Presented to Executive Directors and Institutional Fund Managers

Date: December 05, 2024

In the ever-evolving economic landscape, long-duration Treasury bond ETFs continue to provide a stable and strategic opportunity for portfolio diversification. With the Federal Reserve signaling potential rate cuts in 2025, institutional investors should pay close attention to assets that can capitalize on this environment. This guide presents an updated forecast and technical analysis for three leading Treasury bond ETFs: ZROZ, EDV, and TLT, tailored to the needs of institutional fund managers.

Market Context: Positioning for 2025

The Federal Reserve’s dovish stance and declining inflationary pressures have fostered an environment where Treasury bonds can thrive. Key dynamics include:

- Yield Curve Impacts: Long-term bonds are expected to rally as rate cuts materialize.

- Inflation Stability: With inflation anchored, real yields are projected to remain attractive.

- Institutional Trends: Pension funds, insurance firms, and sovereign wealth funds are increasing exposure to long-duration Treasuries for liability matching.

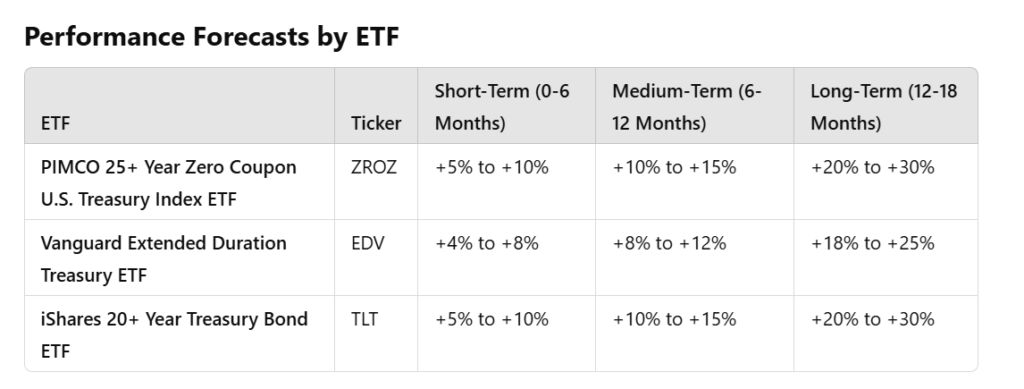

Performance Forecasts by ETF

Technical Analysis: Summary

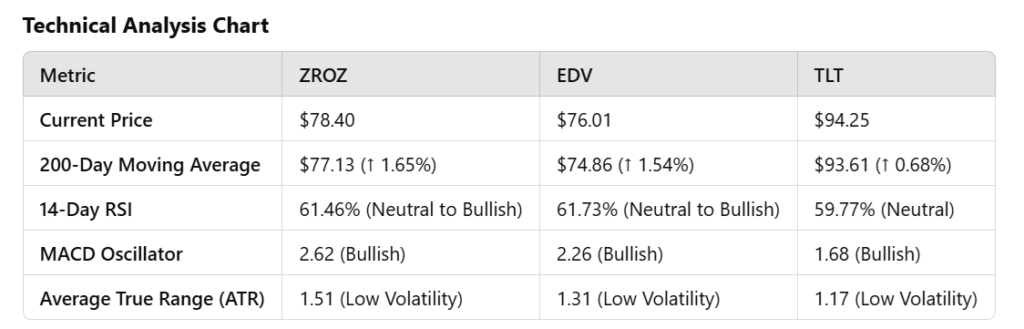

The following technical indicators offer insight into the current trends for ZROZ, EDV, and TLT:

Technical Analysis Chart

- Moving Averages: All three ETFs are trading above their 200-day moving averages, signaling long-term upward momentum.

- RSI: Relative strength is in a stable range, with no overbought conditions.

- MACD: Bullish momentum persists, with all ETFs showing positive MACD readings.

- Volatility: Low ATR values indicate controlled price fluctuations, suitable for institutional risk profiles.

Strategic Implications for Fund Managers

Why Allocate to Treasury Bond ETFs Now?

- Stability in Portfolio Yield:

Long-duration Treasury ETFs provide predictable income and mitigate reinvestment risks in a declining rate environment. - Attractive Total Returns:

Institutional fund managers can expect cumulative returns between 18% and 30% over 18 months, as highlighted by historical performance and forward-looking indicators. - Liability Matching:

The duration profiles of ZROZ, EDV, and TLT align with the long-term obligations of pensions and endowments. - Enhanced Risk-Adjusted Performance:

Low volatility (measured via ATR) reduces overall portfolio risk, while high historical returns improve Sharpe ratios.

Conclusion: A Timely Opportunity for Institutions

ZROZ, EDV, and TLT present compelling opportunities in today’s bond market. Technical indicators confirm an upward trajectory, and macroeconomic conditions support sustained demand for these ETFs. By leveraging their unique characteristics, fund managers can position their portfolios to benefit from declining rates while maintaining stable, long-term growth.

Next Steps

- Monitor Economic Data: Key metrics include Fed rate announcements, inflation reports, and global yield curves.

- Review Portfolio Allocations: Adjust holdings to reflect a higher allocation to long-duration Treasury ETFs.

- Implement Technical Oversight: Use RSI and MACD to fine-tune entry and exit points.

By maintaining focus on these ETFs, institutional investors can achieve superior returns while managing risks effectively. For further guidance, our analysts are available to provide customized insights tailored to your fund’s objectives.