“Empowering Your Financial Success”

Daily Market Insights: November 30th, 2023.

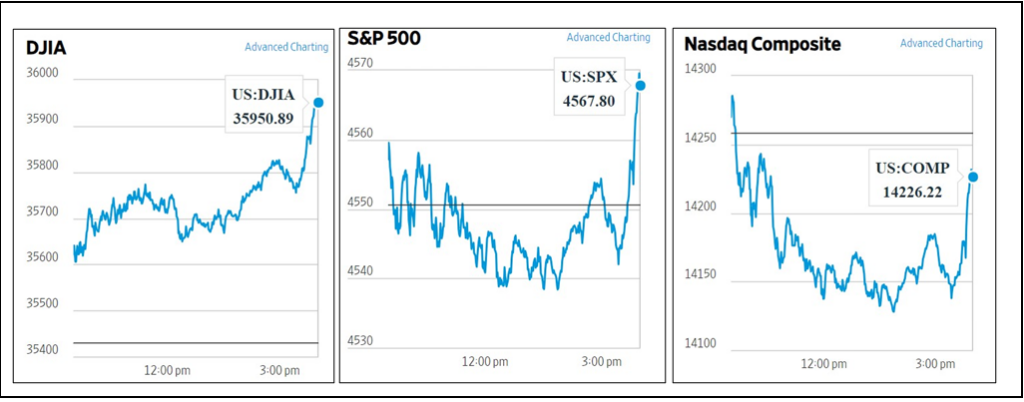

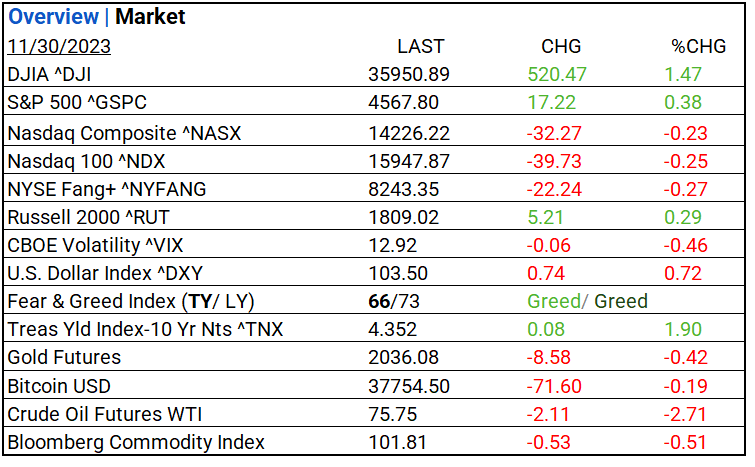

US Market Snapshot: Key Stock Market Indices:

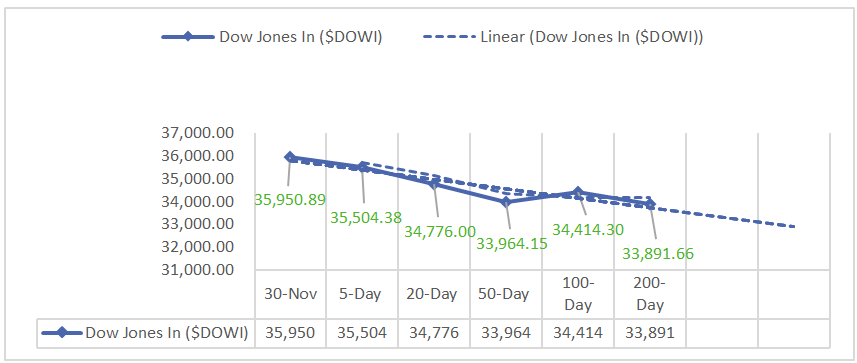

- DJIA ^DJI: 35,950.89 (520.47, 1.47%)

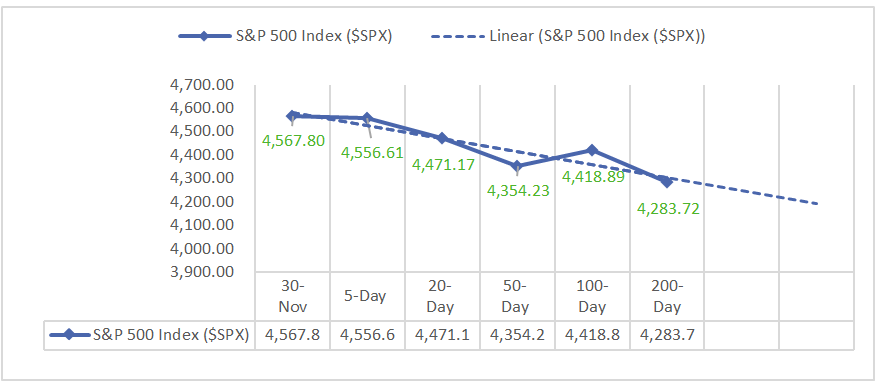

- S&P 500 ^GSPC: 4,567.80 (17.22, 0.38%)

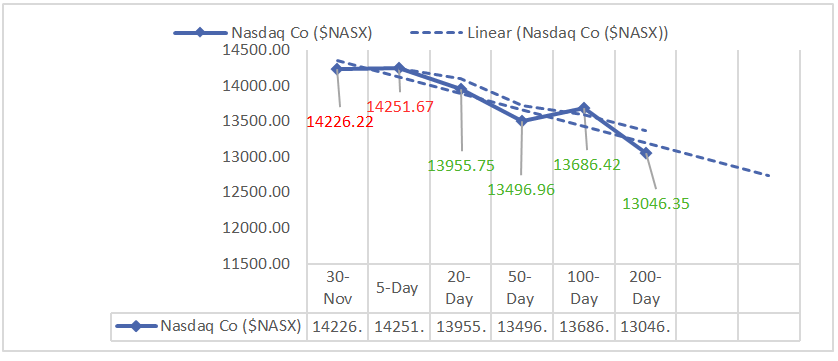

- Nasdaq Composite ^NASX: 14,226.22 (-32.27, -0.23%)

- Nasdaq 100 ^NDX: 15,947.87 (-39.73, -0.25%)

- NYSE Fang+ ^NYFANG: 8,243.35 (-22.24, -0.27%)

- Russell 2000 ^RUT: 1,809.02 (5.21, 0.29%)

Moving Averages: DOW, S&P 500, NASDAQ:

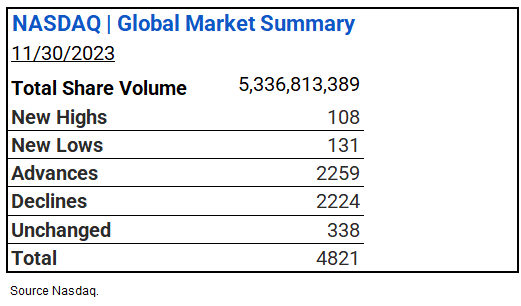

NASDAQ Global Market Summary:

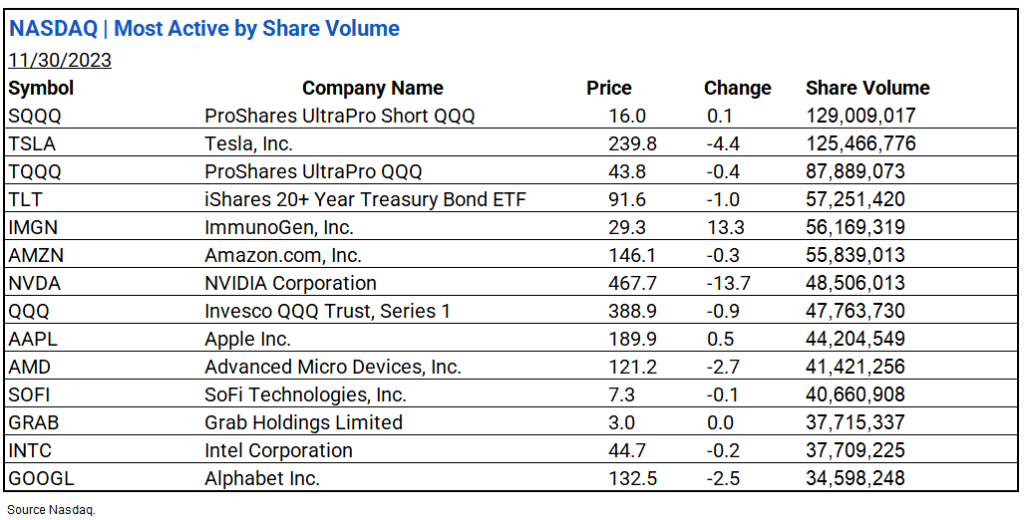

Market Insights: Performance, Sectors, and Trends:

- Economic Data: October’s PCE and Core PCE both increased (0.05% and 0.2%, respectively), with year-over-year rates at 3.0% and 3.5%, all falling below forecasts.

- Market Indices: DJIA (+1.47%), S&P 500 (+0.38%), Nasdaq Composite (-0.23).

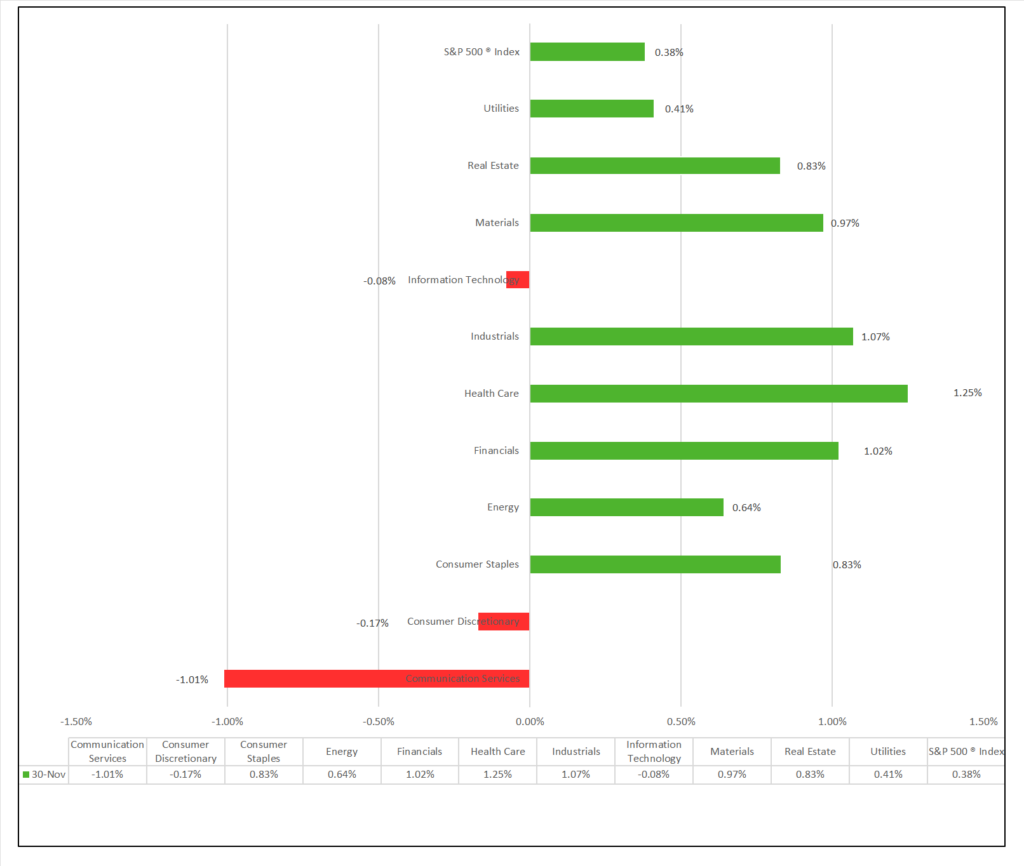

- Sector Performance: 8 of 11 sectors higher; Health Care (+1.25%) leading, Communication Services (-1.01%) lagging. Top industry: Health Care Providers & Services (+2.52%).

- Factors: Value outperforms Growth.

- Treasury Markets: Equity notes experience gains as bills see a downturn.

- Commodities: Gold, Bitcoin, and the Bloomberg Commodity Index experienced moderate declines, while Crude Oil Futures sank.

Sectors:

- 8 of 11 sectors higher; Health Care (+1.25%) leading, Communication Services (-1.01%) lagging. Top industries: Health Care Providers & Services (+2.52%), Consumer Finance (+2.31%), and Biotechnology (+1.77%).

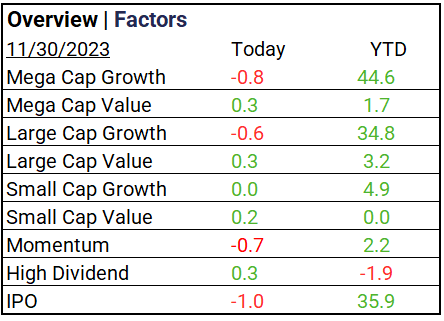

Factors:

- Value outperforms Growth.

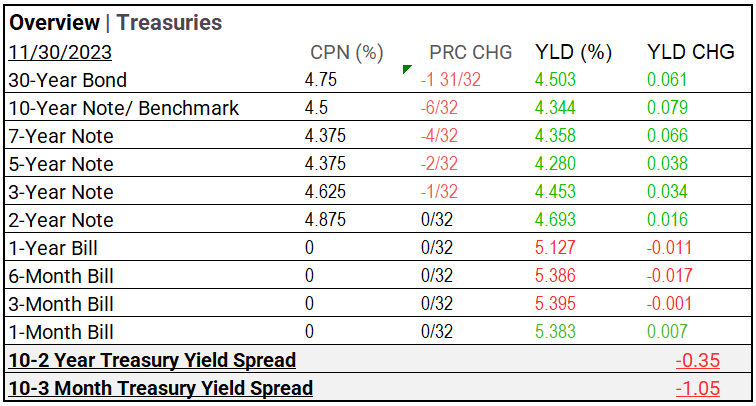

Treasury Markets:

- Equity notes experience gains as bills see a downturn, with the 30-Year Bond showing a rise of 0.061, and the 10-Year Note taking the lead with an increase of 0.079.

Currency and Volatility:

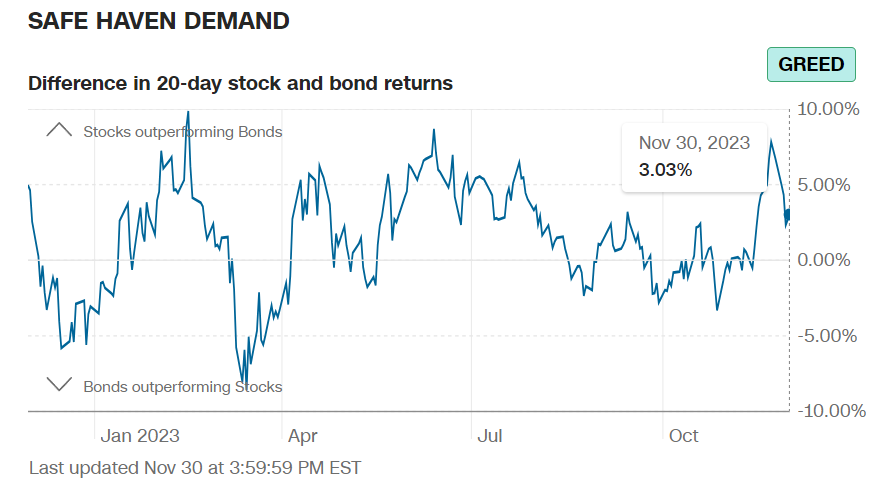

- U.S. Dollar Index drops, CBOE Volatility decreases, Fear & Greed reading signals Greed.

- CBOE Volatility ^VIX: 12.92 (-0.06, -0.46%)

- Fear & Greed Index: 66/73 (Greed/ Greed).

source: CNN Fear and Greed Index

Commodity Markets:

- Gold, Bitcoin, and the Bloomberg Commodity Index experienced moderate declines, while Crude Oil Futures sank.

- Gold Futures: 2,036.08 (-8.58, -0.42%)

- Bitcoin USD: 37,754.50 (-71.60, -0.19%)

- Crude Oil Futures WTI: 75.75 (-2.11, -2.71%)

- Bloomberg Commodity Index: 101.81 (-0.53, -0.51%)

US Economic Data:

- Initial Jobless Claims (Nov. 25): 218,000 (Previous: 220,000, Forecast: 211,000)

- Personal Income (Oct.): 0.2% (Previous: 0.2%, Forecast: 0.4%)

- Personal Spending (Oct.): 0.2% (Previous: 0.2%, Forecast: 0.7%)

- PCE Index (Oct.): 0.05% (Previous: –, Forecast: 0.4%)

- Core PCE Index (Oct.): 0.2% (Previous: 0.3%, Forecast: 0.3%)

- PCE (Year-over-year): 3.0% (Previous: –, Forecast: 3.1%)

- Core PCE (Year-over-year): 3.5% (Previous: 3.7%, Forecast: 3.7%)

- Chicago Business Barometer (PMI) (Nov.): 55.8 (Previous: 46.0, Forecast: 44.0)

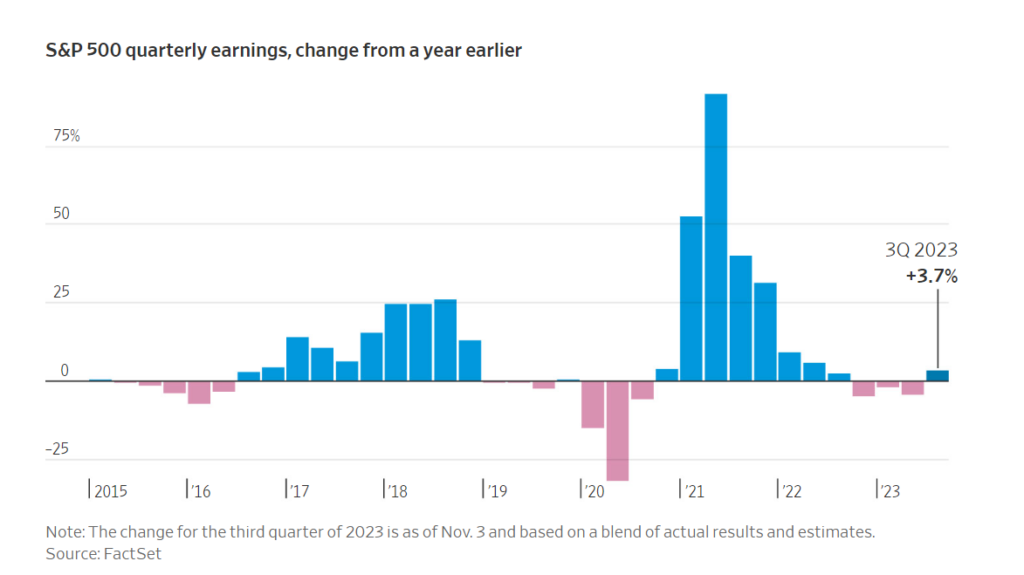

Earnings:

- Q3 Forecast: 64% of S&P 500 companies issue negative EPS guidance for Q3 2023. Communication Services and Consumer Discretionary lead in expected YoY earnings growth. Q3 Final and Q4 forecast next week.

Notable Earnings Today:

- BEAT: Marvell (MRVL) Johnson Controls (JCI), Kroger (KR), BRP Inc (DOOO), UiPath (PATH)

- MISSED: RBC (RY), Toronto Dominion Bank (TD), Dell Tech (DELL), Canadian Imperial Bank (CM), Frontline (FRO), Academy Sports (ASO)

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): -0.06%

- Hang Seng (Hong Kong): -0.11%

- Shanghai Composite (China): 0.00%

- CAC 40 (France): 0.24%

- DAX (Germany): 1.09%

- FTSE 100 (UK): -0.38%

Central Banking and Monetary Policy:

- Consumers Pulled Back on Spending, Inflation Eased in October – WSJ

- Mortgage Rates in US Decline to 7.22%, Falling for Fifth Week – Bloomberg

- Blue-Chip Spreads Rally as Investors Bet Fed is Done Hiking – Bloomberg

Energy:

- Why No One Wants to Pay for the Green Transition – WSJ

China:

- More Chinese investors look abroad to park cash as Beijing seen ‘softening’ on capital flows – SCMP