MARKETS TODAY May 15th, 2023 (Vica Partners)

Last Friday, US Markets finished marginally lower S&P 500 -0.16%, DOW -0.03% and the Nasdaq -0.35%. 9 of 11 of the S&P 500 sectors lower: Utilities +0.63% outperformed/ Financials -0.57% and Real Estate -0.52% lagged. Treasury Yields and the USD Index gained while Gold, Bitcoin and Oil declined. In economic news, the Michigan Survey showed declining consumer sentiment.

Overnight/Premarket, Asian markets finished higher, Hong Kong’s Hang Seng +1.75%, Shanghai Composite +1.17% and Japan’s Nikkei 225 +0.81%. European markets finished higher, London FTSE 100 is +0.26%, France’s CAC 40 +0.05% and Germany’s DAX +0.02%. US futures were trading at 0.2% above fair-value.

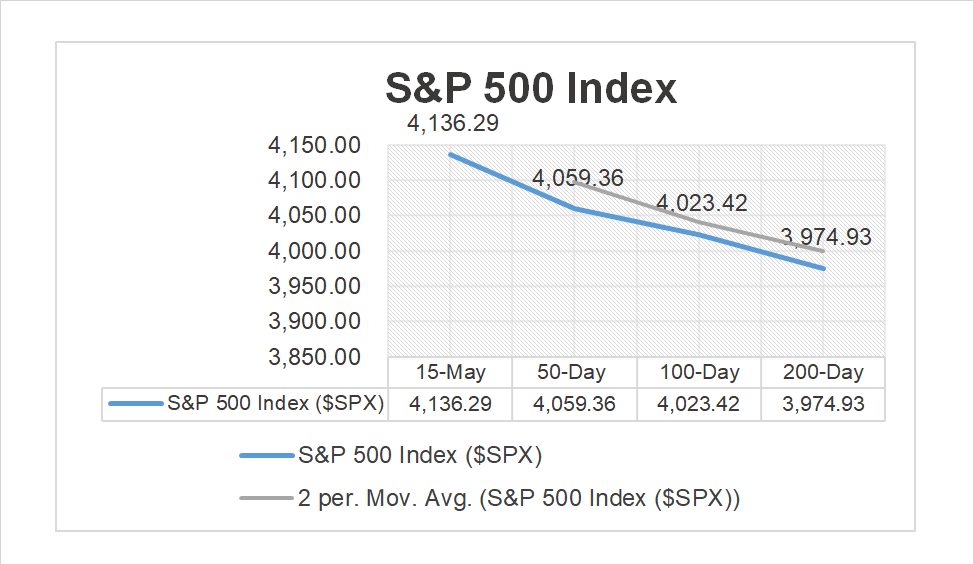

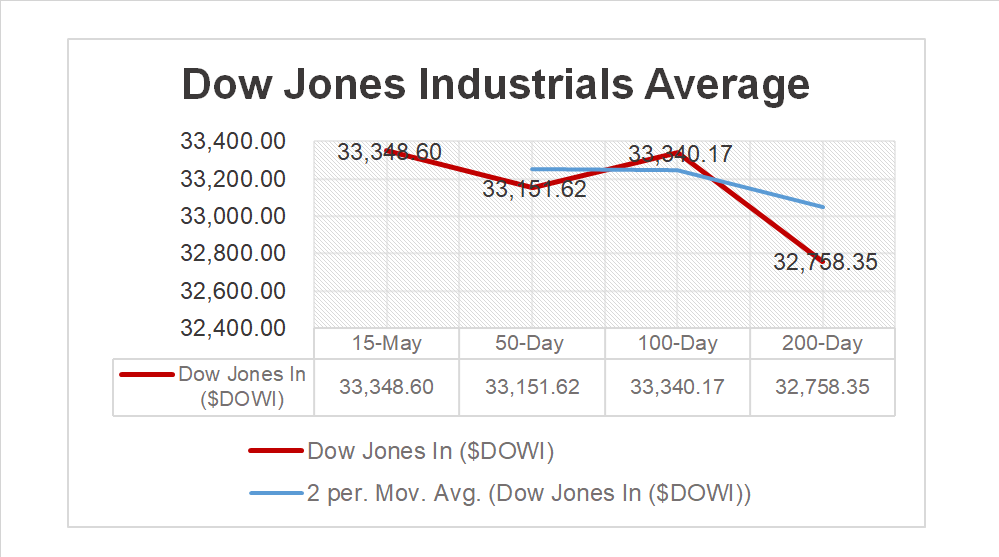

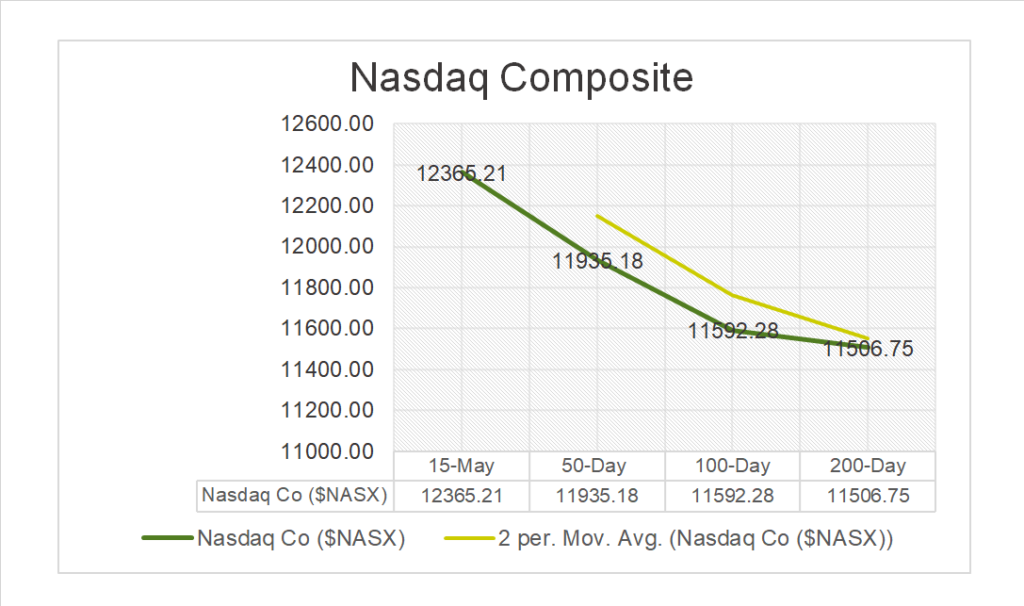

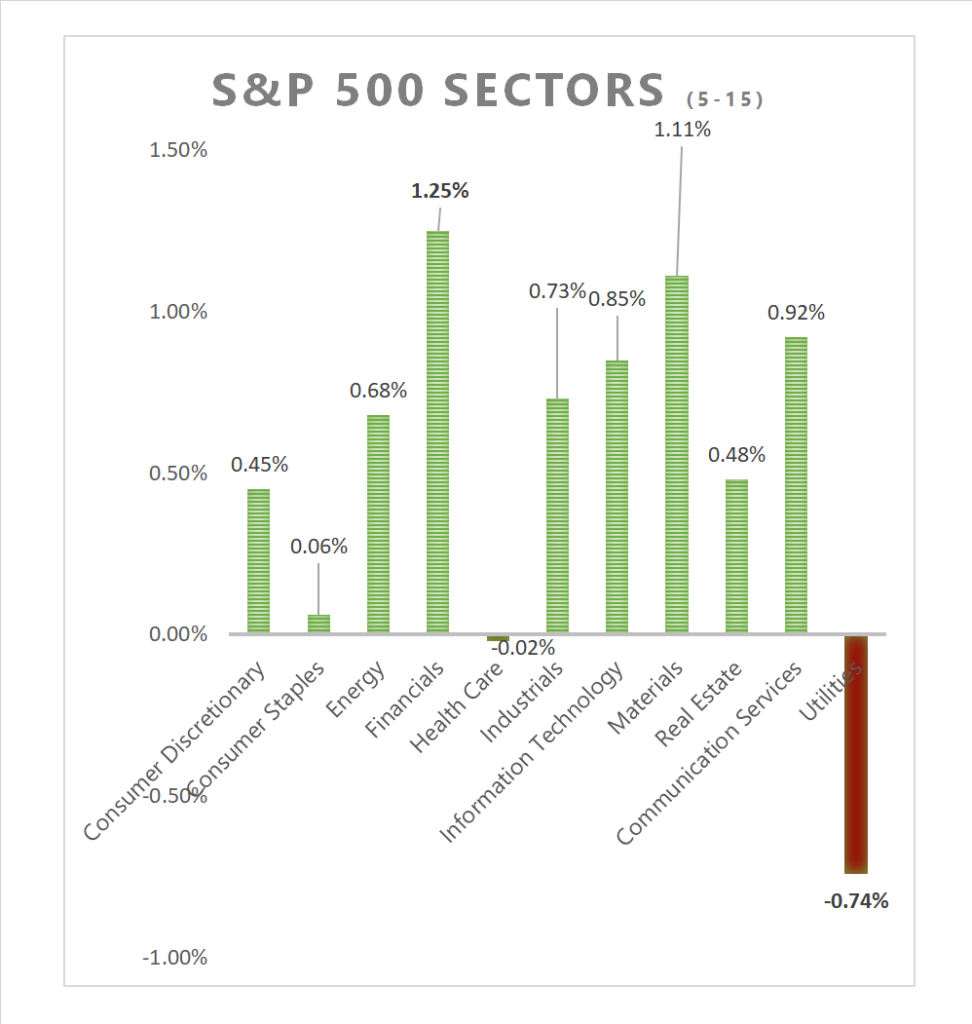

Today, US Markets finished moderately higher, S&P 500 +0.30%, DOW +0.14% and the Nasdaq +0.66%. 9 of 11 of the S&P 500 sectors advance: Financials +1.25% outperforms/ Utilities -0.74% lagged. On the upside, Treasury Yields, Gold, Bitcoin, Oil and Bloomberg Commodity Index gain. In economic news, the Empire State Manufacturing Survey Index declined sharply and missed estimates for May.

Takeaways

- The Empire State Manufacturing Survey Headline index fell to -31.8 from 10.8

- 9 of 11 of the S&P 500 sectors finished higher: Financials outperforms/ Utilities lags

- Regional Banking SPDR S&P Banking ETF (KR) bounces +3.16%

- Semiconductor ETF (SOXX) +2.72%

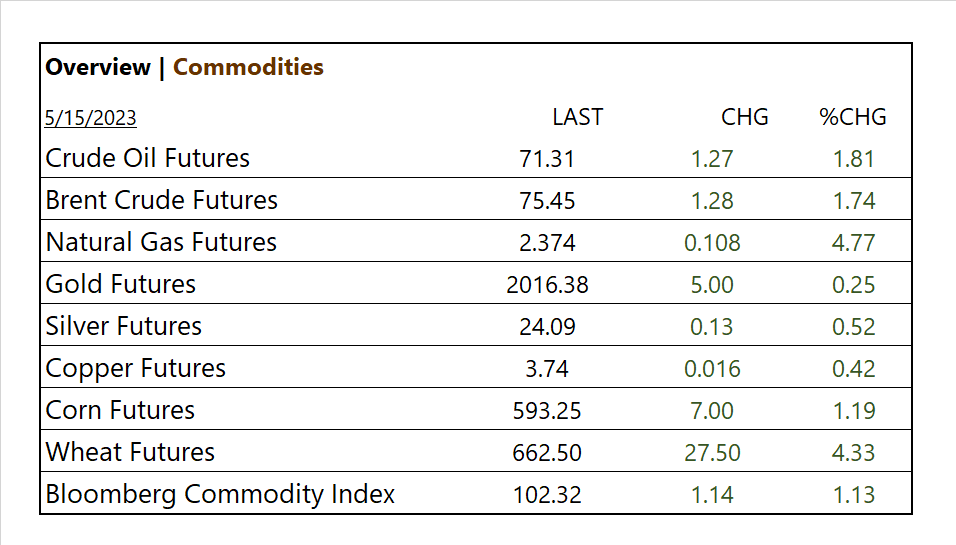

- Materials and Bloomberg Commodity up

- Earning focus this week is major retailers

- Expect to see ramped-up media coverage on failing consumer credit

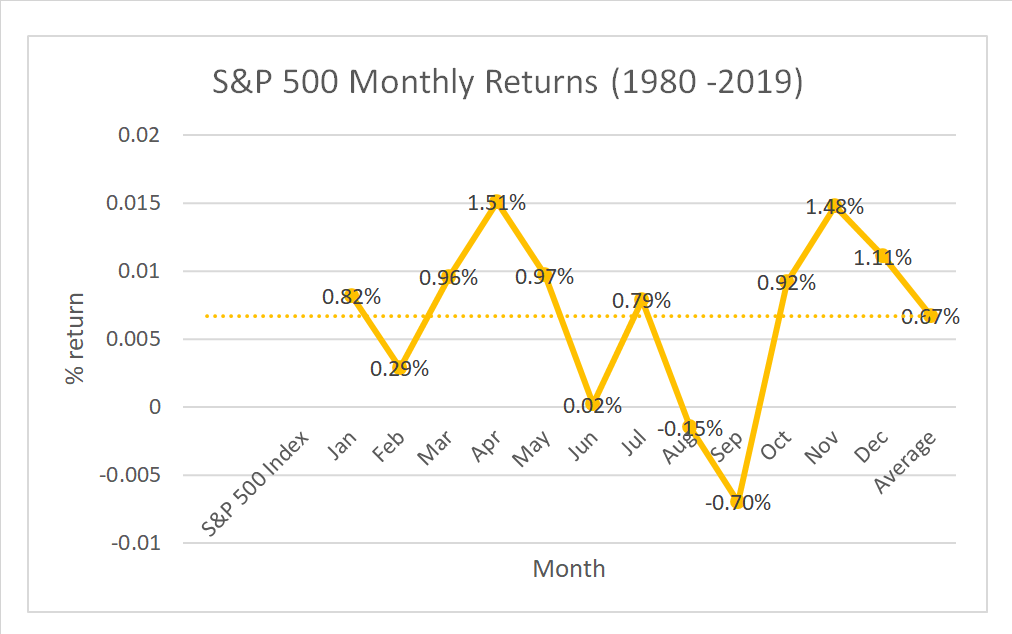

Pro Tip: Revisiting… is it true “Sell in May and Go Away” strategy, which suggests that investors should sell their stocks in May and buy them back in November.

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 9 of 11 of the S&P 500 sectors finished higher: Financials +1.25% and Materials +1.11% outperforms/ Utilities -0.74% lags

Commodities

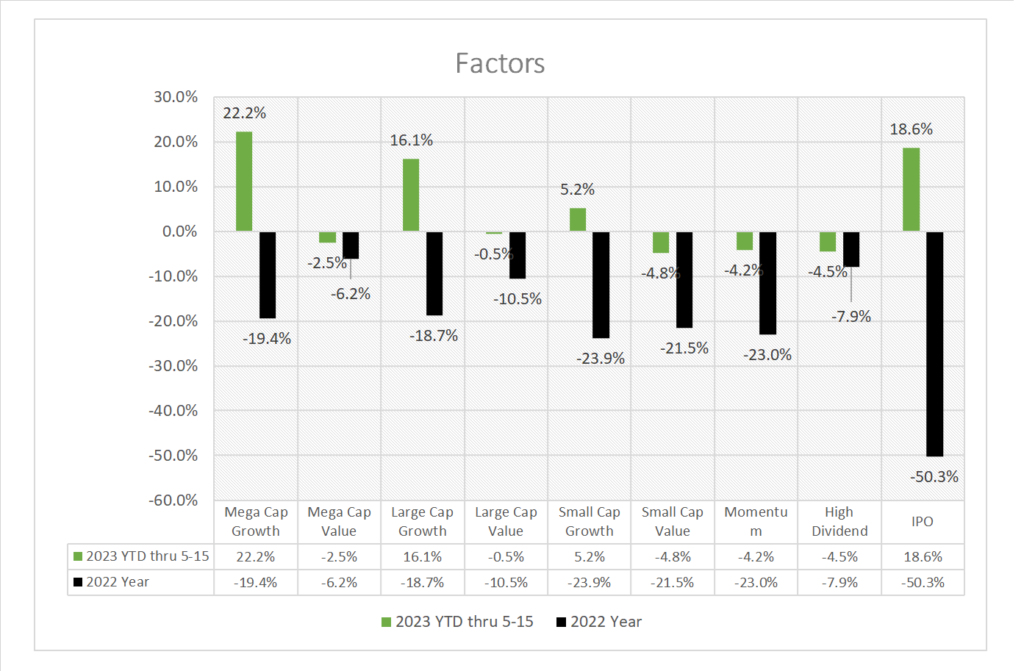

Factors (YTD)

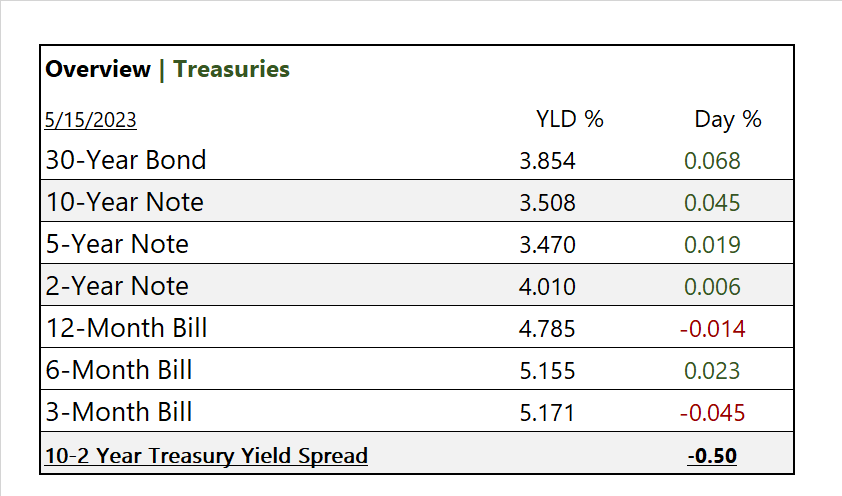

US Treasuries

Notable Earnings Today

- +Beat: Sumitomo Mitsui Financial ADR (SMFG), Bridgestone ADR (BRDCY), Monday.Com (MNDY), Tower (TSEM)

- – Miss: Mizuho Financial ADR (MFG), TPG Inc (TPG), Centerra Gold (CGAU)

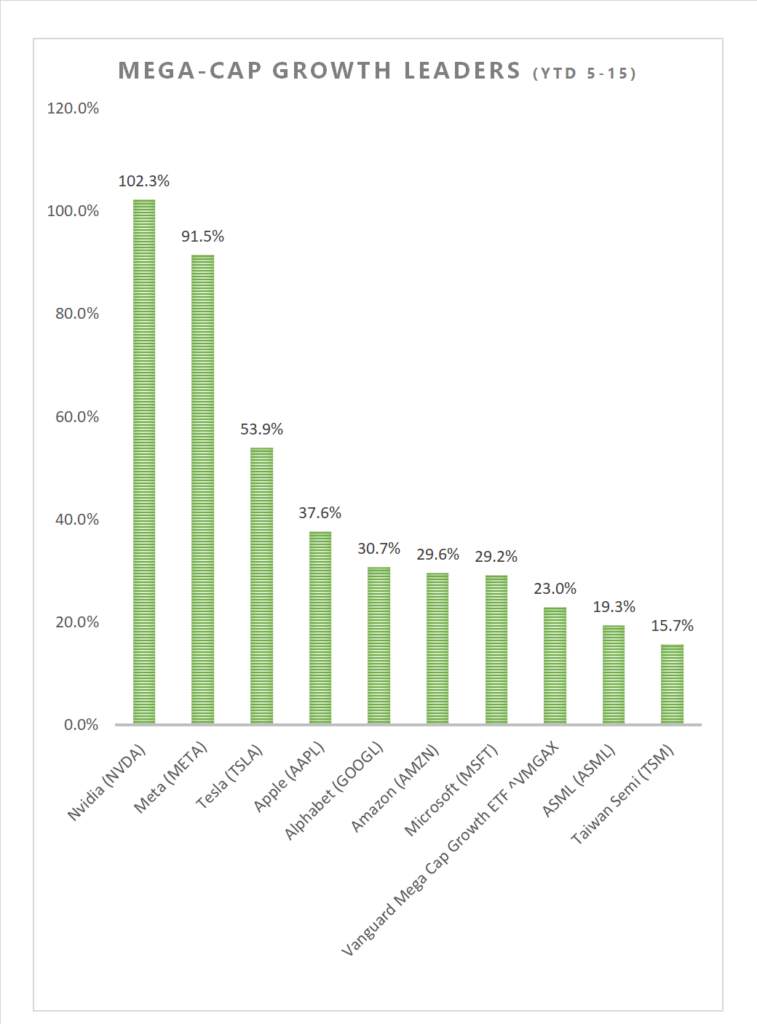

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML),

Economic Data

US

- Empire State manufacturing survey; period May, act -31.8, fc -3.5, prev. 10.8 Level below 0 indicates contracting conditions

News

Company News/ Other

- The New EV Gold-Rush: Automakers Scramble to Get Into Mining – WSJ

- Microsoft’s $75 Billion Activision Blizzard Deal Gets EU Approval – WSJ

- Schick Razor Maker Prioritizes Paying Down Debt Over Buying New Brands – Bloomberg

- Bridgewater dumps bank stocks amid turmoil in first quarter –filings – Reuters

Central Banks/Inflation/Labor Market

- Empire State Manufacturing Survey – New York Fed

- A Look at the Fed’s Likely Next No. 2 – NY Times

- US Households Show Signs of Stress as New Delinquencies Rise – Bloomberg

China

- Why Some Investors Are Betting on China’s Recovery but Avoiding Chinese Shares – WSJ

- Shanghai’s Nasdaq-style Star Market to launch options trading linked to ETFs, giving investors hedging choices against volatility – SCMP