MARKETS TODAY June 12th, 2023 (Vica Partners)

On Friday, US markets finished moderately higher, S&P 500 +0.11%, DOW +0.13% and the Nasdaq +0.16%. 6 of 11 of the S&P 500 sectors lower: Information Technology +0.46% outperforms/ Materials -0.82% lags. On the upside, NY FANG+, Treasury Yields and the USD Index. No economic news scheduled today, CPI and Fed rate decision up next Tuesday/ Wednesday.

Overnight/US Premarket, Asian markets finished mixed, Japan’s Nikkei 225 +0.52%, Hong Kong’s Hang Seng +0.07% and the Shanghai Composite -0.08%. European markets finished higher, Germany’s DAX +0.93%, France’s CAC 40 +0.52% and London’s FTSE 100 +0.11%. US S&P futures were trading at 0.3% above fair value.

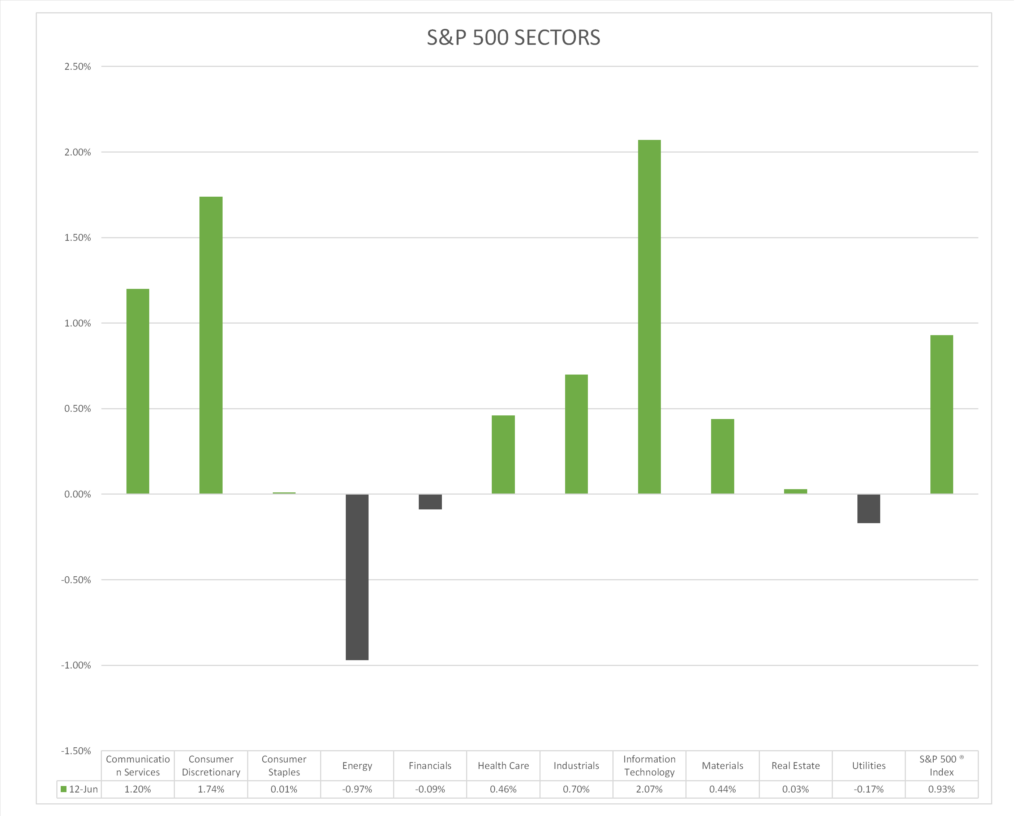

Today US Markets finished higher, S&P 500 +0.93%, DOW +0.56% and the Nasdaq +1.53%. 8 of 11 of the S&P 500 sectors advancing: Information Technology +2.07% outperforms/ Energy -0.97% lags. On the upside, NY FANG+, iShares Semiconductor ETF (SOXX) and the USD Index. In economic news scheduled today, the Federal deficit for the month of May was $240 billion mostly in line with estimates.

Takeaways

- iShares Semiconductor ETF (SOXX) +>3%

- 8 of 11 of the S&P 500 sectors higher: Information Technology +2.07%, outperforms/ Energy -0.97% lags.

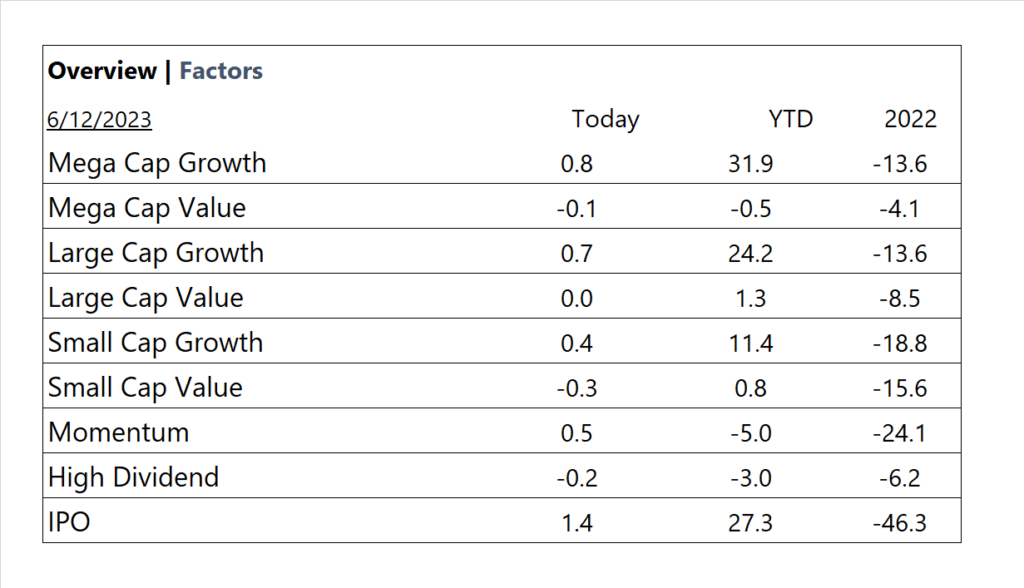

- Mega and Large Cap Growth stocks deliver

- Tesla (TSLA) +15.6% over the past 5 days

- Oil Futures down<4%> today on global demand concerns

- Oracle (ORCL) beats on earnings

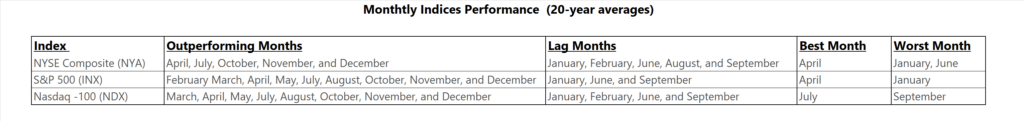

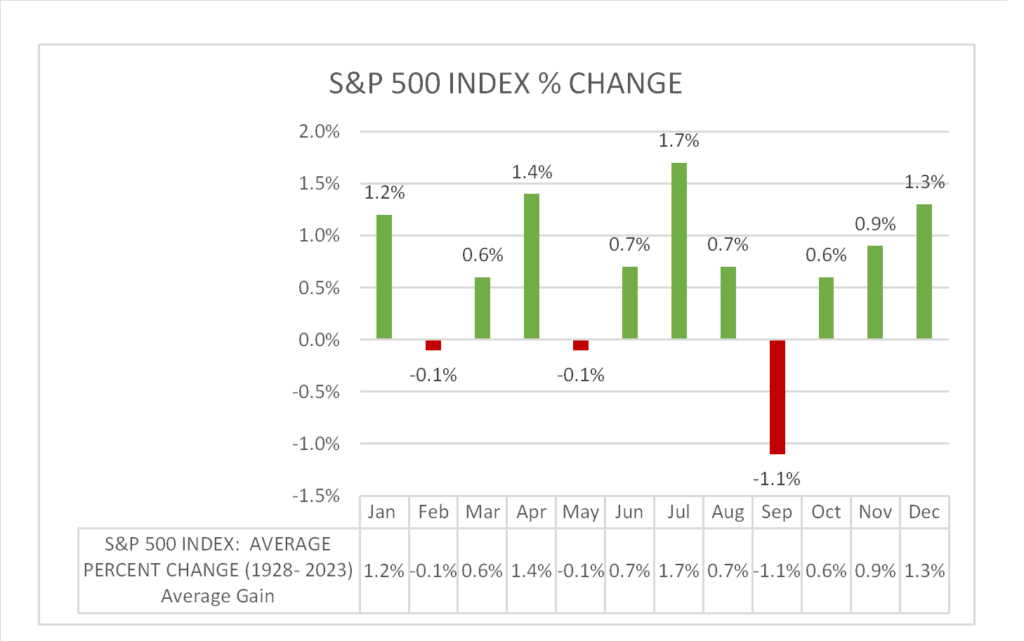

Pro Tip: Historical Monthly data

Sectors/ Commodities/ Treasuries

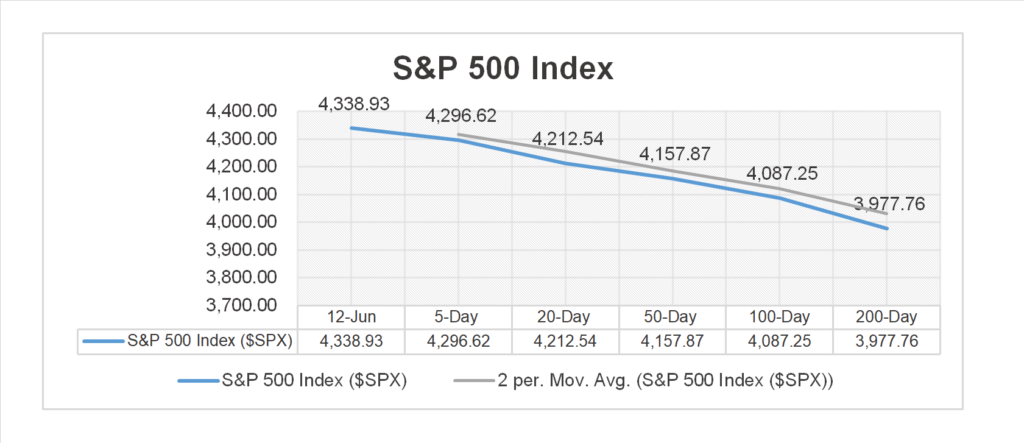

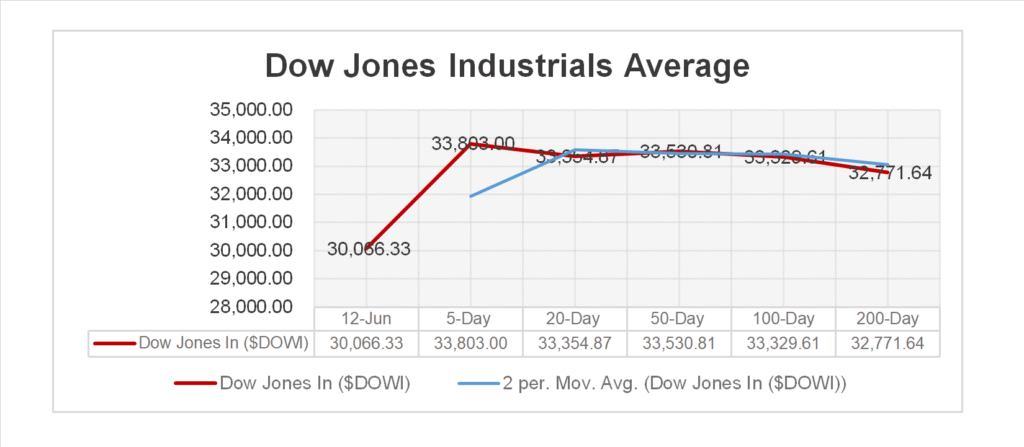

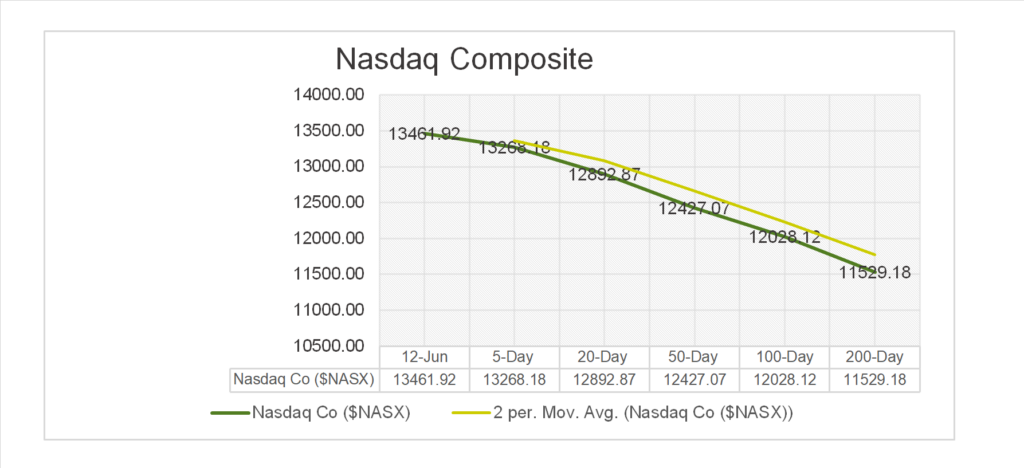

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 8 of 11 of the S&P 500 sectors higher: Information Technology +2.07%, Consumer Discretionary 1.74% outperform/ Energy -0.97% lags.

Commodities

Factor/ Mega Cap Growth Chart (YTD)

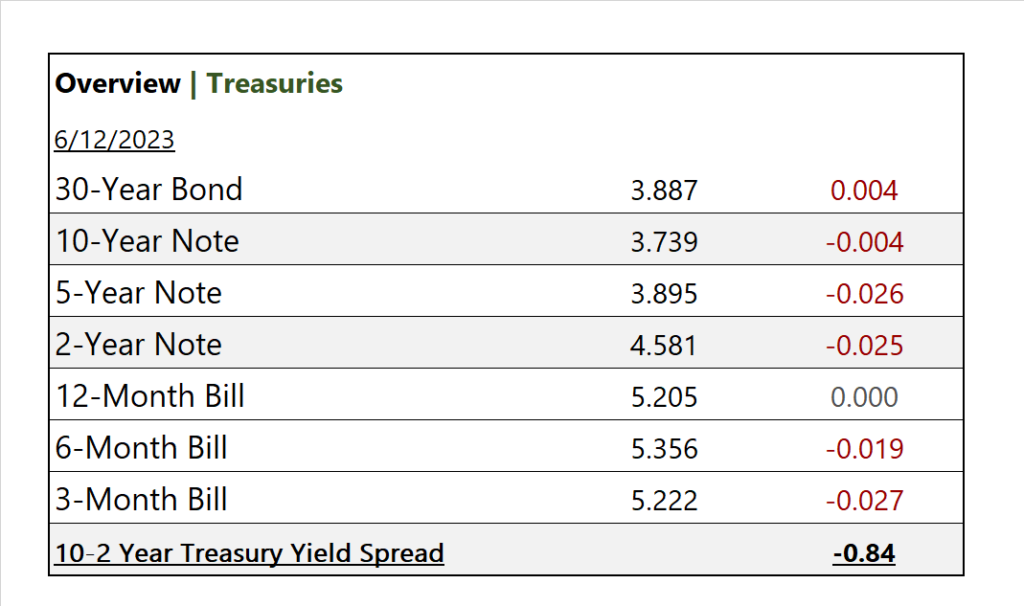

US Treasuries

Notable Earnings Today

- +Beat: Oracle (ORCL)

- – Miss:

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML)

Economic Data

US

- Federal budget; period May, act -$240B, fc -$235.5B, prior-$66B

- CPI and the Fed rate decision Tuesday/ Wednesday.

News

Company News

- Breakup of Google Ad-Tech Business Now on Table in Europe, Too – WSJ

- Tesla’s Shrewdest Product Is Proving to Be Its Charging Network – Bloomberg

Energy/ Materials

- Shell CEO Takes U.K. Oil Giant’s Pitch Direct to Wall Street – WSJ

- China Drills in Deeper Waters to Cut Reliance on Foreign Oil – Bloomberg

Central Banks/Inflation/Labor Market

- Near-Term Inflation Expectations Hit Two-Year Low in Fed Survey – Bloomberg

- Jerome Powell’s Big Problem Just Got Even More Complicated – WSJ

China/ Asia

- Xi Prepares China for ‘Extreme’ Scenarios, Including Conflict with the West – WSJ