Stay Informed and Stay Ahead: Market Watch, July 23rd, 2024.

Early -Week Wall Street Markets

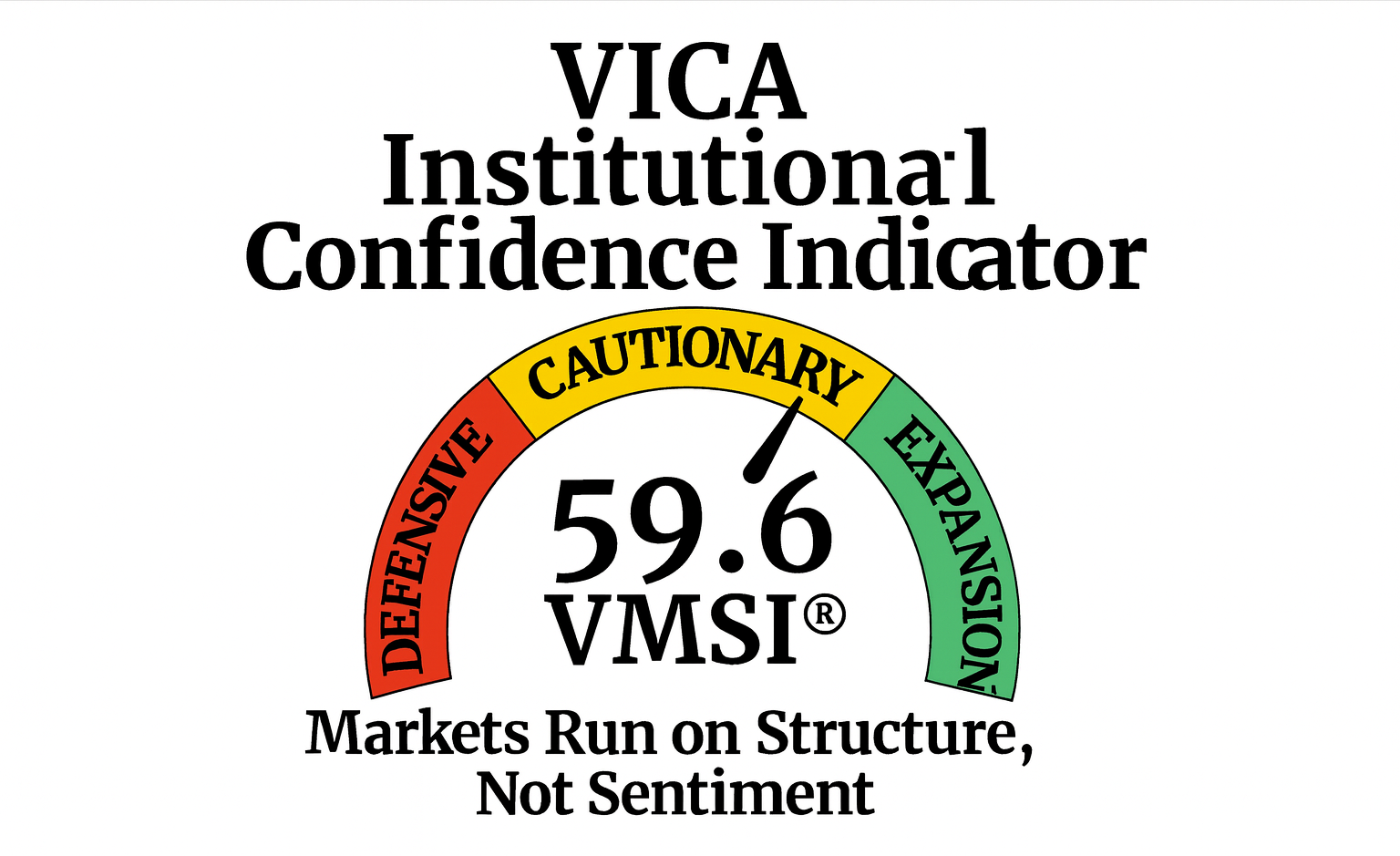

Key Takeaways

- DOW, S&P 500, and NASDAQ were down; Materials led, with Aerospace & Defense as the top industry.

- June existing home sales declined, missing last year’s numbers and falling below forecasts.

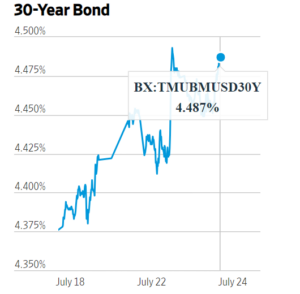

- The 30-Year Bond yield increased, while yields on the 10-Year, 7-Year, 5-Year, and 3-Year Notes decreased. Small caps outperformed. Brent, gold, silver, and corn rose, whereas WTI oil and natural gas fell. Bitcoin pulled back. ETFs Direxion Daily Semiconductor Bear 3X Shares scores. Alphabet (GOOG, GOOGL), Coca-Cola (KO) beat earnings expectations.

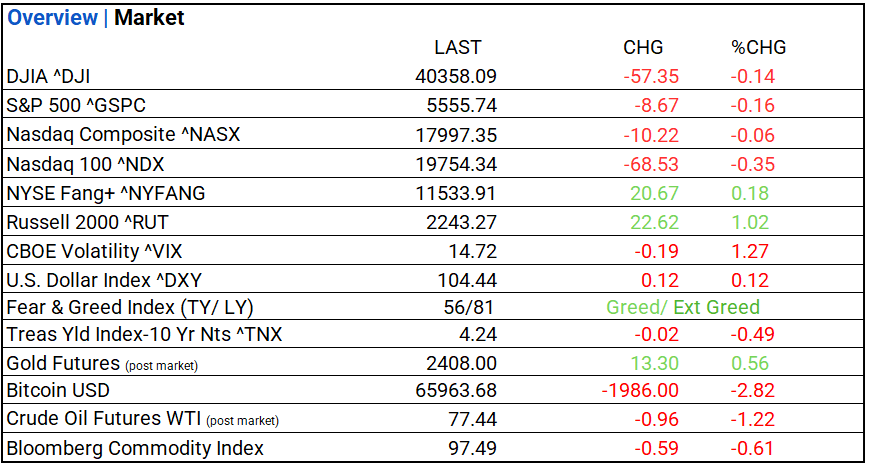

Summary of Market Performance

Indices & Sectors Performance:

- Today, major US stock indices—DOW, S&P 500, NASDAQ—down. Among eleven sectors, eight declined. Materials and Financials led, Energy and Utilities trailed. Top industries: Aerospace & Defense (+3.12%), Broadline Retail (+2.04%) and Office REITs (+1.93%).

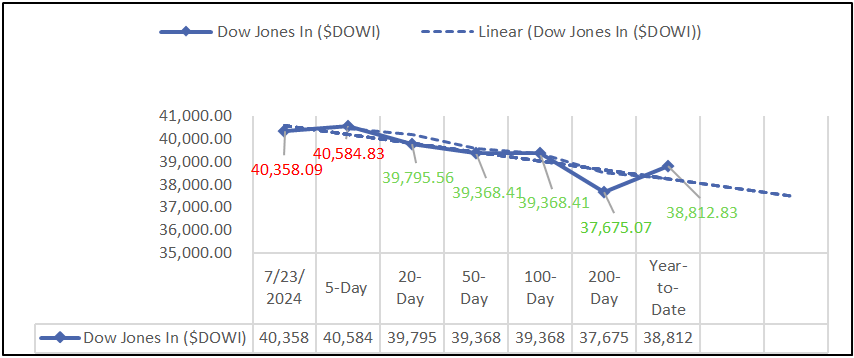

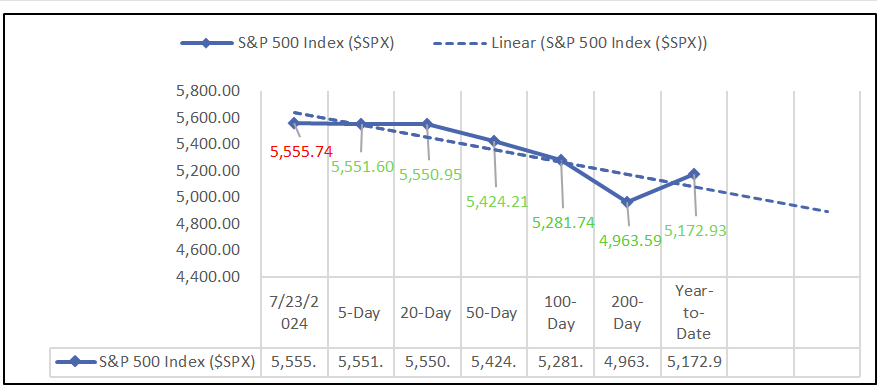

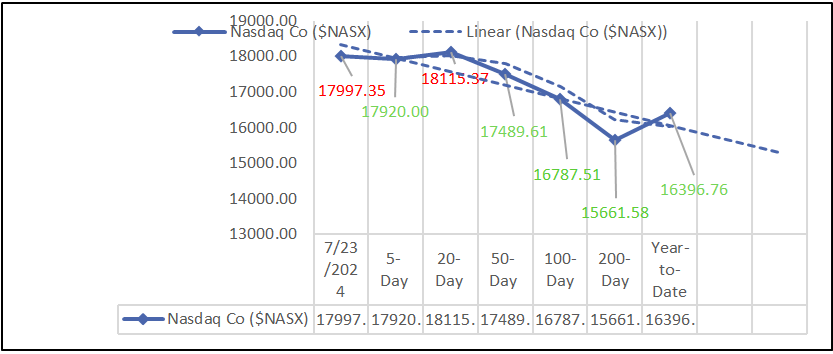

Chart: Performance of Major Indices

Moving Average Analysis:

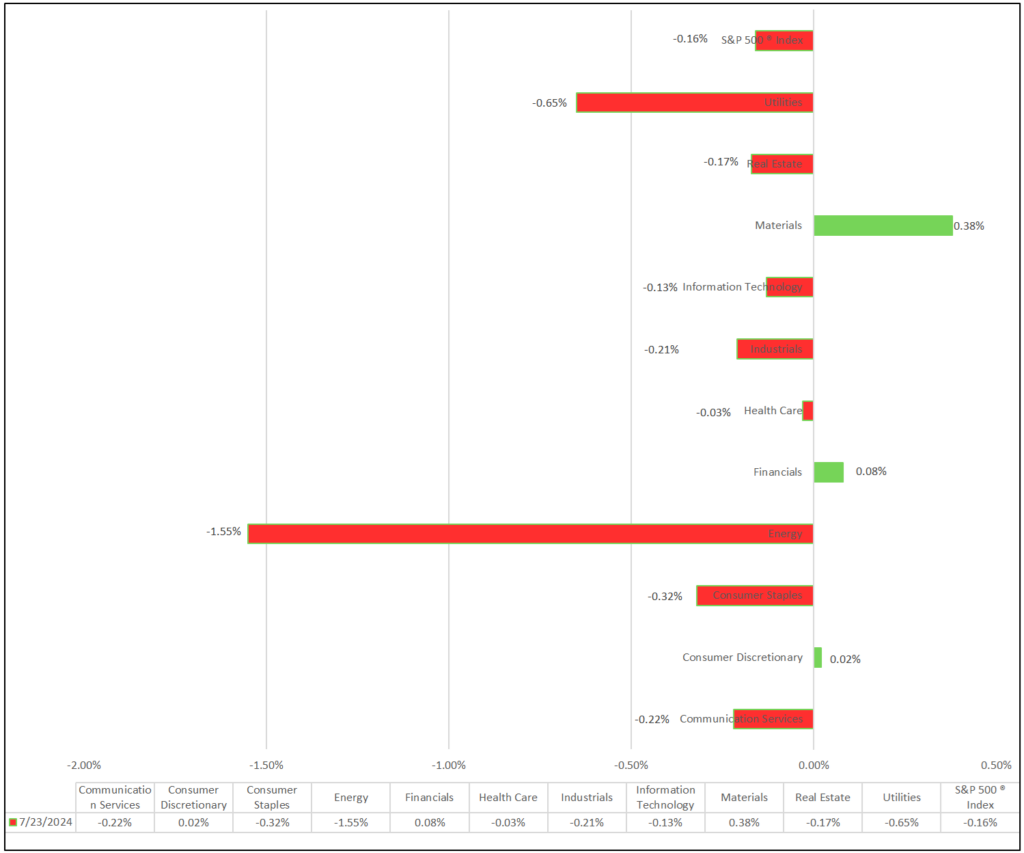

S&P 500 Sectors:

- Among eleven sectors, eight fell. Materials led; Energy trailed.

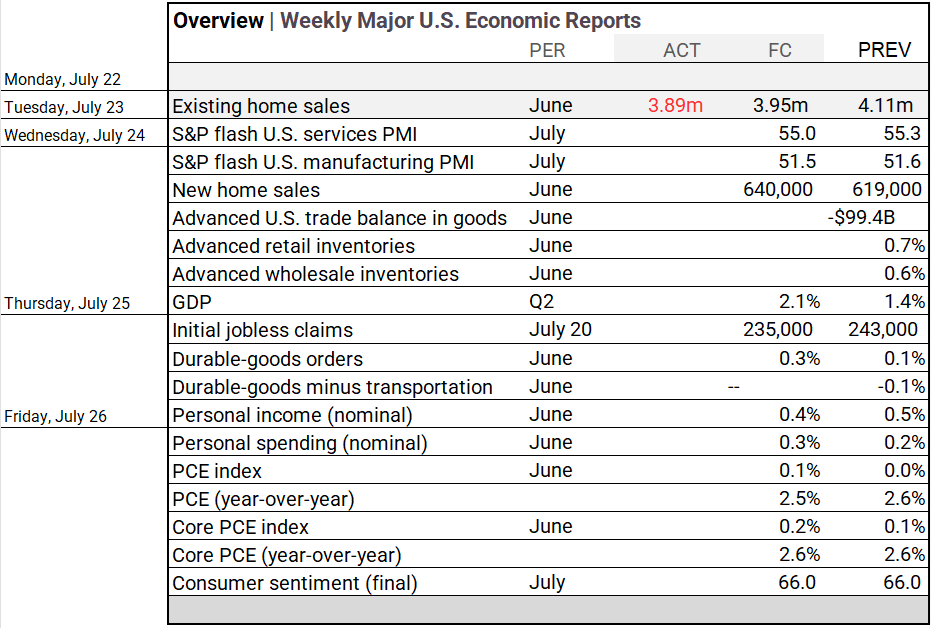

Economic Highlights:

- June existing home sales declined, missing last year’s numbers and falling below forecasts.

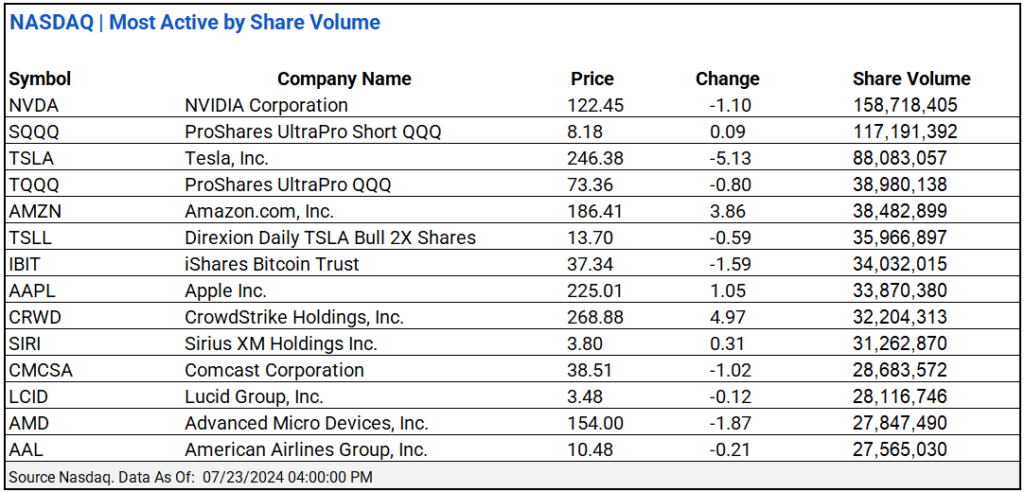

NASDAQ Global Market Update:

- NASDAQ showed total share volume of 4.49 billion, 244 new highs, 88 new lows, and an advance/decline ratio of 1.26, NVIDIA Corporation and ProShares UltraPro Short QQQ led active trading.

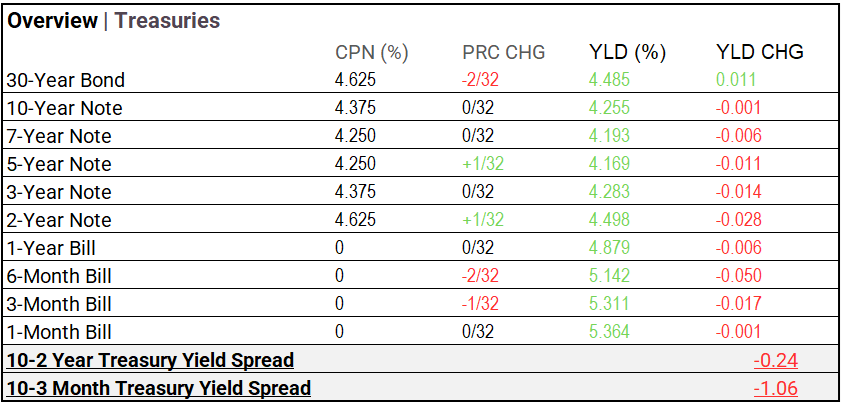

Treasury Markets:

- The 30-Year Bond yield increased to 4.485%, while the 10-Year, 7-Year, 5-Year, and 3-Year Note yields decreased. This indicates rising long-term costs and decreasing short to medium-term costs.

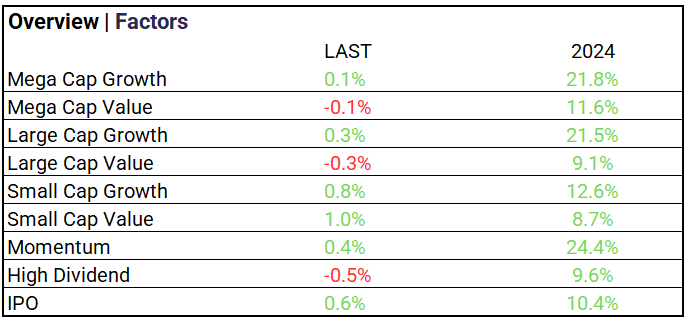

Market Factors:

- Small-cap value stocks rose 1.0%, small-cap growth increased 0.8%, while high dividend stocks declined 0.8%.

Currency & Volatility:

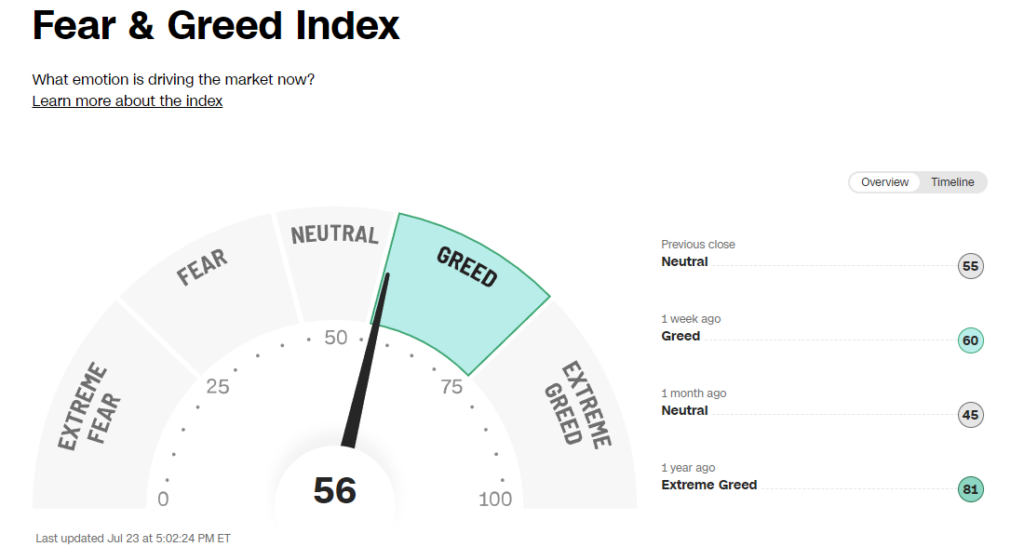

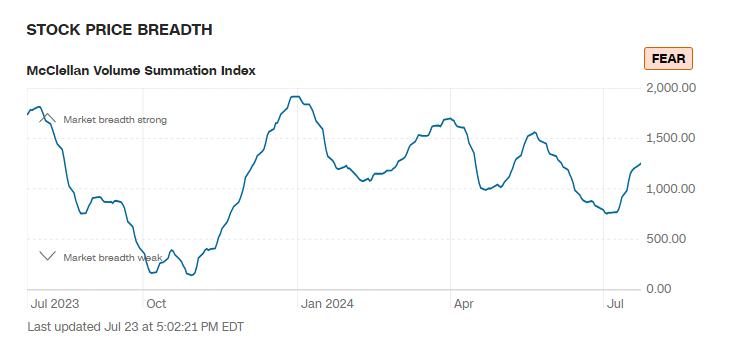

- The VIX decreased to 14.72 (-1.27), and the Fear & Greed Index registered “Greed”, down from “Extreme Greed” last year.

Commodities & ETFs:

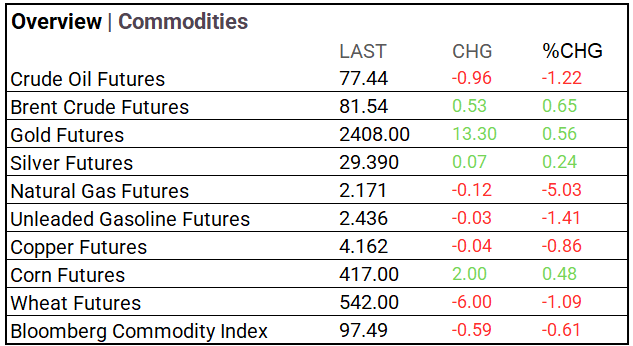

- Commodity markets continued to be under pressure: Brent crude, gold, silver, and corn rose. The Bloomberg Commodity Index decreased.

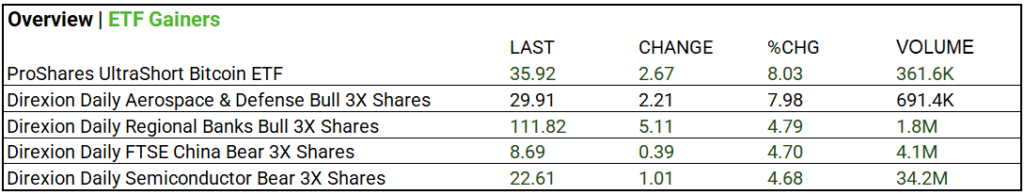

- ETFs: Direxion Daily Semiconductor Bear 3X Shares was up +4.68% on 34.2 volume.

Cryptocurrency Update:

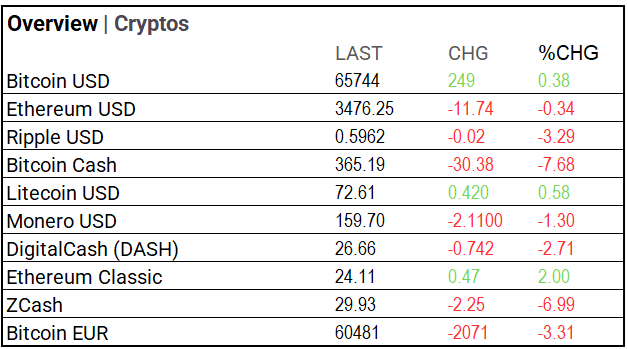

- Bitcoin gave back recent gains, pulling back to 65,999.81 (-2.50%) during the market session.

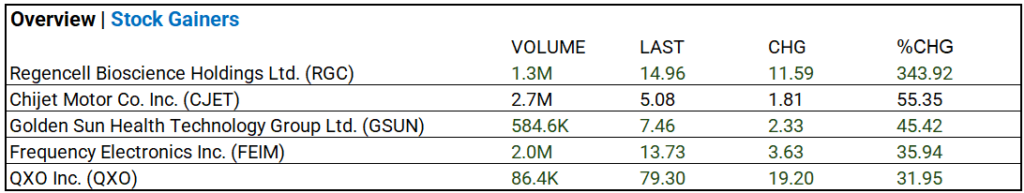

Stocks:

- Regencell Bioscience (RGC) surged 344% on 1.3M volume; Chijet Motor (CJET) rose 55% on 2.7M volume.

Notable Earnings:

- Alphabet (GOOG, GOOGL), Coca-Cola (KO) beat, while Tesla (TSLA), Visa A (V), Louis Vuitton ADR (LVMUY), and United Parcel Service (UPS) miss. General Electric (GE) rallies even with revenue miss.

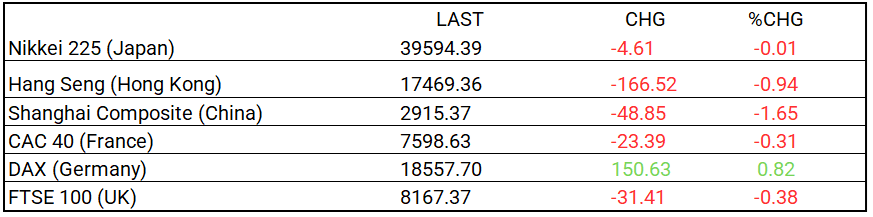

Global Markets Summary:

- Asia mixed: Nikkei flat, Shanghai Composite down 1.65%, Hang Seng down 0.94%; Europe: Germany’s DAX up 0.82%.

Strategic Investment Adjustments and Historical Market Trends

- Focus on long-duration bonds, which benefit from rate cuts due to their inverse relationship with interest rates. As the Fed eases rates, their value rises since fixed payments become more attractive compared to new, lower-rate bonds.

- Continue to invest in Information Technology, especially semiconductors, due to high growth potential, while diversifying with value instruments to mitigate risk.

- Historically, election years support market growth due to increased fiscal stimulus and investor optimism.

-mk

In the NEWS:

Central Banking, Monetary Policy & Economics:

- Bank of Canada Looks Set to Deliver Back-to-Back Rate Cuts – WSJ

- The Harris Tax Plan May Not Be Biden’s Tax Plan – Bloomberg

Business:

- Tesla’s Profit Falls for Second Straight Quarter – WSJ

- Visa Slides After Revenue at Payments Giant Misses Estimate – Bloomberg

China:

- Global demand for Chinese e-commerce goods boosts low-value trade untouched by tariffs – SCMP