MARKETS TODAY May 3rd, 2023 (Vica Partners)

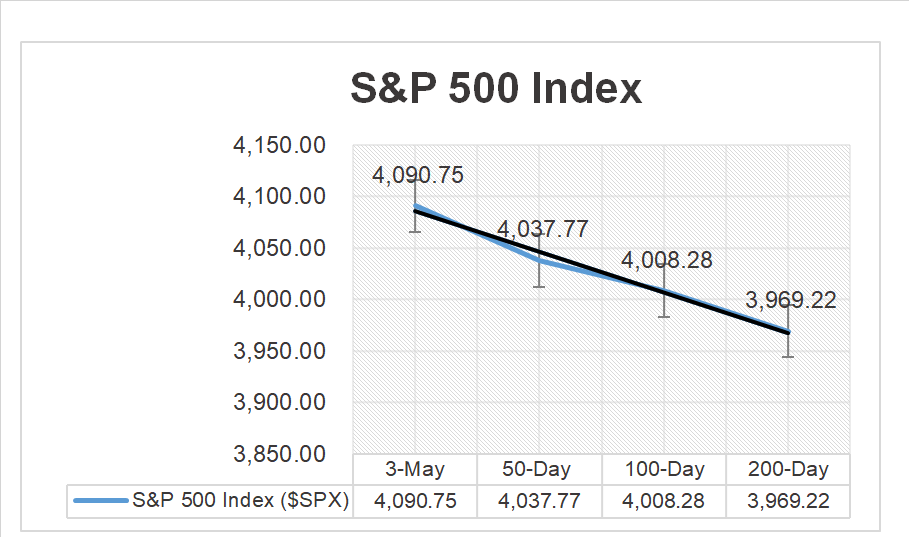

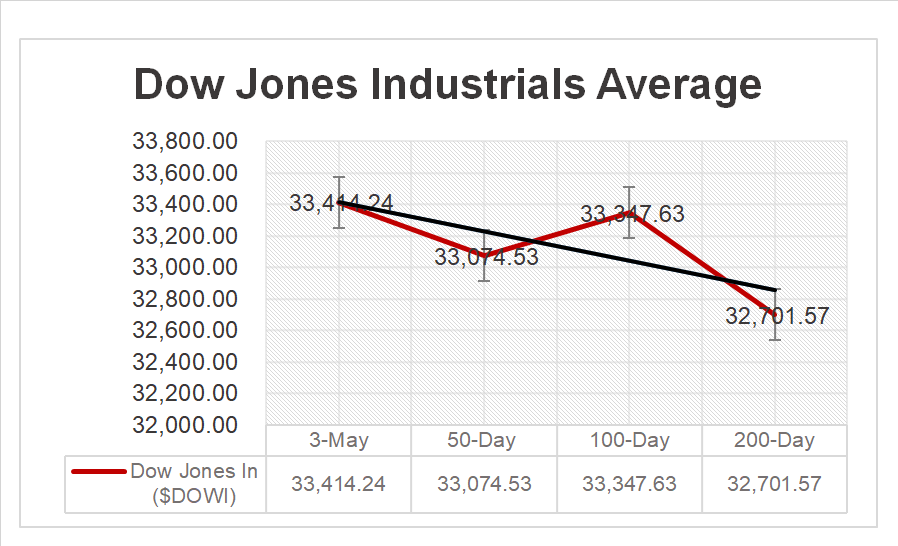

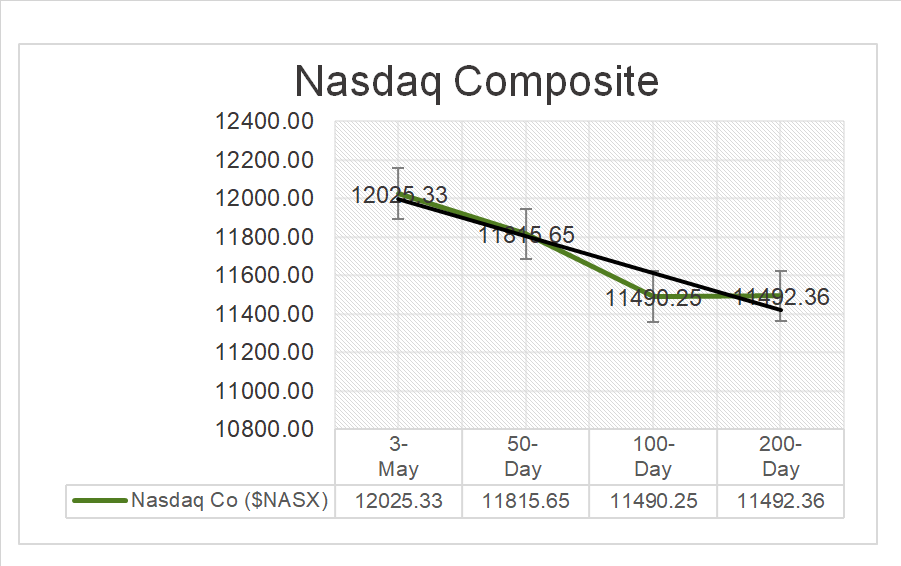

Yesterday, US Markets finished lower for a 2nd consecutive day, the S&P 500 -1.16%, DOW -1.08%, Nasdaq -1.08% and Yields fell. All 11 of the S&P 500 sectors were off on the day, Energy -4.19% sharply led decliners/ Defensives outperformed. Gold +1.74% and Bitcoin +2.09%. In economic news, March Job Openings and Factory Orders fell.

Overnight/Premarket, Asian markets finished mixed, the Shanghai Composite +1.14%, Japan’s Nikkei 225 +0.12% and Hong Kong’s Hang Seng -1.24%. European markets finished higher, Germany’s DAX + 0.56%, France’s CAC 40 +0.28% and London’s FTSE 100 +0.20%. S&P 500 US futures were trading at 0.2% above fair-value.

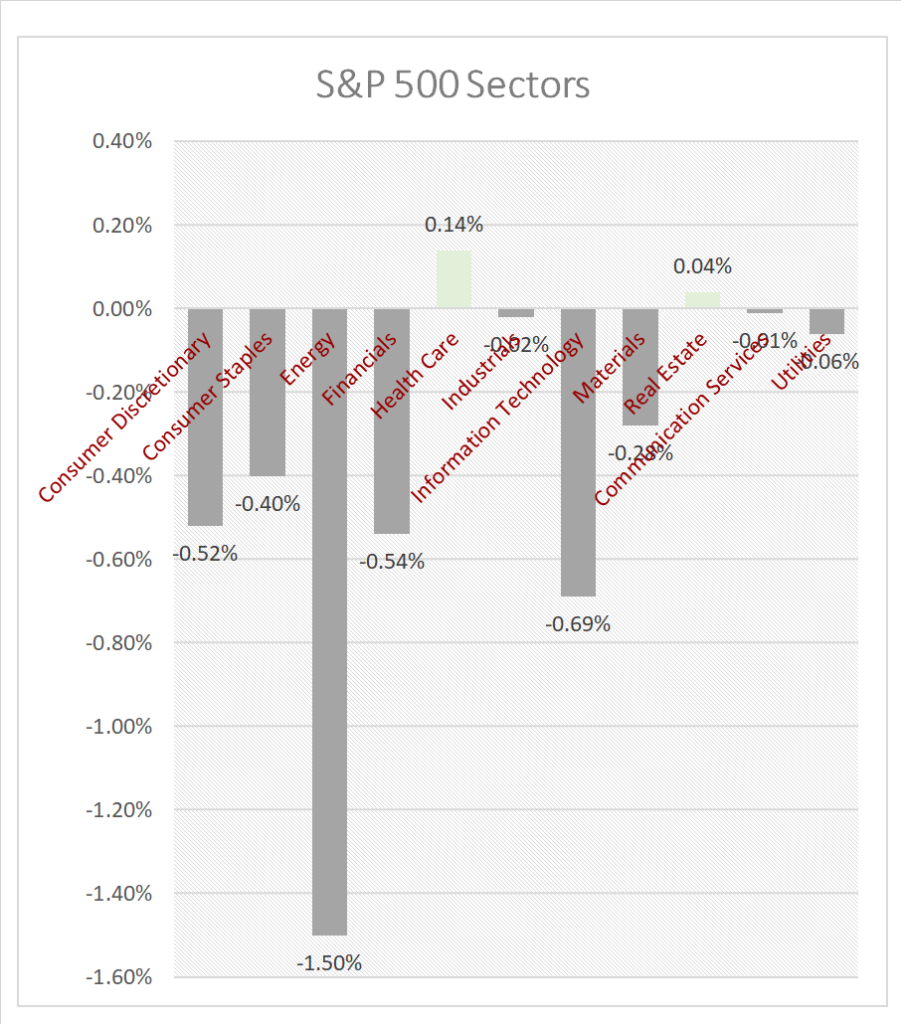

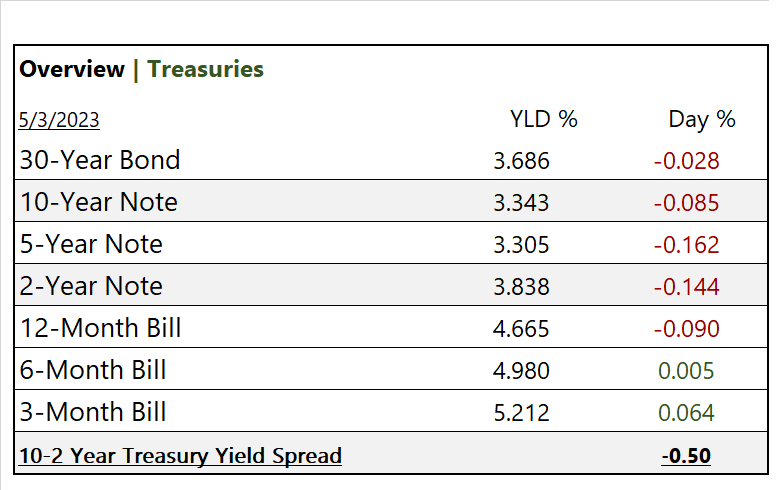

Today, US Markets finished lower, the S&P 500 -0.70%, DOW -0.80%, Nasdaq -0.46%. 9 of 11 of the S&P 500 sectors finished lower on the day, Energy -1.50% led decliners. Yields fell. On the upside, the Defensive/ Healthcare outperformed, Gold +1.66% and Bitcoin +1.50. In economic news, The Federal Reserve approved a quarter-percentage-point interest-rate rise. April ADP Jobs Report reported an increase over consensus. S&P Global US April flash services PMI was in-line with consensus. ISM services slightly beating consensus at 51.9% with numbers above 50 show expansion.

Takeaways

- Federal Reserve approved a quarter-percentage-point interest-rate rise

- Regional Banking down, SPDR S&P Banking ETF (KRE) -1.80%

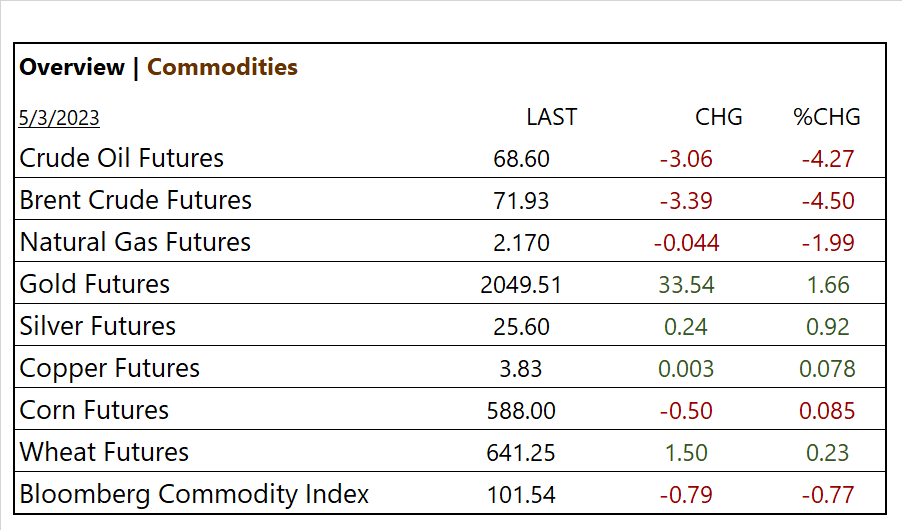

- Energy Sector, Oil continues to fall on Bank fears

- Defensives/ Healthcare outperforms

- Qualcomm (QCOM), CVS Health (CVS), Kraft Heinz (KHC) with earning beats

- March Job Openings greater than expected, misses analyst consensus

- S&P Global US April flash services PMI was in-line with consensus

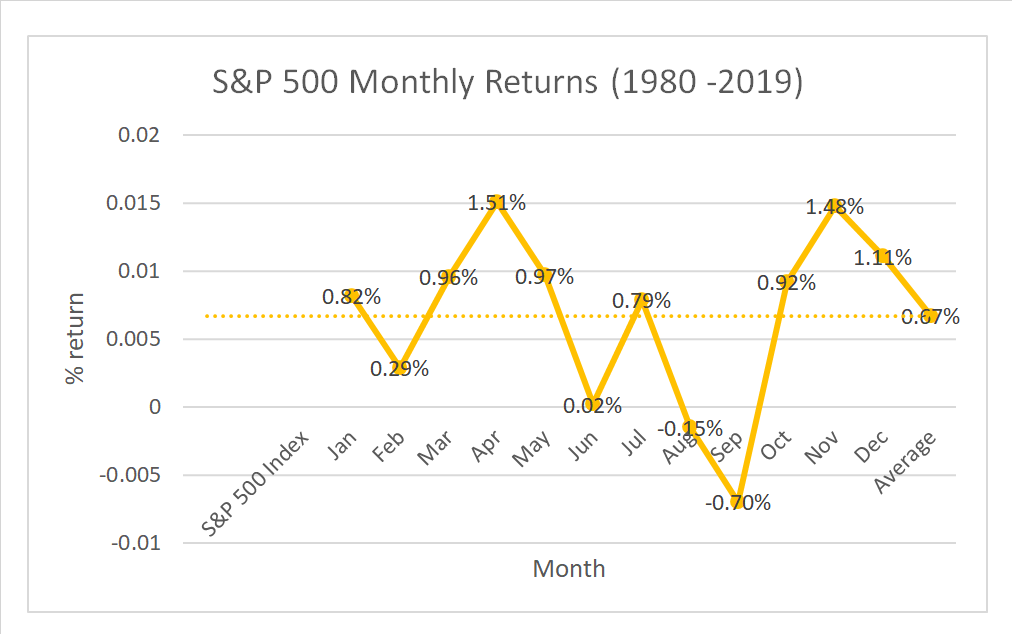

Pro Tip: Is it true “Sell in May and Go Away” strategy, which suggests that investors should sell their stocks in May and buy them back in November.

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 9 of 11 of the S&P 500 sectors finish lower, Energy -1.50% and Information Technology -0.69% led decliners/ Health Care 0.14% and Real Estate 0.04% outperformed

Commodities

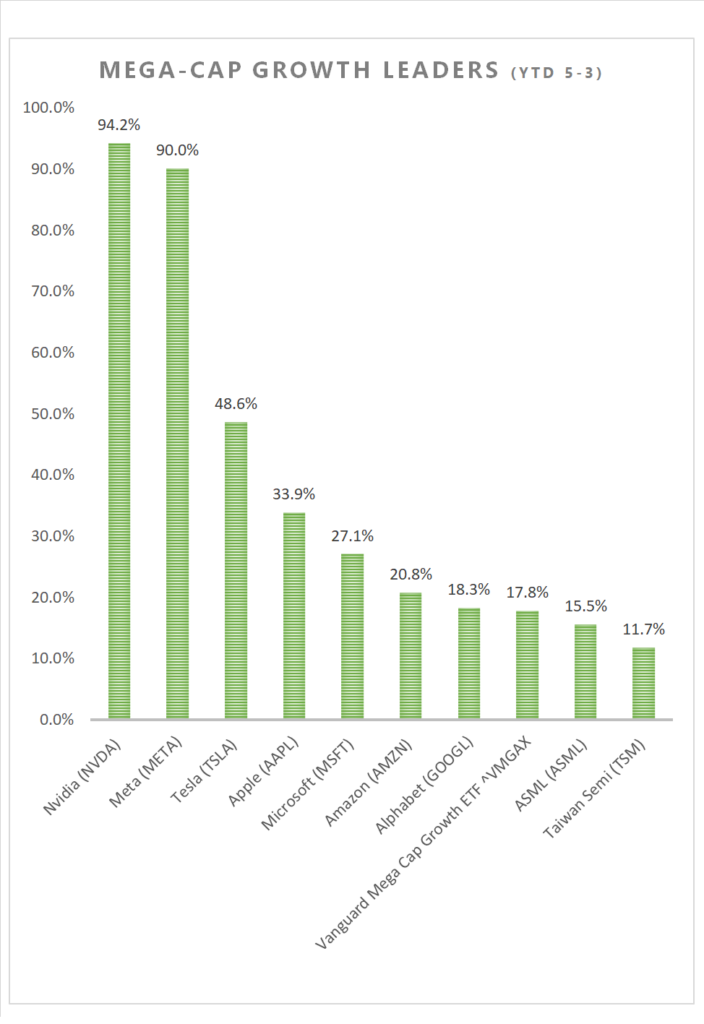

Mega Cap Growth (YTD)

US Treasuries

Notable Earnings Today

- +Beat: Qualcomm (QCOM), CVS Health Corp (CVS), Equinix (EQIX), Kraft Heinz (KHC), Emerson (EMR), Exelon (EXC), Trane Technologies (TT), Realty Income (O), Williams (WMB), Barrick Gold (GOLD), Cognizant A (CTSH)

- – Miss: Airbus Group NV (EADSY), BNP Paribas ADR (BNPQY), Estee Lauder (EL), Public Storage (PSA), MetLife (MET), Phillips 66 (PSX), Yum! Brands (YUM), Allstate (ALL), Albemarle (ALB), Garmin (GRMN)

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Broadcom (AVGO), Citigroup (C), Morgan Stanley (MS), Coca-Cola (KO), Terex (TEX), Owens Corning (OC)

Economic Data

US

- ADP employment; period April, act 290,000, fc 133,000, prev. 142,000

- S&P U.S. services PMI; period April. Act 53.6, fc 7, prev. 53.7

- ISM services; period April. act 51.9%, fc 51.8%, prev. 51.2%

- Federal Reserve interest-rate; period May, The Federal Reserve approved a quarter-percentage-point interest-rate rise. Its tenth consecutive rate increase bringing the federal-funds rate to a range between 5% and 5.25%.

News

Company News/ Other

- Carl Icahn’s empire loses $6 billion in a day after short seller report – Reuters

- Morgan Stanley, UBS Pick Bonds Over Stocks on Recession Risk – Bloomberg

- Oil falls 4%, extending losses after Fed rate hike – Reuters

Central Banks/Inflation/Labor Market

- Bank Pain Is Just Getting Started, Ex-Fed President Kaplan Says – Bloomberg

- World Bank board elects US nominee Ajay Banga as president – Reuters

China

- China’s AI industry barely slowed by US chip export rules – Reuters