MARKETS TODAY July 21st, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished mixed, Hong Kong’s Hang Seng gained 0.78%, Japan’s Nikkei 225 down 0.57%, China’s Shanghai Composite off 0.06%.

European markets finished mixed, France’s CAC 40 up 0.65%, London’s FTSE 100 up 0.23% and Germany’s DAX lost 0.17%. S&P futures opened trading at 0.34% above fair value.

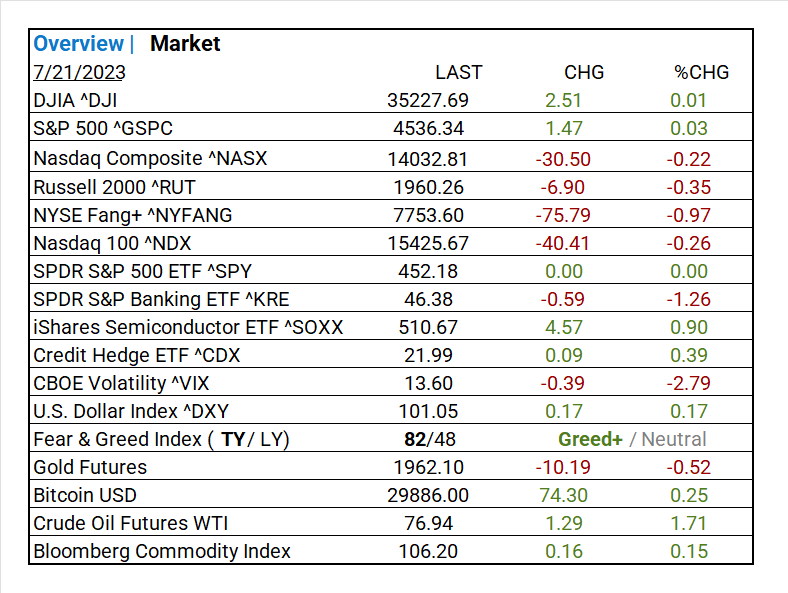

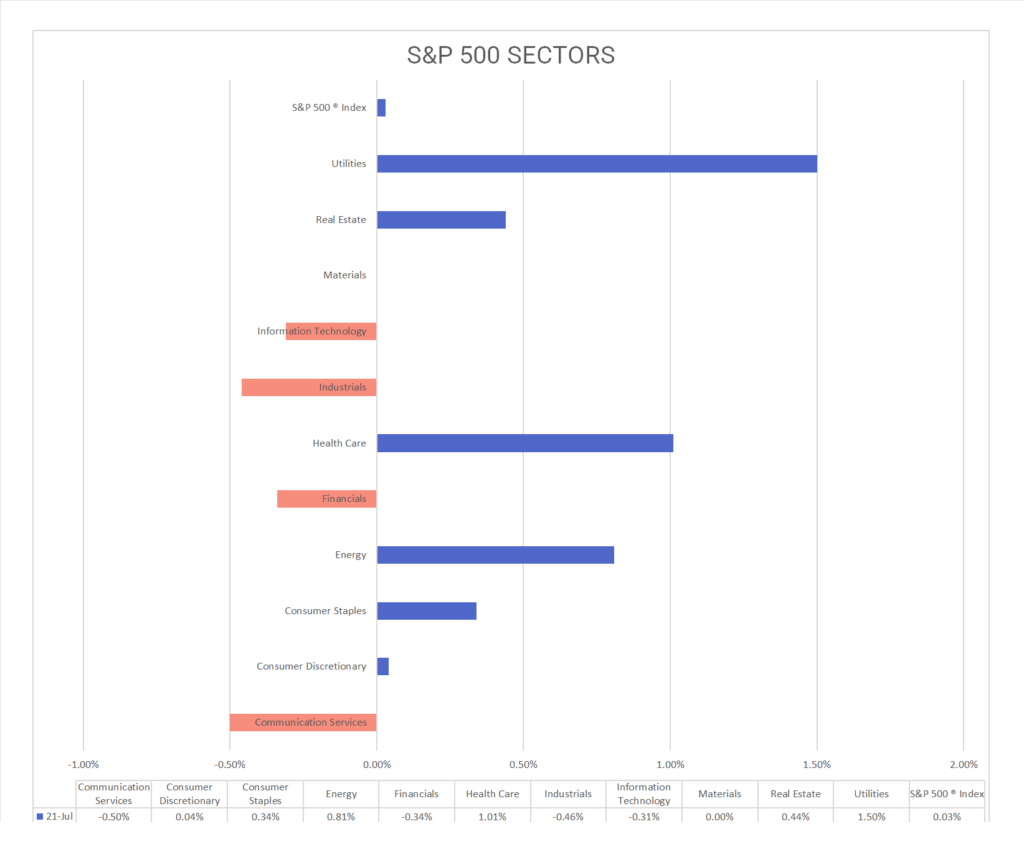

Today US Markets finished mixed, the S&P 500 up 0.03%, the DOW gained 0.01% while the NASDAQ dropped 0.22%. 7 of 11 S&P 500 sectors advancing: Utilities 1.50%, Health Care 1.01% outperform/ Communication Services -0.50% lags. On the upside, Semiconductor ETF ^SOXX, Life Sciences Tools & Services +3.53%, Independent Power & Renewable Electricity Producers +3.02%, Electric Utilities +1.58%, Credit Hedge ETF ^CDX, U.S. Dollar Index, Bitcoin, Oil and the Bloomberg Commodity Index.

In economic news, none scheduled today. On Monday S&P “flash” U.S. manufacturing and Services PMI.

Takeaways

- Investors seek safety in Defensives

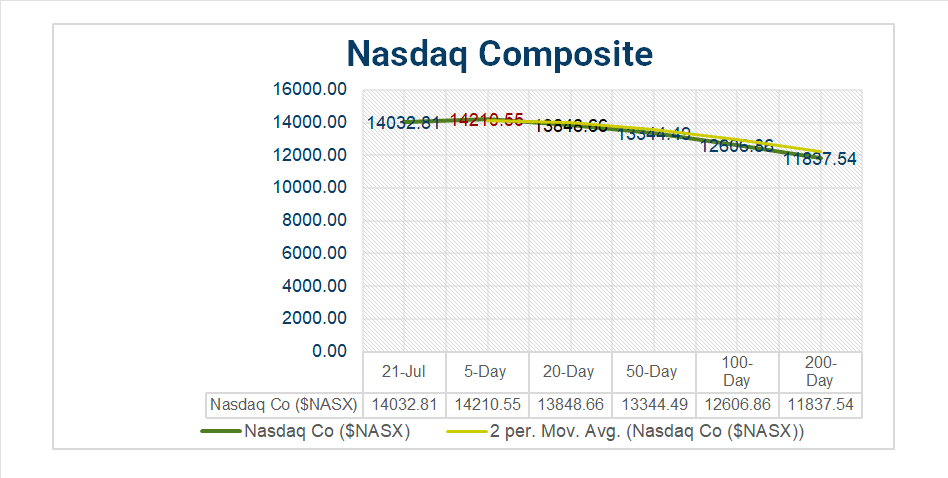

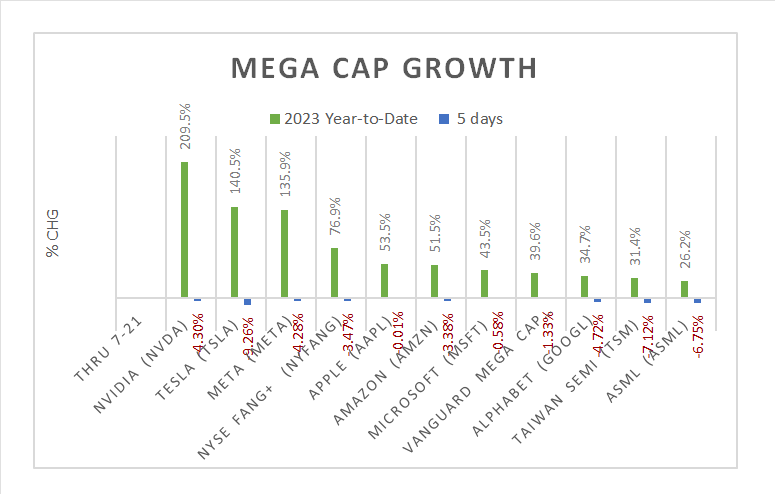

- NY Fang+, Mega Cap Tech selloff

- 7 of 11 S&P 500 sectors advancing: Utilities 1.50%, Health Care 1.01% outperform/ Communication Services -0.50% lags.

- Life Sciences Tools & Services +3.53%, Independent Power and Renewable Electricity Producers +3.02%, Electric Utilities +1.58%,

- USD Index and Bitcoin up

- Oil and the Bloomberg Commodity Index gain

- Roper Technologies (ROP), AutoNation (AN) earnings beat

- American Express (AXP), Schlumberger (SLB) earnings miss

- Markets await Fed .25-point July hike

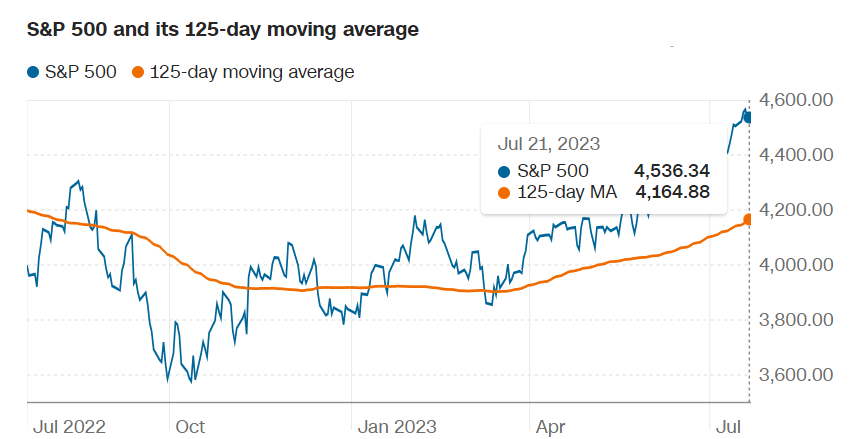

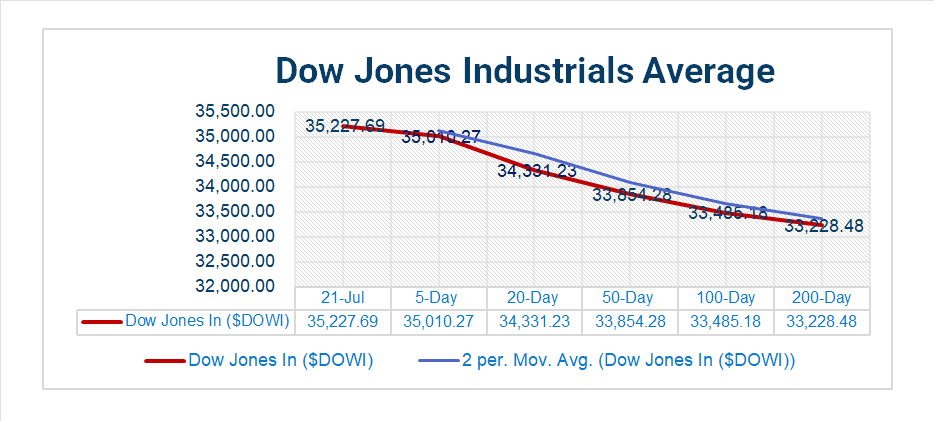

Pro Tip: Market Momentum, when the S&P 500 is above its moving or rolling average of the prior 125 trading days, it’s a positive “bullish” metric.

Sectors/ Commodities/ Treasuries

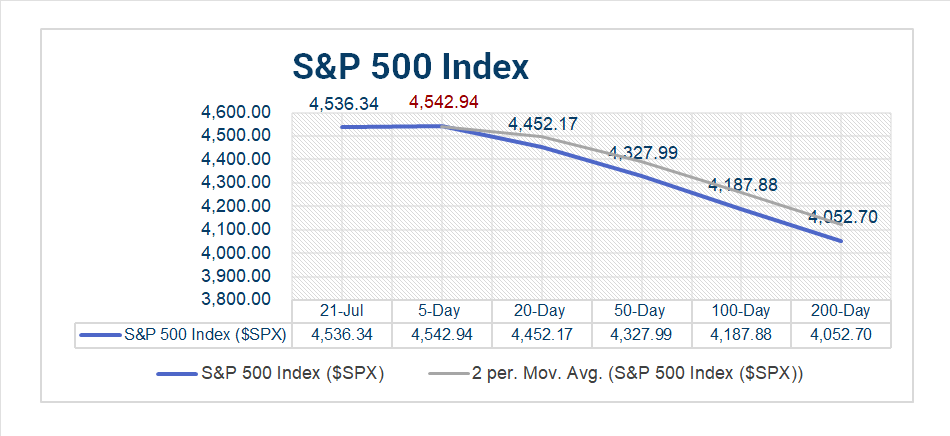

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 7 of 11 S&P 500 sectors advancing: Utilities 1.50%, Health Care 1.01% outperform/ Communication Services -0.50% lags.

- Life Sciences Tools & Services +3.53%, Independent Power and Renewable Electricity Producers +3.02%, Electric Utilities +1.58%, Household Products +1.36%, Industrial REITS +1.36%, Multi-Utilities +1.30%, Pharmaceuticals +1.26%, Water Utilities +1.28%.

Factors

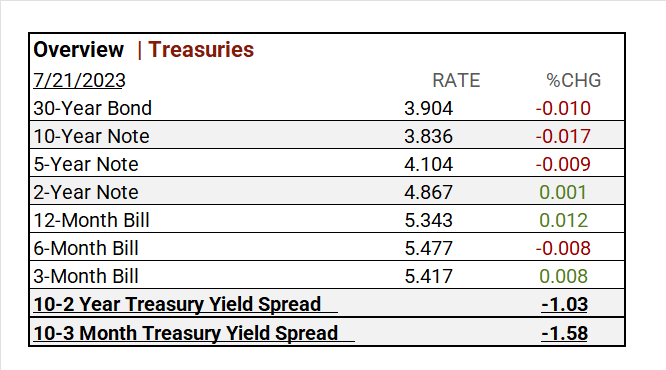

US Treasuries

Q2 ’23 Top Line Earnings Preview

- In Q1 ’23: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 S&P 500 EPS expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

- Expect lower Q1 revenues

- Call topics: economic uncertainty, aggregate demand, inventories, costs, roi

Notable Earnings Today

- +Beat: Roper Technologies (ROP), Autoliv (ALV), Autoliv (ALV), AutoNation (AN), Comerica (CMA)

- – Miss: American Express (AXP), Schlumberger (SLB), IPG (IPG), Danske Bank A/S ADR (DNKEY), IPG (IPG)

Economic Data

US

- None scheduled.

Vica Partner Guidance July ’23, (updated 7-20)

- Q3/4 highlighting Energy Equipment & Services, Banks, Health Care Providers & Services, Passenger Airlines, Building Products. Real Estate Management & Development, Office REITs and Gas Utilities. Undervaluation for Chinese Mega Cap Tech. Japan equities still a better value than US.

- Cautionary, current valuations in question as Mega and Large Cap Growth moderating, Banks shortly may be overprices. Current indicators are recessionary. Credit default swap (CDS) to pick-up through Q4/Q1.

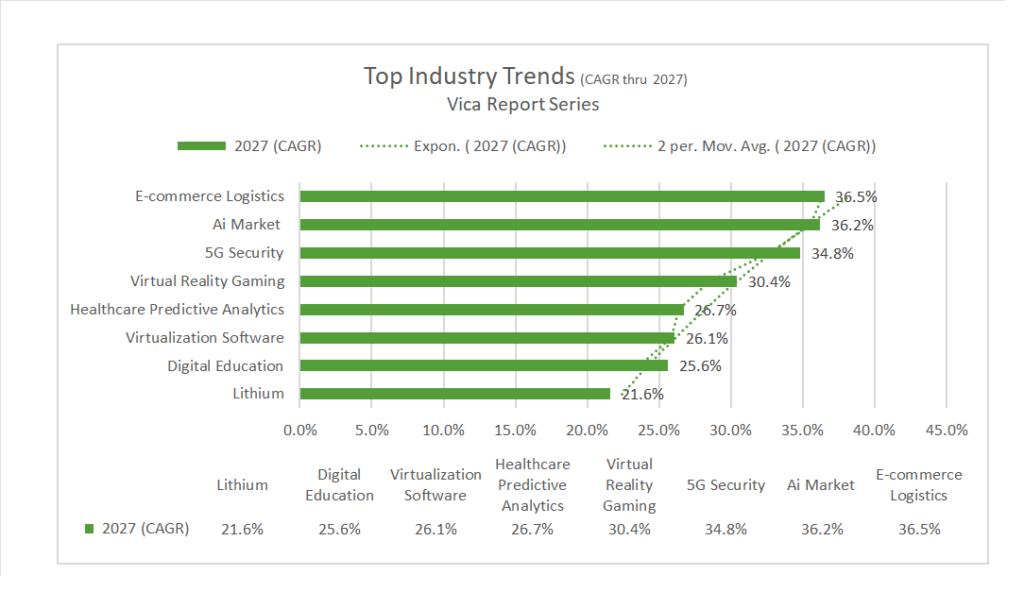

- Longer Term, Nasdaq 100^NDX companies will continue to outperform in the longer term along with Semiconductor Equipment. Forward looking CAGR growth below.

- We continue to emphasize business *quality and strength of balance sheet for all investments. * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom (AVGO).

News

Company News/ Other

- White House Says Amazon, Google, Meta, Microsoft Agree to AI Safeguards – WSJ

- Baidu CEO Robin Li quits Trip.com board as the search giant shifts focus from travel to AI – South China Morning Post

- IPO Market Faces Pivotal Moment as Sell-Side Analysts Weigh In – Bloomberg

Energy/ Materials

- The Race to Invent a Greener Jet Fuel – WSJ

- Elon Musk Relieved That Lithium Prices Are No Longer Insane – Bloomberg

Central Banks/Inflation/Labor Market

- Big Regional Banks Reported Stable Deposits. For Investors, That Counts as Great News – WSJ

- Unemployment Rate At or Near Record Lows in Half of US States – Bloomberg

Asia/ China

- China’s yuan: will economic recovery lift currency out of the jungle after Fed effect fades? – South China Morning Post

- Seoul expects Beijing to play ‘constructive’ role on North Korea even as both diverge over sanctions – South China Morning Post