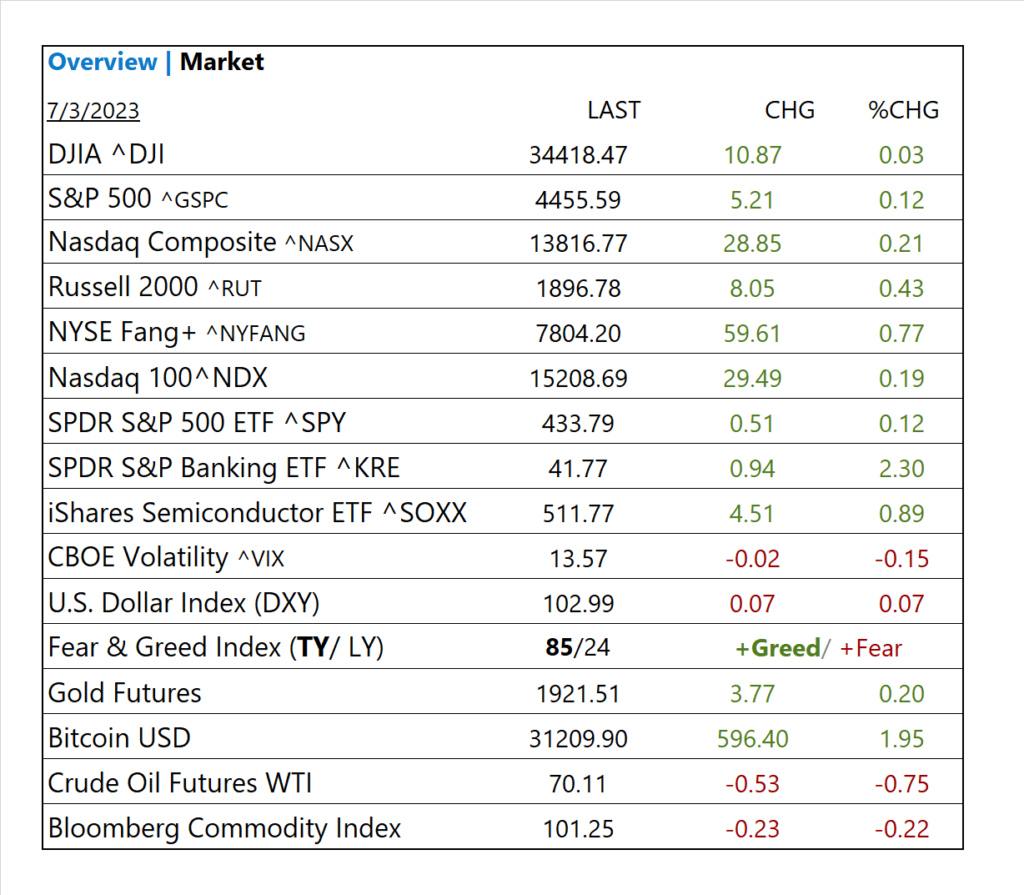

MARKETS TODAY July 3rd, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished higher, Hong Kong’s Hang Seng +2.14%, Japan’s Nikkei 225 +1.70%, China’s Shanghai Composite 1.31%. European markets finished lower, Germany’s DAX -0.41%, France’s CAC 40 -0.18%, London’s FTSE 100 -0.06%. S&P futures were trading at 0.8% below fair-value.

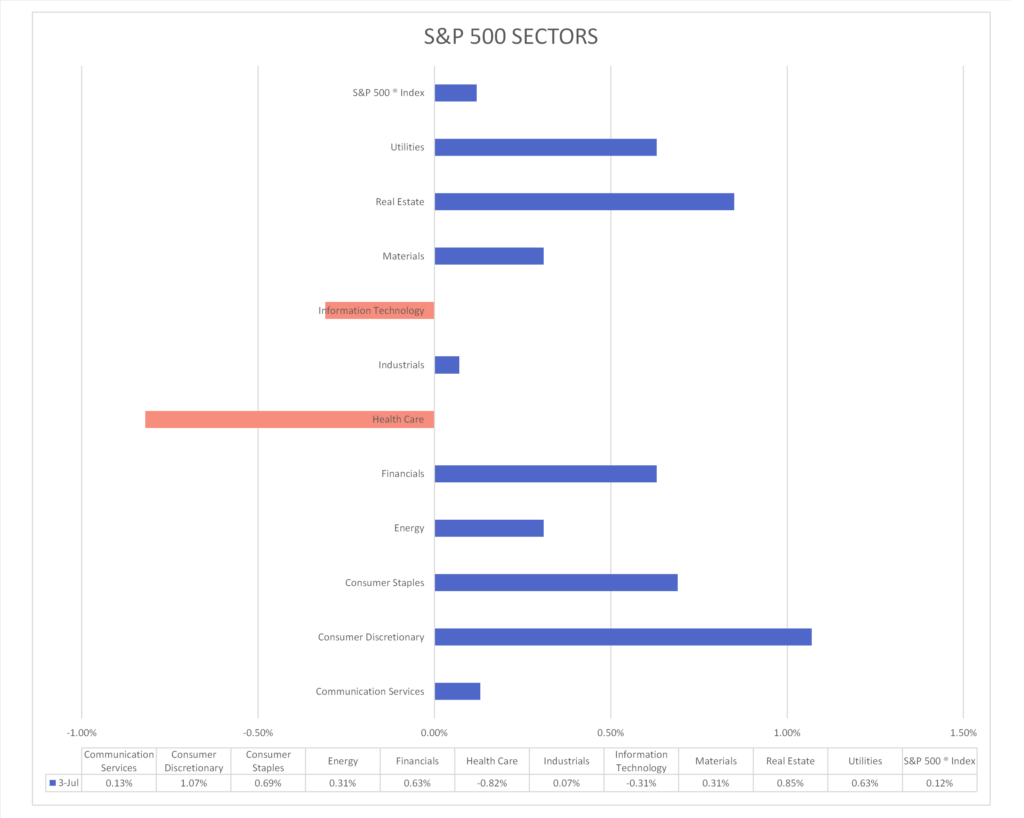

Today US Markets finished moderately higher, S&P 500 +0.12%, DOW +0.03%, NASDAQ +0.21%. 9 of 11 S&P 500 sectors advancing: Consumer Discretionary +1.07% outperforms/ Health Care -0.82% lags. On the upside, Key Indices, FANG+, Small Cap Value, S&P Banking ETF (KRE), Semiconductor ETF (SOXX), Treasury Yields, Gold, Bitcoin. In economic news, June S&P U.S. manufacturing PMI was inline and ISM manufacturing missed on estimates. May Construction spending beat.

Takeaways

- Half trading session, light volume

- S&P U.S. manufacturing PMI inline, ISM manufacturing missed

- FNYSE Fang+ ^NYFANG +0.77%

- 9 of 11 S&P 500 sectors advancing: Consumer Discretionary +1.07% outperforms/ Health Care -0.82% lags.

- S&P Banking ETF (KRE) +2.30%

- Semiconductor ETF (SOXX) +0.89%

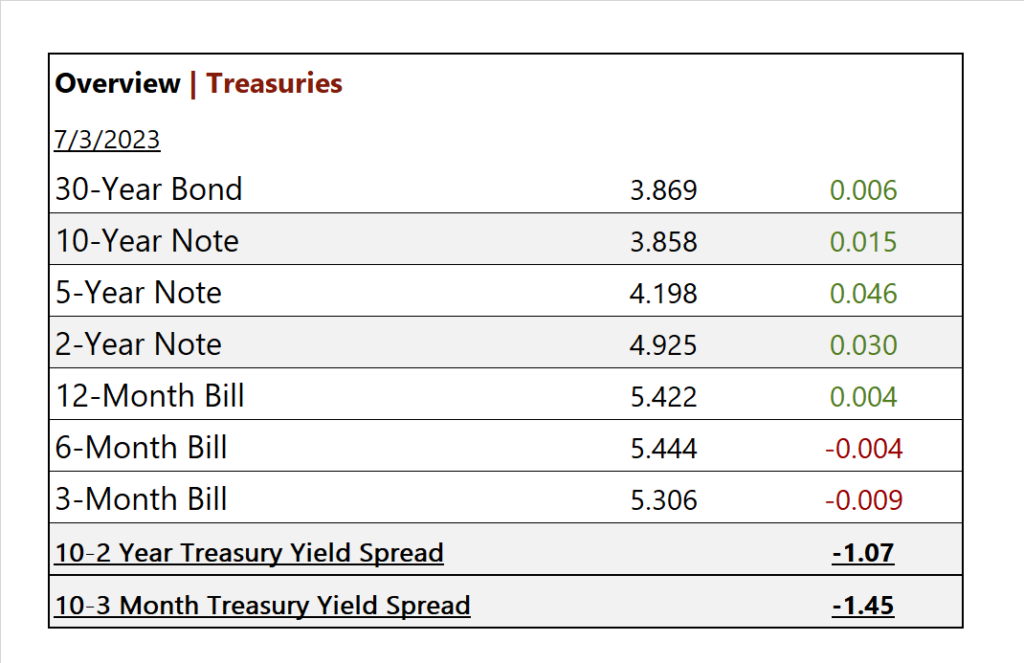

- S. Treasury yields higher

- Bitcoin gains +1.95%

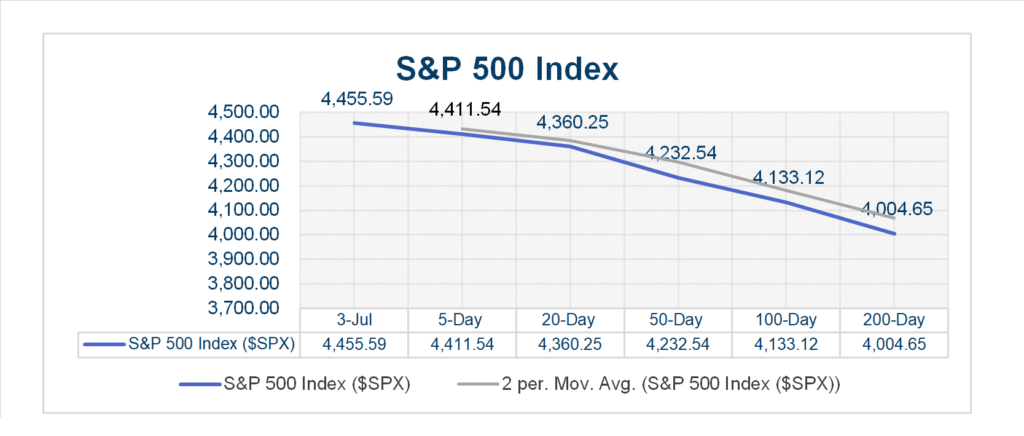

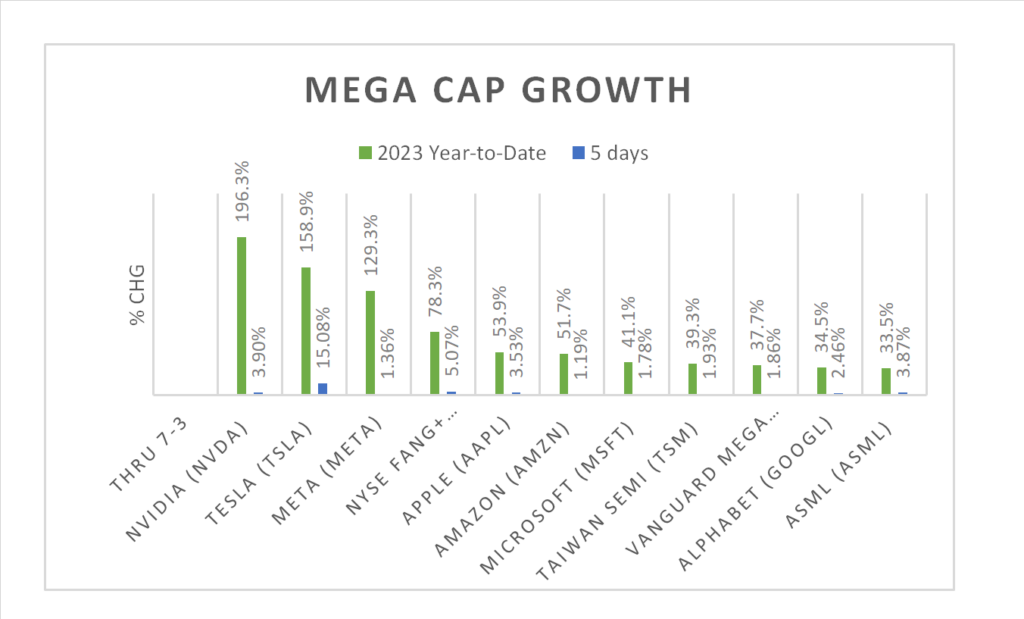

Vica Partner Guidance: Mega and Large Cap Growth continue to look attractive in early Q3. Nasdaq 100^NDX 14,500 level is buying opportunity. HighlightIng Lithium Miners on >+25% CAGR growth. Q3 2023/ credit default swap (CDS) will pick-up. Q1 2024/ expect economy pullback.

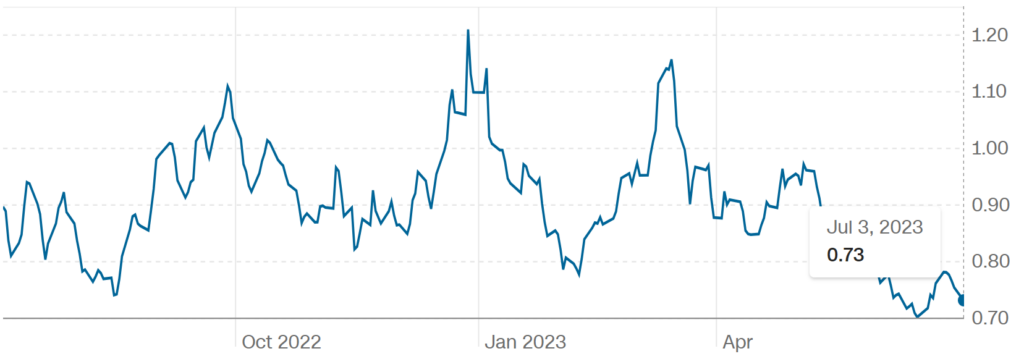

Pro Tip: When the ratio of puts to calls is decreasing it is bullish sign. A ratio below 1 is considered bullish.

PUT AND CALL OPTIONS

Sectors/ Commodities/ Treasuries

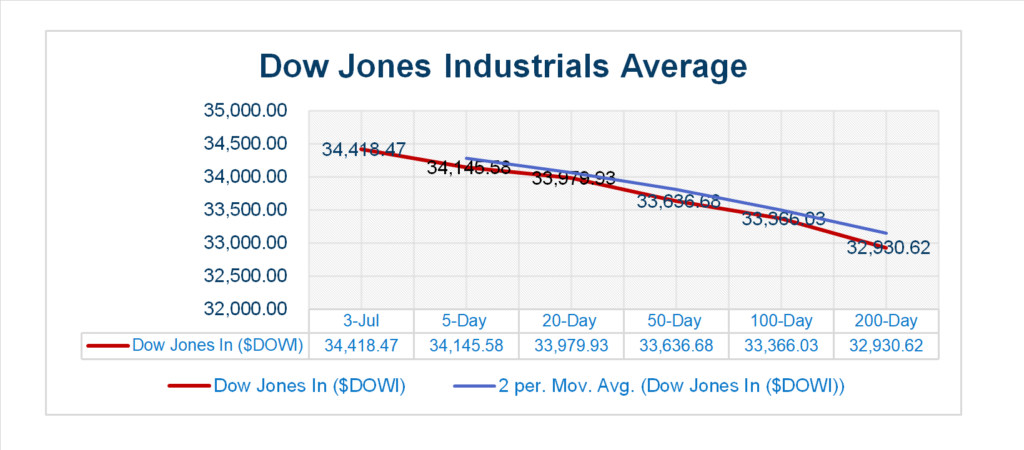

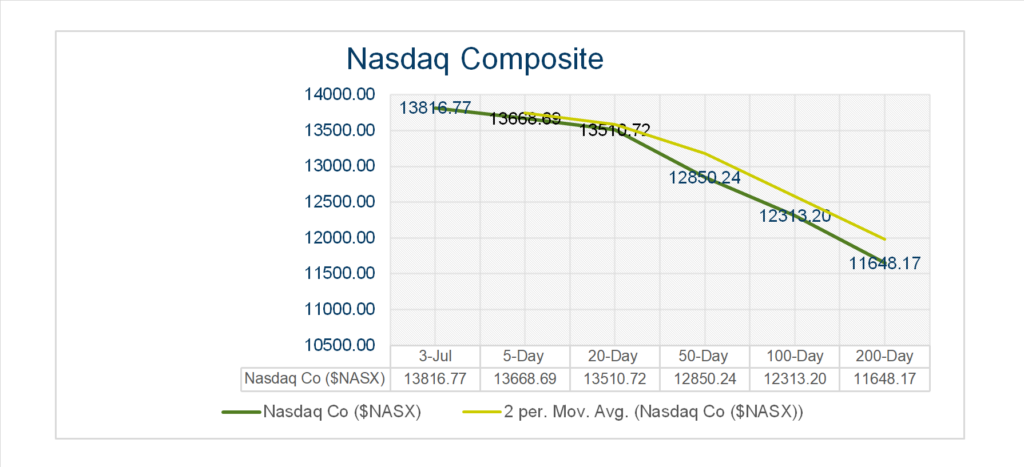

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 9 of 11 S&P 500 sectors advancing: Consumer Discretionary +1.07%, Real Estate +0.85% outperform/ Health Care -0.82%, Information Technology -0.31% lag.

Factors/ Mega Cap Growth

US Treasuries

US Treasuries

Notable Earnings Today

Notable Earnings Today

- +Beat: no notable activity today

- – Miss: no notable activity today

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML)

Economic Data

US

- S&P U.S. manufacturing PMI (final); period June, act 46.3, fc 46.3, prior 46.3

- ISM manufacturing, period June, act 46.0%, fc 47.3%, prior 46.9%

- Construction spending. period May, act 0.9%, fc 0.5%, prior 4%

News

Company News/ Other

- Diamond Giant De Beers to Let Botswana Keep Half of Production – WSJ

- China’s BYD Takes Next Steps on $290 Million Lithium Project in Chile – Bloomberg

- America’s Factory Building Boom – WSJ

- Adobe’s $20 Billion Takeover of Figma Faces EU Merger Review – Bloomberg

Energy/ Materials

- Market Bets on Cheaper Oil, Undermining Saudi Hopes for a Price Rebound – WSJ

- Venture Capital Funding for Climate Tech Dips 40% in First Half of 2023 – Bloomberg

- Lumber Producers Are Back in Favor on Wall Street – WSJ

Central Banks/Inflation/Labor Market

- US Manufacturing Activity Shrinks by Most in Three Years – Bloomberg

- Janet Yellen Sees Path to Cool Inflation With Healthy Job Market – Bloomberg

China/ International