Stay Informed and Stay Ahead: Market Watch, April 26th, 2024.

Wall Street Week Economic Report Recap

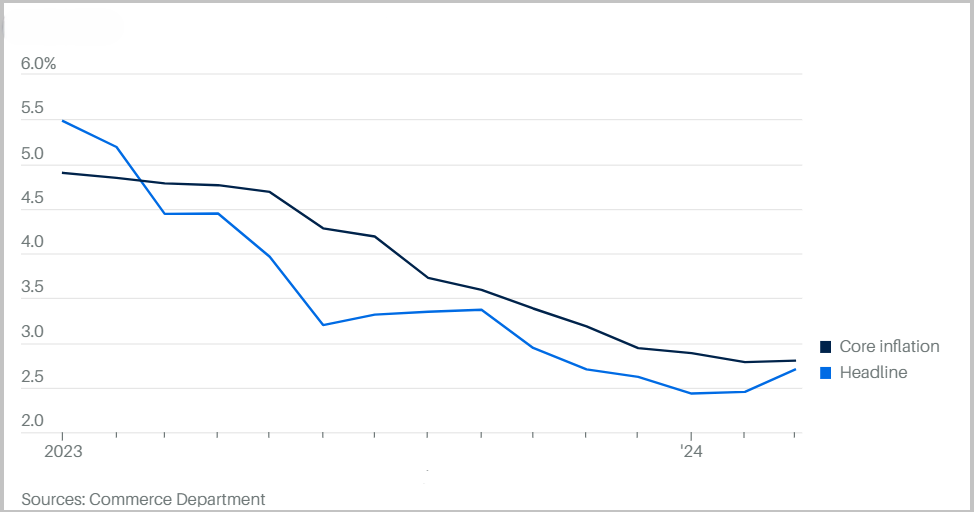

The latest data on inflation from the Federal Reserve indicates that controlling price growth continues to prove more challenging if they continue to remain focused primarily on a 2% inflation target.

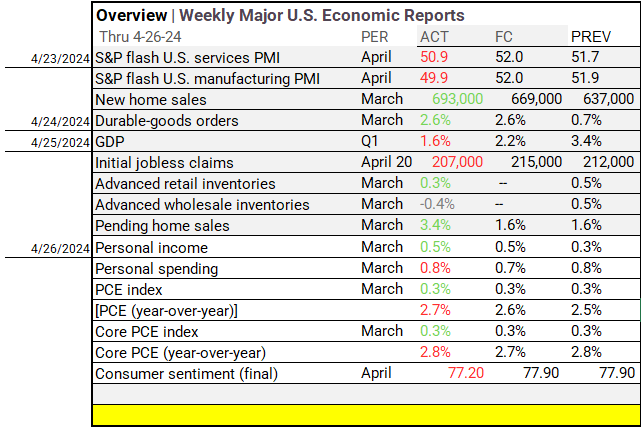

In March, the personal-consumption expenditures price index revealed the following:

- Headline inflation was at +2.7% year-over-year and +0.3% month-over-month, slightly surpassing expectations of +2.6% year-over-year and matching expectations month-over-month.

- Core inflation stood at +2.8% year-over-year and +0.3% month-over-month, exceeding expectations of +2.6% year-over-year and aligning with expectations month-over-month.

Last Word

Critics argue that the Fed’s reliance on CPI and PCE data for targeting 2% inflation lacks responsiveness to real-time economic dynamics.