MARKETS TODAY May 8th, 2023 (Vica Partners)

Last Friday, US Markets finished sharply higher, the S&P 500 +1.85%, DOW +1.65%, Nasdaq +2.25%. All 11 of the S&P 500 sectors gained, Energy and Financials outperformed. Yields rose, Oil >4% and Bitcoin >2%. In economic news, U.S. job growth picked up in April while wage gains increased. US Consumer Credit came in high.

Overnight/Premarket, Asian markets finished mixed, the Shanghai Composite +1.81%, Hang Seng +1.24%, the Nikkei 225 -0.71%. European markets finished mixed, the FTSE 100 +0.98%, CAC 40 +0.11% and the DAX -0.05%. US futures were trading at 0.6% above fair-value.

Today, US Markets finished mixed the S&P 500 and Nasdaq only saw moderate gains. Mega cap growth continues to outperform with NYFANG+ Index +1.6%. 6 of 11 of the S&P 500 sectors declined, Utilities lagged. On the upside mega cap growth continues to outperform with NYFANG+ Index +1.6%. Yields rise and Oil >2.5%. In economic news, wholesale inventories were unchanged and the NFIB’s Small Business Optimism Index decreased marginally. The Feds quarterly loan survey reports tightening standards.

Takeaways

- The Feds quarterly loan survey reports tightening standards

- Markets with marginal gains

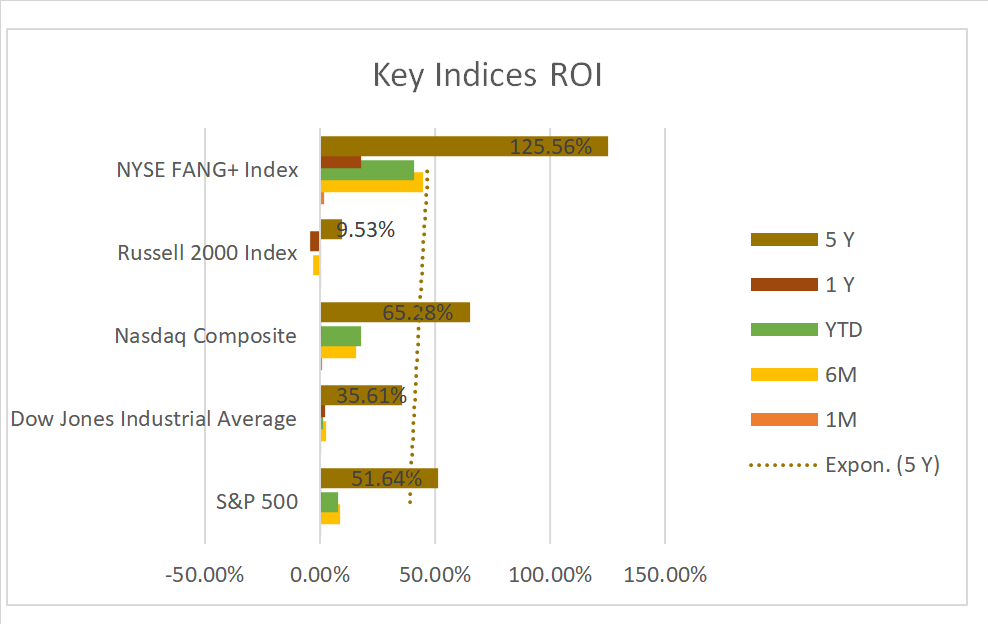

- NYSE FANG+ index +1.6%, >43% YTD

- 6 of 11 of the S&P 500 sectors finished lower/ Utilities underperforms

- Regional Banking SPDR S&P Banking ETF (KR) -2%

- PayPal Holdings Inc (PYPL) beats on earnings in afterhours

- Last Week’s US Consumer Credit reading in March, concerning

Pro Tip: Review the Indices ROI chart below its deal breaker!

Sectors/ Commodities/ Treasuries

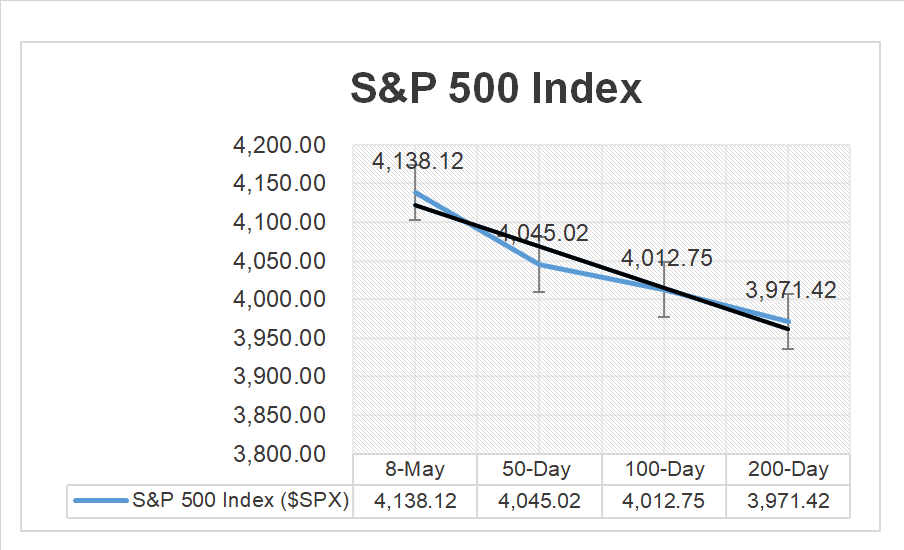

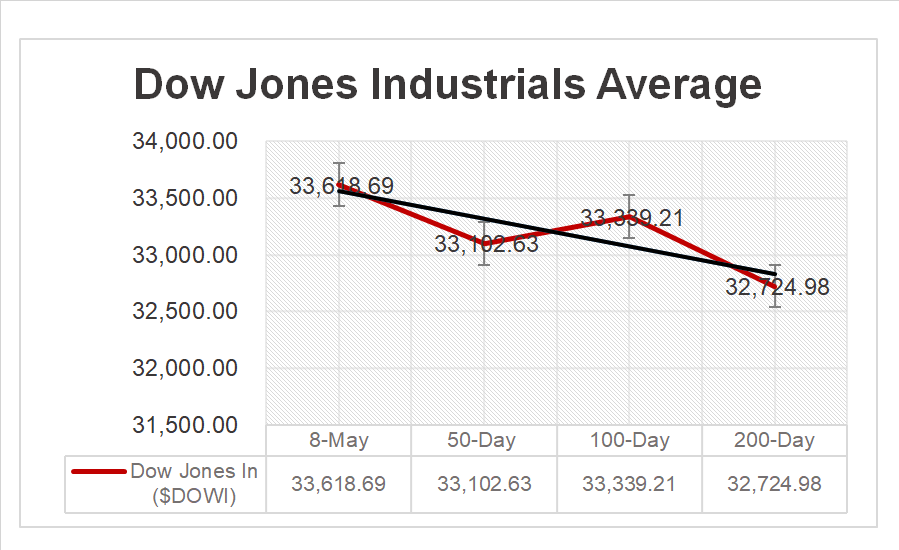

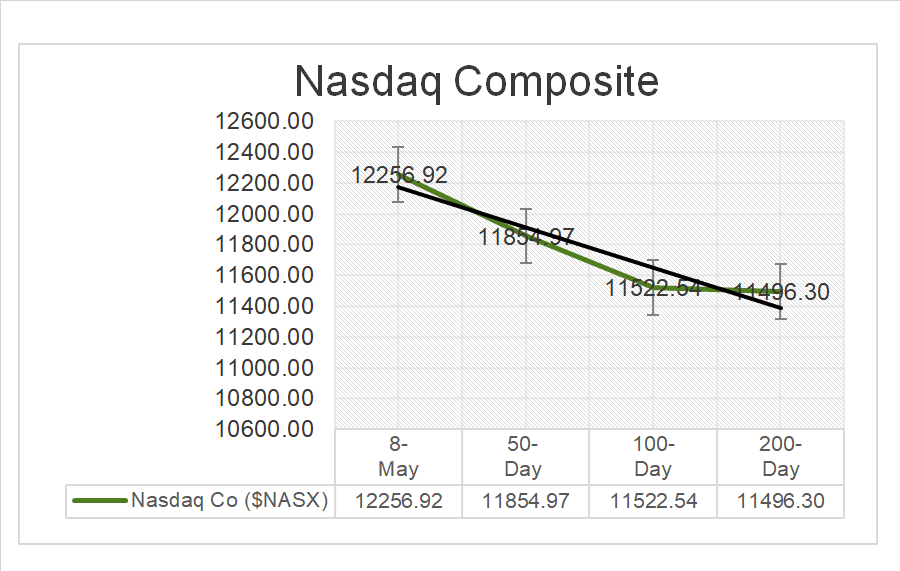

Key Indexes (50d, 100d, 200d)

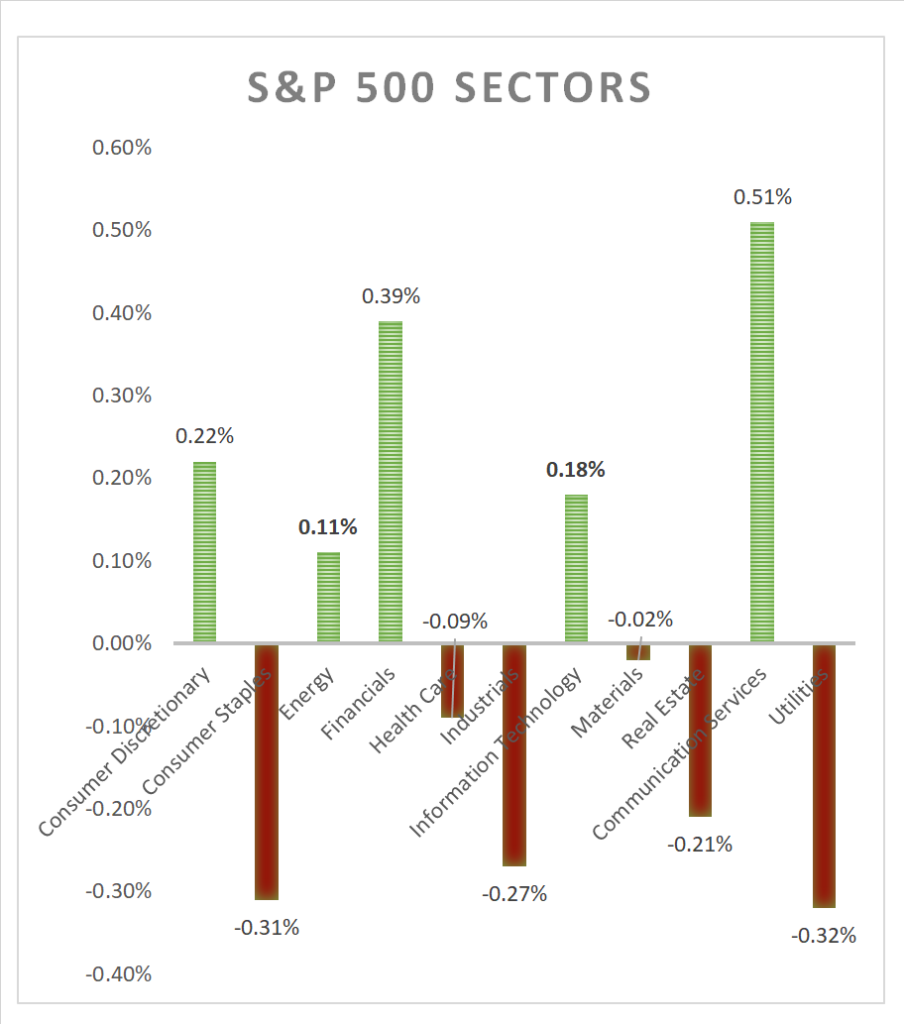

S&P Sectors

- 6 of 11 of the S&P 500 sectors finish lower, Utilities -0.32% and Consumer Staples -0.31% underperformed/ Communication Services +0.51% outperformed

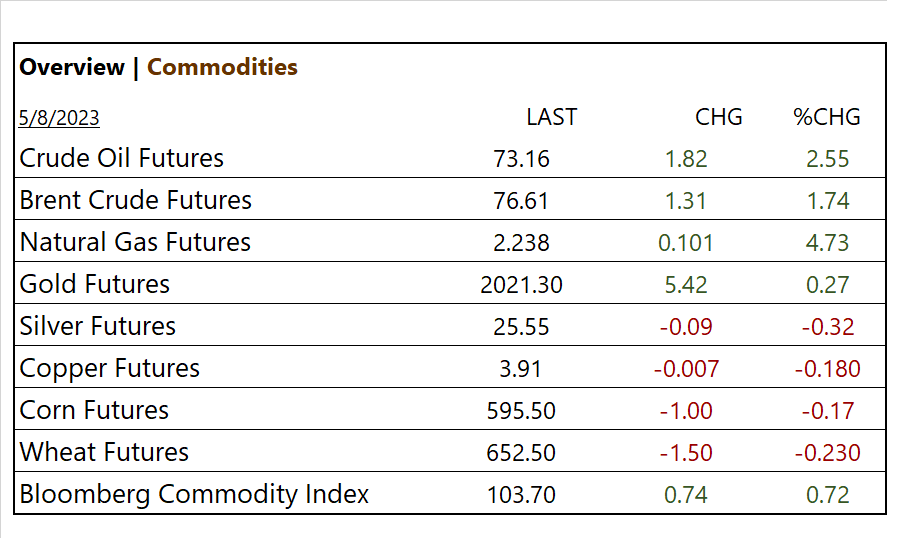

Commodities

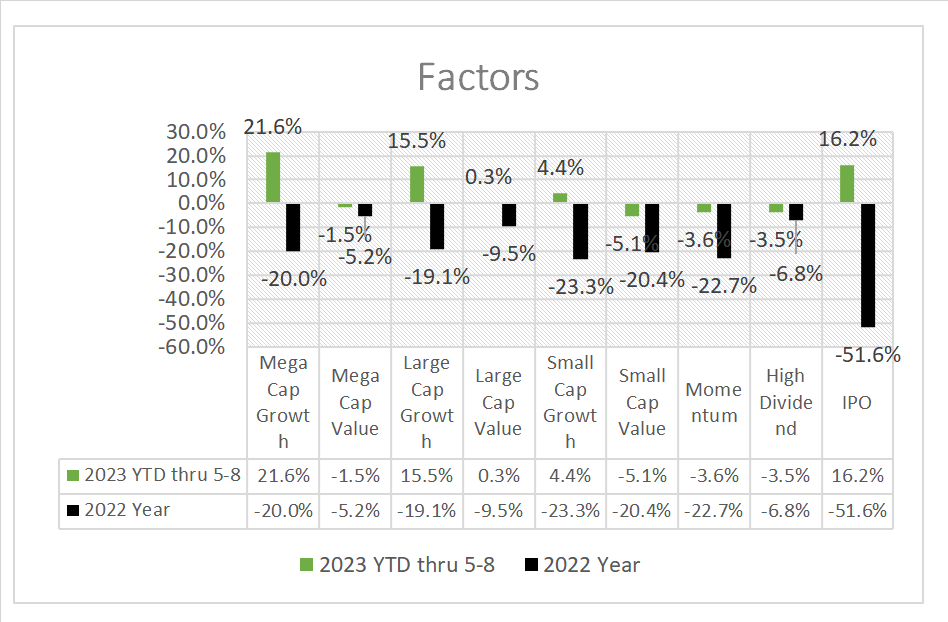

Factors (YTD)

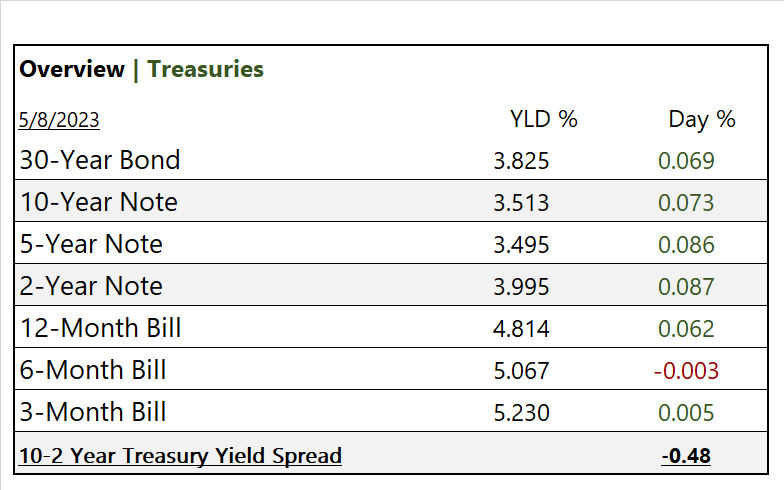

US Treasuries

Notable Earnings Today

- +Beat: PayPal Holdings Inc (PYPL), McKesson (MCK), KKR & Co (KKR), BioNTech (BNTX), Alpha Metallurgical Resources (AMR), Devon Energy (DVN), Palantir (PLTR), Ventas (VTR), Aecom Technology (ACM), DaVita (DVA)

- – Miss: Hoya Corp (HOCPY), IFF (IFF), Tyson Foods (TSN), Viatris (VTRS), DISH Network (DISH), Lucid Group (LCID), Essential Utilities (WTRG)

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Alpha Metallurgical Resources (AMR), DaVita (DVA)

Economic Data

US

- NFIB’s Small Business Optimism Index; period March, actual 90.1 (15th consecutive month below the 49-year average of 98)

- Wholesale inventories ; period March, act 0.1%. fc 0.1%

- Federal Reserve’s Opinion Survey (SLOOS), lenders reported that they expect to tighten standards across all loan categories for the remainder of ‘23

News

Company News/ Other

- Warren Buffett Has a History With Banks—as a Critic and Investor – WSJ

- Oil climbs over 2% as recession fears begin to fade – Reuters

- S. Exchanges List More Than a Dozen Cryptos the SEC Says Are Illegal to Sell – WSJ

Central Banks/Inflation/Labor Market

- ABA’s Camper interviewed on NPR about shorting of bank stocks – ABA

- Fed Flags Concerns About Credit Tightening and Financial Stress – Bloomberg

- Why labor shortages could be here to stay – Axios

China