The VOLATILITY & MARKET SENTIMENT INDEX (VMSI©) is VICA Partners’ freely‑available, institution‑grade lens on market risk and opportunity. It captures where capital is moving now and where it’s likely headed next by blending 1,000+ live indices and data streams into a single, intuitive score.

Why VMSI Is Different

• Fuses real‑time trading, options skew, and flow analytics to forecast institutional positioning

• Benchmarks those signals against retail sentiment to highlight crowd dislocations

• Surfaces rotations three moves ahead of broad‑market recognition

• Beats the depth of most paid terminals — yet remains 100 % free

HOW IT WORKS – FIVE PILLARS

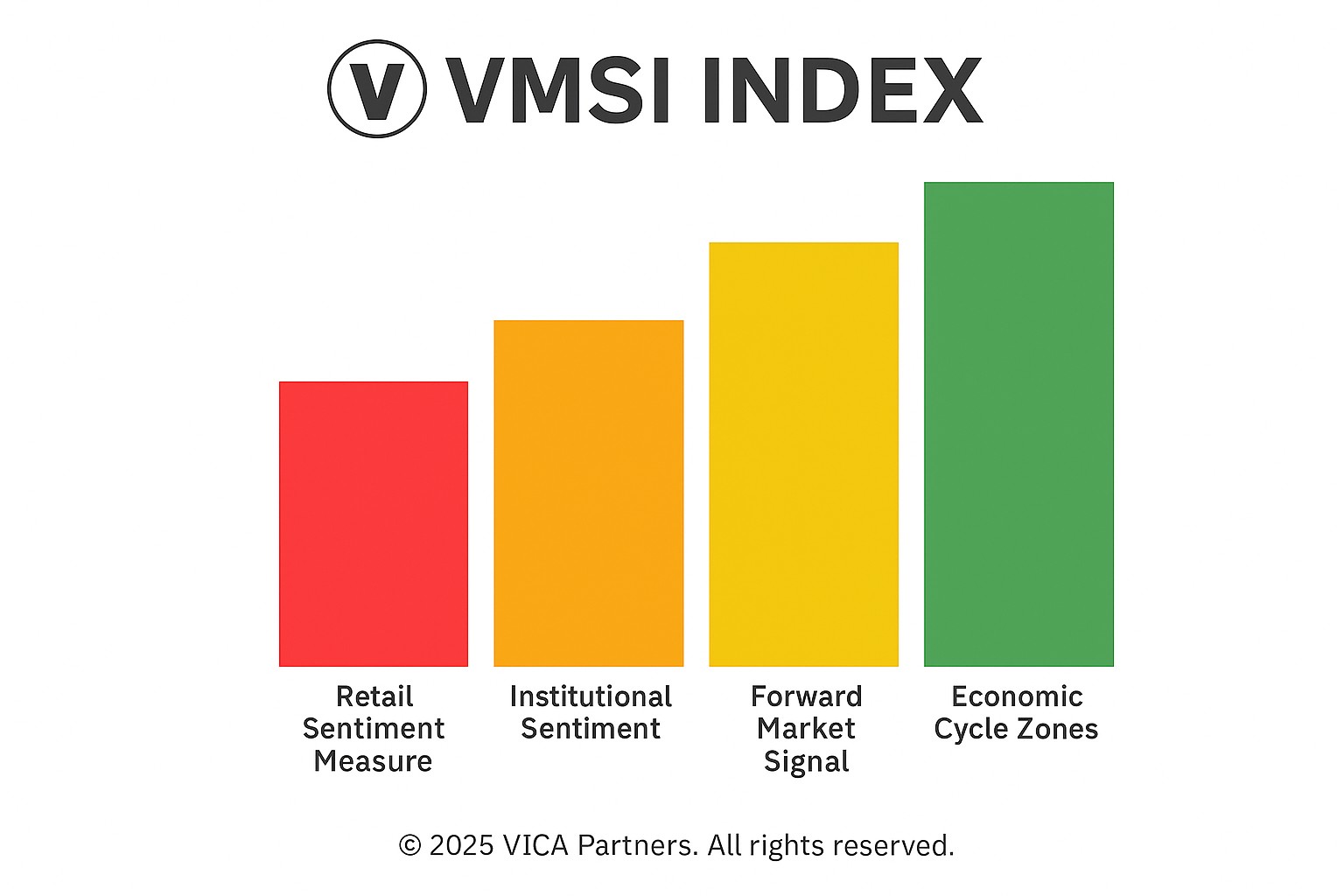

VMSI includes a dynamic market forecast based on whether key signals have been met. It contrasts institutional flows with real-time public sentiment, anticipates economic regime shifts, and distills high-frequency inputs into clear forward guidance.

- MOMENTUM – leadership across indices & sectors

- LIQUIDITY – credit, funding & capital availability

- VOLATILITY / HEDGING – cost of protection & risk premiums

- SAFE‑HAVEN DEMAND – flows to gold, Treasuries, TIPs & cash

- SENTIMENT & MACRO SIGNALING – contrasts retail vs. institutional sentiment, detects economic cycle shifts, and confirms forward signal triggers

Each pillar is scored 0‑100 and rolled into the composite VMSI scale:

| ZONE | SCORE | MARKET TONE |

|---|---|---|

| 🔴 CRITICAL RISK | 0‑25 | Disorderly selling / capital flight |

| 🟠 DEFENSIVE | 26‑49 | Cautious, hedge‑heavy |

| 🟡 CAUTIONARY OPTIMISM | 50‑74 | Selective risk‑taking |

| 🟢 HIGH CONVICTION | 75‑100 | Broad expansion, bull‑driven |

WHO IT SERVES

VMSI exists because VICA is a socially-minded research firm — we believe vital market intelligence should be free and accessible.

- Portfolio managers & ETF strategists trimming hedges or adding beta

- Family offices & advisors balancing growth vs. capital preservation

- C‑suite leaders sensing macro turning points

- Self‑directed investors tired of click‑bait sentiment surveys

VMSI FREEMIUM already outclasses most subscription research. It’s our way of leveling the playing field — insight should lift everyone, not just those who can out‑spend the rest.

WHY SHARE IT?

Knowledge compounds when it’s circulated. By forwarding VMSI you:

- Raise the signal‑to‑noise ratio for your network.

- Expand an informed community that can debate with data, not drama.

- Help rewrite an industry that keeps vital context behind paywalls.

WHAT’S NEXT – VMSI‑X (Q4 2025)

An institutional‑grade trigger engine delivering sector & factor breakouts weeks before they appear in mainstream models. Built for portfolio desks, hedge funds, and allocators who refuse to trail consensus.

TAKE THE SMART STEP

Sign up for the VICA Newsletter and pass it on — free, forward‑looking, and sharper than most pay‑walled services.