Stay Informed and Stay Ahead: Report Series, June 11th, 2024

U.S. Economic Reports Series: Weekly Petroleum Status Report

The Weekly Petroleum Status Report by the EIA provides data on U.S. petroleum supply, including crude oil and product inventories, imports, refinery operations, and production. It helps traders and analysts understand market trends and supply-demand dynamics. This EIA report is released every Wednesday at 10:30 a.m. ET. Traders also check the API Weekly Statistical Bulletin, released Tuesdays at 4:30 p.m. ET.

If crude inventories rise more than expected, it suggests weaker demand, often driving prices down. Conversely, a smaller increase hints at stronger demand, potentially boosting prices. However, it’s not always that simple—other market factors can influence price movements significantly.

Weekly Petroleum Data Insights: Production, Inventories, and Market Implications

Key Takeaway for Commodity Traders

The significant rise in U.S. crude oil refinery inputs and crude oil imports, along with notable shifts in gasoline and distillate fuel production and fluctuating product supply, are critical insights for traders.

U.S. Crude Oil Refinery Inputs:

- Averaged 17.1 million barrels/day, up 61 thousand barrels/day from the previous week, with refineries operating at 95.4% capacity.

- Market Implication: Enhanced production capacity suggests potential for meeting higher future demand, stabilizing or boosting refined product prices.

Gasoline Production:

- Decreased to 9.5 million barrels/day, while distillate fuel production rose to 5.1 million barrels/day.

- Market Implication: Reduced gasoline production may lead to tighter supply, potentially increasing gasoline prices if demand remains steady.

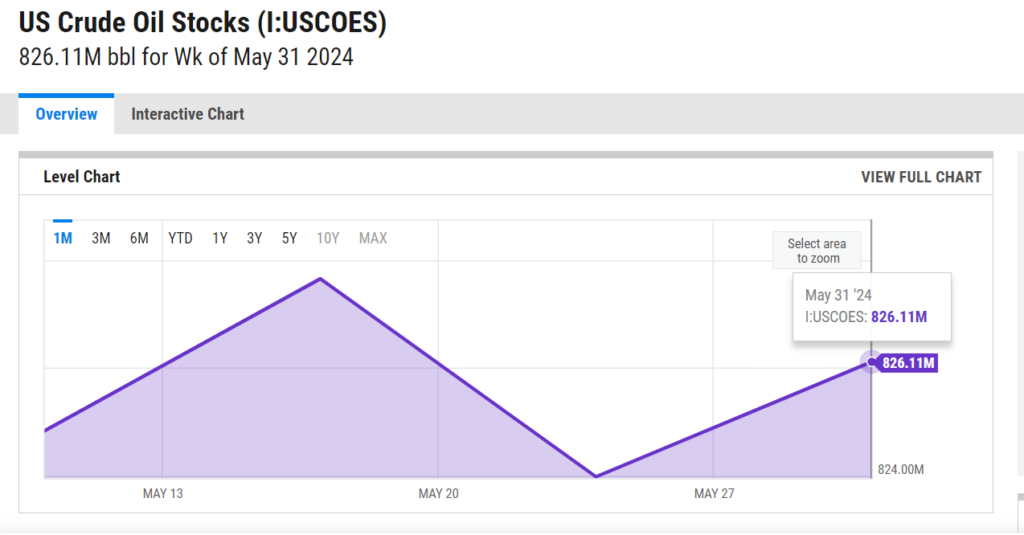

Crude Oil Inventories:

- Increased by 1.2 million barrels, reaching 455.9 million barrels, about 4% below the five-year average. Total motor gasoline inventories increased by 2.1 million barrels, and distillate fuel inventories increased by 3.2 million barrels.

- Market Implication: The rise in inventories indicates a temporary surplus, but being below the five-year average suggests overall supply stability, potentially preventing significant price drops.

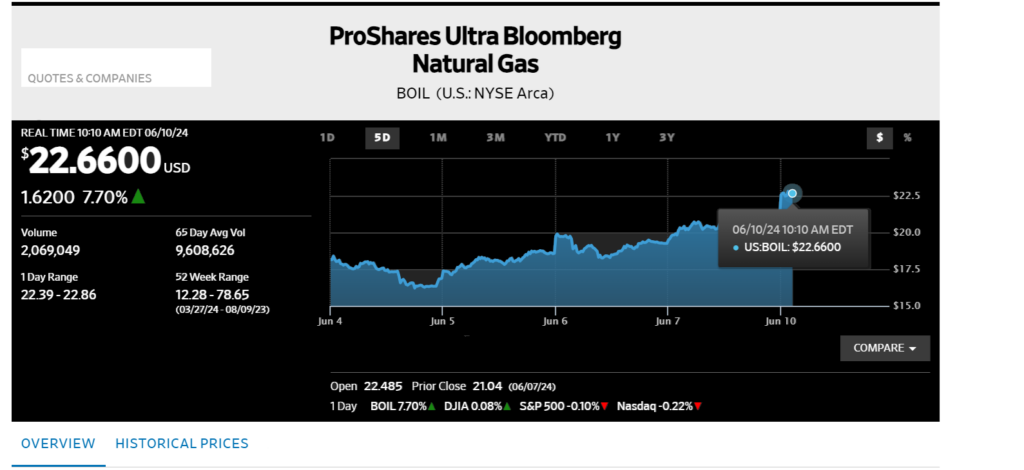

Natural Gas ETF’s

The current rise in natural gas ETFs is due to positive signals from increased refinery inputs, stable crude oil inventories, shifts in production, and favorable market sentiment.

Increased Refinery Inputs and Capacity Utilization:

- U.S. crude oil refinery inputs and high capacity utilization (95.4%) indicate robust demand for refinery operations, indirectly benefiting natural gas used as a fuel for these operations.

Shifts in Gasoline and Distillate Fuel Production:

- Decreased gasoline production and increased distillate fuel production reflect shifts in petroleum products, affecting natural gas demand as a feedstock or energy source.

Crude Oil and Product Inventories:

- Increased crude oil inventories, despite being below the five-year average, and rising gasoline and distillate inventories suggest a mixed supply-demand scenario, leading to increased investor confidence in the broader energy market, including natural gas.

Economic Reports and Market Sentiment:

- Weekly reports from the EIA and API provide critical data for traders. Anticipation of higher future demand for refined products and stable crude oil inventories create positive market sentiment, boosting natural gas demand.

Broader Energy Market Dynamics:

- Natural gas prices are influenced by the broader energy market. The report’s insights suggest a balanced supply-demand scenario, leading to positive spillover effects as traders anticipate steady or increasing natural gas demand.

Speculative and Hedging Activities:

- Commodity traders may engage in speculative or hedging activities based on the report. Anticipation of higher future energy demand, including natural gas, leads to increased investments in natural gas ETFs, driving prices higher.

Conclusion for Commodity Traders:

- Enhanced Production Capacity: Refineries operating at high capacity signal potential for stable or rising prices of refined products, suggesting an opportunity for traders to leverage increased market activity.

- Tighter Gasoline Supply: Decreased gasoline production amidst steady demand could lead to higher prices, presenting a potential trading opportunity for those focusing on gasoline markets.

- Stable Crude Oil Inventories: Despite the temporary surplus, the overall inventory levels being below the five-year average suggest supply stability, which could moderate extreme price fluctuations, making it a relatively safe environment for trading.

Conclusion: The Value and Limitations of the Weekly Petroleum Status Report

The Weekly Petroleum Status Report (WPSR) offers valuable insights into crude oil and petroleum product supply and pricing. However, it has notable shortcomings:

- Data Timeliness: The report’s data collection relies on company submissions up to the preceding Friday, potentially missing recent developments.

- Limited Geographic Coverage: U.S. territories are excluded from weekly petroleum supply statistics, limiting the report’s comprehensiveness.

- Demand Approximation Accuracy: While the report estimates U.S. petroleum demand using aggregated supply data, it may overlook nuanced demand patterns, affecting forecasting accuracy.

- Transparency on Data Sources: Details regarding the verification and validation of company submissions are lacking, raising concerns about data reliability.

- Price Data Sources: The report relies on Reuters, Inc. for price data, potentially introducing bias or limited coverage compared to multiple sources.

Improving these areas could enhance the report’s reliability and usefulness for stakeholders seeking insights into petroleum supply and pricing.