“Empowering Your Financial Success”

Daily Market Insights: September 27th, 2023

Global Markets Summary:

Asian Markets:

- Hong Kong’s Hang Seng: +0.83%

- Japan’s Nikkei 225: +0.18%

- China’s Shanghai Composite: +0.16%

US Futures:

- S&P Futures: opened @4,282.63 (+0.21%)

European Markets:

- Germany’s DAX: -0.25%

- London’s FTSE 100: -0.43%

- France’s CAC 40: -1.57%

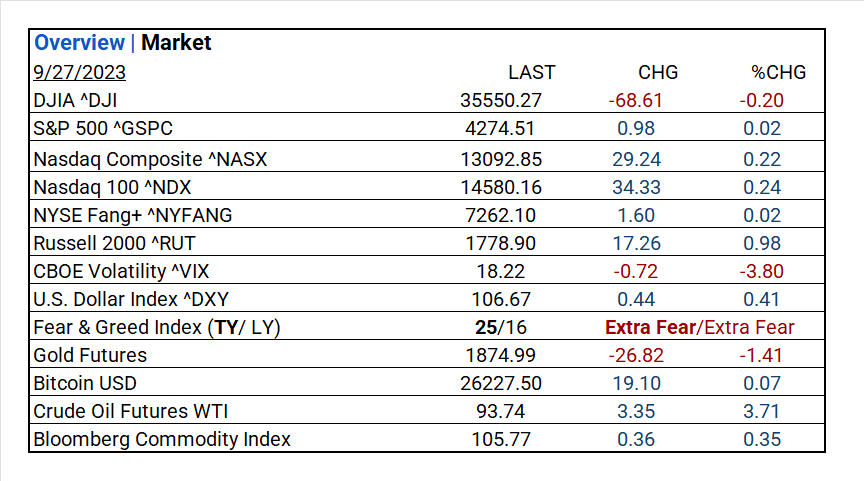

US Market Snapshot:

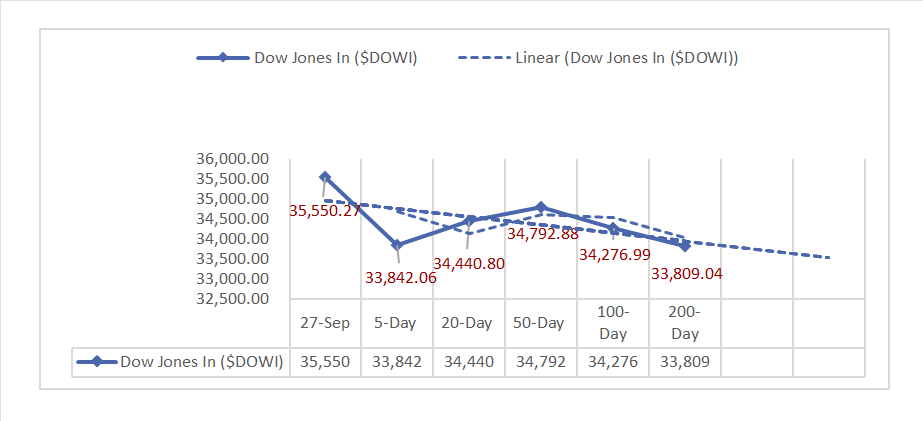

Key Stock Market Indices:

- DJIA ^DJI: 35,550.27 (-68.61, -0.20%)

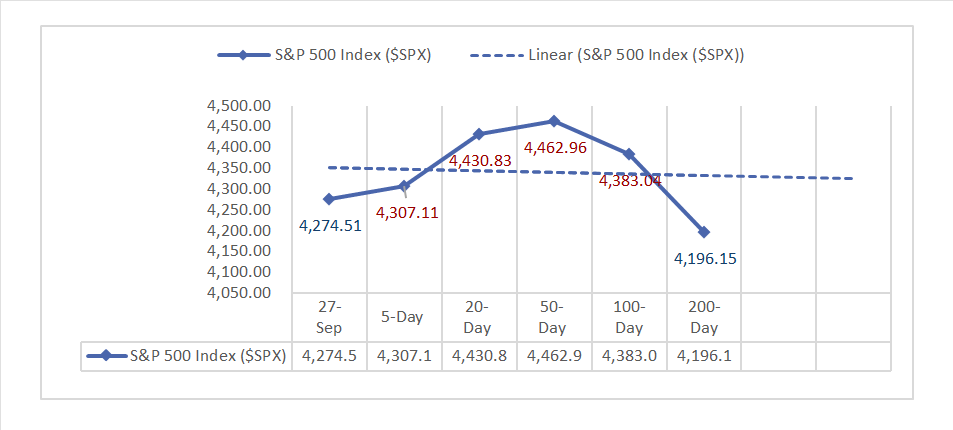

- S&P 500 ^GSPC: 4,274.51 (0.98, 0.02%)

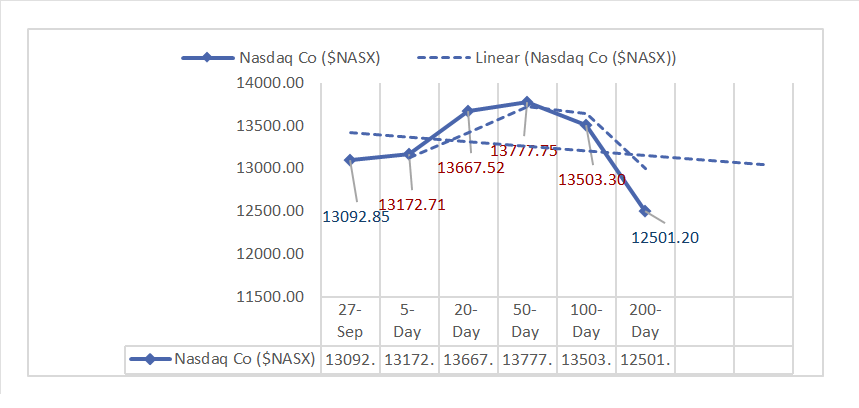

- Nasdaq Composite ^NASX: 13,092.85 (29.24, 0.22%)

- Nasdaq 100 ^NDX: 14,580.16 (34.33, 0.24%)

- NYSE Fang+ ^NYFANG: 7,262.10 (1.60, 0.02%)

- Russell 2000 ^RUT: 1,778.90 (17.26, 0.98%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: In the week ending September 22, MBA Mortgage Applications dropped by 1.3% after a 5.4% jump. The 30-year mortgage rate rose from 7.3% to 7.4%. In August, Durable Goods Orders rose by 0.2%, surpassing expectations and recovering from a -5.6% slump. Excluding transportation, orders grew by 0.4%, beating expectations and the prior month’s 0.1% increase.

- Market Indices: DJIA (^DJI) declined, S&P 500 (^GSPC) edged up, Nasdaq Composite (^NASX) and Nasdaq 100 (^NDX) advanced, NYSE Fang+ (^NYFANG) saw a slight rise, and Russell 2000 (^RUT) posted the most significant gain.

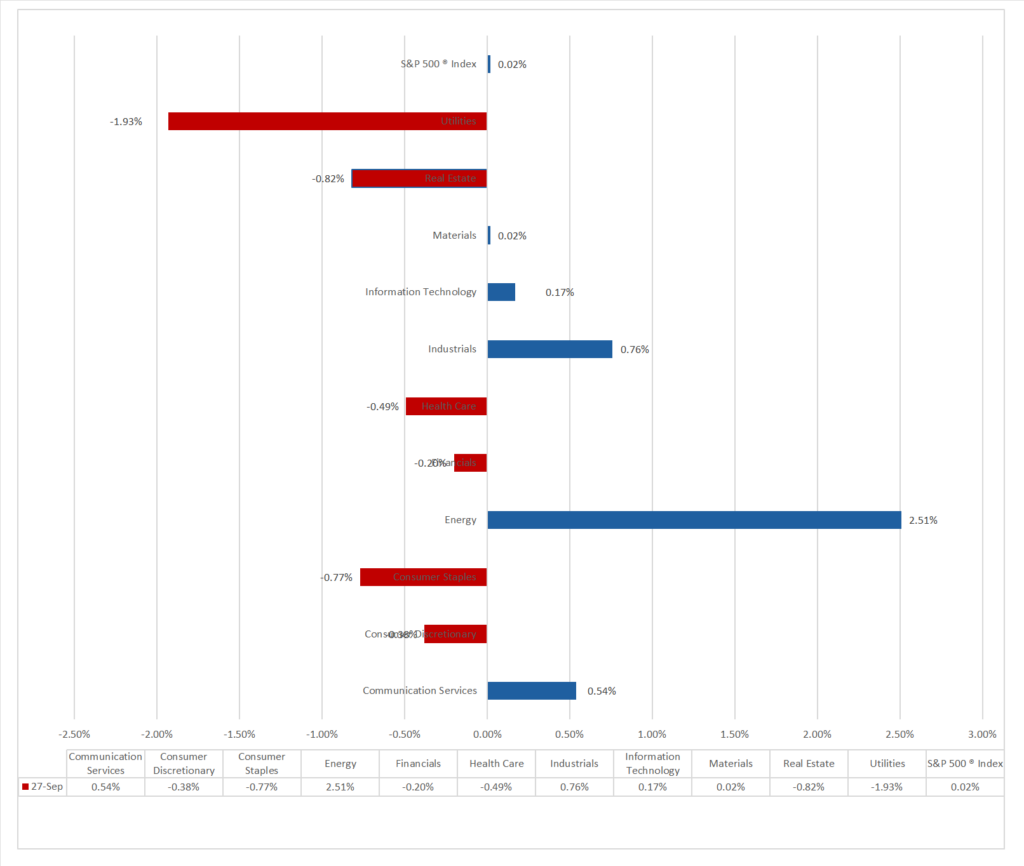

- Sector Performance: 6 of 11 sectors fell, with Energy (+2.51%) outperforming while Utilities (-1.93%) lagged. Industry: Construction & Engineering industry surged by 2.85%.

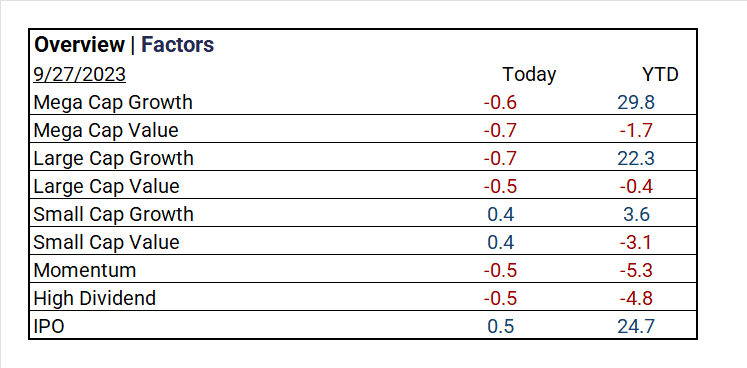

- Factors: IPOs and Small Caps outperformed.

- Top ETF: Direxion Daily Semiconductor Bull 3X Shares ^SOXL gained +2.55%.

- Worst ETF: ProShares Ultra VIX Short Term Futures ETF ^UVXY declined by -6.21%.

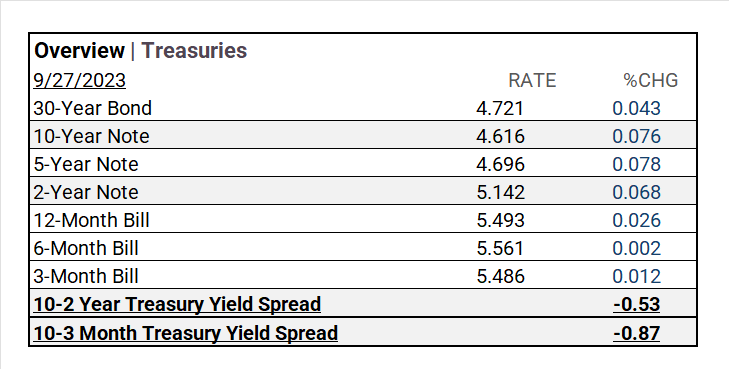

- Treasury Markets: Long-term bonds, like the 30-Year Bond, experienced increased yields, with the 30-Year Bond reaching 4.721% (+0.043).

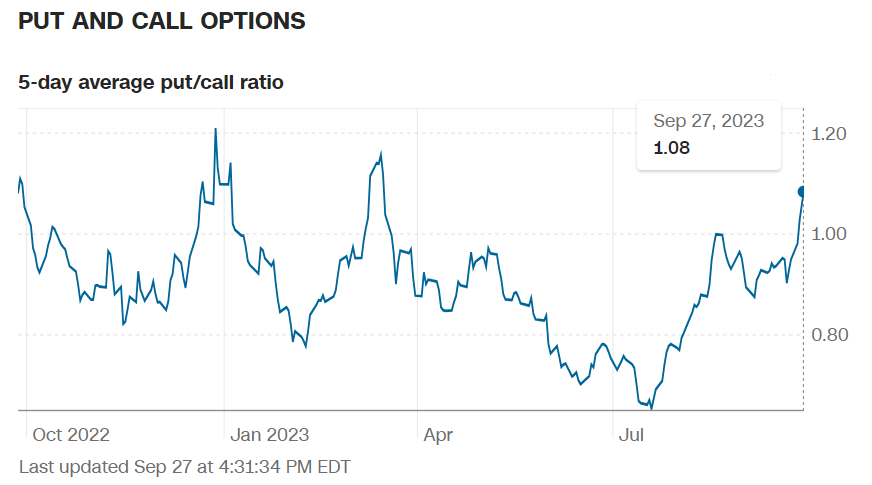

- Currency and Volatility: The U.S. Dollar Index rose, CBOE Volatility decreased, and the Fear & Greed Index indicated extreme fear.

- Commodity Markets: Gold Futures fell, while Bitcoin, Crude Oil Futures WTI, and the Bloomberg Commodity Index increased.

Sectors:

- 6 of 11 sectors fell, with Energy (+2.51%) outperforming while Utilities (-1.93%) lagged.

Treasury Yields and Currency:

- In Treasury markets, long-term bonds like the 30-Year Bond saw higher yields, with the 30-Year Bond rate at 4.721%, up by 0.043%. Short-term bills had slight fluctuations, and yield spreads shifted, including the 10-2 Year spread narrowing and the 10-3 Month spread declining to -0.53 and -0.87, respectively.

- The U.S. Dollar Index ^DXY: 106.67 (+0.44, +0.41%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 18.22 (-0.72, -3.80%)

- Fear & Greed Index (TY/LY): 27/17 (Fear/Extreme Fear).

Commodities:

- Gold Futures: 1874.99 (-26.82, -1.41%)

- Bitcoin USD: 26227.50 (+19.10, +0.07%)

- Crude Oil Futures WTI: 93.74 (+3.35, +3.71%)

- Bloomberg Commodity Index: 105.77 (+0.36, +0.35%)

Factors:

- IPOs led (+0.5%) followed by Small Caps (+0.4%)

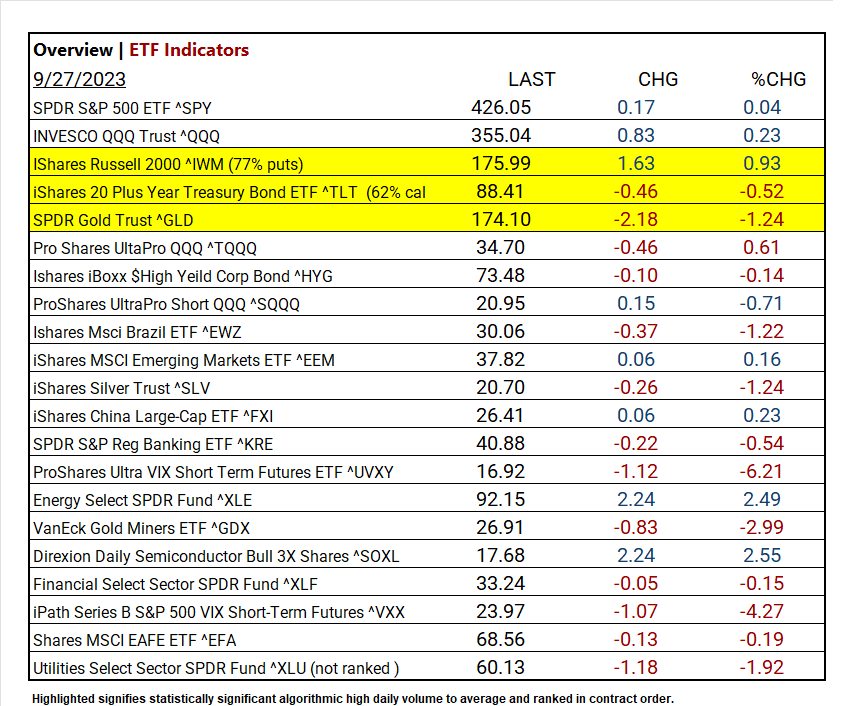

ETF Performance:

Top 3 Best Performers:

- Direxion Daily Semiconductor Bull 3X Shares ^SOXL: +2.55%

- Energy Select SPDR Fund ^XLE: +2.49%

- iShares Russell 2000 ^IWM: +0.93%

Top 3 Worst Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY: -6.21%

- iPath Series B S&P 500 VIX Short-Term Futures ^VXX: -4.27%

- VanEck Gold Miners ETF ^GDX: -2.99%

US Economic Data

- MBA Mortgage Applications for the week ending September 22nd decreased by 1.3% week-over-week, following a 5.4% increase in the previous week.

- The 30-year mortgage rate rose to 7.4%, up from the previous rate of 7.3%.

- Durable Goods Orders in August showed a month-over-month increase of 0.2%, surpassing market expectations of a -0.5% decline and recovering from the prior month’s significant drop of -5.6%.

- Excluding transportation, Durable Goods Orders in August exhibited a month-over-month growth of 0.4%, exceeding the anticipated 0.1% increase and surpassing the previous month’s 0.1% gain.

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023 results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: S&P 500 to see -0.2% YoY earnings decline, marking 4th consecutive drop. S&P 500’s 12-month P/E ratio is 18.0, below 5-year (18.7%) average but above 10-year (17.5%) average. 74 S&P 500 firms gave negative EPS guidance, 42 exceeded expectations with positive guidance.

Notable Earnings Today:

- Beat: Micron (MU), Paychex (PAYX), Duckhorn Portfolio (NAPA).

- Miss: Jefferies Financial (JEF), Concentrix (CNXC), H B Fuller (FUL), Worthington Industries (WOR).

Resources:

News

Investment and Growth News

- Palantir Wins $250 Million AI Deal With US Defense Department – Bloomberg

- Lululemon Strikes Deal With Peloton for Fitness Content, Will Ax Mirror Device – Bloomberg

- More CFOs Pull Back Spending Plans Due to Higher Interest Rates – WSJ

Infrastructure and Energy

- A Single ESG Fund Category Has Soared More Than 300% in the US – Bloomberg

- Shale Tycoon Hamm Wants End of ‘Roller Coaster’ US Energy Plans – Bloomberg

Real Estate Market Updates

- BlackRock Sees Insurers Betting on Credit, Paring Private Equity – Bloomberg

Central Banking and Monetary Policy

- Dollar Surge Is Bringing ‘Pseudo Tightening’ to Southeast Asia – Bloomberg

International Market Analysis (China)

- China’s Xi Jinping appeals to decades-old mantra of reform and opening up, as economy slows and foreign investors ponder leaving – SCMP