Stay Informed and Stay Ahead: Market Watch, March 6th, 2024.

Wall Street Mid-Week Edition

Market Highlights & Analysis: Indices, Sectors, and More…

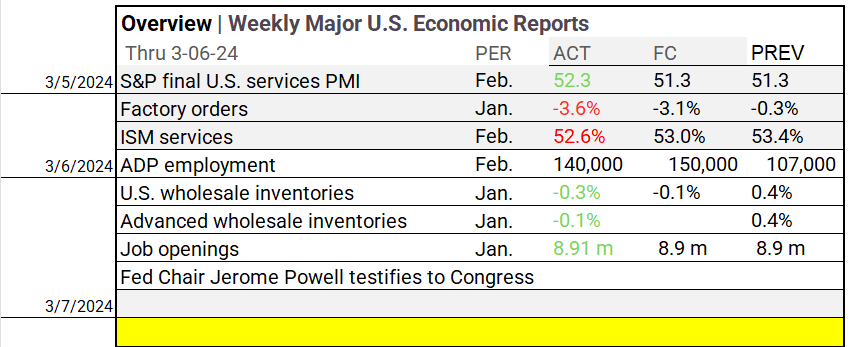

- Economic Data: ADP employment at 140,000, U.S. wholesale inventories down 0.3%, job openings stable at 8.9 million. Fed Chair Powell testifies.

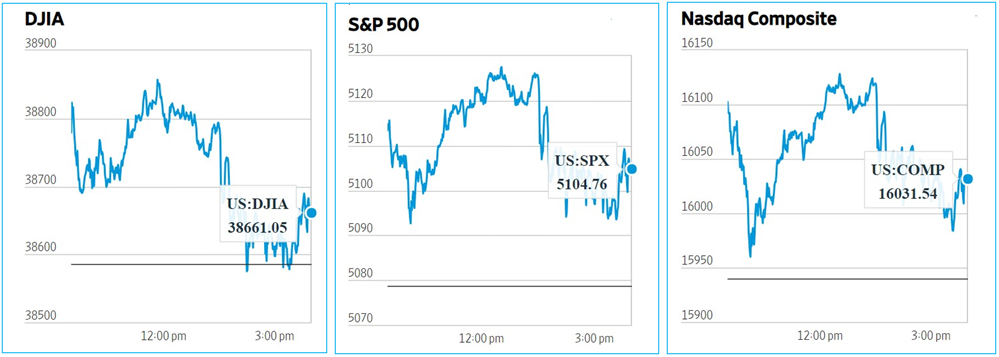

- Market Indices: DJIA (+0.20%), S&P 500 (+0.51%), Nasdaq Composite (+0.58%).

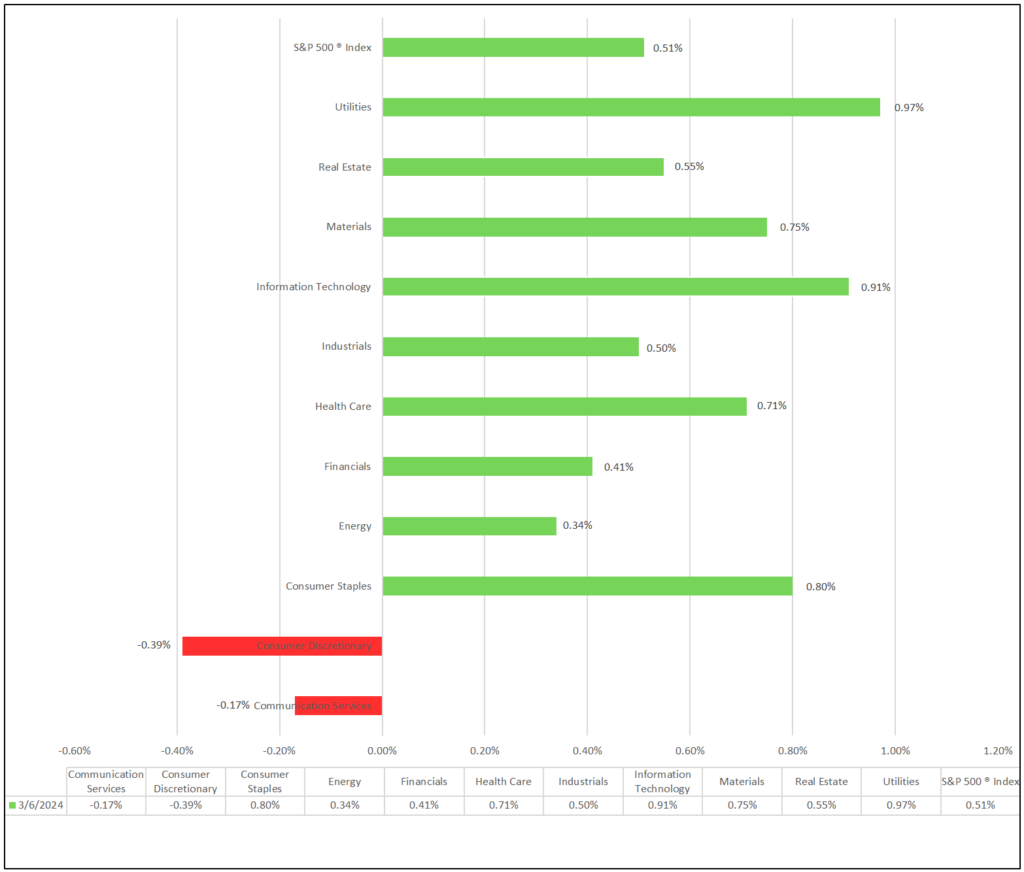

- Sector Performance: 9 of 11 sectors higher; Information Technology (+0.91%) leading, Consumer Discretionary (-0.39%) lagging. Top Industry: Semiconductor & Semiconductor Equipment (+2.44%).

- Factors: IPO and Large Cap Value and Momentum lead on the day, Momentum +18.8% YTD.

- Treasury Markets: 30-year bond at 4.250, 10-year at 4.000, and shorter durations adjusting marginally.

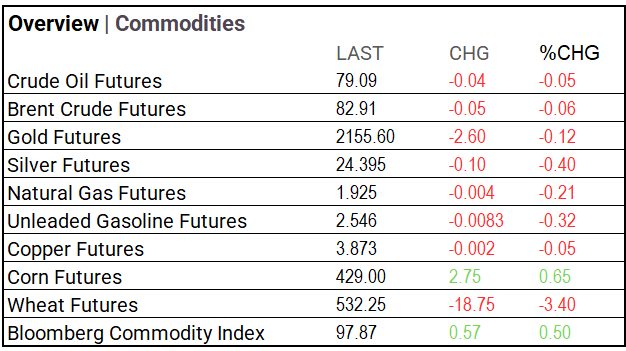

- Commodities: Bitcoin up $2.3k.

- ETFs: 2x Bitcoin Strategy ETF jumps to $50.06, yielding 5.1M in volume.

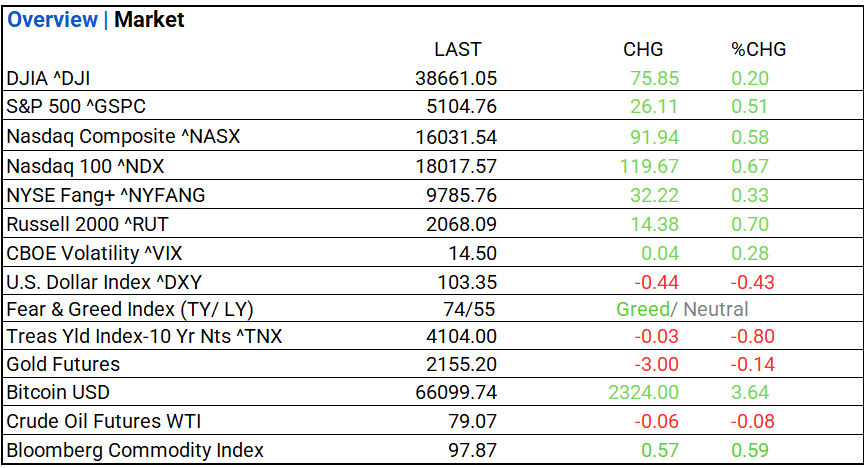

US Market Snapshot: Key Metrics:

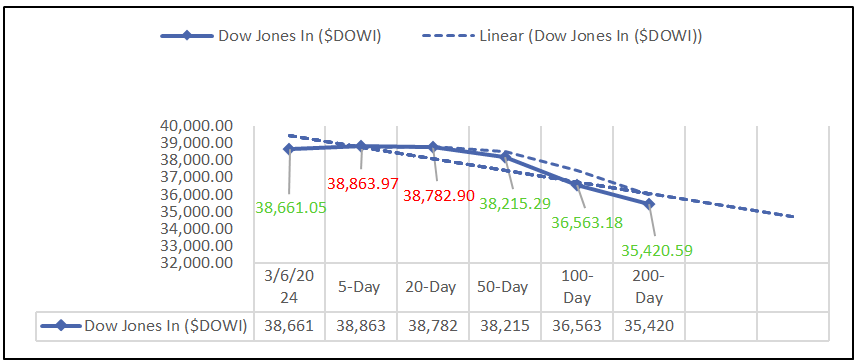

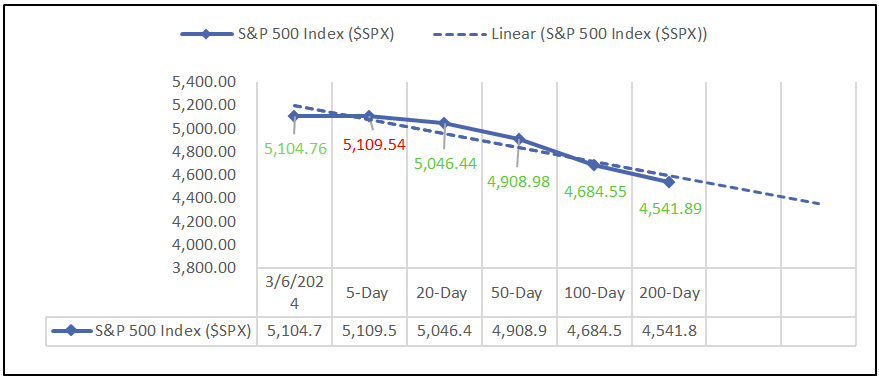

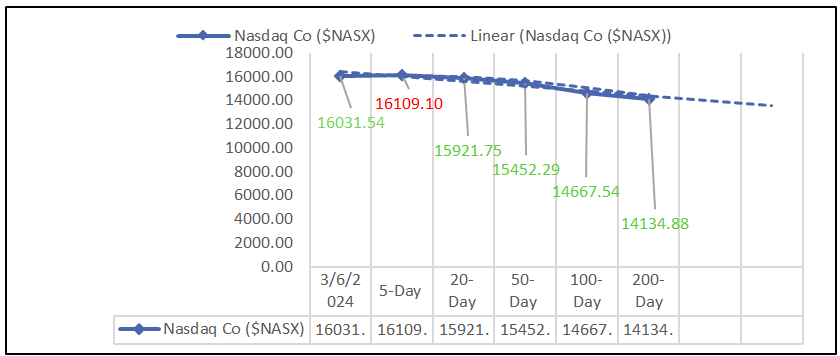

Moving Averages: DOW, S&P 500, NASDAQ:

NASDAQ Global Market Summary:

Sectors:

- 9 of 11 sectors higher; Information Technology (+0.91%) leading, Consumer Discretionary (-0.39%) lagging. Top industries: Semiconductor & Semiconductor Equipment (+2.44%), Tobacco (+1.65%), and Multi-Utilities (+1.37%).

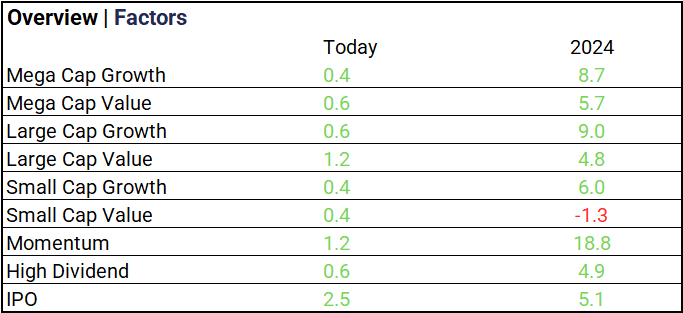

Factors:

- IPO and Large Cap Value and Momentum lead on the day, Momentum +18.8% YTD.

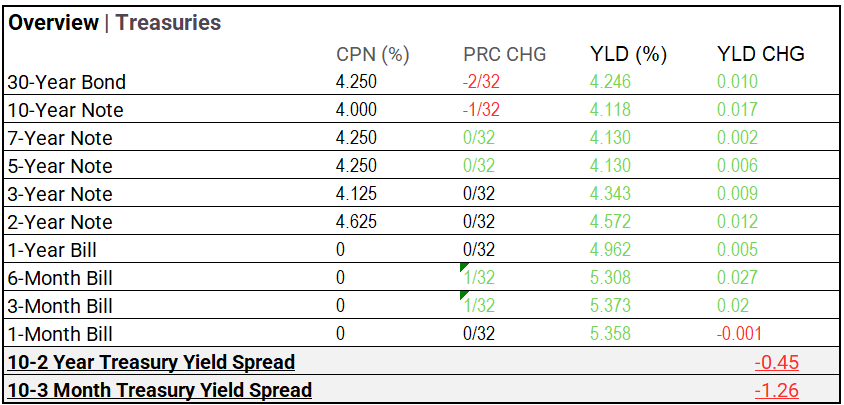

Treasury Markets:

- Bond yields fluctuated moderately, with 30-year bond at 4.250, 10-year at 4.000, and shorter durations adjusting marginally.

Currency and Volatility:

- S. Dollar Index ^DXY: 103.35 (-0.44, -0.43%)

- CBOE Volatility ^VIX: 14.50 (+0.04, +0.28%)

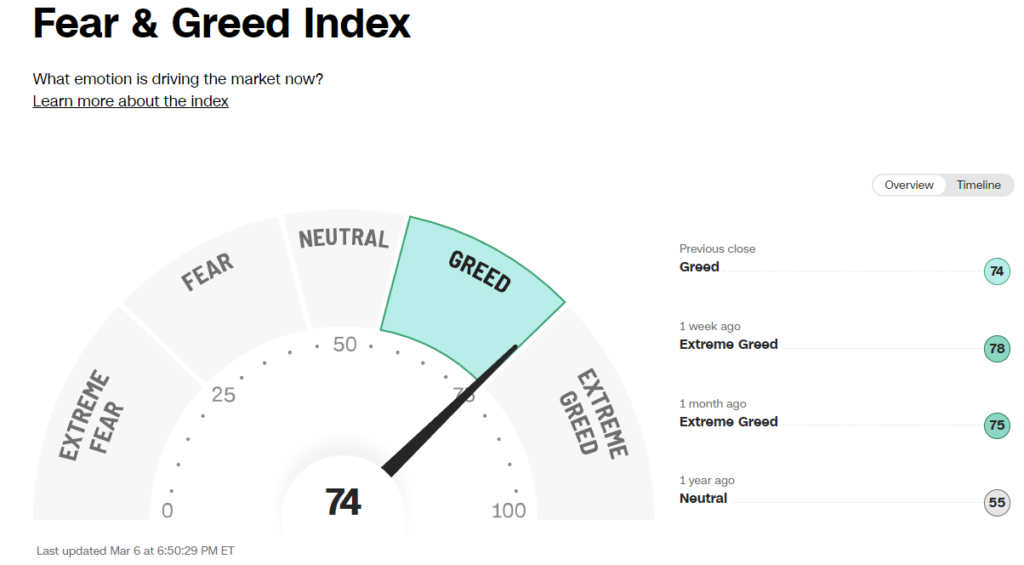

- Fear & Greed Index: 74/TY 55/LY (Greed/Neutral)

Commodity Markets:

Note: differences in chart due to post market activity

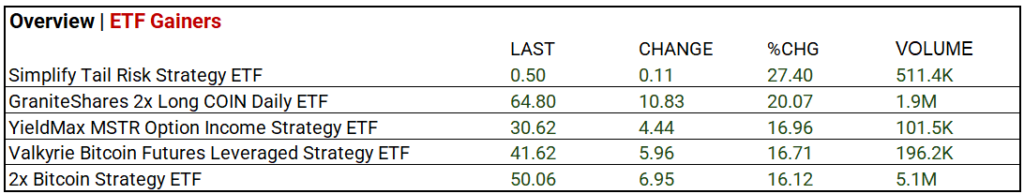

ETF’s:

- Biggest volume mover: 2x Bitcoin Strategy ETF jumps to $50.06, yielding 5.1M in volume.

US Economic Data:

- ADP employment at 140,000, U.S. wholesale inventories down 0.3%, job openings stable at 8.9 million. Fed Chair Powell testifies.

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT: com Inc Adr (JD), Campbell Soup (CPB), Descartes Systems (DSGX), Abercrombie&Fitch (ANF), Korn Ferry (KFY), Foot Locker (FL).,

- MISSED: Constellation Software (CNSWF), Brown Forman A (BFa), Thor Industries (THO), Chemours Co (CC).

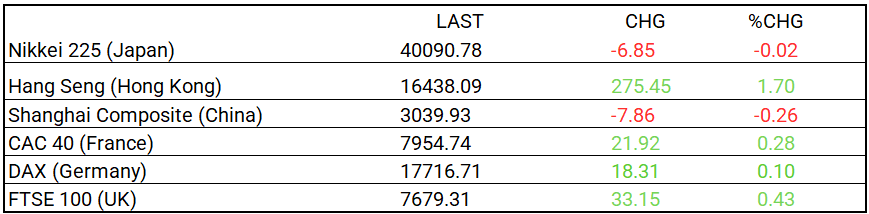

Global Markets Summary: Asian & European Markets:

Central Banking and Monetary Policy, Noteworthy:

- Jerome Powell Says Fed on Track to Cut Rates This – WSJ

- Bank of Canada Keeps Policy Rate at 5%, ‘Too Early’ to Weigh Cuts – WSJ

- Powell Reiterates Fed Needs More Confidence on Inflation to Cut – Bloomberg

Energy:

- Exxon Files for Arbitration Over Chevron’s Deal for Hess – WSJ

- IEA Defends Its Energy Models Against ‘Green Censors’ Criticism – Bloomberg

China:

- Beijing calls for ‘hard work’, flags hopes and risks in growing China GDP by 5% – SCMP