Stay Informed and Stay Ahead: Market Watch, December 12th, 2023.

Market Highlights & Analysis: Indices, Sectors, and More…

- Economic Data: CPI Year Over Year: 3.1% and Core CPI Year Over Year: 4.0%, in line with consensus.

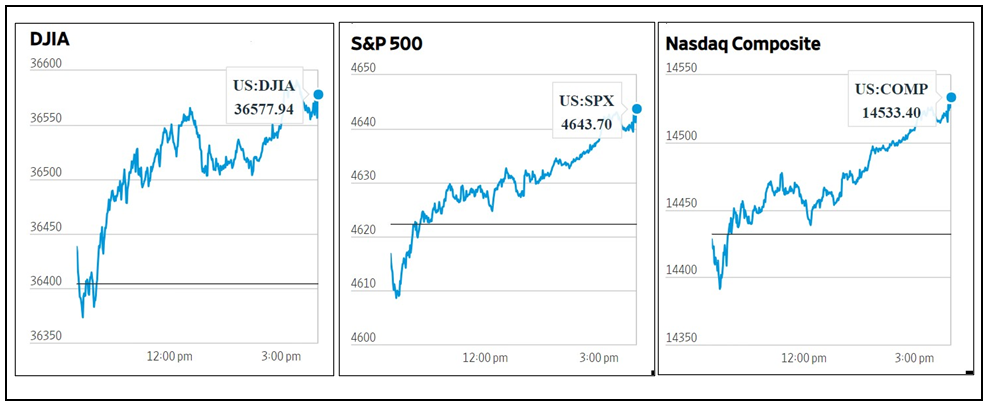

- Market Indices: DJIA (+0.48%), S&P 500 (+0.46%), Nasdaq Composite (+0.70%).

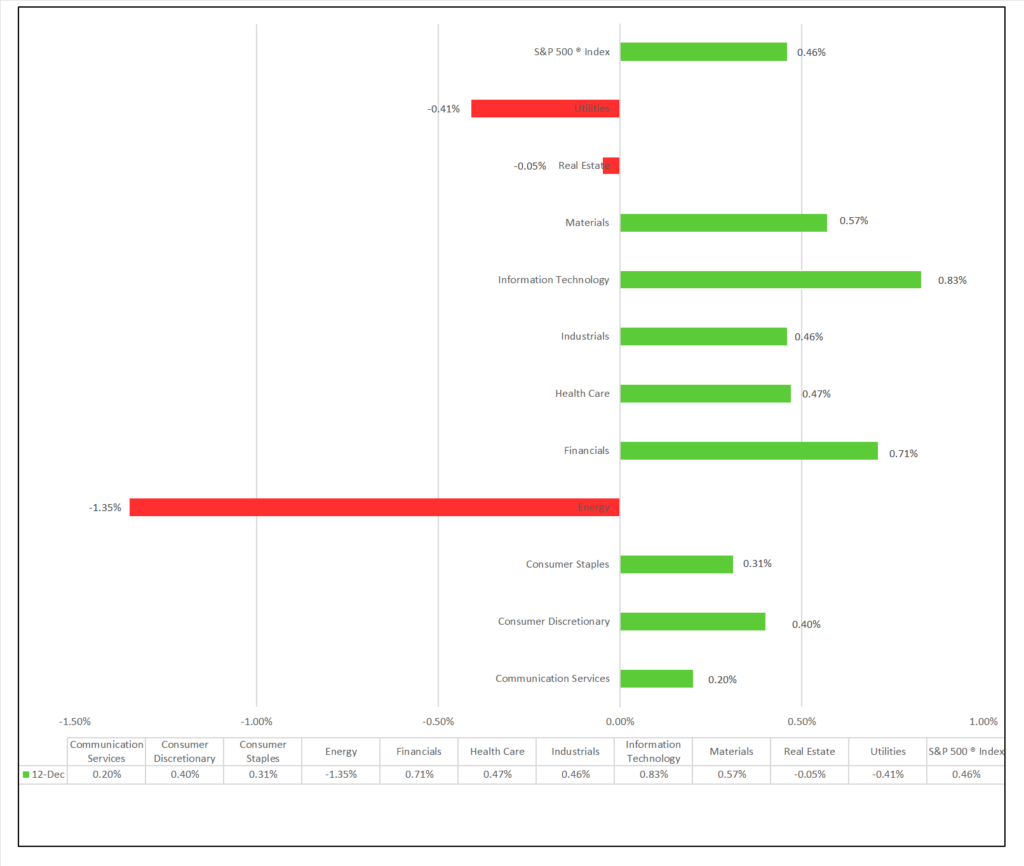

- Sector Performance: 8 of 11 sectors higher; Information Technology (+0.83%) leading, Energy (-1.35%) lagging. Top industries: Passenger Airlines (+2.32%).

- Factors: Large caps outperform, growth over value.

- Treasury Markets: Shorter notes and bills rise, with the 6-month leading with a yield change of 0.046.

- Commodities: Bitcoin falls during the session but gains in afterhours, while Gold and the Bloomberg Commodity decrease. Crude Oil Futures sink.

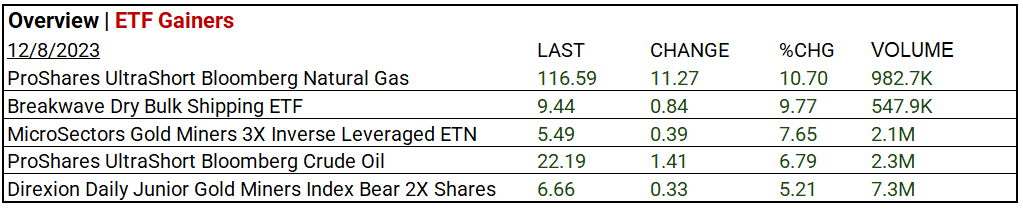

- ETFs: ProShares UltraShort Bloomberg Natural Gas (+10.70%) and Breakwave Dry Bulk Shipping ETF (+9.77%) led the gains. Overall winners included those engaging in ultra short positions on both oil/gas and Gold.

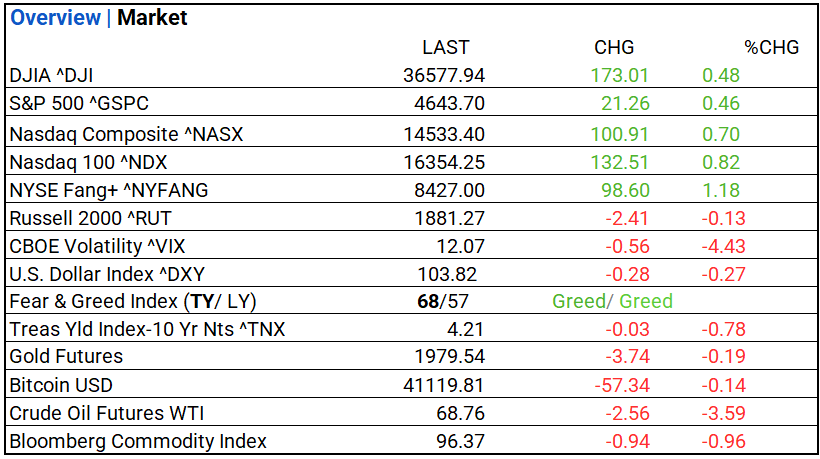

US Market Snapshot: Key Stock Market Indices:

- DJIA ^DJI: 36,577.94 (+173.01, +0.48%)

- S&P 500 ^GSPC: 4,643.70 (+21.26, +0.46%)

- Nasdaq Composite ^NASX: 14,533.40 (+100.91, +0.70%)

- Nasdaq 100 ^NDX: 16,354.25 (+132.51, +0.82%)

- NYSE Fang+ ^NYFANG: 8,427.00 (+98.60, +1.18%)

- Russell 2000 ^RUT: 1,881.27 (-2.41, -0.13%)

- Russell 2000 ^RUT: 1,880.82 (+12.57, +0.67%)

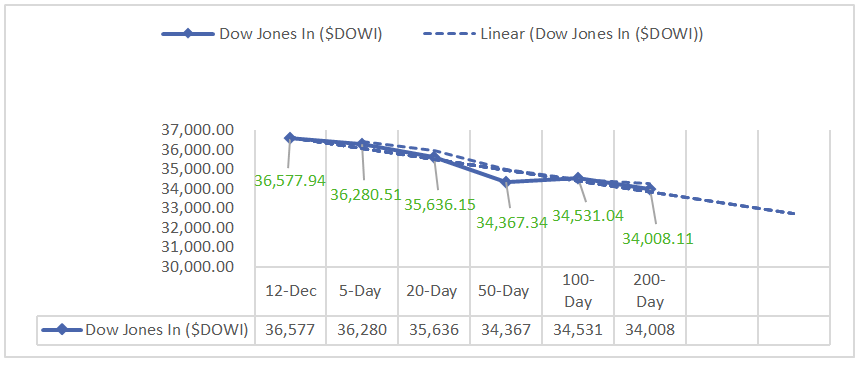

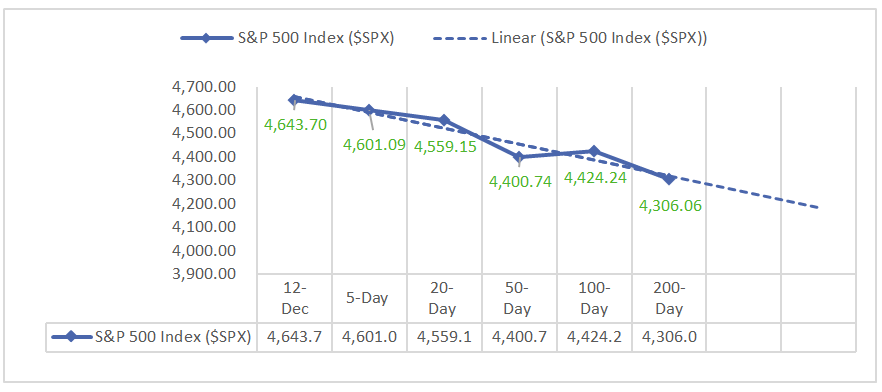

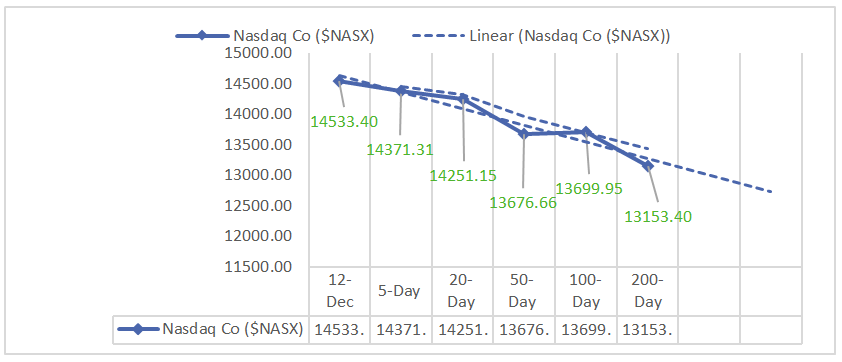

Moving Averages: DOW, S&P 500, NASDAQ:

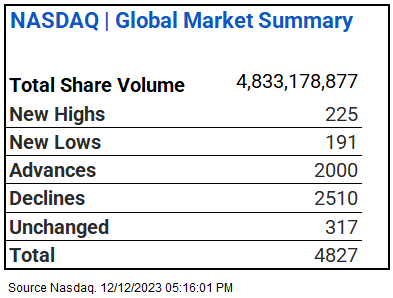

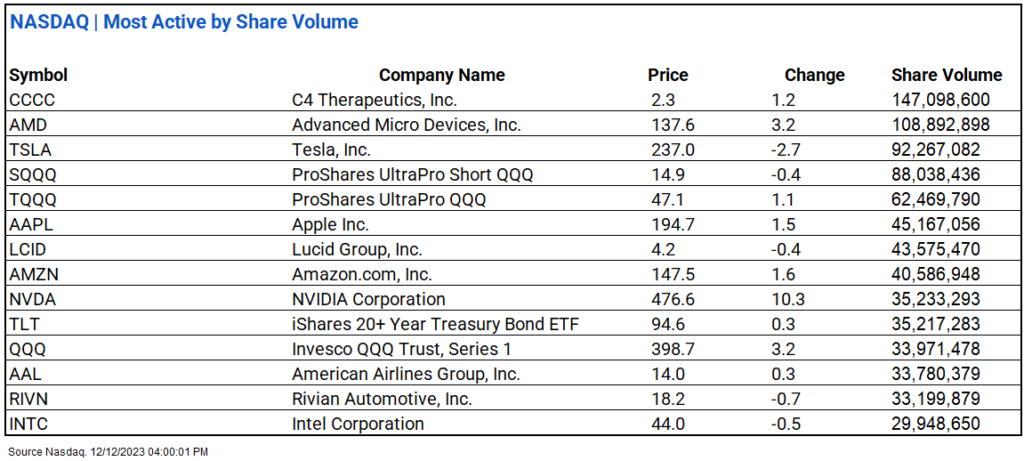

NASDAQ Global Market Summary:

Sectors:

- 8 of 11 sectors higher; Information Technology (+0.83%) leading, Energy (-1.35%) lagging. Top industries: Passenger Airlines (+2.32%), Construction & Engineering (+1.74%), and Semiconductor & Semiconductor Equipment (+1.53%).

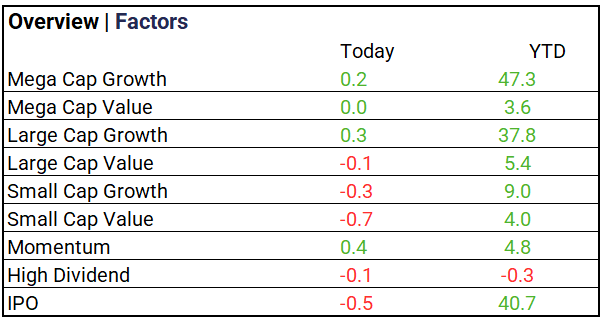

Factors:

- Large Caps outperform, Growth over Value

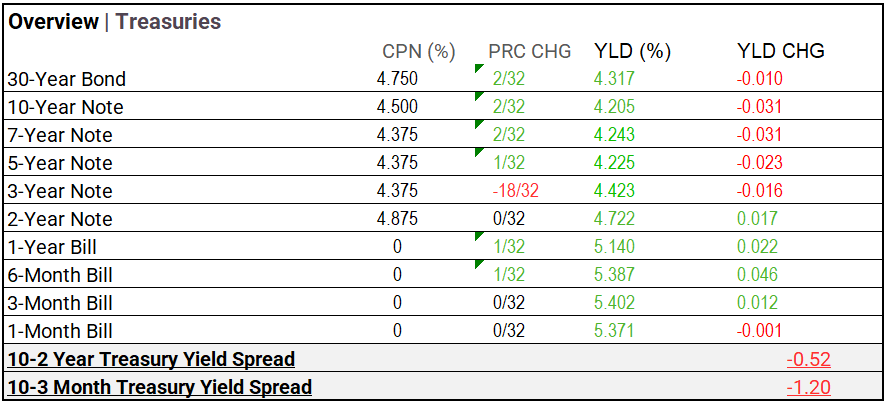

Treasury Markets:

- Shorter Notes and Bills rise, the 6-Month leading with yield change of 0.046

Currency and Volatility:

- U.S. Dollar Index and CBOE Volatility down, Fear & Greed indicates Greed.

- CBOE Volatility ^VIX: 12.07 (-0.56, -4.43%)

- Fear & Greed Index: 68/LY 57 (Greed/ Greed)

Commodity Markets:

- Gold Futures: $1,979.54 (-$3.74, -0.19%)

- Bitcoin USD: $41,119.81 (-$57.34, -0.14%)

- Crude Oil Futures WTI: $68.76 (-$2.56, -3.59%)

- Bloomberg Commodity Index: 96.37 (-$0.94, -0.96%)

ETF’s:

US Economic Data:

- Consumer Price Index (CPI) Nov.: 0.1% (Previous: 0.0%, Forecast: 0.0%)

- Core CPI Nov.: 0.3% (Previous: 0.3%, Forecast: 0.2%)

- CPI Year Over Year: 3.1% (Previous: 3.1%, Forecast: 3.2%)

- Core CPI Year Over Year: 4.0% (Previous: 4.0%, Forecast: 4.0%)

- Monthly U.S. Federal Budget Nov.: -$314B (Previous: -$290B, Forecast: -$249B)

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT:

- MISSED: Johnson Controls (JCI), Carl Zeiss Meditec ADR (CZMWY),

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): 0.16%

- Hang Seng (Hong Kong): 1.07%

- Shanghai Composite (China): 0.40%

- CAC 40 (France): -0.11%

- DAX (Germany): -0.02%

- FTSE 100 (UK): -0.03%

Central Banking and Monetary Policy, Noteworthy:

- Jerome Powell’s Inflation Fight Is Succeeding, Raising Questions About Rate Cuts – WSJ

- US Consumer Prices Pick Up in Bumpy Path Down for Inflation – Bloomberg

Energy:

- What India Needs to Ditch Coal – WSJ

- Tripling Renewables Is Difficult But Completely Doable – Bloomberg

China: