MARKETS TODAY May 22nd, 2023 (Vica Partners)

On Friday US Markets finished broadly lower, S&P 500 -0.14%, DOW -0.33% and the Nasdaq -0.24%. 7 of 11 of the S&P 500 sectors lower: Consumer Discretionary -0.84% lagged/ Energy +0.73% outperformed. The Greed Index, Treasury Yields, Gold Bitcoin and the Bloomberg Commodity Index all gained. In economic news, Fed Chair Powell said that tightening credit conditions in the banking sector means that the Central Bank may not need to raise its policy rate.

Overnight/Premarket Asian markets finished higher, Hong Kong’s Hang Seng +1.17%, Japan’s Nikkei 225 +0.90% and the Shanghai Composite +0.39%. European markets finished mixed, London FTSE 100 +0.18%, Germany’s DAX -0.32% and France’s CAC 40 -0.18%. US futures were trading at 0.5% below fair value.

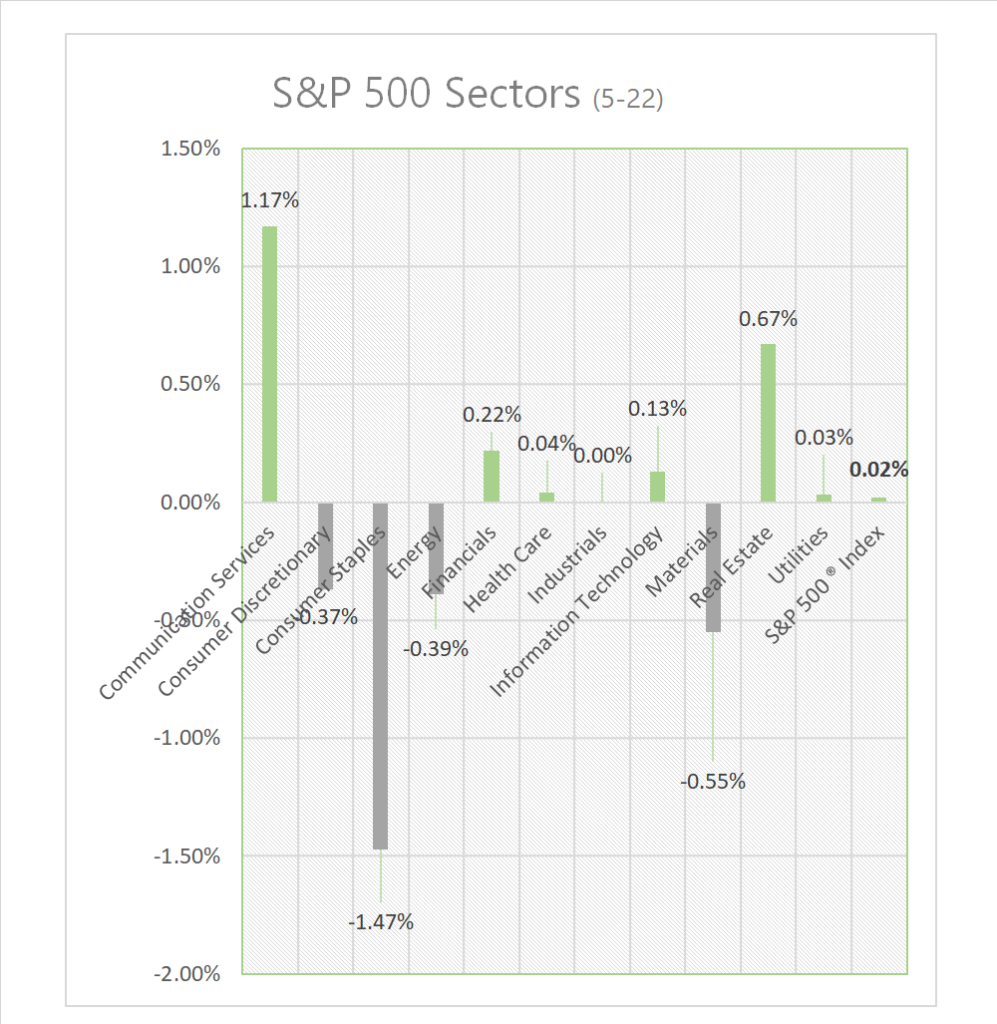

Today US Markets finished mixed, S&P 500 +0.02%, DOW -0.42% and the Nasdaq +0.50%. 7 of 11 of the S&P 500 sectors higher: Communication Services +1.17% outperforms/ Consumer Staples -1.47% lags. On the upside, Treasury Yields, Oil, Bitcoin and USD Index all gain. In economic news, no US economic data only Fed commentary.

Takeaways

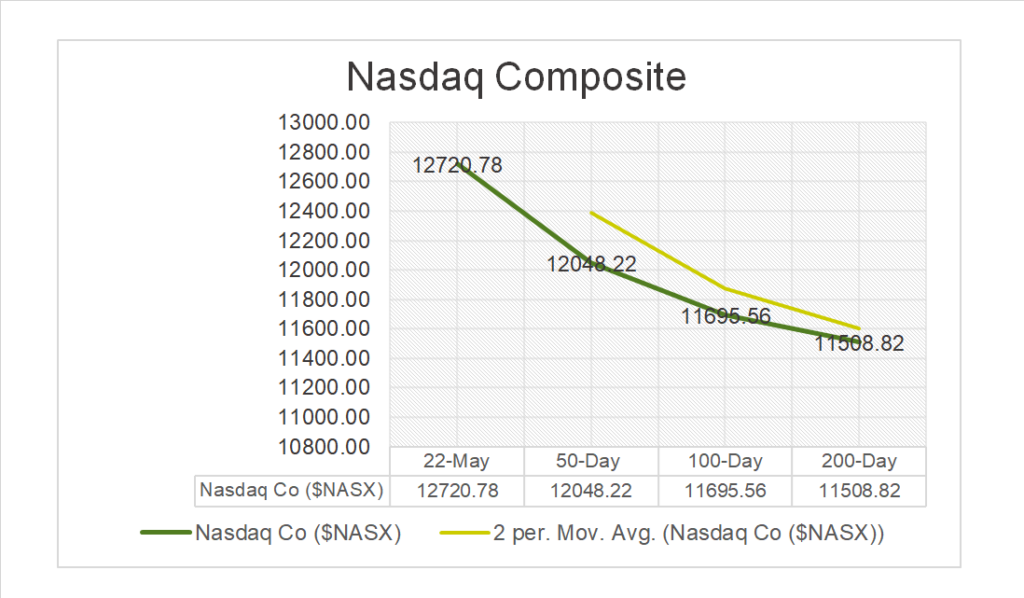

- Nasdaq Composite hits ‘23 high

- Russell 2k outperforms +1.22%

- SPDR S&P Banking ETF (KRE) +3.19%

- Pac West Bank (PACW) >+19.5%

- 7 of 11 of the S&P 500 sectors higher: Communication Services outperforms/ Consumer Staples lags

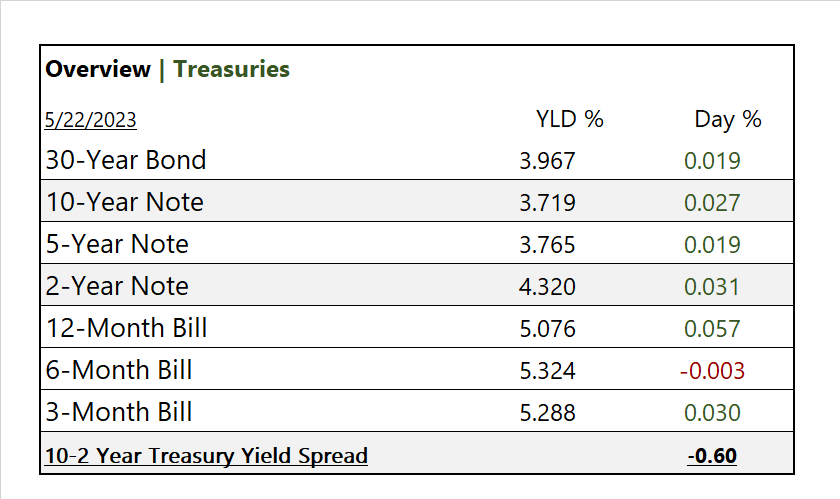

- US yields continue higher and were up between 2-5bps

- Zoom Video (ZM), Ryanair ADR (RYAAY) with earnings beats

- Fed commentary slightly hawkish

Pro Tip: TBA tomorrow

Sectors/ Commodities/ Treasuries

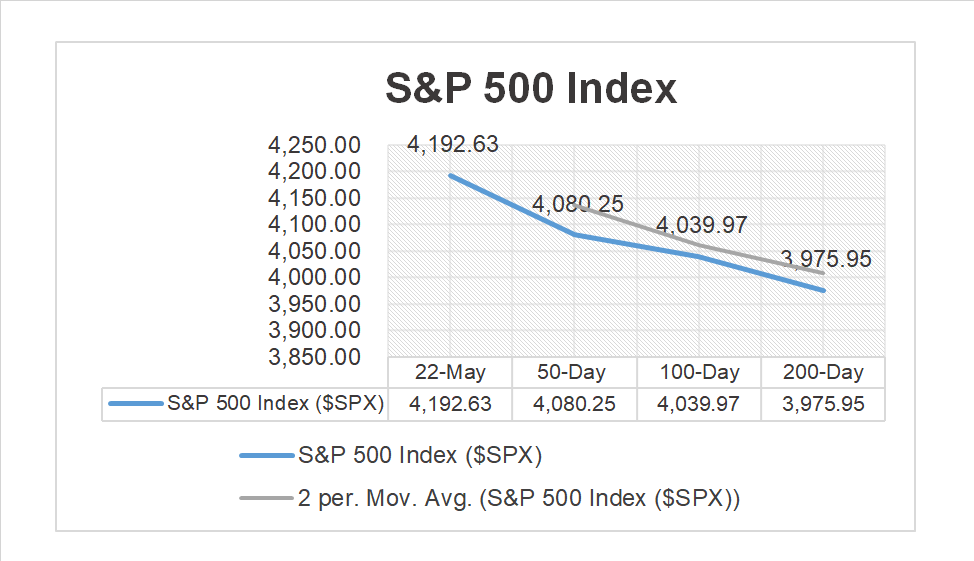

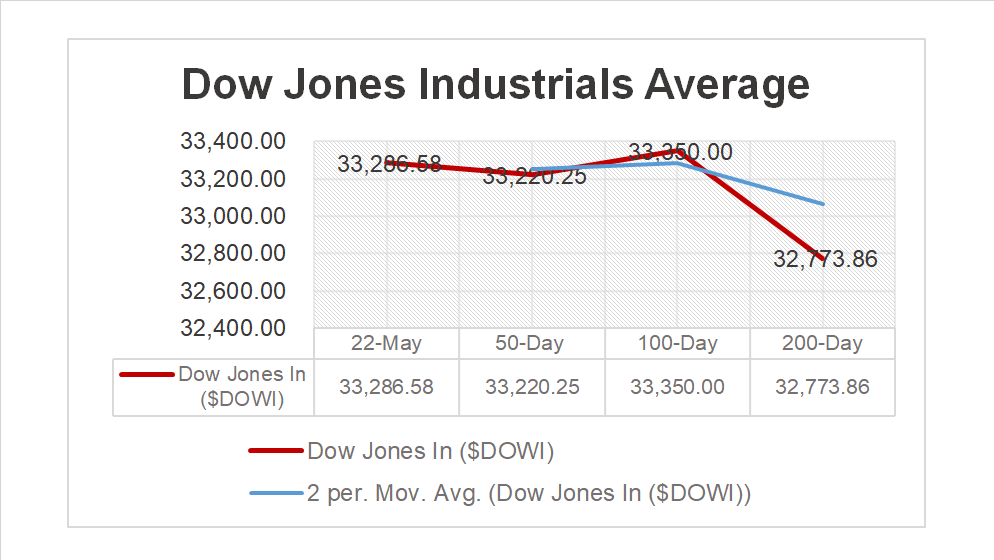

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 7 of 11 of the S&P 500 sectors higher: Communication Services +1.17%, Real Estate +0.67% outperform/ Consumer Staples -1.47% lags

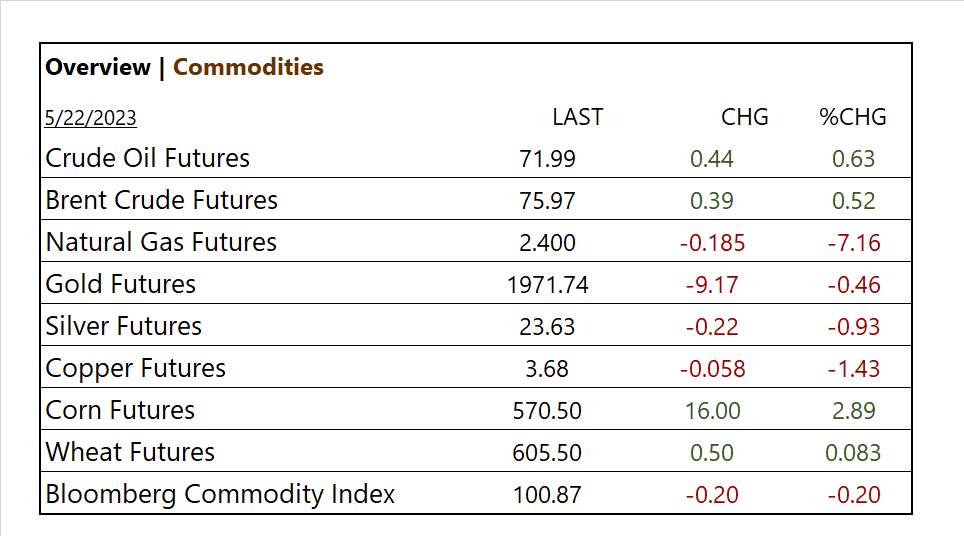

Commodities

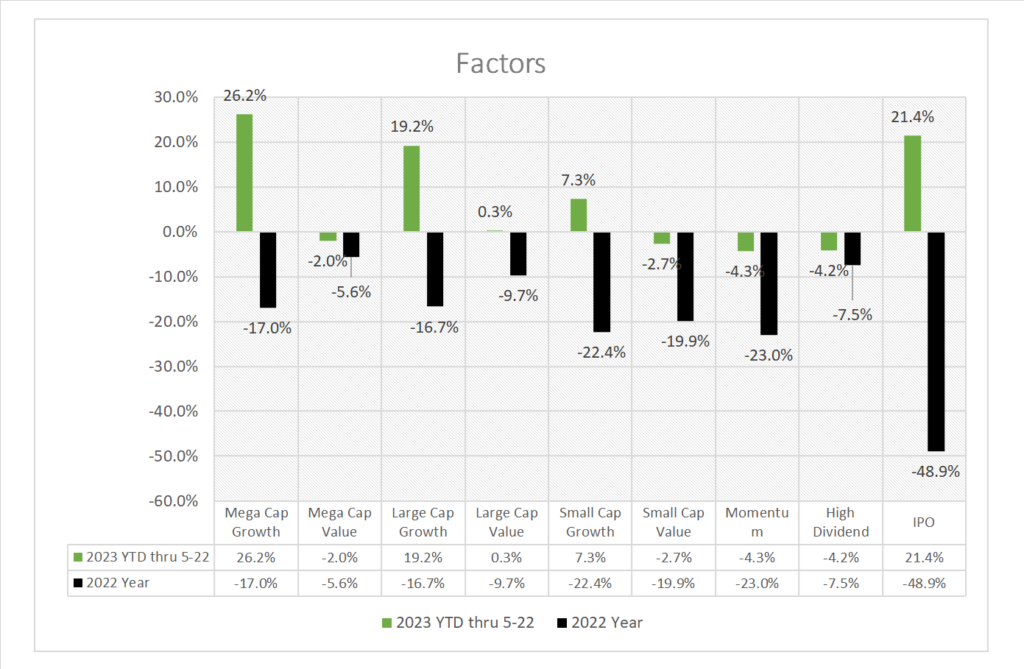

Factors (YTD)

US Treasuries

Notable Earnings Today

- +Beat: Zoom Video (ZM), Heico A (HEIa), Ryanair ADR (RYAAY), Nordson (NDSN), Bank Hapoalim ADR (BKHYY), GlobalE Online (GLBE),

- – Miss: IVERIC bio (ISEE), Immunovant (IMVT), Lufax (LU), ZIM Integrated Shipping Services (ZIM), Moneygram (MGI)

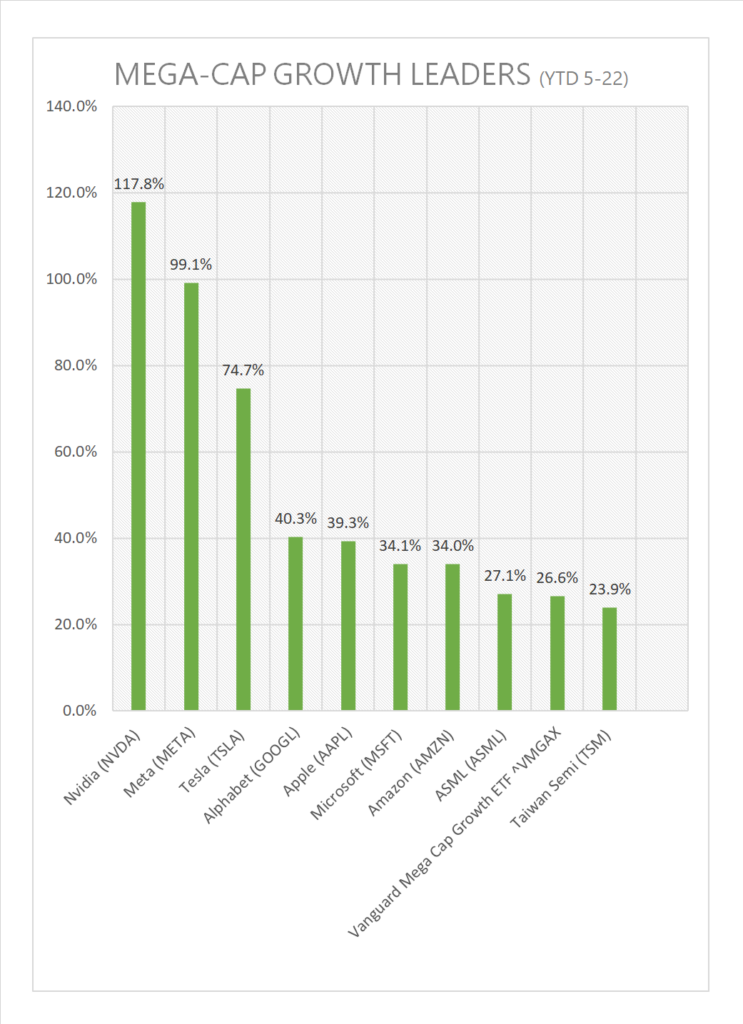

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Baidu (BIDU), Nu Holdings (NU)

Economic Data

US

- No major release reports on Monday

- Fed speakers; St. Louis Fed’s Bullard sees two more rate increases this year and Minneapolis’s Kashkari calls June rate pause a ‘close call’

News

Company News/ Other

- Regional Bank Stocks Get a Lift After PacWest’s Loan Portfolio Sale – WSJ

- Meta hit with record $1.3 billion fine over data transfers – Reuters

- Biden’s Billion-Dollar Oil Trade Faces a Big Test – WSJ

- Regional Banks Rallied Last Week. Traders Continued to Short the Sector – Bloomberg

Central Banks/Inflation/Labor Market

- Fed Rate Increases Hit Small Businesses the Hardest – WSJ

- Treasury confirms U.S. default as early as June 1 without debt ceiling hike – Reuters

- Two Fed Officials Say More Interest-Rate Raises May Be Needed to Cool Prices – Bloomberg

China

- Asia Stock Futures Edge Up in Shadow of Debt Talks: Markets Wrap – Bloomberg