MARKETS TODAY Nov 29 (Vica Partners) – U.S. stocks closed mostly lower Tuesday as the Dow gained a mere 3 points following Monday’s selloff. Traders await both Jerome Powell’s remarks on economy and a slew of reports out later this week that could spark renewed worries among investors.

The Dow Jones Industrial Average gained 3 points. The S&P 500 dropped 0.2%, and the Nasdaq Composite declined 0.6%.

Key Market Statistics

- S&P 500 and Nasdaq ended lower today

- 10-year Treasury yield flat at 3.748%, the 2 year Treasury yield flat at 4.481%

- S. Dollar Index (DXY) up at $106.84, 0.14%

- Bitcoin up at $16,432, 1.40%

- Oil prices mixed with Brent crude down $83.03 , -0.16%, and US West Texas Intermediate up at $78.70 or 0.64%

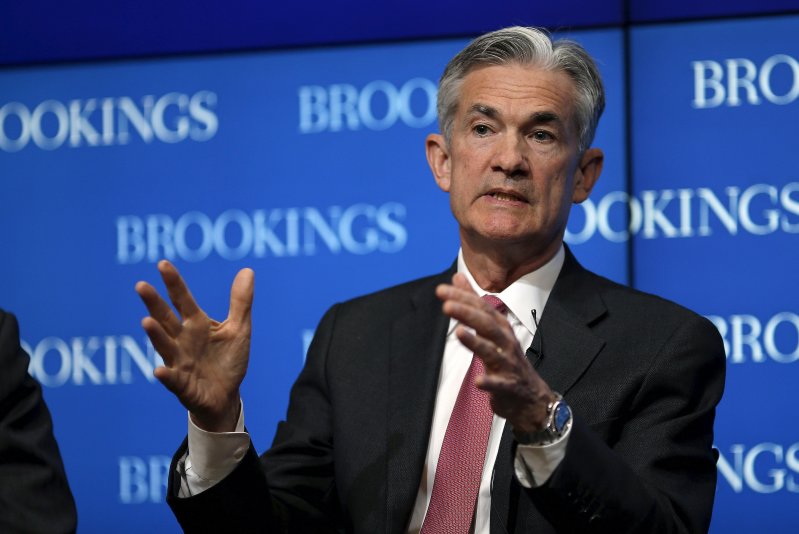

Fed Chair Jay Powell speaks tomorrow at the Brookings Institute

Fed Chair speaks tomorrow! Key market data due out later tomorrow including ADP’s private business payroll figures and job openings on with unemployment data on Friday. Analysts will be focusing on jobs data as tight labor market is historically associated with high inflation, and personal spending as they could provide further Federal Reserve intervention.

S&P 4,000 level benchmark, today closing down today at 3,958

The S&P 500 is on its 200-day moving average. The line has been a resistance level for the index, most notably in April and August and can indicate a breakout. Since the late September lows the index is up about 11%.

Vica Momentum Stock Report

Helmerich & Payne NYSE (HP) (Grade A-) 50 Day Average +17.36%, 100 Day Average +17.19%, 200 Day Average +48.10, YTD +112.53%.

Helmerich & Payne Inc. is engaged in the contract drilling of oil and gas wells in the U.S. and internationally. The company supplies drilling rigs, equipment, personnel, and camps on a contractual basis to explore for and develop oil and gas.

IMPORTANT TO READ; Low interest rates will return!

The Federal Reserve gave guidance that back in August of 2022 that they would raise rates to 4% and have. Rate adjustments will drive down inflation and slow the pace of the economy. Company earnings will remain mixed with stronger support for Communication services, Consumer staples, Energy, Financials and Health care. As these sectors tend to perform well during recessions

Following 2022 we expect the Central Bank to begin to cut interest rates in late Q2 of 2023 to avoid an extended recession. As the cure for inflation is not just raising rates. Vica analysts see a significant policy change coming by late spring of 2023 with Powell reversing direction… just look at 12 month declining lower commodity pricing and new reports on rising retail inventories.

Yearly commodity prices will rise “as there are still production shortages” which include: iron, copper and crude oil. Upside will continue!

Solid strategy for these type of market days ….

We suggest investing in companies that have solid balance sheets and offer dividends.

Look to Communication services, Consumer staples, Energy, Financials and Health care as these sectors tend to perform well during recessions

Best to continue to cost average buy value stocks and resist most all tech and growth stocks where companies have negative margins. Our Teams forecast a negative 6-8% valuation correction for speculative stocks. DON’T try to time market lows!

*** Watch for our emerging 30/ 60/ 90 day Sector and leading company watchlist’s

*** Look to Index ETF’s like SPY to outperform stocks and most managed funds

*** Energy is the Top Performing Sector in S&P 500 Year to Date and will regain strength

*** Banks will profit from higher interest rates on new loans and other products which will offset defaults