Stay Informed and Stay Ahead: Market Watch, June 3rd, 2024.

Early-Week Wall Street Market Digest

Three Key Takeaways

+NASDAQ and S&P 500 up, DJIA declined. Healthcare/Tech outperform, Energy lags as Oil falls on OPEC+ announcement.

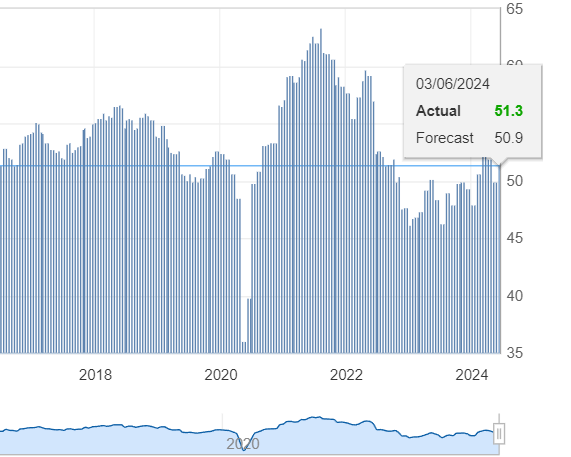

+Today’s S&P manufacturing PMI indicates expansion, surpassing expectations and boosting market sentiment.

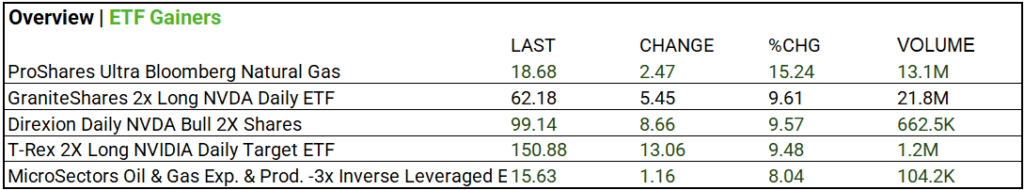

+ GraniteShares 2x Long NVDA Daily ETF surged 9.61% with a 21.8M volume, showcasing Nvidia’s dominance in AI and its appeal as a growth asset.

Summary of Market Performance

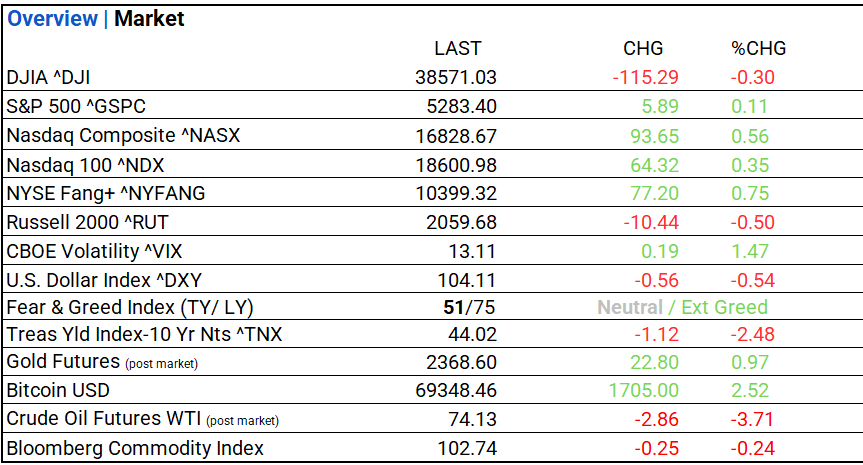

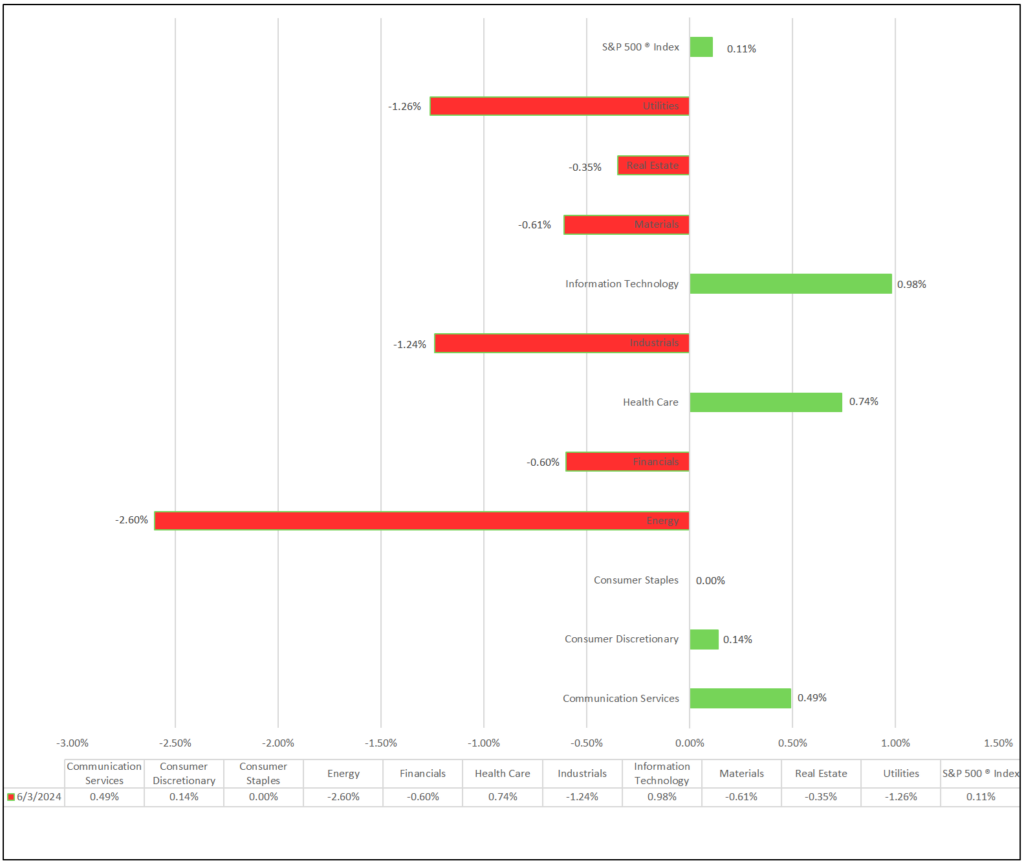

Indices & Sectors Performance:

- Major indices, NASDAQ and S&P 500 up, DJIA declined.

- 6 of 11 sectors decreased: Healthcare/Tech outperform, Energy lags as Oil falls on OPEC+ announcement.

Chart: Performance of Major Indices and Sectors

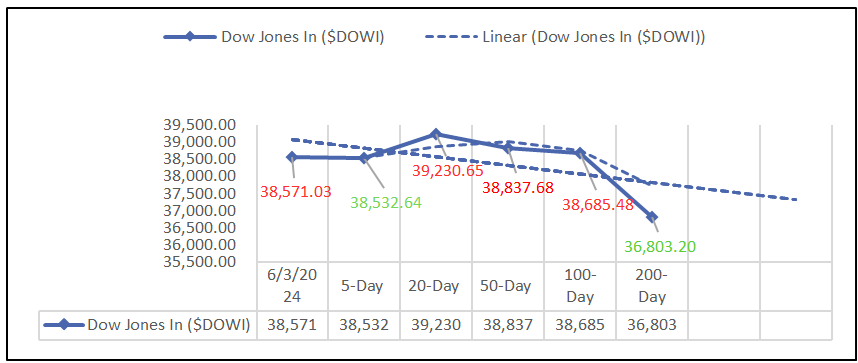

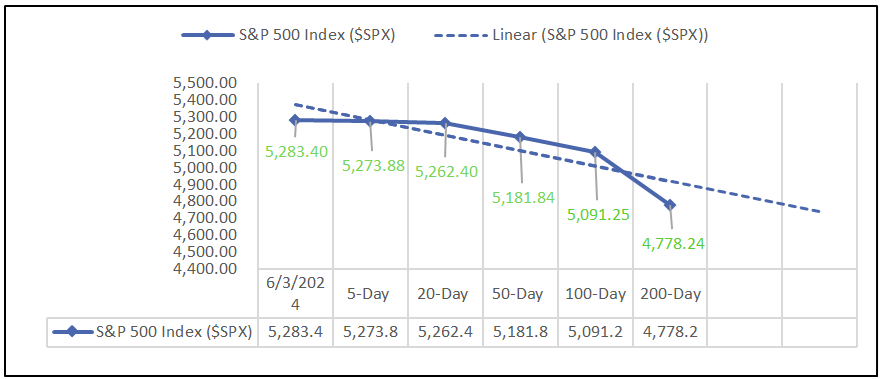

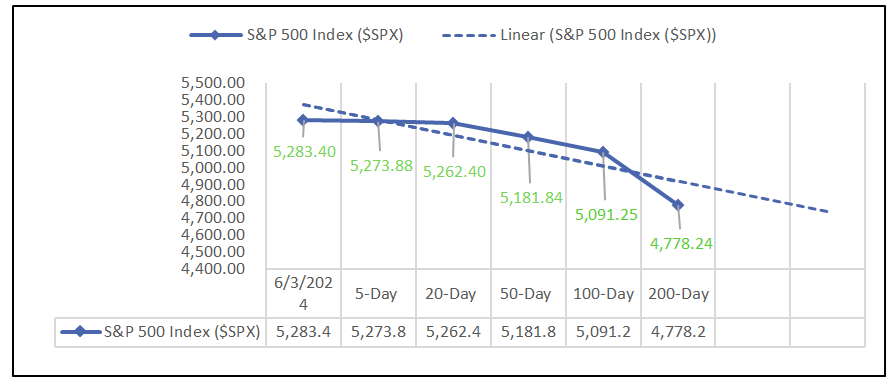

Moving Average Analysis:

- On Friday US indices rose over 1% last week after a final 30-minute rally tied to MSCI rebalance flows. The S&P 500 finished May up 5%, recovering all April losses.

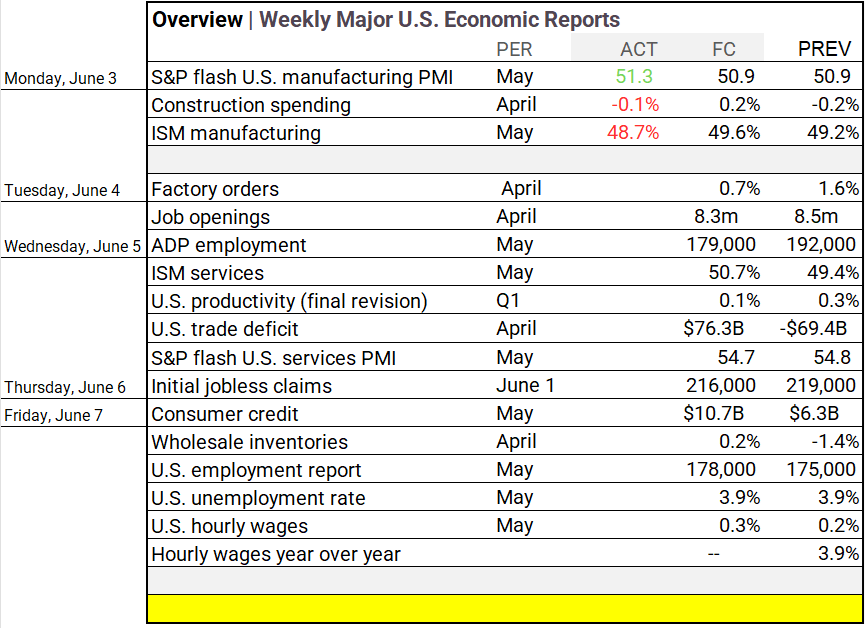

Economic Highlights:

- S&P manufacturing PMI exceeding expectations at 51.3, construction spending declining by 0.1%, and ISM manufacturing falling short at 48.7%.

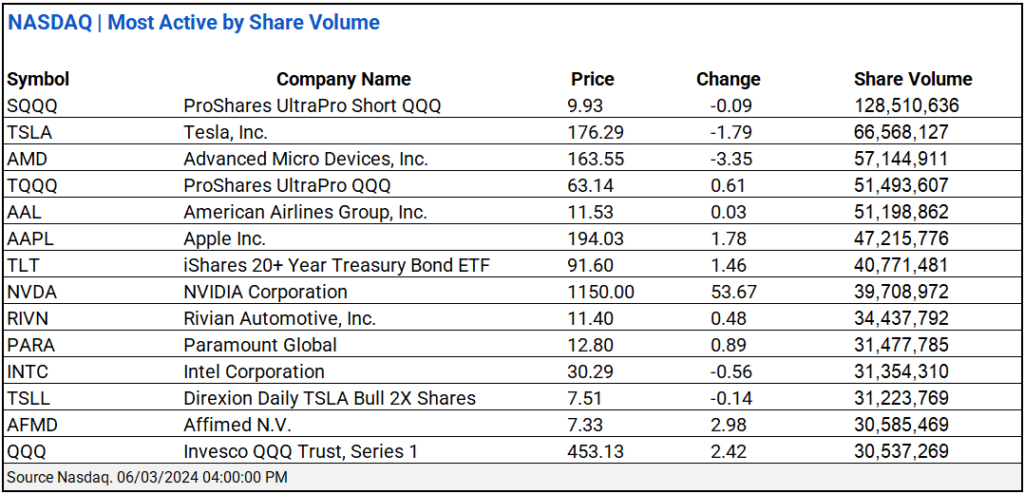

NASDAQ Global Market Update:

- Nasdaq data today illustrates a relatively balanced stock market activity with a nearly equal number of advances and declines among the 4739 total stocks.

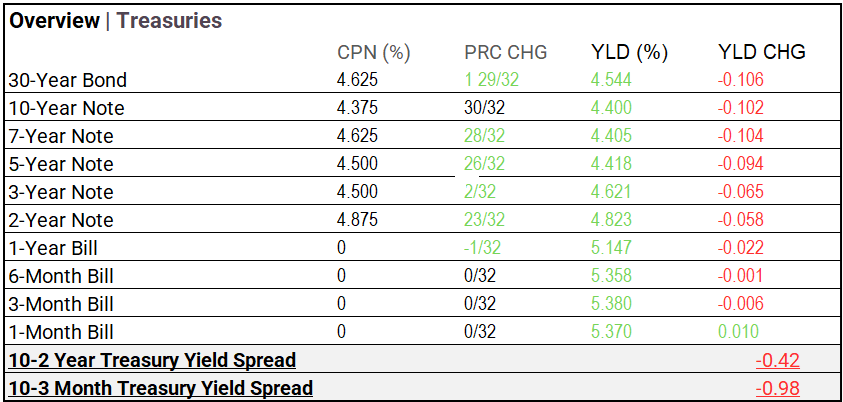

Treasury Markets:

- Following a stronger-than-expected S&P flash U.S. manufacturing PMI, bond yields decreased across most maturities, with the 30-year bond at 4.544% (-0.106), the 10-year note at 4.400% (-0.102), and the 1-month bill at 5.370% (+0.010).

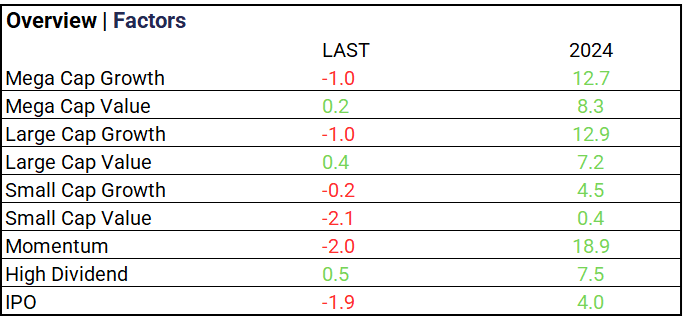

Market Trends:

- High Dividend led, while Value, especially large caps, continues to gain ground.

Currency & Volatility:

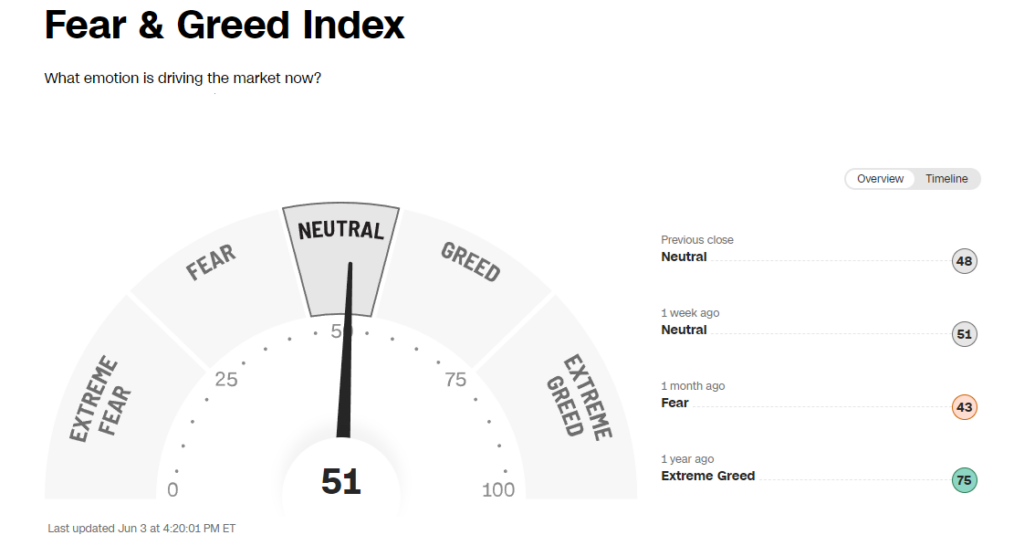

- The US Dollar Index fell by 0.54%, CBOE Volatility rose by 1.47%, and the Fear & Greed Index stayed neutral.

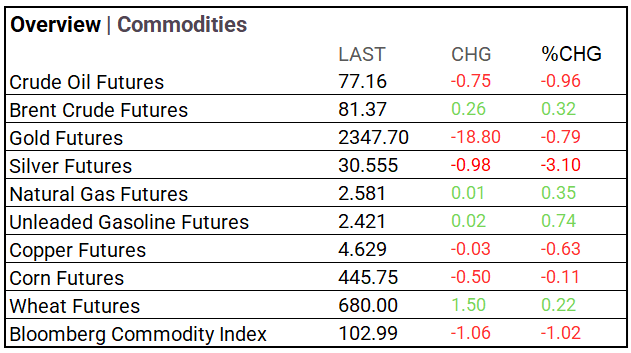

Commodities & ETFs:

- Crude oil falls on OPEC+ announcement and gold futures declined, while Brent crude, natural gas, unleaded gasoline, and wheat futures rose; Bloomberg Commodity Index dropped by 1.02%.

- ETF’s, ProShares Ultra Bloomberg Natural Gas surged 15.24% on a 13.1M volume, while GraniteShares 2x Long NVDA Daily ETF climbed 9.61% with 21.8M volume.

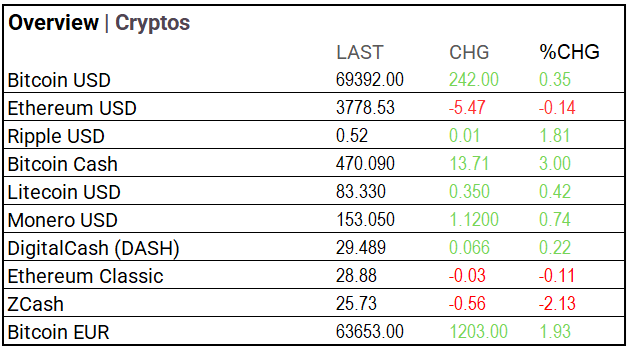

Cryptocurrency Update:

- Bitcoin and Bitcoin Cash gained, while Ripple was gains 1.8%; Ethereum, ZCash, and Ethereum Classic saw slight declines.

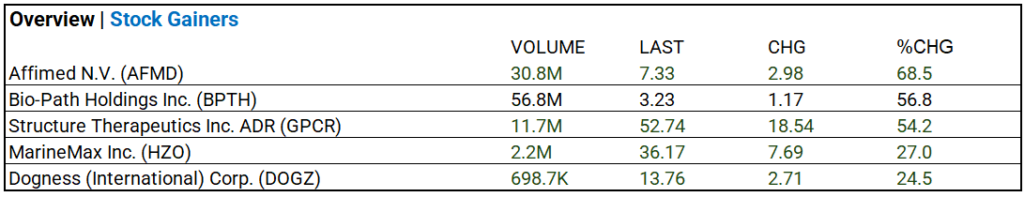

Stocks:

- Affimed N.V. (AFMD) led with 30.8M volume and 68.5% increase, followed by Bio-Path Holdings Inc. (BPTH) with 56.8M volume and 56.8% increase.

Notable Earnings Today:

- Gitlab (GTLB) and Healthequity Inc (HQY) exceeded earnings expectations in an otherwise inactive day.

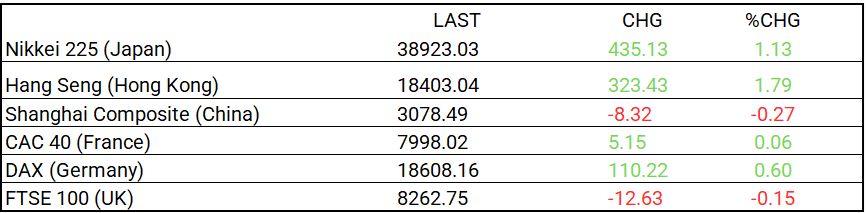

Global Markets Summary:

- Hang Seng +1.79% and Nikkei 225 +1.13%, making them the notable gainers.

In the NEWS:

Central Banking and Monetary Policy:

- Cost Pressures Cast Shadow Over Asia’s Fledgling Manufacturing Recovery – Wall Steet Journal

- ECB Rate Cut Will Be Rare Bright Spot in Troubled Euro Area – Bloomberg

Business:

- Logistics Operators Are Looking to Break the Sector’s IPO Logjam – Wall Street Journal

- Regulators Raid Toyota Offices Over Safety Scandal, Sending Stock Down – Bloomberg

China:

- China’s factory activity growth hits 2-year high in May, Caixin PMI shows, amid strong production and new orders – South China Morning Post