MARKETS

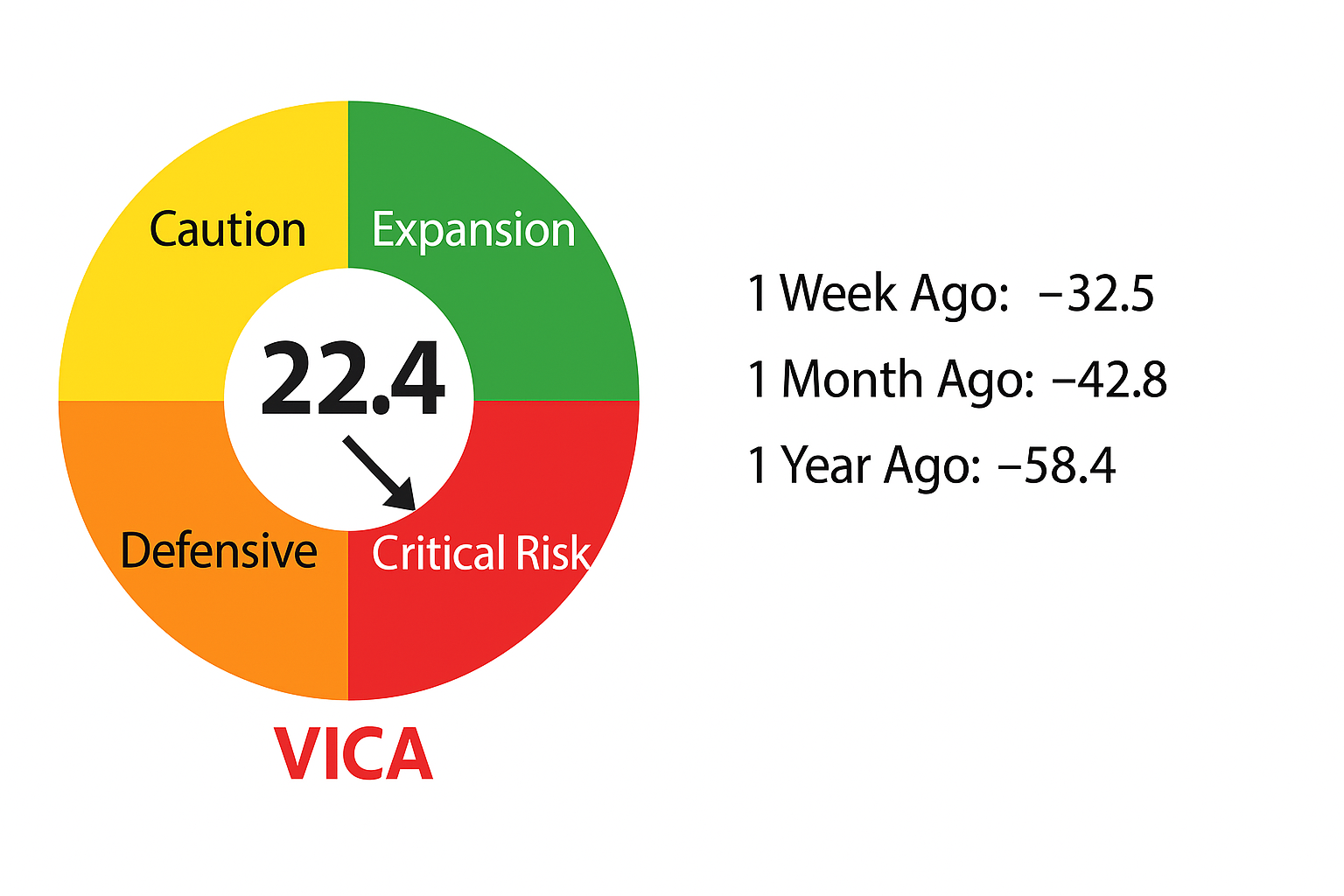

- The S&P 500, has been below its 200-day moving average for 100 trading days, the longest since June of 2009.

- The Nasdaq Composite has been beneath that average for 157 straight trading days, the longest run since a 178-day streak that ended in May 2009.

- The Dow industrials, trading has been trading under its 200-day moving average for 9 days.

200 day moving average indicator means…

The 200 day moving average is a long-term trend indicator. If the price is above the 200 day moving average indicator, then look to buy. If the price is below the 200 day moving average indicator, then look to sell.

In addition yield curve inversions indicate downturns

Inversion of the relationship between two-year and 10-year notes has reliably signaled recent economic downturns 80% of the time.