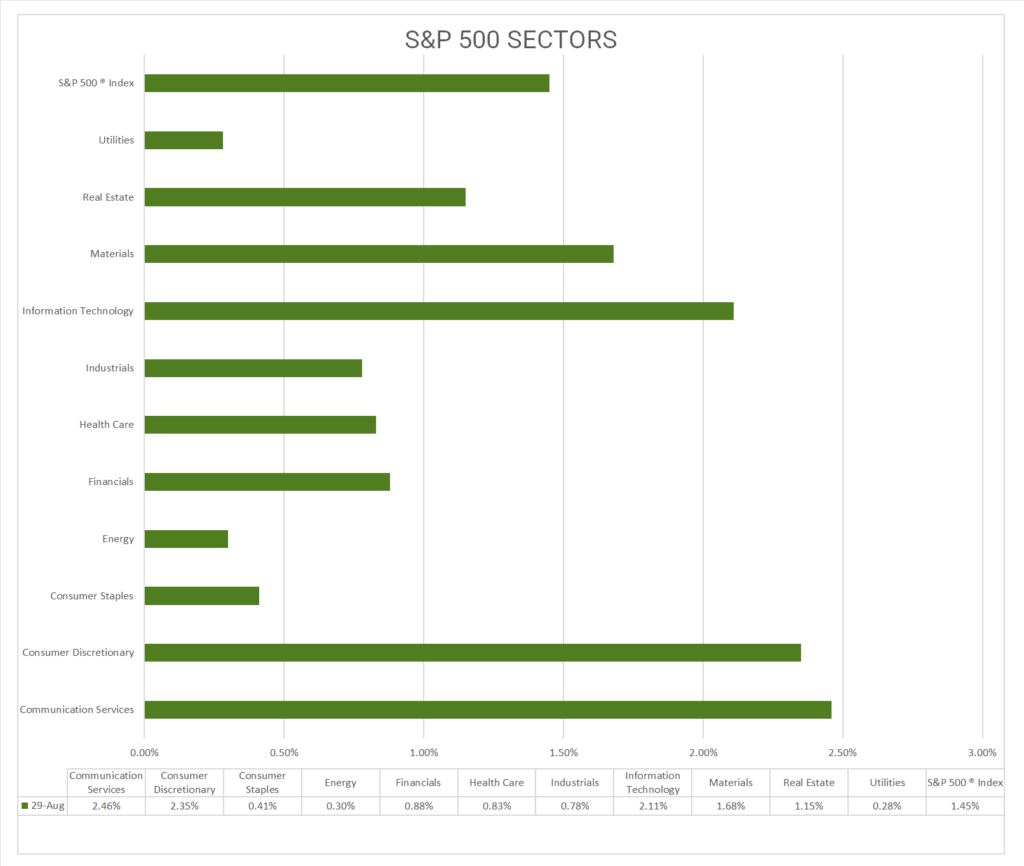

Today US Markets finished higher, NASDAQ up 1.74%, S&P 500 up 1.45% and the DOW up 0.85%. All 11 S&P 500 sectors advancing: Communication Services +2.46% outperforms/ Utilities +0.28% lags. Trending Industries: Automobiles, Diversified Telecommunication Services, Semiconductor & Semiconductor Equipment, Metals & Mining, Interactive Media & Services, Passenger Airlines.

In US economic news, JOLTS Job Openings (July) and CB Consumer Confidence (Aug) were lower than expected. S&P/Case-Shiller Home Prices beat exceeded forecasts as a result of continued rise in MoM property prices.

Takeaways

- Jobs and Consumer Confidence miss

- S. Court supports Bitcoin ETF

- Fed may pause in Sept, start cutting rates in early ‘24

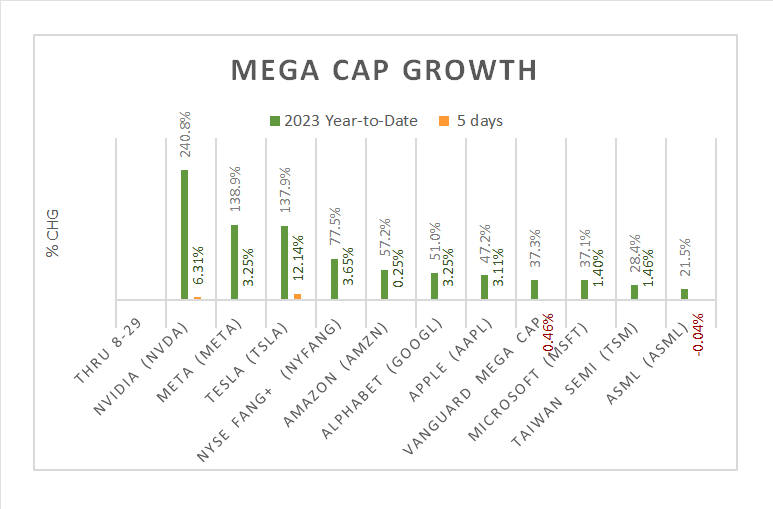

- NYSE Fang+ ^NYFANG +3.10%

- Growth Stocks pop!

- China Tech ETF ^KWEB +3.07%

- Semiconductor ETF ^SOXX +2.63%

- Russell 2000 ^RUT +1.42%/ Banking ETF ^KRE +1.45%

- Trending “on the Day” Automobiles +6.87%

- Bitcoin +5.90%, Gold +0.84%

- Oil Futures, Bloomberg Commodity Index rise

- PDD Holdings DRC (PDD) with solid earnings beat

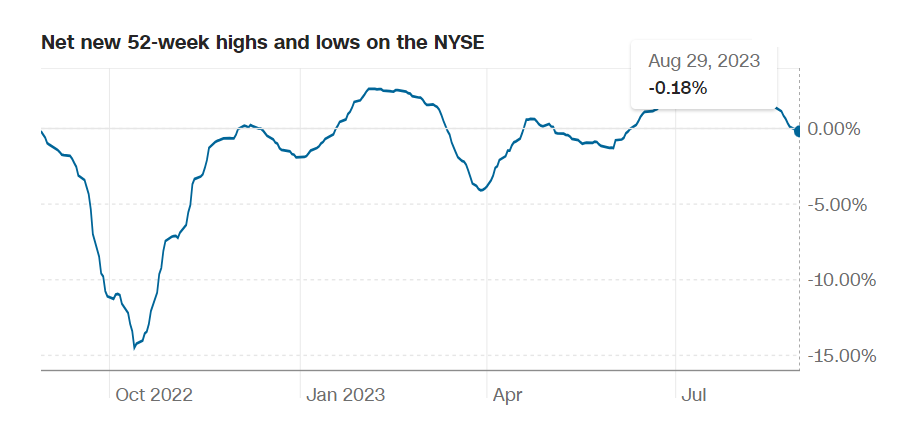

Pro Tip: Stock Price Strength shows the number of stocks on the NYSE at 52-week highs compared to those at 52-week lows.

Sectors/ Commodities/ Treasuries

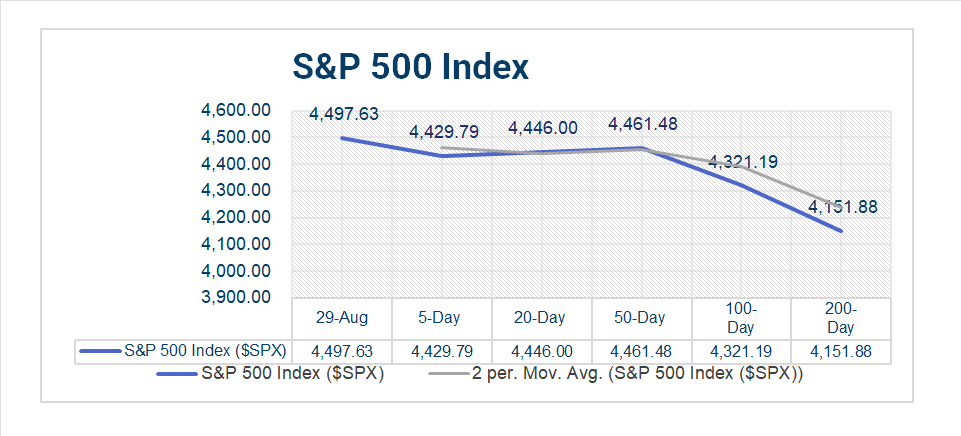

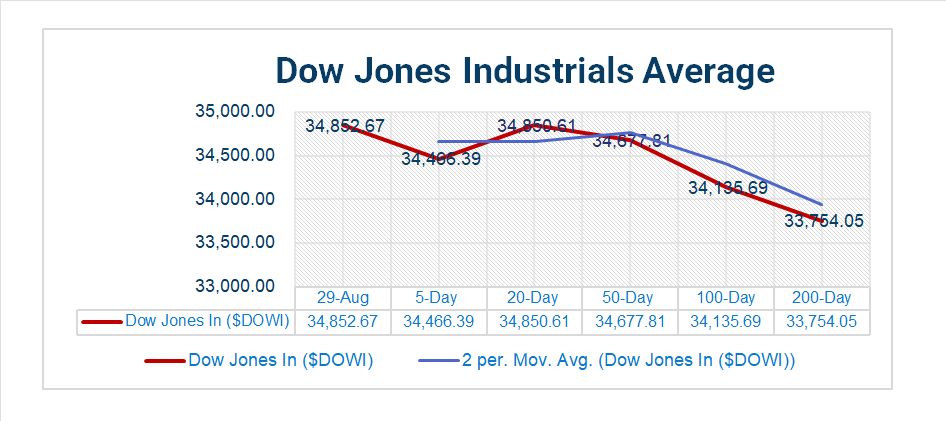

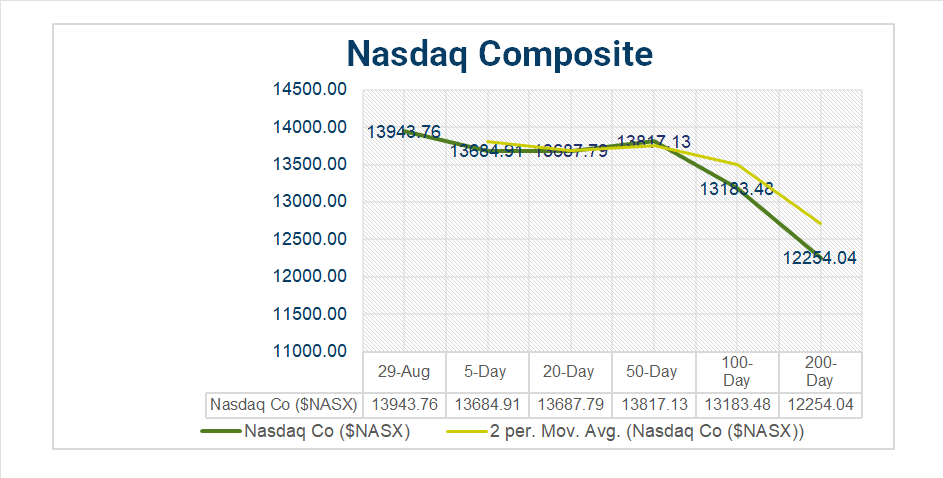

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- All 11 S&P 500 sectors advancing: Communication Services +2.46% outperforms/ Utilities +0.28% lags.

- Trending “on the Day” Automobiles +6.87%, Diversified Telecommunication Services +3.62%, Semiconductor & Semiconductor Equipment +3.24%, Metals & Mining +2.79% Interactive Media & Services +2.72%, Passenger Airlines +2.35%.

- *1 Month Leaders: Energy +2.41%, Health Care -0.89%

- *YTD Leaders: Communication Services +40.03%, Information Technology +39.04%, Consumer Discretionary +29.59%

- *S&P 500 +15.47% *as of Aug-28-2023

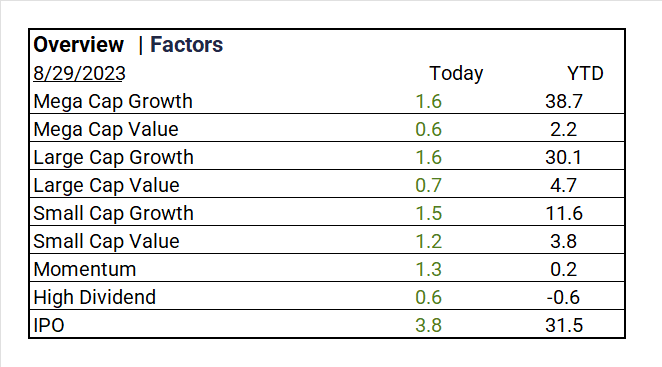

Factors

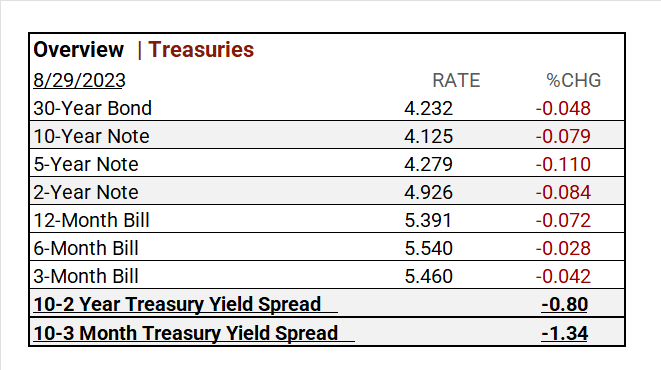

US Treasuries

Earnings

Q2 ’23 Top Line Top Line

- Q1 ’23 Actual: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 Forecast: S&P 500 EPS was expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

Q2 Seasonal Actual (TBA)

Notable Earnings Today

- +Beat: PDD Holdings DRC (PDD), Hewlett Packard (HPE), Best Buy (BBY), PVH (PVH), Box Inc (BOX), Evotec SE ADR (EVO), Ncino (NCNO), Ambarella (AMBA), Prospect Capital (PSEC)

- – Miss: Bank of Montreal (BMO), Bank of Nova Scotia (BNS), HP Inc (HPQ), COSCO SHIPPING ADR (CICOY), Nio A ADR (NIO), JM Smucker (SJM), Catalent Inc (CTLT), Donaldson (DCI)

Economic Data

US

- S&P Case-Shiller home price index (20) June: act -1.2%, fc -1.5%, prior -1.7%

- JOLTS Job openings July: act 8.8m, fc 9.5m, prior 9.2m

- Consumer confidence Aug: act 106.1, fc 116.0, prior 114.8

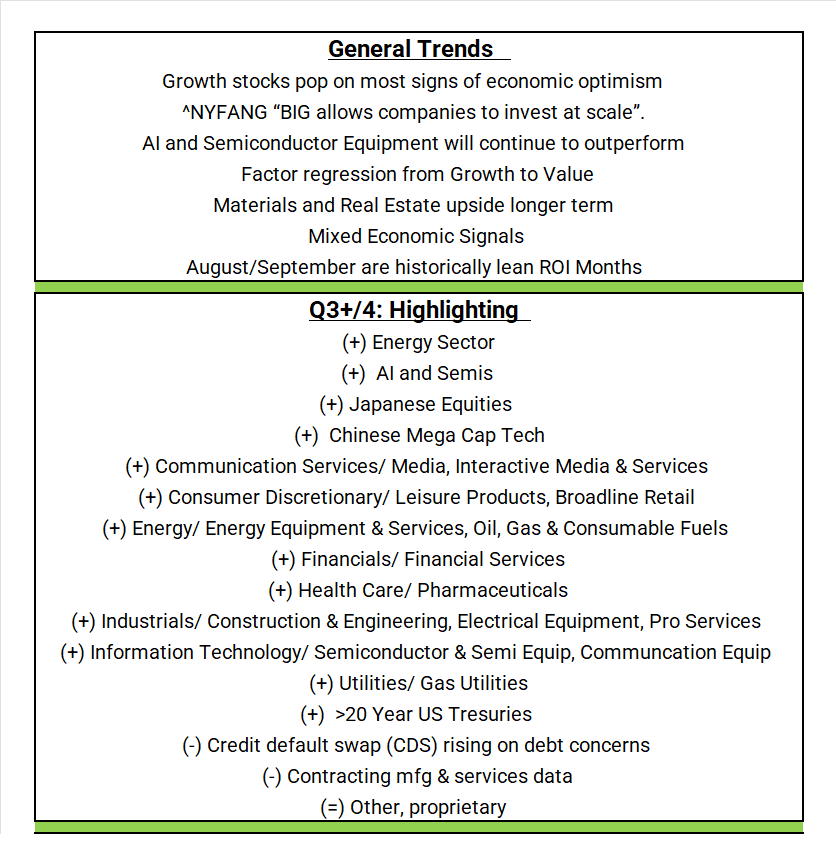

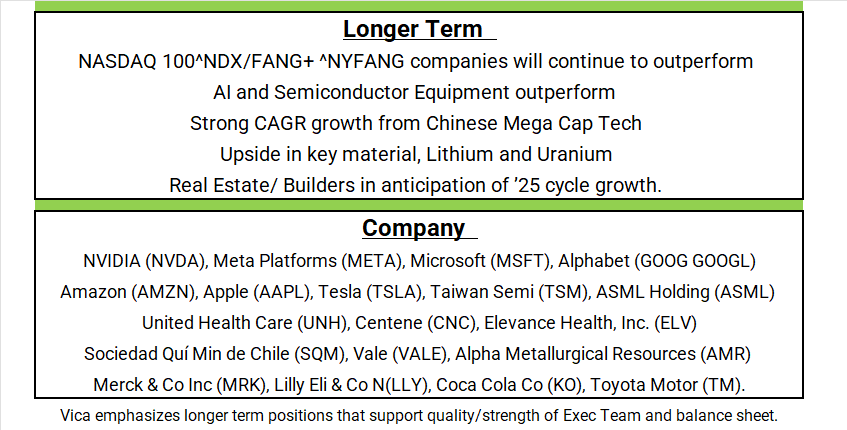

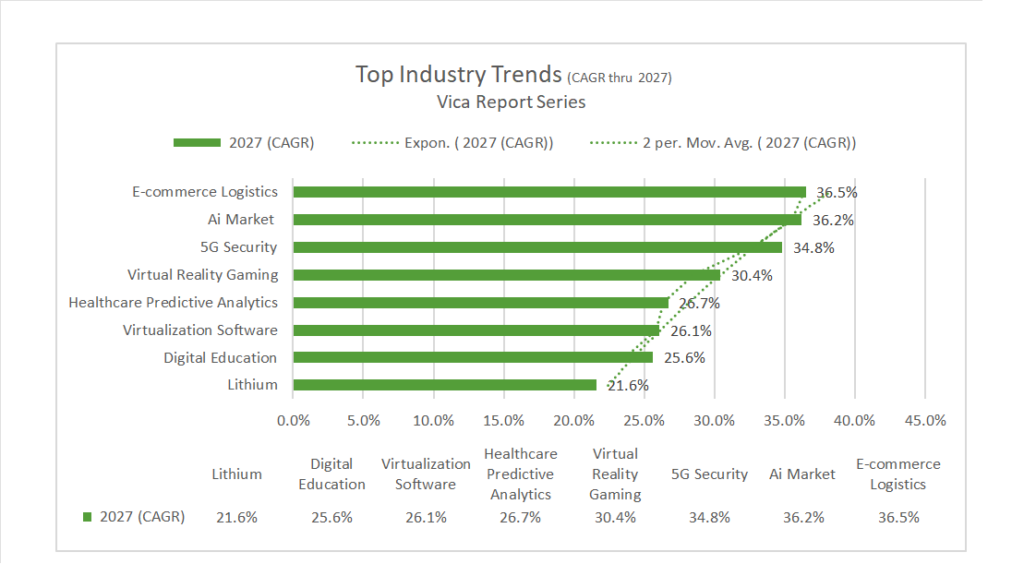

Vica Partners Guidance

Vica Partners Economic Forecast

The Federal Reserve as of August 2023 was no longer predicting Recession; to quote Investor Jeremy Grantham “the Federal Reserve record on predicting recessionary cycles is guaranteed to be wrong! Pundits can all agree that the Fed has never called any recession in-kind.

So why don’t we support the soft-landing scenario…

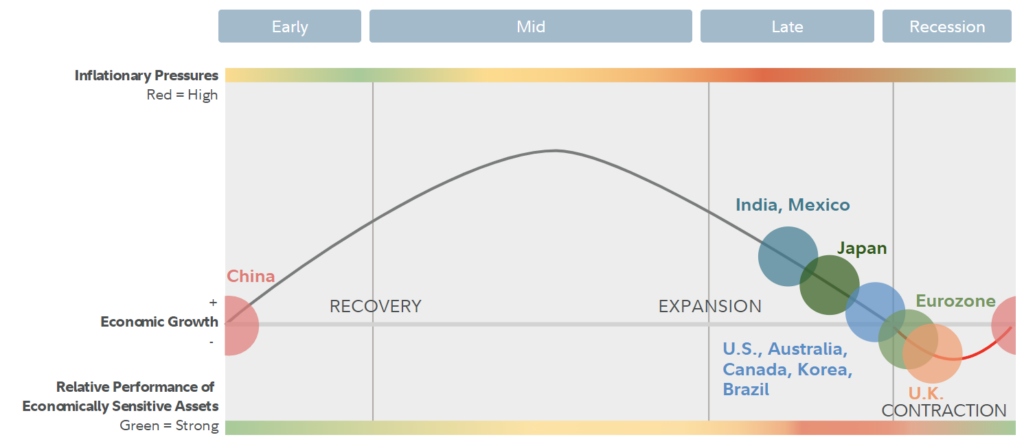

- Vica forecasts that the US will have a Recession, starting as early as Q4 ’23 and deep into ’24: the combination to date of Fed tightening, surging oil prices, stock market overvaluations and a strong dollar will shortly give us our bottom.

- Market bottoms are made on bad news and with deflationary signals: economic reports are currently mixed and arguably too much focus placed on product prices and weekly jobs. Our biggest concern is rising interest rates and the depressing slow-moving effect it has on the Real Estate market. And… all with Consumer debt rising to historical highs.

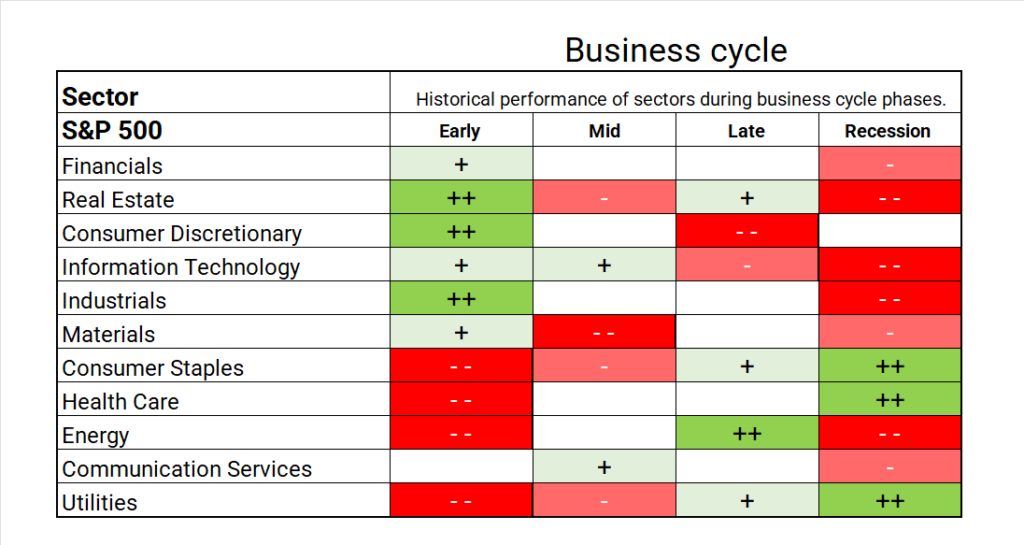

- Current S&P 500 Sector Metrics support contraction: strong trends in the Energy sector indicate the US is in a late business cycle (see chart below).

- A correction in excessive market asset valuations: the current shift from Growth to Value stocks and the Information Technology sector pullback are both underway.

And why…

- The Federal Reserve has limited power in controlling inflation: applying old school economic principles is ineffective in a highly automated and expanding global economy. By simply raising rates to counter jobs (1.6 jobs available for every job seeker) will NOT moderate on demands.

- A 2% inflation target is not realistic today: perhaps a >3% base rate could help fund a) appropriated wages for skilled workers and training b) an executable and efficient energy transition c) improving operational efficiencies across the economy d) and most importantly (look at China today) protection from deflation!

News

Company News/ Other

- Toyota Shuts Factories, Investors Shrug. That’s Resilience – Bloomberg

- Where Peak-Season Shipping Is Headed, In Charts – WSJ

- Why Crypto and Wall Street Are Longing for Spot Bitcoin ETFs – Bloomberg

Energy/ Materials

- Startup Pushing Green Natural Gas Label Shakes Up Leadership, Strategy – Bloomberg

- London Is Now the World’s Largest Low-Emissions Zone. Was the Fight Worth It? – Bloomberg

Real Estate

- Mortgage Rates at 7% Are Making Everything Worse for US Homebuyers – Bloomberg

Central Banks/Inflation/Labor Market

Asia/ China

- China’s too-big-to-fail property giants just the tip of real estate crisis, as ‘suppliers are being dragged to death – SCMP