Stay Informed and Stay Ahead: “Special Edition” Research, December 13th, 2024

A Key Macroeconomic Trend Under the Trump Administration: Pro-Business Deregulation and Sector-Specific Stimulus

Vica Partners Forecast: S&P 500 Gains of >17% in 2025

The fusion of AI innovation and pro-business policies under the Trump administration is setting the stage for substantial market gains in 2025. Vica Partners projects the S&P 500 to achieve returns of >17%, driven by strategic opportunities in high-growth sectors. Key beneficiaries include technology, financials, manufacturing, and energy, all poised to capitalize on deregulation, sector-specific stimulus, and advancements in AI. For institutional investors, this convergence represents an unparalleled moment to align portfolios with transformative economic trends.

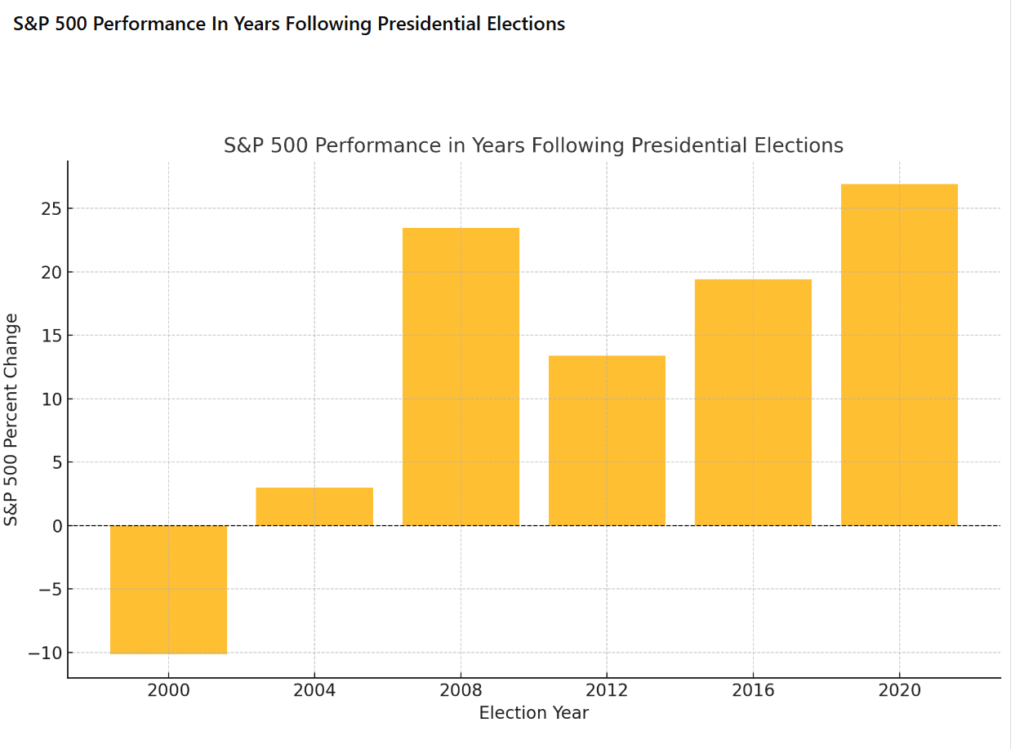

Markets Typically Rise Post-Elections, Reflecting Optimism and Policy Impact

In the year following the 2016 election, the S&P 500 delivered a total return of approximately 12%, driven by investor optimism toward pro-business policies. Building on this momentum, 2025 offers the potential for even greater market growth fueled by policy continuity and emerging technologies.

This chart reveals that markets typically experience post-election growth, reflecting investor optimism and the anticipated impact of new policies. Following the 2016 election, the S&P 500’s 12% return was driven by confidence in pro-business policies like deregulation and tax reforms. Building on this historical trend, 2025 presents even greater growth potential fueled by policy continuity, sector-specific stimulus, and advancements in AI. These combined factors not only drive short-term market momentum but also foster long-term structural changes, positioning industries for sustained expansion.

Deregulation and Stimulus—Cornerstones of Economic Growth

Donald J. Trump’s second term has cemented his administration’s commitment to pro-business policies, with aggressive deregulation and targeted sector-specific stimulus unleashing growth across energy, finance, defense, and manufacturing. These measures have created fertile ground for investment, innovation, and long-term industry transformation.

This analysis explores the macroeconomic impact of these policies while integrating strategies to navigate regulatory and economic shifts in 2025.

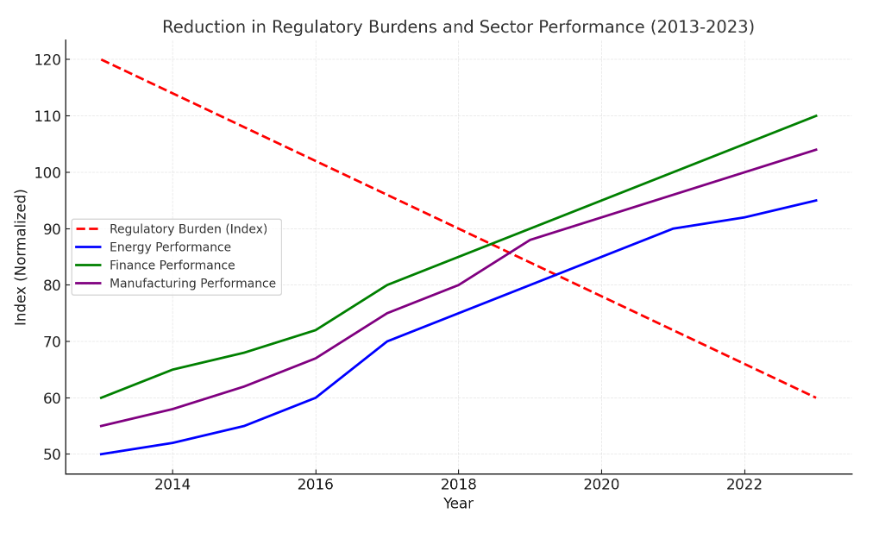

1. Deregulation: The Economic Catalyst

Unshackling Key Sectors

Deregulation remains a cornerstone of Trump’s economic agenda, significantly reducing compliance burdens across key industries:

- Energy: Accelerated oil and gas production due to fewer exploration restrictions.

- Finance: Loosened lending regulations, enabling greater capital flows.

- Manufacturing: Simplified compliance standards boosting automation and efficiency investments.

Actionable Insights for Leaders

- Identify opportunities within deregulated industries to maximize cost savings.

- Reassess investment strategies to capitalize on reduced barriers to entry.

This chart illustrates how deregulation has been a transformative economic catalyst, driving significant growth in key sectors such as energy, finance, and manufacturing from 2013 to 2023. By reducing compliance burdens, energy production accelerated, financial capital flows expanded, and manufacturing investments in automation and efficiency surged. It underscores the direct correlation between regulatory rollbacks and sector performance, revealing opportunities for businesses to capitalize on reduced barriers and realign strategies for maximum growth potential.

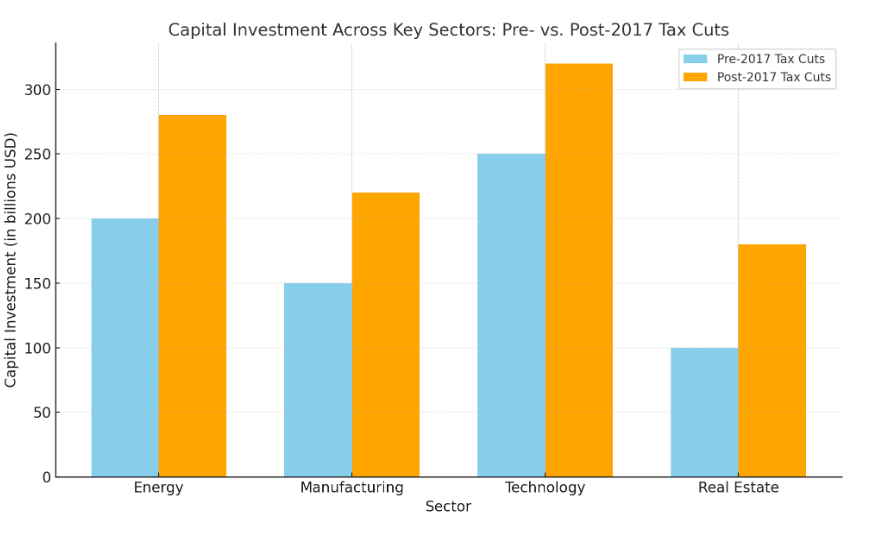

2. Sector-Specific Stimulus: Driving Focused Growth

Targeted Policy Support

The Trump administration has prioritized funding and incentives for industries with high growth potential.

Examples of Stimulus Success:

- Defense: Military spending growth drives aerospace, cybersecurity, and AI-powered systems.

- Infrastructure: Federal projects open opportunities for construction and engineering firms.

- Technology: R&D tax incentives foster AI and advanced manufacturing innovation.

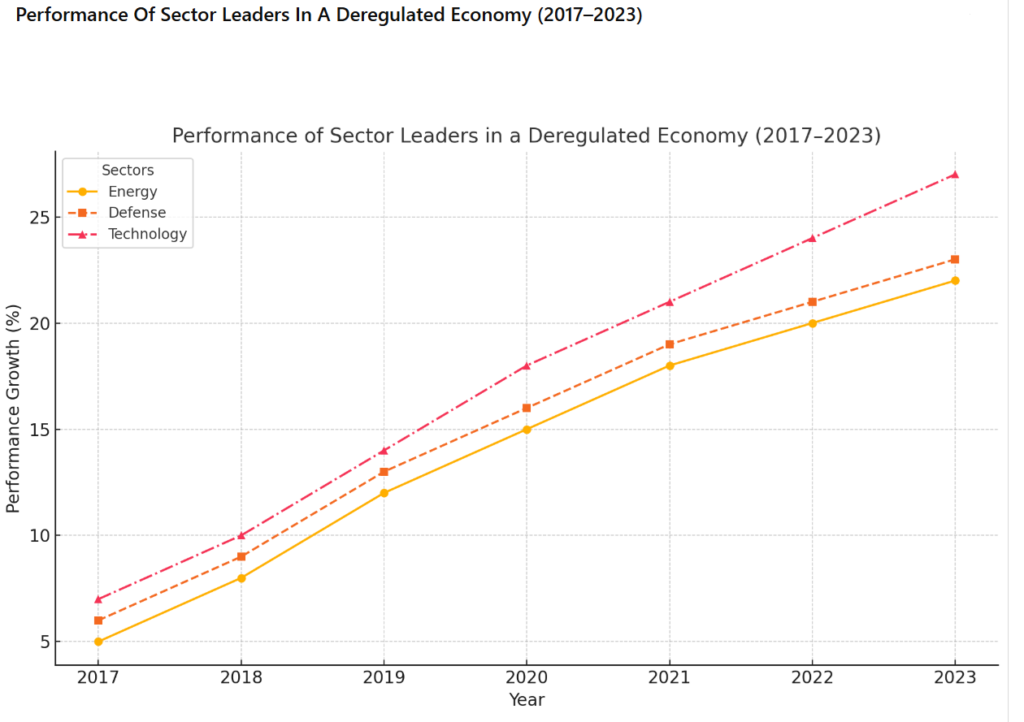

Strategic Investment Areas for 2025

- Defense contractors with multi-year government contracts.

- Infrastructure-focused companies positioned to benefit from federal spending.

- Technology leaders spearheading AI adoption.

This chart highlights the impact of sector-specific stimulus in driving growth across key industries. Targeted funding and incentives have positioned defense, energy, and technology sectors for significant expansion in 2025. Increased military spending is boosting aerospace and AI-powered systems, federal infrastructure projects are creating opportunities for construction and engineering, and R&D tax incentives are accelerating advancements in AI and manufacturing. The chart underscores how strategic stimulus measures align with high-growth industries, making them focal points for investment and long-term economic gains.

3. AI as an Accelerator: Industry-Specific Innovations

AI Trends Shaping Economic Growth

AI is revolutionizing industries, driving efficiency, and reshaping competition. Its integration with deregulation and stimulus measures enhances productivity and unlocks new opportunities.

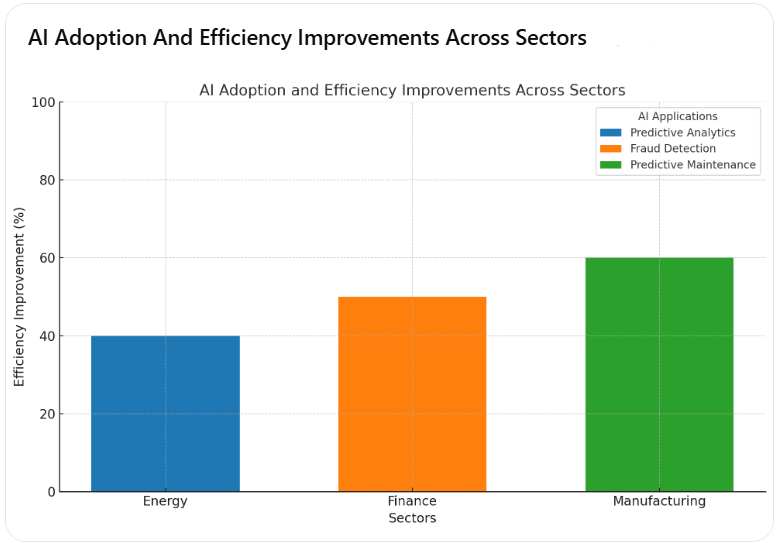

AI-Driven Sector Highlights:

- Energy: Predictive analytics and smart grid management optimize production.

- Finance: Fraud detection and algorithmic trading increase operational efficiency.

- Manufacturing: AI-driven predictive maintenance minimizes downtime, while machine learning ensures quality control.

Challenges to Address

- Ethical concerns like bias in AI models and transparency in decision-making.

- Integration issues with legacy systems requiring scalable infrastructure.

This chart represents the transformative impact of AI across key sectors, highlighting efficiency improvements driven by sector-specific applications. In Energy, predictive analytics optimizes production and grid management; in Finance, AI enhances fraud detection and operational efficiency; and in Manufacturing, predictive maintenance reduces downtime and ensures quality. These advancements showcase AI’s ability to align with industry-specific needs, driving productivity and competitive advantages.

4. Navigating Regulatory and Economic Shifts in 2025

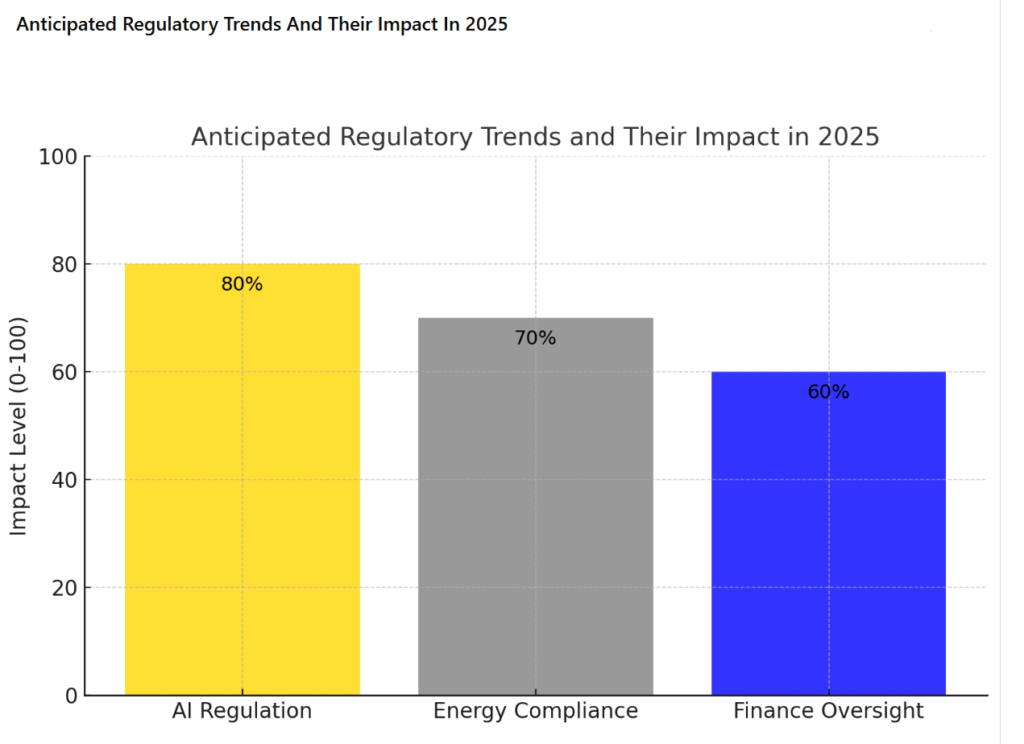

Anticipating Regulatory Adjustments

While deregulation has driven growth, new regulations—particularly in AI governance and environmental compliance—are expected to emerge.

Key Regulatory Trends:

- AI Regulation: Stricter policies around data privacy and cybersecurity.

- Energy Compliance: Renewed focus on emissions standards despite deregulation.

- Finance Oversight: Adjustments to lending practices and fintech operations.

Strategies for Leaders

- Monitor evolving policies to align business strategies with compliance requirements.

- Build proactive compliance frameworks to adapt to regulatory changes.

This chart illustrates the anticipated impact levels of key regulatory changes expected in 2025 across three critical areas: AI governance, energy compliance, and finance oversight. It highlights how stricter policies in data privacy, emissions standards, and lending practices are projected to influence business strategies and industry operations, emphasizing the need for proactive adaptation and compliance.

5. Strategic Investment Recommendations for 2025

Maximizing Opportunities in Key Sectors

Institutional investors and corporate leaders should focus on high-growth areas influenced by deregulation, stimulus, and AI advancements.

Recommended Focus Areas:

- Energy: AI-integrated projects in traditional and renewable energy.

- Defense: Contractors leveraging AI and advanced R&D for modernization.

- Technology: Companies driving autonomous systems and predictive analytics.

This chart highlights consistent growth across energy, defense, and technology sectors from 2017 to 2023, with technology leading gains driven by AI innovation, defense benefiting from increased government spending, and energy advancing through deregulation and operational efficiencies.

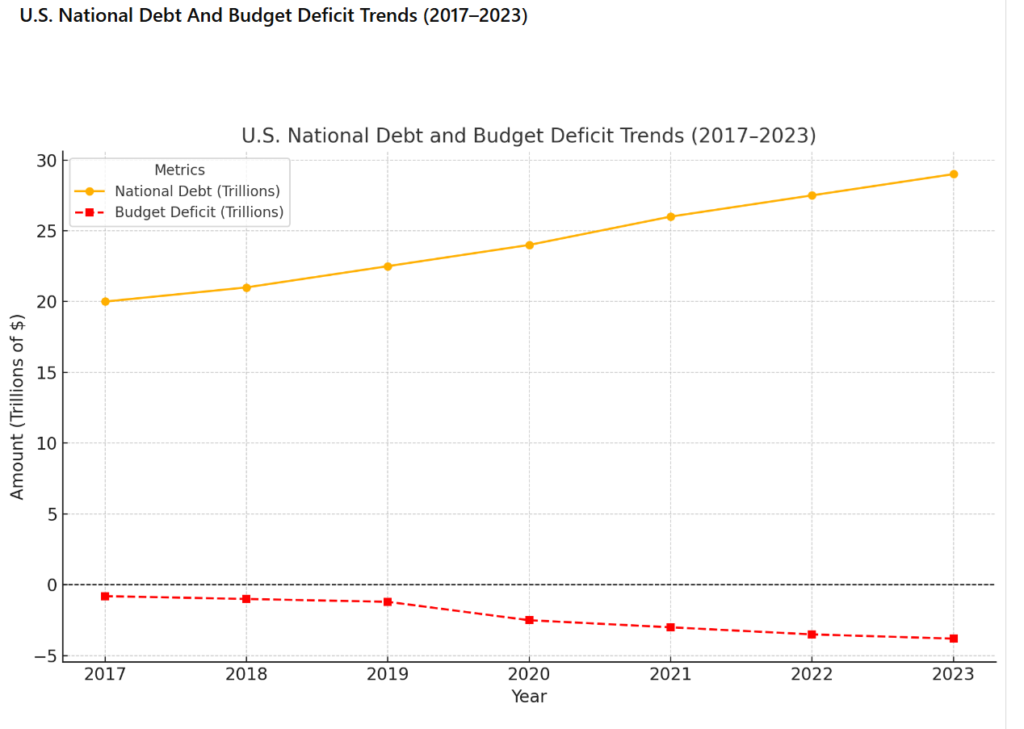

6. Balancing Growth with Fiscal Responsibility

Addressing Economic Risks

While deregulation and stimulus drive growth, fiscal sustainability remains a concern as national debt and deficits continue to rise.

Key Risks:

- Debt Expansion: Increased spending on defense and infrastructure could impact stability.

- Overreliance on AI: Misaligned AI integration may result in inefficiencies and ethical concerns.

Strategies for Mitigation

- Focus on cost-saving innovations to improve ROI.

- Diversify portfolios to hedge against sector volatility.

- Balance growth initiatives with disciplined fiscal management.

This chart highlights the steady rise in national debt and the widening budget deficit from 2017 to 2023, driven by increased spending on defense, infrastructure, and stimulus measures. While these investments support economic growth, they underscore the growing tension between short-term policy gains and long-term fiscal sustainability, emphasizing the need for disciplined financial management and strategic investment to mitigate potential economic risks.

Conclusion: A Pro-Business Vision for 2025 and Beyond

The Trump administration’s pro-business policies, combined with the rapid acceleration of AI-driven innovation, provide a unique roadmap for transformative growth in 2025. This article has been carefully constructed to resonate with institutional investors, fund managers, and executive directors who are not only looking to understand emerging macroeconomic trends but also seeking actionable strategies to capitalize on them.

Why Industry Leaders Will Value This Analysis

Alignment with Strategic Priorities

Successful leaders operate at the intersection of vision and execution. This article distills complex economic dynamics into a practical framework, enabling fund managers and CEOs to identify high-growth sectors and optimize resource allocation effectively.

Navigating Complexity with Confidence

The best in the industry understand that growth is rarely linear—it’s about balancing opportunity with risk. By addressing deregulation, stimulus, and AI innovation alongside fiscal and regulatory challenges, the article offers a comprehensive lens through which leaders can make well-informed, confident decisions.

Future-Proofing Investments

CEOs and fund managers who excel are those who anticipate and adapt to change. This article prepares leaders for evolving regulatory landscapes and technological disruptions, ensuring they can navigate the dual challenges of compliance and innovation.

Actionable Guidance for Strategic Success

From sector-specific stimulus to AI adoption, the article offers practical, data-driven recommendations tailored for decision-makers. Whether it’s investing in AI-integrated energy projects or identifying defense contractors with multi-year contracts, the insights provide a clear path forward.

Final Call to Action

The coming year represents a defining moment for institutional investors and executive leaders. Those who embrace the opportunities presented by deregulation, sector-specific stimulus, and AI-driven transformation will position themselves not only for success in 2025 but also as frontrunners in shaping the economic landscape of the future.

By aligning investments with these pivotal trends, the best of the industry will lead with vision, decisiveness, and unparalleled results in this transformative era. This article empowers those leaders to seize the moment.