“Empowering Your Financial Success”

Daily Market Insights: November 9th, 2023

Global Markets Summary:

Asian Markets:

- Nikkei 225 (Japan): -0.60%

- Hang Seng (Hong Kong): -1.52%

- Shanghai Composite (China): Closed.

European Markets:

- CAC 40 (France): +1.13%

- DAX (Germany): +0.81%

- FTSE 100: +0.0%

US Futures:

- S&P Futures: opened @ 4391.41(+0.20%)

US Market Snapshot:

Key Stock Market Indices:

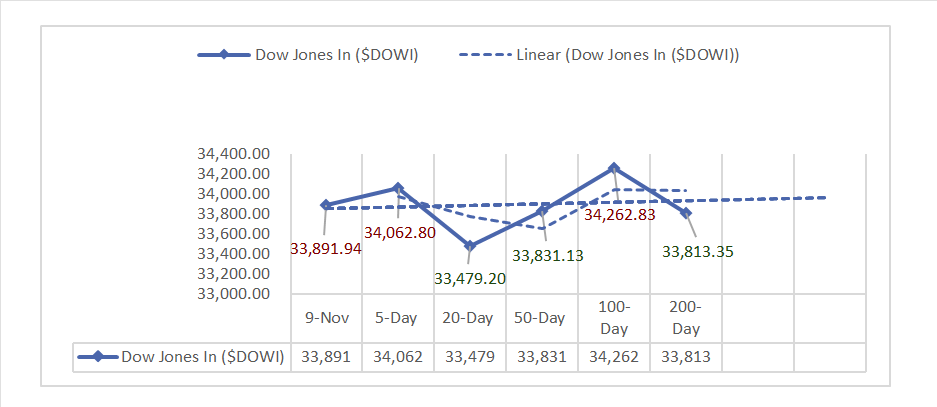

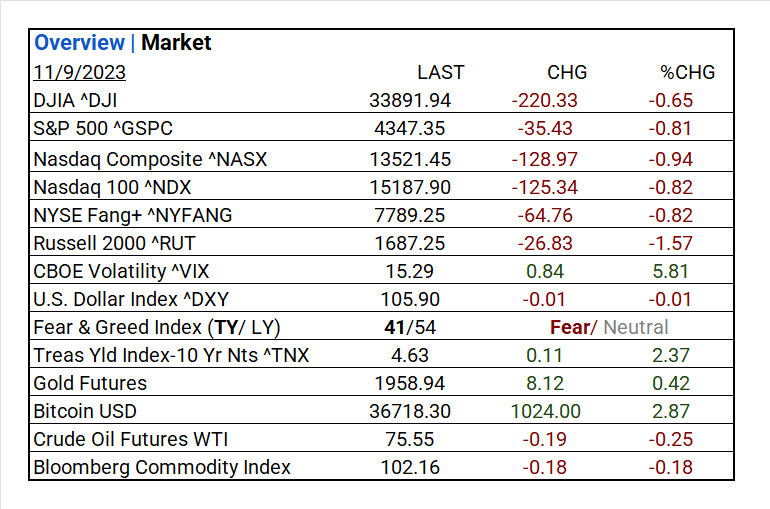

- DJIA ^DJI: 33,891.94 (-220.33, -0.65%)

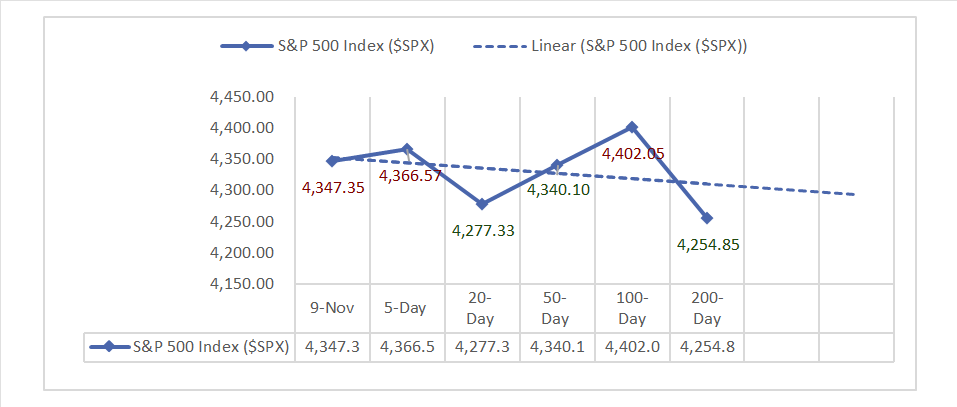

- S&P 500 ^GSPC: 4,347.35 (-35.43, -0.81%)

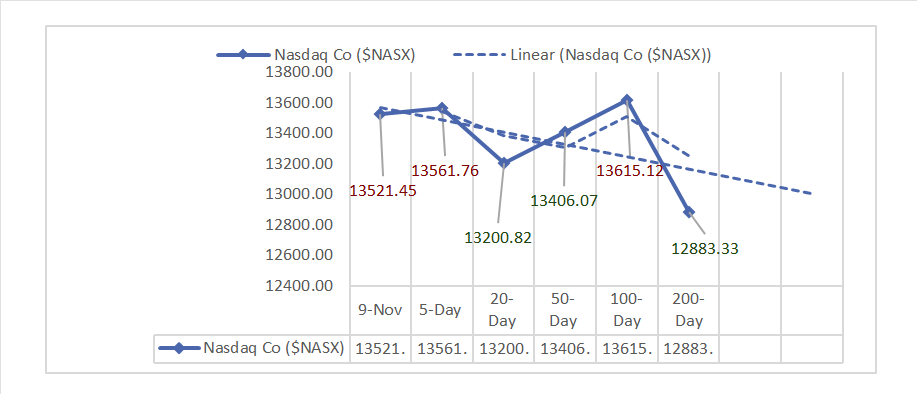

- Nasdaq Composite ^NASX: 13,521.45 (-128.97, -0.94%)

- Nasdaq 100 ^NDX: 15,187.90 (-125.34, -0.82%)

- NYSE Fang+ ^NYFANG: 7,789.25 (-64.76, -0.82%)

- Russell 2000 ^RUT: 1,687.25 (-26.83, -1.57%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: Initial Claims slightly beat expectations at 217k (vs. 218k consensus) with a prior revision. Continuing Claims exceeded consensus at 1.834ml (vs. 1.819ml).

- Market Indices: All major indices retreated, led by Nasdaq and Russell 2000, with declines in DJIA, S&P 500, Nasdaq Composite, Nasdaq 100, NYSE Fang+, and Russell 2000. The drops ranged from -0.65% to -1.57%.

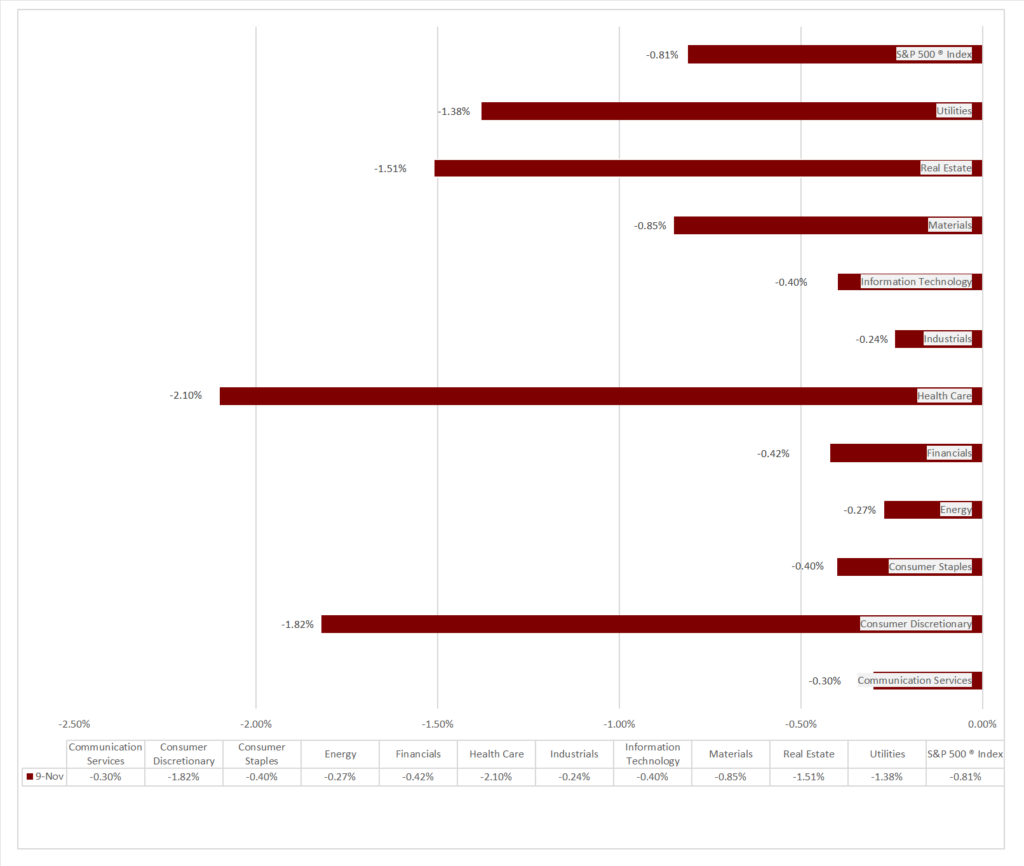

- Sector Performance: All 11 sectors were lower, with Industrials (-0.24%) leading and Health Care (-2.10%) lagging. Top industry: Entertainment (+2.51%),

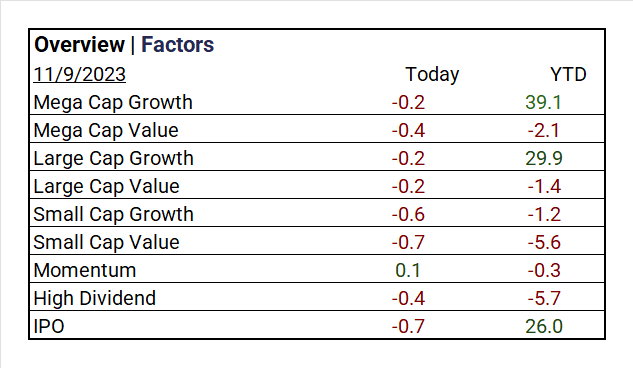

- Factors: Momentum (+0.10) outperforms.

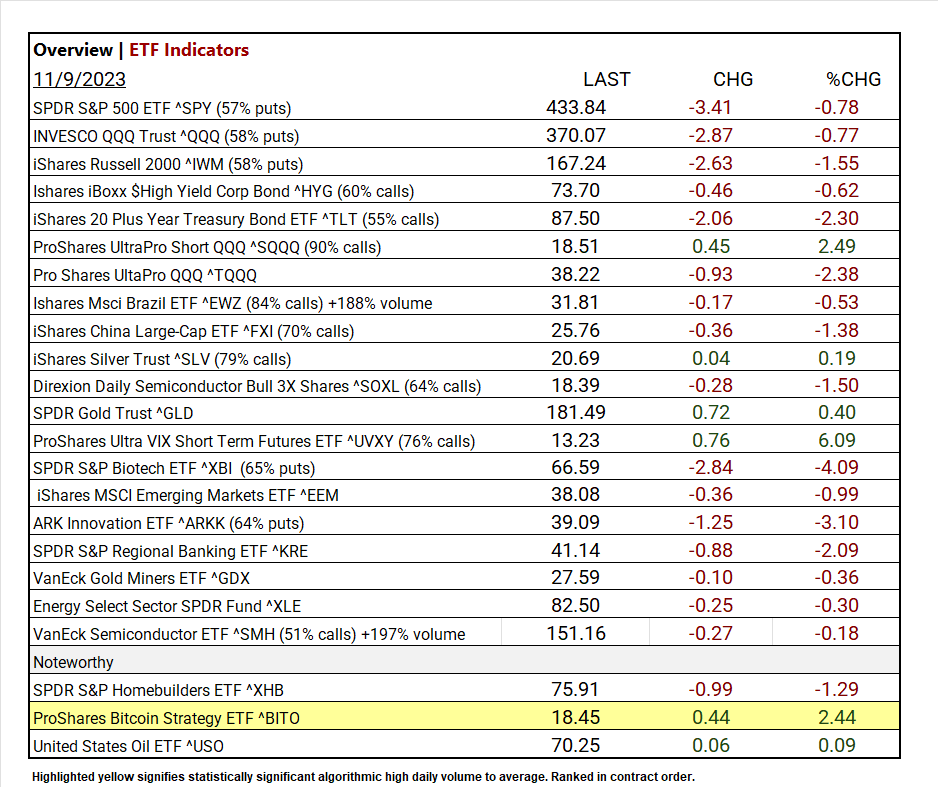

- Top ETF: ProShares Ultra VIX Short Term Futures ETF ^UVXY +6.09%

- Low ETF: SPDR S&P Biotech ETF ^XBI -4.09%

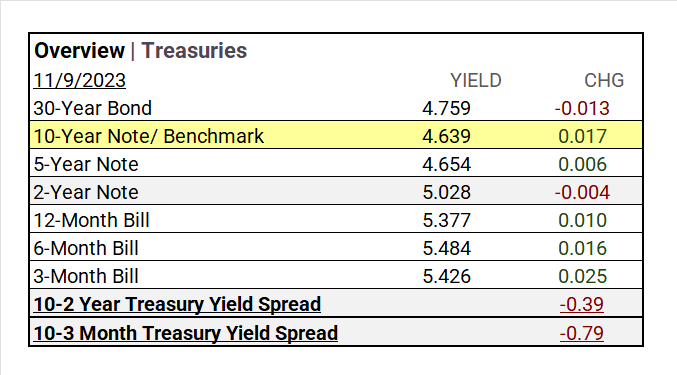

- Treasury Markets: Long-term bond yields shifted slightly: 30-Year Bond at 4.759% (-0.013), 10-Year Note at 4.639% (+0.017). Short-term bills strengthened.

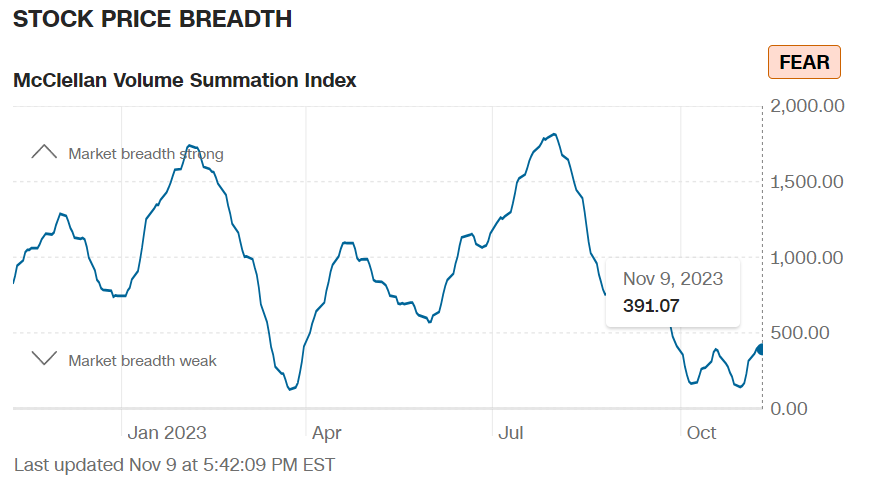

- Currency and Volatility: The U.S. Dollar Index moderately declined, CBOE Volatility rose 5.81%, and the Fear & Greed reading reflects fear.

- Commodity Markets: Gold futures and Bitcoin gained, Crude Oil futures, and the Bloomberg Commodity Index saw minor declines.

- Notable: Options market activity, Proshares Bitcoin Strategy ETF ^BITO +2.44%, iShares 20 Plus Year Treasury Bond ETF ^TLT remains bullish even on pullbacks.

Sectors:

- All 11 sectors were lower, with Industrials (-0.24%) leading and Health Care (-2.10%) lagging. Top industries: Entertainment (+2.51%), Gas Utilities (+1.85%), and Hotel & Resort REITs (+0.74%).

Treasury Yields and Currency:

- Long-term bond yields saw a slight shift, 30-Year Bond at 4.759% (-0.013), 10-Year Note at 4.639% (+0.017). Short-term bills strengthened: 12-Month Bill at 5.377% (+0.010), 6-Month Bill at 5.484% (+0.016), 3-Month Bill at 5.426% (+0.025). Notably, the 10-2 Year Treasury Yield Spread contracted to -0.39, and the 10-3 Month Treasury Yield Spread widened to -0.79.

- Treas Yld Index-10 Yr Nts ^TNX: 4.63 (+0.107, +2.37%)

- The U.S. Dollar Index ^DXY: 105.90 (-0.01, -0.01%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 15.29 (+0.84, +5.81%)

- Fear & Greed Index (TY/LY): 41/54 (Fear/ Neutral).

source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1,958.94 (+8.12, +0.42%)

- Bitcoin USD: 36,718.30 (+1,024.00, +2.87%)

- Crude Oil Futures WTI: 75.55 (-0.19, -0.25%)

- Bloomberg Commodity Index: 102.16 (-0.18, -0.18%)

Factors:

- Momentum (+0.10) outperforms.

ETF Performance:

Top 3 Best Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY +6.09%

- ProShares UltraPro Short QQQ ^SQQQ +2.49%

- SPDR Gold Trust ^GLD +0.40%

Top 3 Lowest Performers:

- SPDR S&P Biotech ETF ^XBI -4.09%

- ARK Innovation ETF ^ARKK -3.10%

- Pro Shares UltaPro QQQ ^TQQQ -2.38%

US Major Economic Data

- Initial Claims: 217k (vs. 218k consensus), prior revised to 220k from 217k.

- Continuing Claims: 1.834ml (vs. 1.819ml consensus), prior 1.818ml.

Earnings:

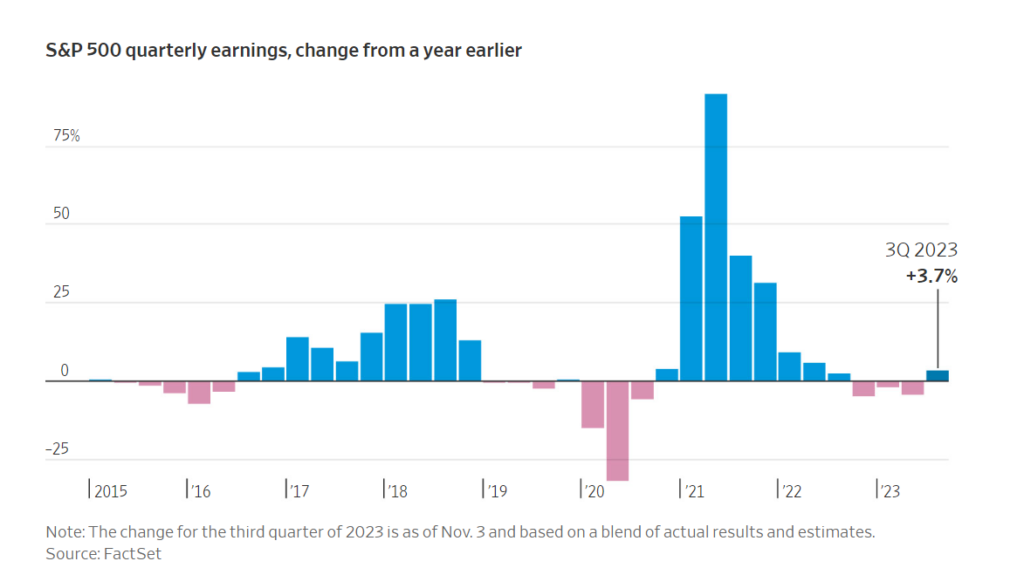

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are expected to experience earnings declines.

Notable Earnings Today:

- BEAT: Merck ADR (MKKGY), Becton Dickinson (BDX), Transdigm (TDG), Constellation Software (CNSWF), Li Auto (LI), The Trade Desk (TTD), Johnson Controls (JCI), Banco Do Brasil SA (BDORY), News Corp (NWS), Wynn Resorts (WYNN), Hawaiian Electric Industries (HE).

- MISSED: AstraZeneca ADR (AZN), Deutsche Telekom ADR (DTEGY), Sony ADR (SONY), SoftBank Group (SFTBY), Henkel Ag A (HENOY), Singapore Telecommunications PK (SGAPY), Wheaton Precious Metals (WPM), Nissan Motor ADR (NSANY), US Foods (USFD), Rakuten ADR (RKUNY), Dillards (DDS).

Resources:

News

Investment and Growth News

- Meta Strikes Deal to Return to China After 14 Years – WSJ

- China AI Startup Stockpiled 18 Months of Nvidia Chips Before Ban – Bloomberg

- Trade Desk’s 31% Plunge Sends Warning on Ad Market, Economy – Bloomberg

- Griffin Says Peace Dividend Over, High Inflation to Last Decades – Bloomberg

Infrastructure and Energy

- China’s strategic mineral supply push ‘a very urgent mission’, says resources minister, amid self-reliance push – SCMP

- Alaska Judge Sides With ConocoPhillips on New $7.5 Billion Oil Project – Bloomberg

- Nuclear Is Out, Hydrogen Is In: Where Countries Put Energy R&D Money – Bloomberg

Real Estate

- Fed Sees Risks for Banks From US Office Space, Interest Rates – Bloomberg

Central Banking and Monetary Policy

- Stocks Snap Winning Streak After Powell Warns Inflation Victory Not Assured – WSJ

- Austan Goolsbee Says Fed Will Need to Monitor Risks of Overshooting on Rates – WSJ

- China’s Consumer Deflation Returns as Recovery Remains Fragile – Bloomberg

International Market Analysis (China)

- China inflation: 4 takeaways from October’s data as pork pummels consumer prices, but is it deflation? – SCMP