MARKETS TODAY July 28th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished mixed, China’s Shanghai Composite gained 1.84% and Hong Kong’s Hang Seng up1.41%. Japan’s Nikkei 225 lost 0.40%.

European markets finished higher, Germany’s DAX gained 0.39%, France’s CAC 40 up 0.15% and London’s FTSE 100 up 0.02%. S&P futures opened trading at 0.62% above fair value.

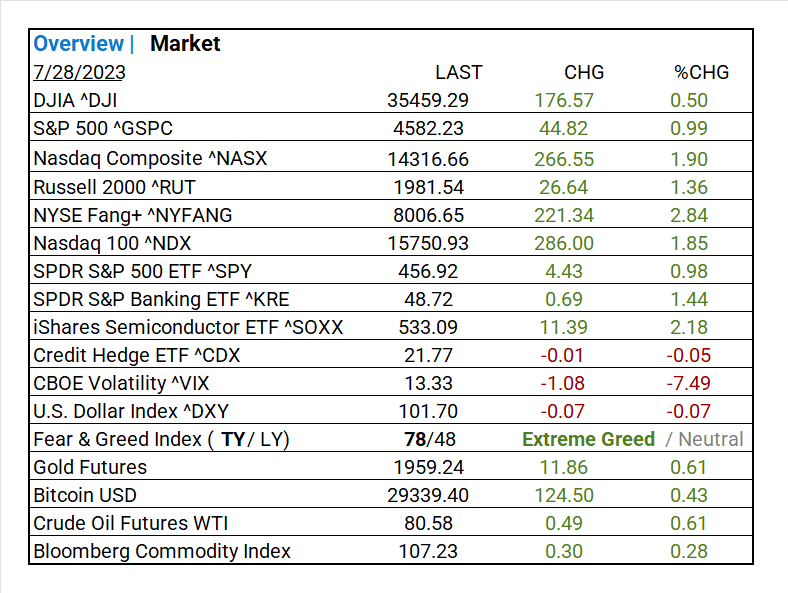

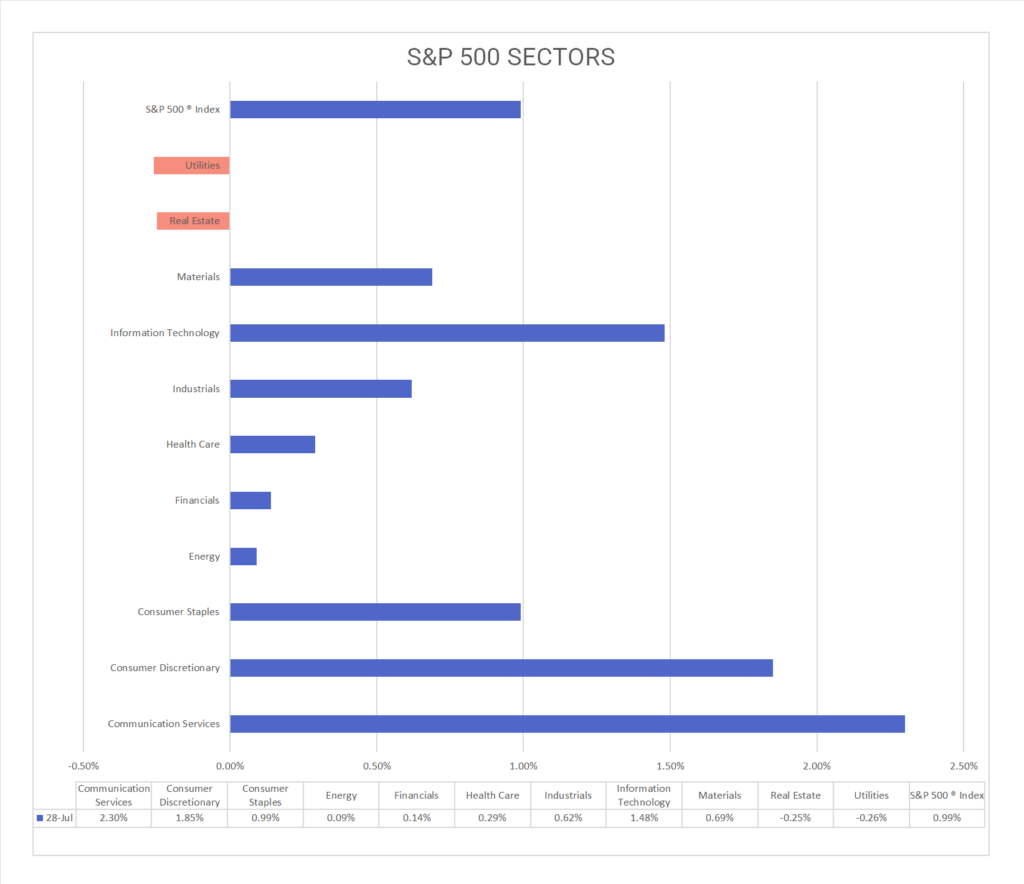

Today US Markets finished higher, the NASDAQ gained 1.90%, S&P 500 up 0.64% and the DOW up 0.50%. 9 of 11 S&P 500 sectors advancing: Communication Services +2.30% outperforms/ Utilities -0.26%, Real Estate -0.25% lag. On the upside, Fang+ ^NYFANG, Nasdaq 100 ^NDX, Semiconductor ETF ^SOXX, S&P Banking ETF ^KRE, Mega Cap Growth, Top Sector Subs, Personal Care Products, Hotel & Resort REITs, Automobiles. Other, Gold, Bitcoin, Oil and the Bloomberg Commodity Index.

In US economic news, PCE/Core PCE were inline with estimates. CPI’s, Personal Income came in below estimates, Personal Spending came in above. The Employee Cost Index beat consensus.

Takeaways

- PCE/Core PCE were inline with estimates

- Half of the S&P 500 has reported so far, >79% beating earnings estimates

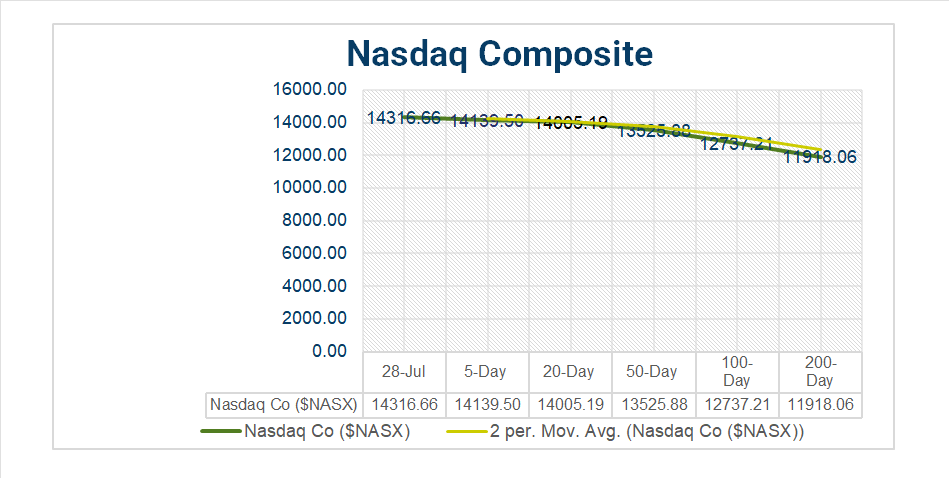

- NASDAQ leads majors +1.90%

- NYSE Fang+ ^NYFANG +2.84%

- 9 of 11 S&P 500 sectors advancing: Communication Services +2.30% outperforms/ Utilities -0.26%, Real Estate -0.25% lag.

- Sector Subs/ Personal Care Products +4.03%, Hotel & Resort REITs +3.71%, Automobiles +3.24%, Broadline Retail +3.10% Interactive Media & Services +3.08%

- iShares Semiconductor ETF ^SOXX +2.18%

- SPDR S&P Banking ETF ^KRE +1.44%

- Oil and Bloomberg Commodity Index gain

- AstraZeneca ADR (AZN), Hermes International SA (HESAY) w/ solid earnings beats

Pro Tip: Stock Price Strength shows the number of stocks on the NYSE at 52-week highs compared to those at 52-week lows.

Sectors/ Commodities/ Treasuries

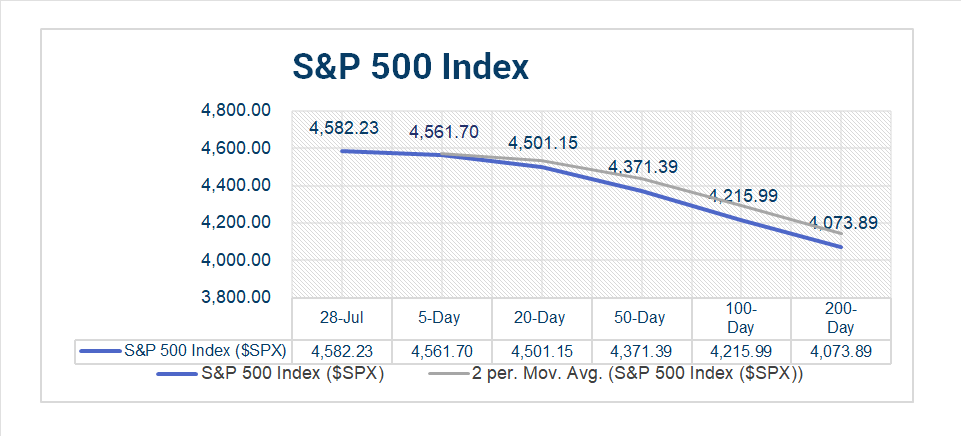

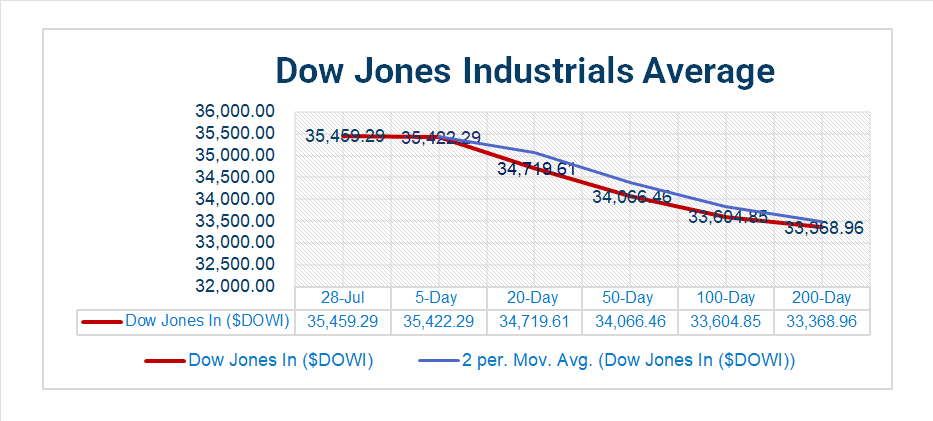

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 9 of 11 S&P 500 sectors advancing: Communication Services +2.30% outperforms/ Utilities -0.26%, Real Estate -0.25% lag.

- Personal Care Products +4.03%, Hotel & Resort REITs +3.71%, Automobiles +3.24%, Broadline Retail +3.10% Interactive Media & Services +3.08%, Semiconductor & Semiconductor Equipment +1.99%, Software +1.90%

- 1 Month Leaders: Energy +8.24%, Financials +7.36%, Communication Services +6.77%

- YTD Leaders: Information Technology +43.50%, Communication Services +41.51%

Factors

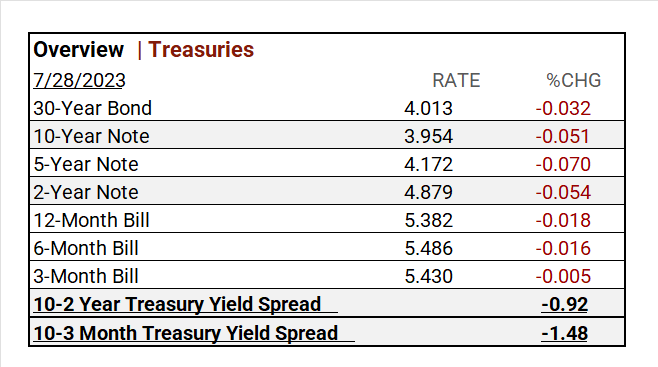

US Treasuries

Q2 ’23 Top Line Earnings Preview

- In Q1 ’23: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 S&P 500 EPS expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

- Expect lower Q1 revenues

- Call topics: economic uncertainty, aggregate demand, inventories, costs, roi

This Week ending 7/28

- >17% of S&P 500 names have reported, 40% more will release earnings this week.

- To date BIG picture, credit resilience, deposit stabilization, travel demand

- Technology sector, mega caps reporting META, MSFT, GOOGL

Notable Earnings Today

- +Beat: Procter&Gamble (PG), Chevron (CVX), Hermes International SA (HESAY), AstraZeneca ADR (AZN), Colgate-Palmolive (CL), Natwest Group (NWG), BBVA ADR (BBVA), Centene (CNC), T Rowe (TROW), Komatsu (KMTUY), Church&Dwight (CHD), Booz Allen Hamilton (BAH), Franklin Resources (BEN), Shinhan (SHG), IAG ADR (ICAGY), Gentex (GNTX), Newell Brands (NWL), Air France KLM SA (AFLYY)

- – Miss: Exxon Mobil (XOM), Sanofi ADR (SNY), Charter Communications (CHTR), KDDI Corp PK (KDDIY), Aon (AON), Hitachi ADR (HTHIY), Denso ADR (DNZOY), BASF ADR (BASFY), Avantor (AVTR), Saia (SAIA), nVent Electric (NVT), Chart Industries (GTLS), Chemours Co (CC), Seiko Epson ADR (SEKEY), Portland General Electric (POR), Balchem (BCPC), Moog B (MOGb)

Economic Data

US

- Personal income (nominal): period June, act 0.3%, fc 0.4%, prior 0.4%

- Personal spending (nominal) period June, act 0.5%, fc 0.5%. prior 0.1%

- PCE index: period June, act 0.2%, prior 0.1%

- Core PCE index: period June, act 0.2%, fc 0.2%, prior 0.3%

- PCE (year-over-year): act 3.0%, prior 3.8%

- Core PCE (year-over-year), act 4.1%, fc 4.2%, prior 4.6%

- Employment cost index: period Q2, act 1.0%, fc 1.1%, prior 1.2%

- Consumer sentiment (final): period July, act 71.6, fc 72.6, prior 72.6

Vica Partner Guidance July ’23, (updated 7-28)

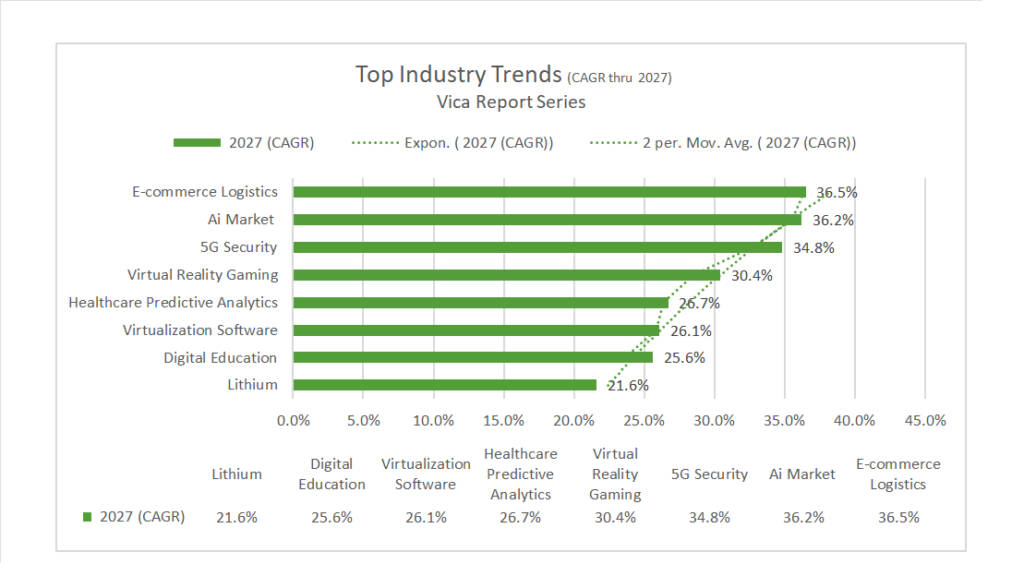

- Q3/4 highlighting, Industries: Interactive Media & Services, Household Durables, Broadline Retail, Consumer Finance, Automobiles, Construction & Engineering, Semiconductor & Semiconductor Equipment, Construction Materials, Specialized REITs, Gas Utilities. Other: Undervaluation for Chinese Mega Cap Tech. Japan equities still a better value than US. Look for continued strength in Mega and Large Cap Growth “the new defensives”. Expect Energy Sector rally!

- Cautionary, Banks shortly may be overpricing. Current indicators are mixed. Credit default swap (CDS) to pick-up through Q4/Q1.

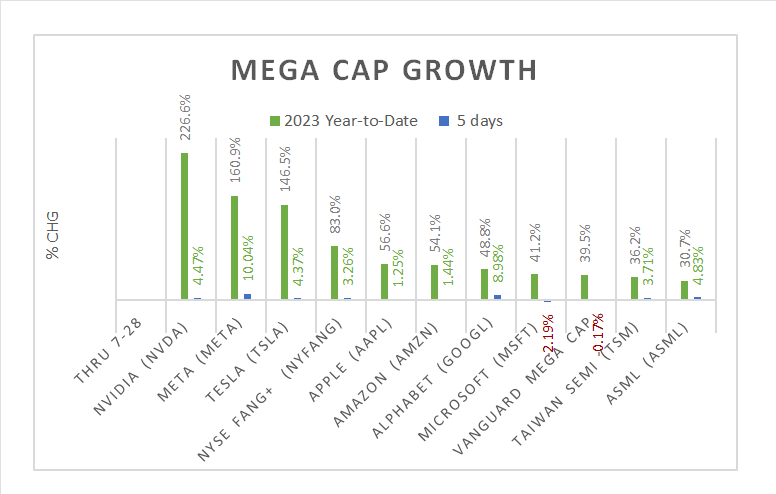

- Longer Term, NASDAQ 100^NDX/FANG+ ^NYFANG companies will continue to outperform “BIG allows you to invest at scale”. TOP Sector outperform includes AI and Semiconductor Equipment, Key Metals like Lithium.

Forward looking CAGR growth

- We continue to emphasize business *quality and strength of balance sheet for all investments. * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom (AVGO).

News

Company News/ Other

- Meta plans retention ‘hooks’ for Threads as more than half of users leave app – South China Morning Post

- Biogen Buying Rare-Disease Drugmaker in $7.3 Billion Deal – Wall Street Journal

- Hedge Funds Turn More Bullish Across Energy as Prices Rally – Bloomberg

Energy/ Materials

- Glencore in Advanced Talks for Argentina Copper Stake – Bloomberg

- Why Chile’s New Approach to Lithium Matters Globally – Bloomberg

Central Banks/Inflation/Labor Market

- Bank of Japan Loosens Grip on Market, Lets Yields Jump to 9-Year High – Wall Street Journal

- US Inflation Cooled While Consumer Spending Picked Up in June – Bloomberg

Asia/ China

- Taiwan’s economy returns to growth in second quarter, pulling out of recession – South China Morning Post