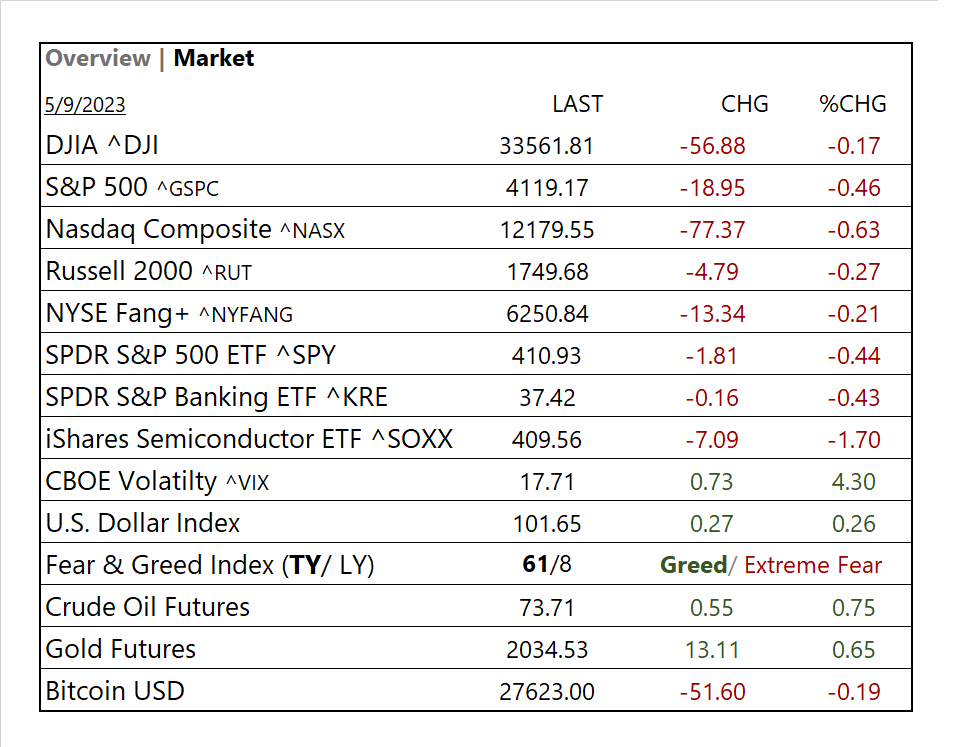

MARKETS TODAY May 9th, 2023 (Vica Partners)

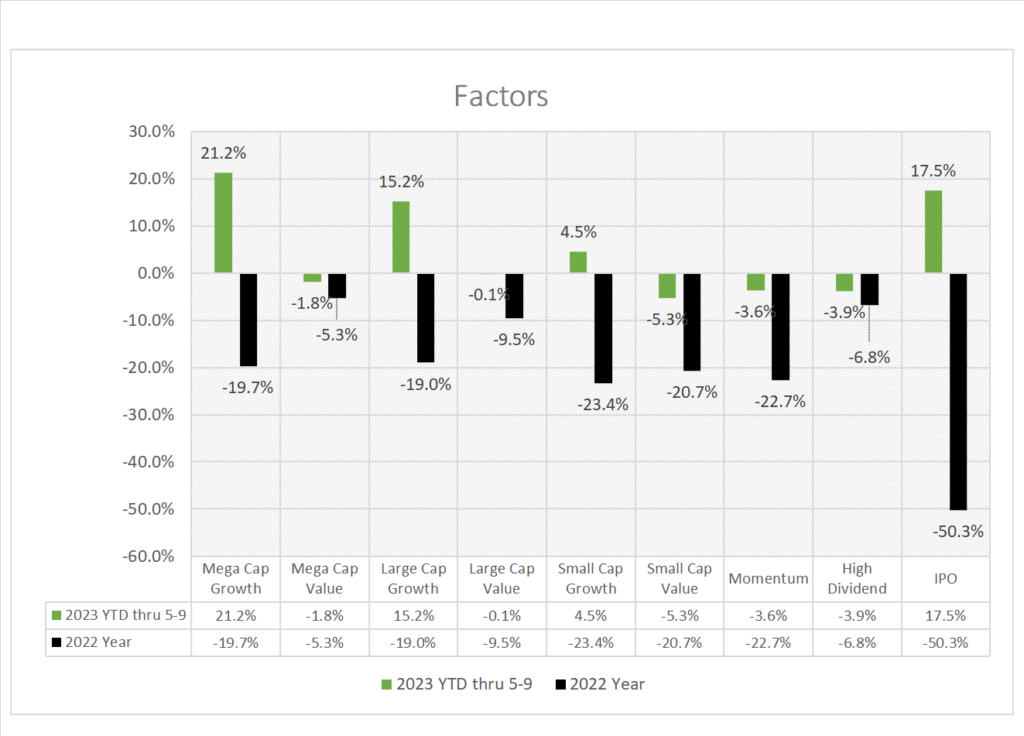

Yesterday, US Markets finished mixed the S&P 500 and Nasdaq only saw moderate gains. Mega cap growth continued to outperform with NYFANG+ Index +1.6%. 6 of 11 of the S&P 500 sectors declined, Utilities lagged while Yields and Oil gained. In economic news, the Feds quarterly loan survey reported tightening standards.

Overnight/Premarket, Asian markets finished mixed, the Nikkei 225 +1.01%, Hang Seng -2.21% and the Shanghai Composite -1.10%. European markets also finished mixed the DAX +0.02%, CAC 40 -0.59% and the FTSE 100 -0.33%. US futures were trading at 0.4% below fair-value.

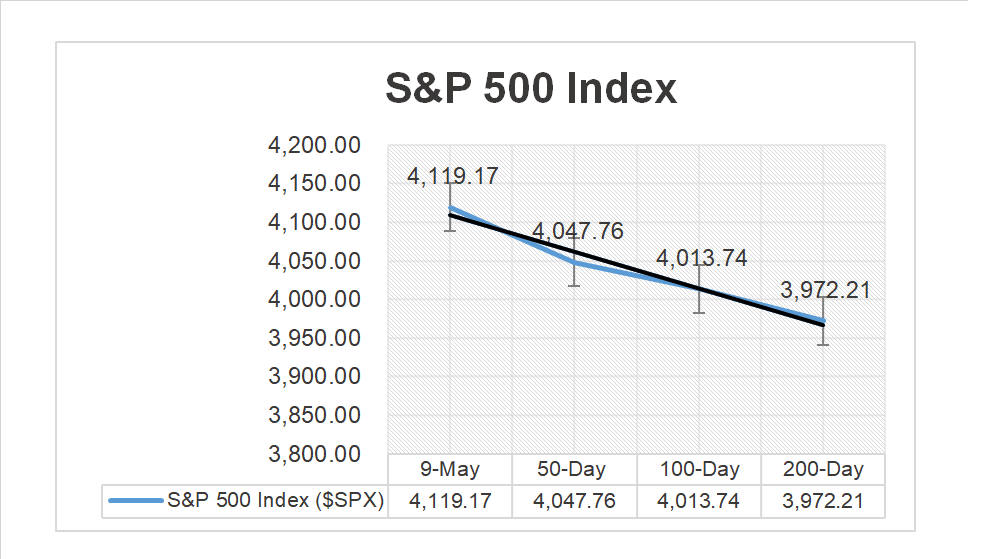

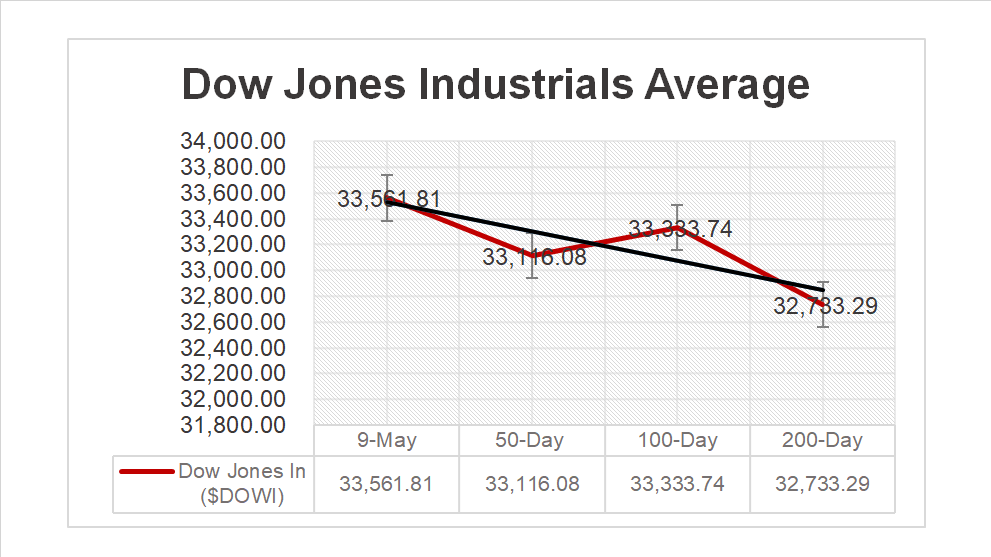

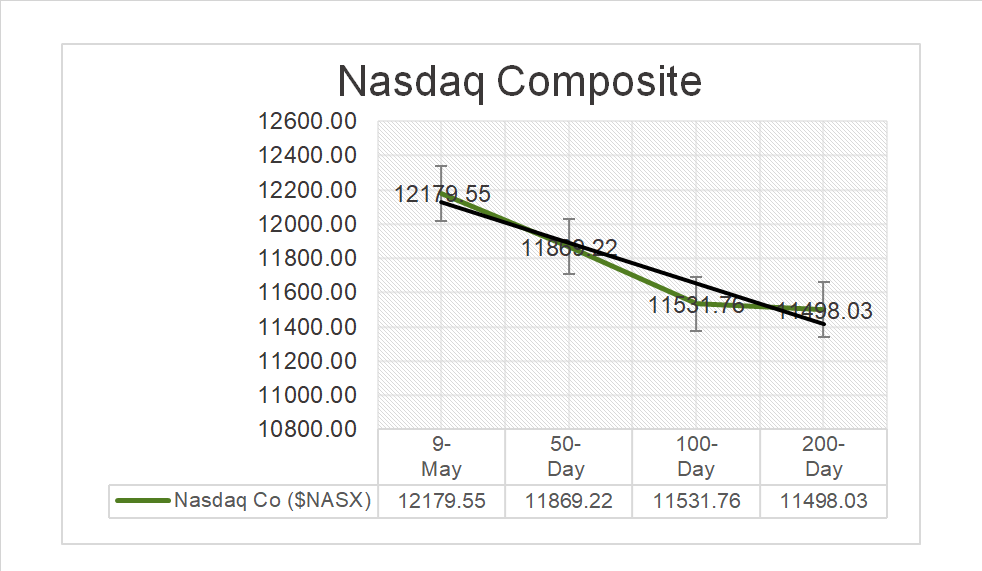

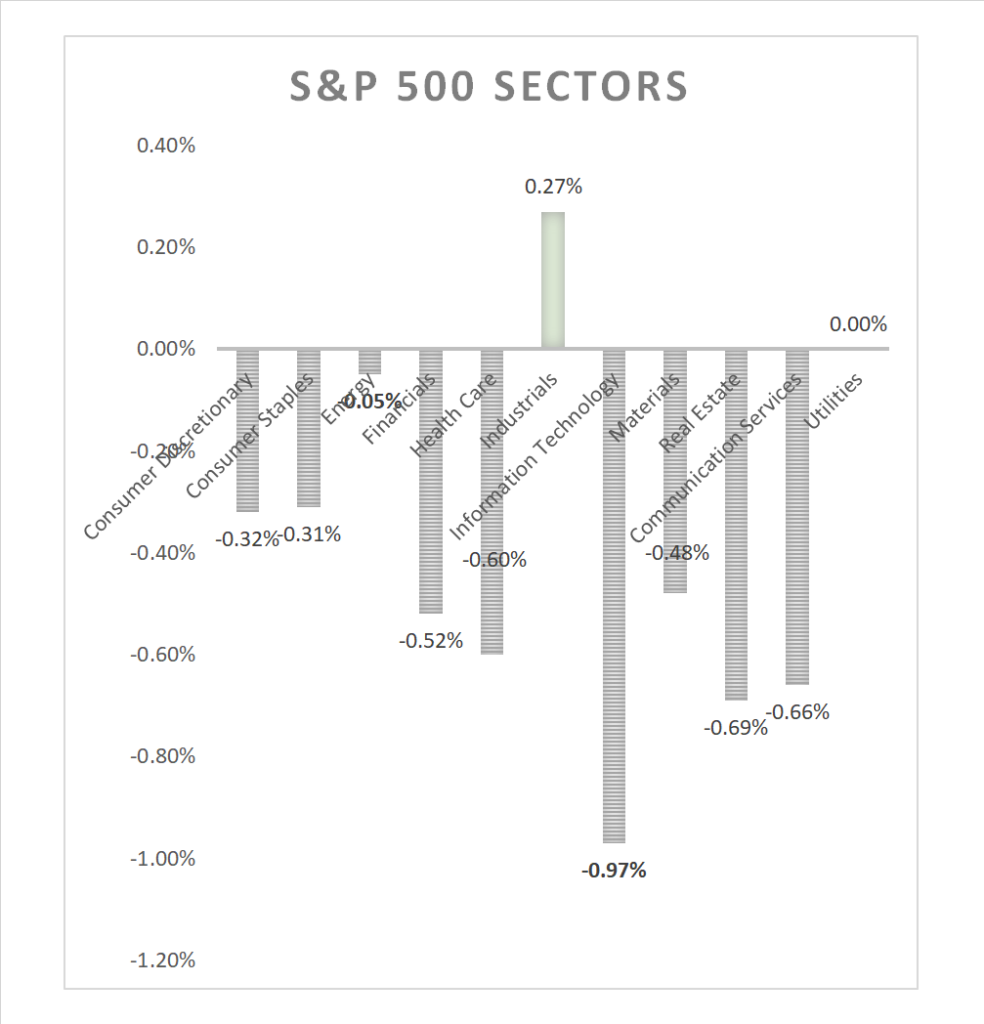

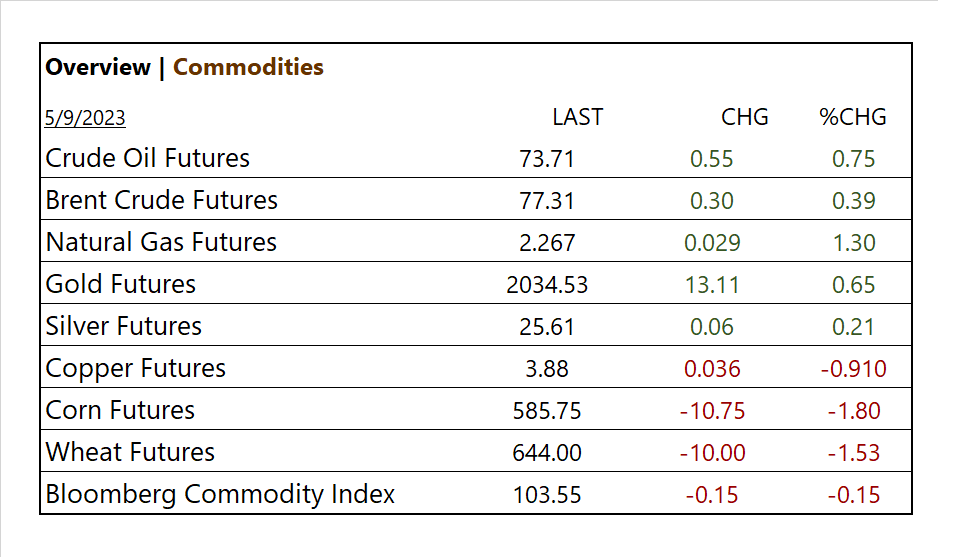

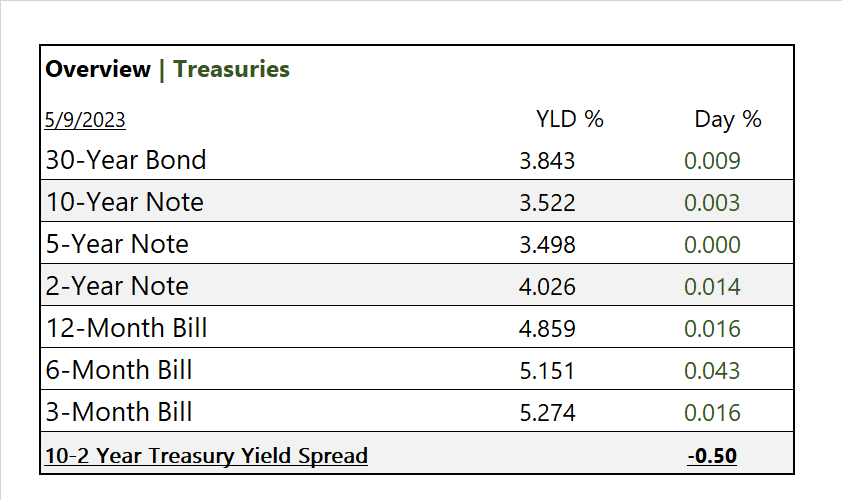

Today, US Markets finished lower the S&P 500 -0.46%, DOW -0.17% and the Nasdaq -0.63%. 9 of 11 of the S&P 500 sectors declined: Information Technology underperformed/ Industrials outperformed. Mega cap growth lagged as iShares Semiconductor ETF (SOXX) was off 1.70%. On the upside Yields rose, Oil and Gold advanced >1%. In economic news, no action with CPI reporting tomorrow. NY Fed Pres. Williams speaking today expects unemployment at 4-4.5% by year end, with inflation at 2% target in 2025.

Takeaways

- Markets with marginal losses

- 9 of 11 of the S&P 500 sectors finished lower: Information Technolgy lags/ Industrials outperforms

- Regional Banking SPDR S&P Banking ETF (KR) moderates lower 0.43%

- Airbnb (ABNB) and Occidental (OXY) miss on earnings in afterhours

- CPI reports tomorrow

Pro Tip: It’s important to approach business news critically and to seek out a range of perspectives and sources and here why a) overemphasis on short-term financial performance b) lack of diversity in sources c) sensationalism/ attention-grabbing stories d) Influence of advertisers who may have a financial interest/ agenda.

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 9 of 11 of the S&P 500 sectors finish lower, Information Technology -0.97% and Real Estate -0.69% underperformed/ Industrial +0.27% outperforms

Commodities

Factors (YTD)

US Treasuries

Notable Earnings Today

- +Beat: Air Products (APD), Daikin Industries ADR (DKILY), Transdigm (TDG), Globalfoundries (GFS), Sumitomo ADR (SSUMY)

- – Miss: Airbnb (ABNB), Duke Energy (DUK), Occidental (OXY), Itochu ADR (ITOCY), Nintendo ADR (NTDOY), Sumitomo ADR (SSUMY), Warner Music (WMG)

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Alpha Metallurgical Resources (AMR), DaVita (DVA)

Economic Data

US

- No reports scheduled today

- Fed Pres. Williams; Expects unemployment to be between 4%-4.5% by year end with inflation at 2% target around 2025.

News

Company News/ Other

- PayPal tumbles 12%, eyes lowest close since 2017 – Reuters

- Americans Lack Confidence in Major Economic Leaders – Gallup

- Metaverse could contribute up to 2.4% of US GDP by 2035, study shows – Reuters

Central Banks/Inflation/Labor Market

- Goldman Sachs Joins Barclays in Bet Against Fed Rate Cuts This Year – Bloomberg

- Premature for Fed to call end to rate hikes with inflation still high, Williams says – Reuters

China

- China Warns of ‘Strong’ Reaction If EU Sanctions Its Companies – Bloomberg