Stay Informed and Stay Ahead: Market Watch, January 23rd, 2024.

Market Highlights & Analysis: Indices, Sectors, and More…

- Economic Data: Japan’s BoJ maintains its interest rate at -0.1%, Canada’s New Housing Price Index remains unchanged at 0.0% MoM in December, and EU’s Consumer Confidence (Flash) for January is -16.1.

- Market Indices: DJIA (-0.25%), S&P 500 (+0.29%), Nasdaq Composite (+0.43%).

- Sector Performance: 6 of 11 sectors higher; Consumer Staples (+1.08%) leading, Real Estate (-0.51%) lagging. Top industry: Diversified Telecommunication Services (+4.86%).

- Factors: Mega Cap Value outperforms, while Small Cap Value lags.

- Treasury Markets: The 30-Year Bond and 10-Year Note experienced the highest gains, while Bills saw declines.

- Commodities: Gold Futures rise to $2,029.10 (+0.40%), Bitcoin USD drops to $39,420.18 (-0.76%), Crude Oil Futures WTI decline to $74.37 (-0.52%), and Bloomberg Commodity Index increases to 97.60 (+0.73%).

- ETFs: Direxion Daily FTSE China Bull 3X Shares jump by 13.4%.

- Fact: MSCI China Index is >56% cheaper than the US equity benchmark.

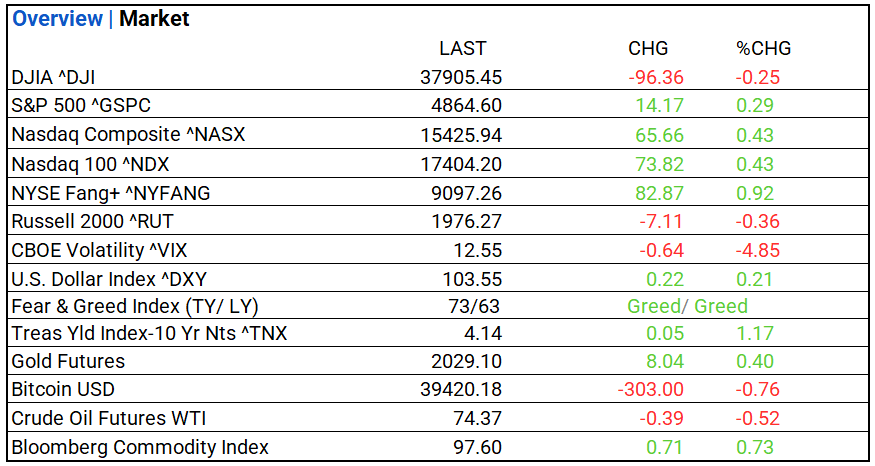

US Market Snapshot: Key Stock Market Indices:

- DJIA ^DJI: 37,905.45, -96.36, -0.25%

- S&P 500 ^GSPC: 4,864.60, 14.17, 0.29%

- Nasdaq Composite ^NASX: 15,425.94, 65.66, 0.43%

- Nasdaq 100 ^NDX: 17,404.20, 73.82, 0.43%

- NYSE Fang+ ^NYFANG: 9,097.26, 82.87, 0.92%

- Russell 2000 ^RUT: 1,976.27, -7.11, -0.36%

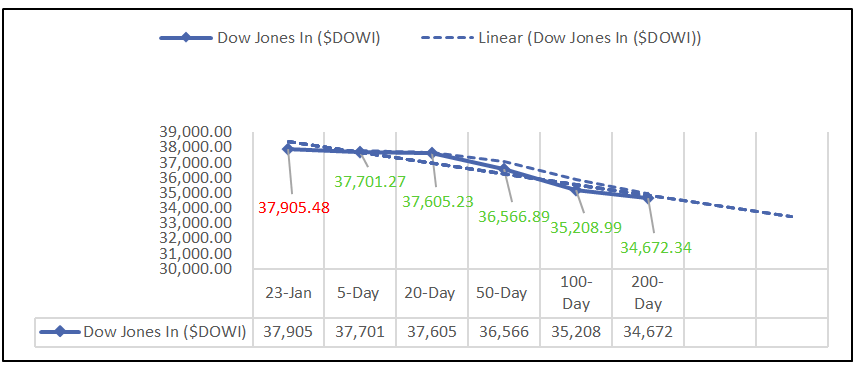

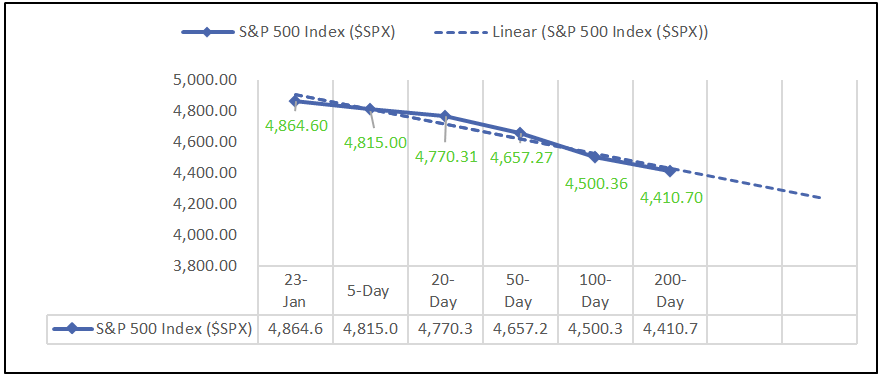

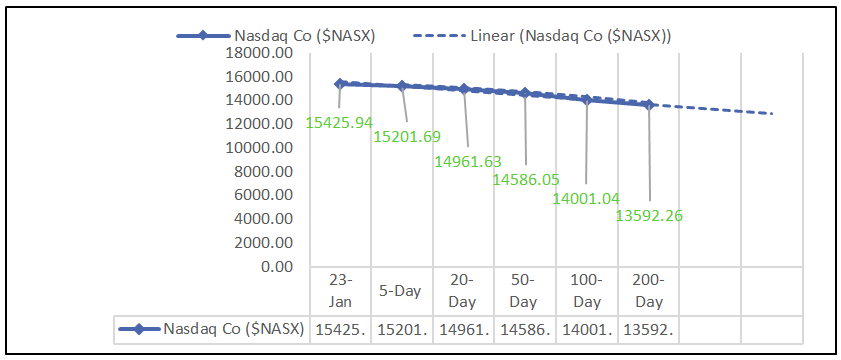

Moving Averages: DOW, S&P 500, NASDAQ:

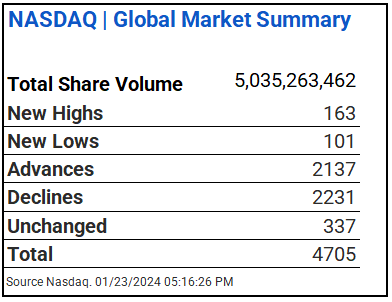

NASDAQ Global Market Summary:

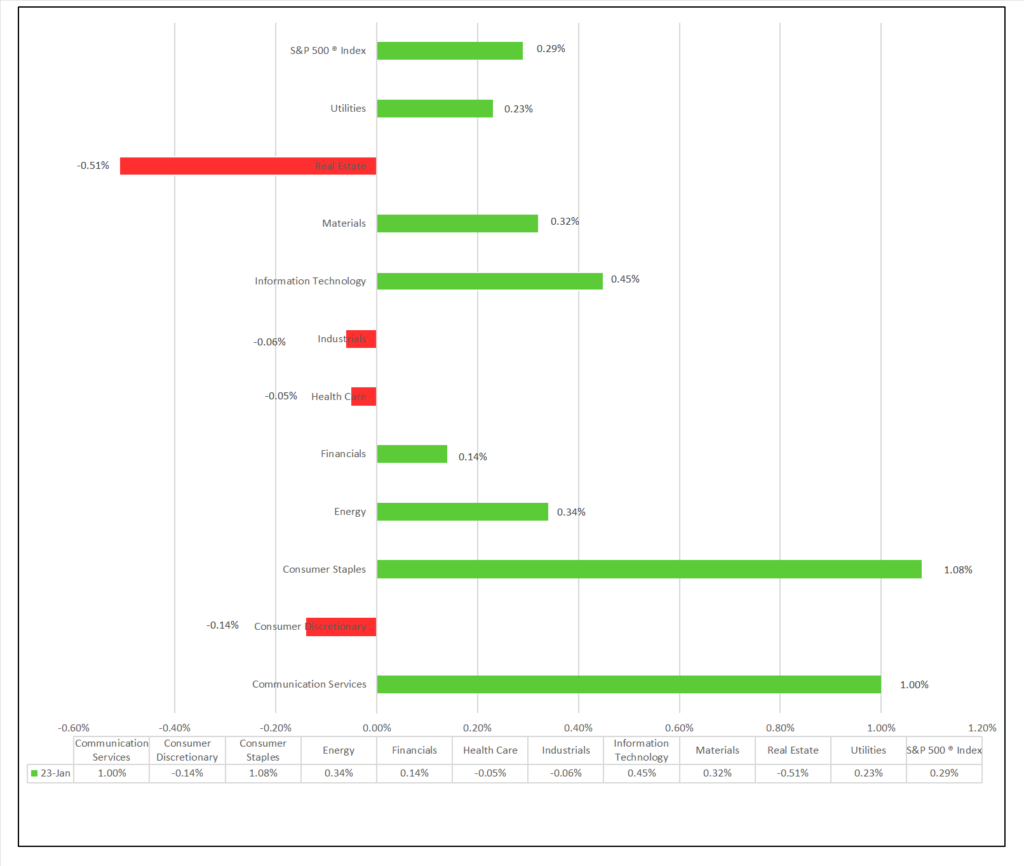

Sectors:

- 6 of 11 sectors higher; Consumer Staples (+1.08%) leading, Real Estate (-0.51%) lagging. Top industries: Diversified Telecommunication Services (+4.86%), Passenger Airlines (+3.39%), and Household Products (+3.35%).

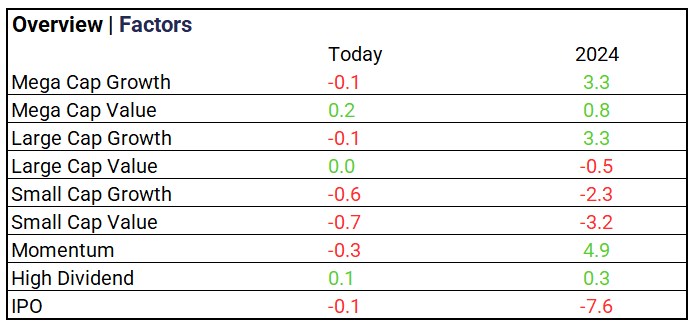

Factors:

- Mega Cap Value outperforms, while Small Cap Value lags.

Treasury Markets:

- The 30-Year Bond and 10-Year Note experienced the highest gains, while Bills saw declines.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 103.55 (+0.22, +0.21%)

- CBOE Volatility ^VIX: 12.55 (-0.64, -4.85%)

- Fear & Greed Index: 73/LY 63 (Greed/ Greed)

Commodity Markets:

- Gold Futures: $2,029.10, +$8.04, +0.40%

- Bitcoin USD: $39,420.18, -$303.00, -0.76%

- Crude Oil Futures WTI: $74.37, -$0.39, -0.52%

- Bloomberg Commodity Index: 97.60, +$0.71, +0.73%

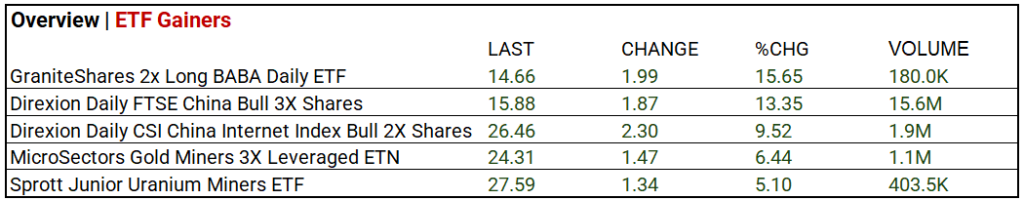

ETF’s:

- Direxion Daily FTSE China Bull 3X Shares jump by 13.4% with substantial trading volume reaching 15.6 million.

US Economic Data:

- Richmond Fed Services/Mfg Index: -15 vs. -2.8 fc, prior -11

Global:

- Interest rate decision: Japan BoJ -0.1% vs -0.1% fc, prior -0.1%

- Canada New Housing Price Index MoM Dec 0.0% vs 0.0% fc, prior -0.2%

- EU Consumer Confidence (Flash) Jan -16.1 vs -14.3 fc, prior -15.0)

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT: J&J (JNJ), Verizon (VZ), General Electric (GE), Intuitive Surgical (ISRG), Rtx Corp (RTX), Lockheed Martin (LMT), Canadian National Railway (CNI), 3M (MMM), PACCAR (PCAR), Invesco (IVZ), Logitech (LOGI), LM Ericsson B ADR (ERIC).

- MISSED: Procter&Gamble (PG), Netflix (NFLX), Texas Instruments (TXN), DR Horton (DHI), Baker Hughes (BKR), Halliburton (HAL), Steel Dynamics (STLD).

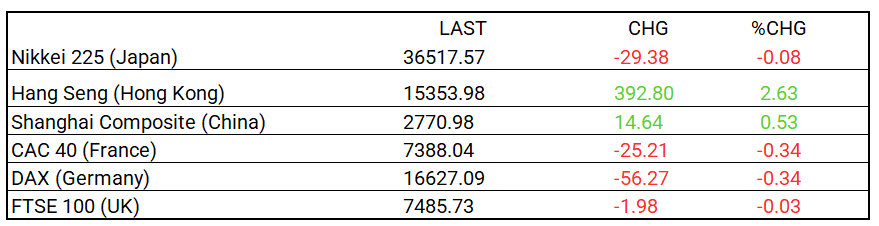

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): 36,517.57, -29.38, -0.08%

- Hang Seng (Hong Kong): 15,353.98, 392.80, 2.63%

- Shanghai Composite (China): 2,770.98, 14.64, 0.53%

- CAC 40 (France): 7,388.04, -25.21, -0.34%

- DAX (Germany): 16,627.09, -56.27, -0.34%

- FTSE 100 (UK): 7,485.73, -1.98, -0.03%

Central Banking and Monetary Policy, Noteworthy:

- Bank of Canada Expected to Hold Rates Steady in Wednesday Policy Decision – WSJ

- Japan Exports Beat Consensus as China Shipments Resume Rise – Bloomberg

- Hedge Fund Stars Who Got China Wrong Are Paying a Big Price – Bloomberg

Energy:

- Sunoco to Buy NuStar Energy in $7.3 Billion Deal – WSJ

China:

- China’s slow response to economic turbulence leaves market bewildered: ‘Where do we go from here’ as policy changes remain elusive? – SCMP