Energy Logistics as a VMSI-Positive, Asymmetric Trade

In a market addicted to volatility, the most defensible position in energy isn’t predicting prices—it’s controlling flow. Logistics infrastructure is not just a high-yield utility hold; it’s a mispriced, option-rich asset class that screens strong across all four VMSI vectors.

Value: Yield Without the Duration Risk

- Trades at 6–9x forward EBITDA

- 6–7.5% dividend yields backed by volume-based contracts, not commodity exposure

- CPI-linked escalators and take-or-pay terms de-risk cash flow

- Embedded option value from infrastructure reuse: hydrogen, CO₂, renewable fuels

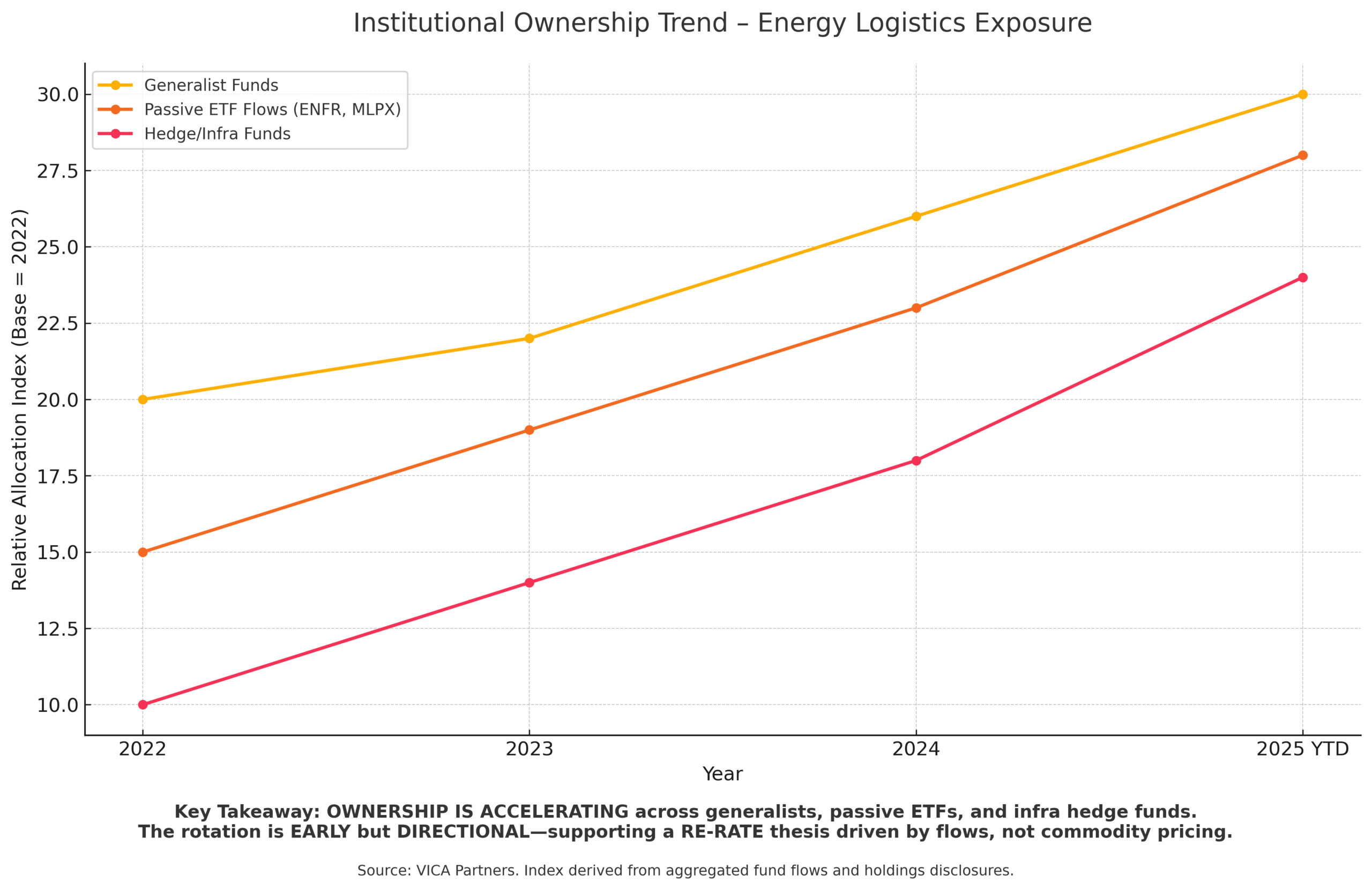

Valuation vs Yield across core energy logistics equities and ETFs.

Source: Internal model based on 2025 YTD data; public company filings and ETF reports. Chart prepared by VICA Partners.

Key takeaway: Core logistics players offer high cash yields with low EBITDA multiples—a rare combination. This mismatch highlights a mispricing opportunity between perceived “utility” risk and actual contracted cash generation.

🔵 Read-through: Defensive cash generator with upside leverage to transition flows. Market mislabels it as ex-growth yield.

Momentum: Positive Convexity in Disruption

- Names like KMI, EPD, TRP and ETFs like ENFR, AMLP show steady outperformance vs. upstream and energy beta

- Logistics benefits from volatility—storage spreads, arbitrage, rerouting drive upside

- Flow volumes are up: LNG, refined products, basin-to-export rebalancing

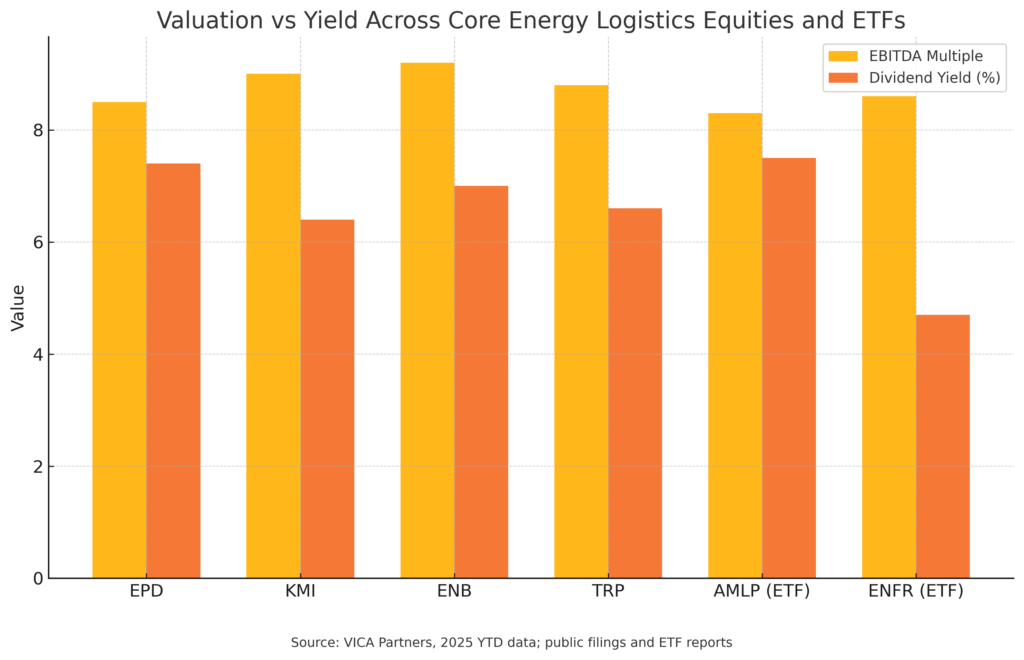

Normalized 3-year performance of ENFR, AMLP, and XLE (broad energy ETF).

Source: ETF performance data pulled from Bloomberg; ENFR, AMLP, and XLE total return indices. Chart prepared by VICA Partners.

Key takeaway: Logistics ETFs (ENFR, AMLP) have steadily outperformed broad energy (XLE), showing positive momentum without chasing price beta. This reflects their structural link to flows—not speculation.

🔶 Read-through: Not fast-moving, but quietly persistent. Durable momentum that catches late-cycle capital rotation.

Sentiment: Rotation from Ignored to Essential

- Private capital is way ahead—Brookfield, Blackstone, IFM buying up assets

- Street still anchors on “legacy energy,” missing the platform economics and transition enablement

- Narrative pivot underway: from “old infra” to “critical corridor”

🔶 Read-through: Underfollowed and underpriced. Sentiment catching up to strategic reality.

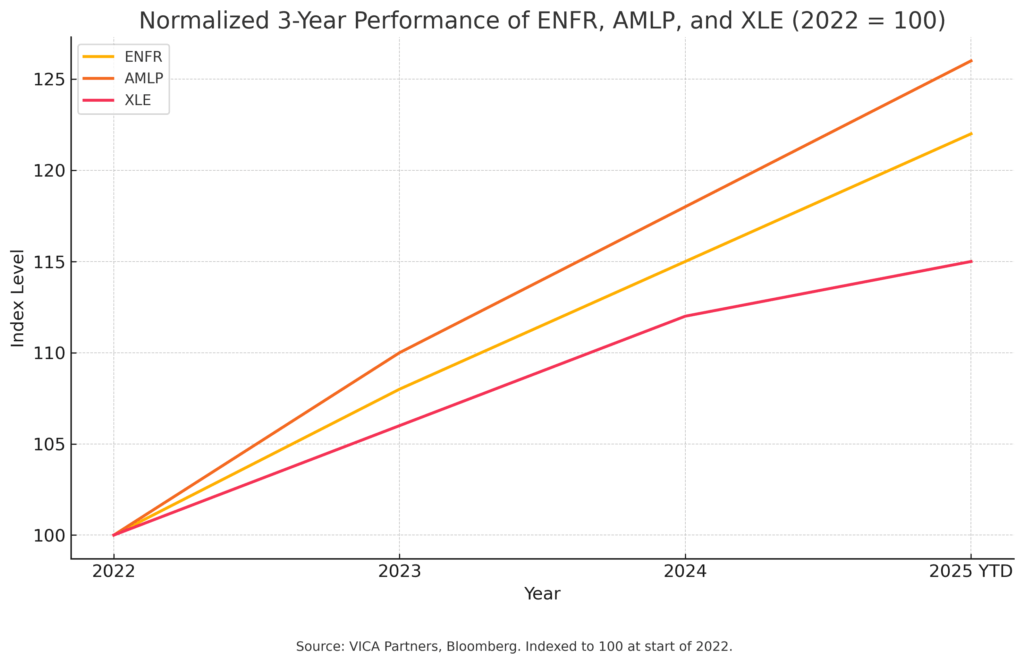

Institutional Ownership: Flow Is Coming

- Generalist funds still underweight logistics names

- Rising passive flows into MLP/infra ETFs (ENFR, MLPX) as real asset allocators rotate in

- Hedge funds and infra desks increasing exposure for yield + spread capture thesis

Institutional Ownership Trend – Energy Logistics Exposure (2022–2025 YTD).

Source: VICA Partners. Index derived from aggregated fund flows and holdings disclosures.

Key takeaway: Ownership across generalists, passive ETFs, and infra hedge funds is accelerating. Rotation is early but directional—supporting a re-rating thesis tied to capital flow rather than price movement.

🔶 Read-through: Flows inbound, re-rate likely. Setup favors early accumulation.

Bottom Line

You’re not betting on energy prices. You’re owning access to movement.

This is:

- Contracted yield now

- Embedded optionality later

- Misunderstood positioning in public markets

🔵 Own the Pipe. Not the Price.

Disclaimer: This article is for informational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any securities. All opinions expressed are the author’s own and based on publicly available data at the time of writing. Investors should conduct their own due diligence and consult a qualified financial advisor before making any investment decisions.

© 2025 VICA Partners. All rights reserved.