MARKETS TODAY Dec 7 (Vica Partners) – The Dow Jones Industrial Average ended little changed today. The best performing sectors today were Health Care and Real Estate sectors, up 0.67% and 0.26%.

The Dow Jones Industrial Average even at 0 points. The S&P 500 declined 0.19%, and the Nasdaq off 0.51%.

Key Market Statistics

- Dow flat, S&P 500 and Nasdaq declined today

- The best performing sectors were the Health Care and Real Estate sectors, up 0.67% and 0.26%.

- Notable sector laggards were Consumer Discretionary and Energy, down 0.58% and 0.54%.

- Greed Index today was 58 (mild)

- 10-year Treasury yield declined to 3.415%, the 2 year Treasury yield down at 4.256%

- S. Dollar Index (DXY) at $105.14, declining 0.42%

- Bitcoin at $16,819 falling 1.52% and Gold at $1798.70, up 0.91%

- Oil prices fell with traders actively shorting futures, with Brent crude $77.44, declining 2.41%, and US West Texas Intermediate at $72.39, declining 2.51%

EIA Petroleum Status Report out today

WTI Oil moved lower after the release of the EIA Weekly Petroleum Status Report which indicated that crude inventories declined by 5.2 million barrels from the previous week. Analysts expected that crude inventories would decline by 3.3 million barrels.

Total motor gasoline inventories increased by 5.3 million barrels, while distillate fuel inventories grew by 6.2 million barrels. The growth of total motor gasoline and distillate fuel inventories serves as price decliner for WTI oil.

Domestic oil production increased from 12.1 million bpd to 12.2 million bpd despite the recent pullback in oil markets.

Vica Momentum Stock Report

Globalfoundries Inc NYSE (GFS) (Grade B+) 50 Day Average +15.51%, 100 Day Average +35.46, 200 Day Average +23.82%

GlobalFoundries Inc. is a semiconductor manufacturer. It delivers feature-rich solutions which enable its customers to develop innovative products for pervasive chips. GlobalFoundries Inc. is based in MALTA, N.Y.

Timely Market Outlook Reports will be posted at vicapartners.com starting Friday 12-9

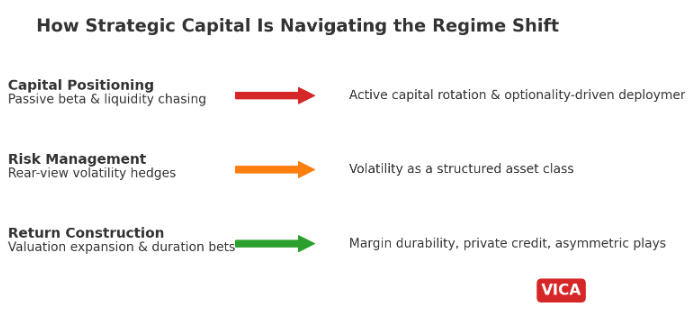

Keep in mind that solid strategy for these type of market days is important and include…

- Investing in companies that have solid balance sheets and offer dividends.

- Look to Communication services, Consumer staples, Energy, Financials and Health care as these sectors tend to perform well during recessions.

- When buying value and growth DON’T try to time market lows as its best to cost average buy companies that have solid profits.

- Try to resist most all tech and growth stocks where companies have negative margins.

*** Continue to watch for our daily momentum company recommendations as they are built by on our industry leading data base

*** Look to Index ETF’s like SPY to outperform stocks and most managed funds

*** Energy is the Top Performing Sector in the S&P 500 Year to Date and should regain strength through the winter months