MARKETS TODAY April 13th, 2023 (Vica Partners)

Happy Thursday!

Yesterday, key Indices closed lower, Nasdaq and FANG+ led decliners w/ the Semiconductor ETF ^SOXX down 1.83%. 6 of 11 of the S&P 500 sectors were higher/ Industrials outperformed, Communication Services lagged. Yields decline across the curve. In economic news, CPI headline inflation for March came in lower-than-expected and Core was inline. FOMC Minutes published yesterday forecast from that banking sector stress would move the economy into recession

Overnight, Asian markets finished mixed as the Nikkei 225 gained 0.26% and the Hang Seng rose 0.17% and the Shanghai Composite lost 0.27%. Premarket, European markets finished higher today with shares in France leading the region. The CAC 40 was up 1.13% the London’s FTSE 100 up 0.24% and Germany’s DAX up 0.16%. S&P 500 US futures were trading +0.4% above fair value fair value prior to opening.

US markets today, Key Indices closed sharply higher led by Nasdaq and FANG+. 10 of 11 of the S&P 500 sectors were higher – Communication Services and Consumer Discretionary outperform/ Real Estate lags. Yield mostly rise, Bitcoin and Gold gain as while USD Index moves lower. In economic news, headline PPI and Core PPI came in lower than expected for March. US initial jobless claims were higher than expected while continuing jobless claims were in-line.

Takeaways

- PPI and Jobs data promotes Market rally today

- CBOE Volatility Index ^VIX closes at 17.80, records a YTD low today

- Nasdaq and FANG+ lead “BIG tech back on top”

- Communication Services and Consumer Discretionary outperform

- Bitcoin and Gold price “near record high” continue to rise

- Markets are pricing in a 71% chance of a 25-basis-point rate hike in the May

- Q1 Bank earning risk as $300b in deposits exit banks last month

Pro Tip: Level set your portfolio performance. Warren Buffett Portfolio obtained a 9.21% compound annual return, with a 13.51% standard deviation, in the last 30 Years.

Sectors/ Commodities/ Treasuries

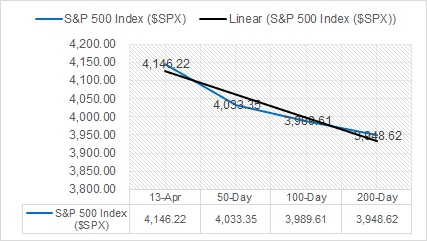

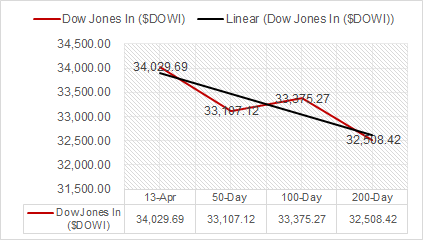

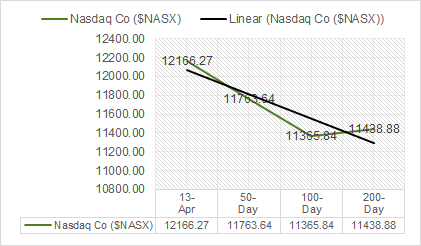

Key Indexes (50d, 100d, 200d)

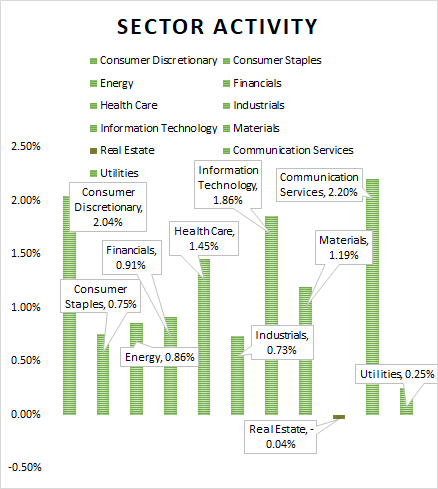

S&P Sectors

- 10 of 11 of the S&P 500 sectors were higher – Communication Services +2.20% and Consumer Discretionary +2.04% outperform/ Real Estate -0.04% underperforms

Commodities

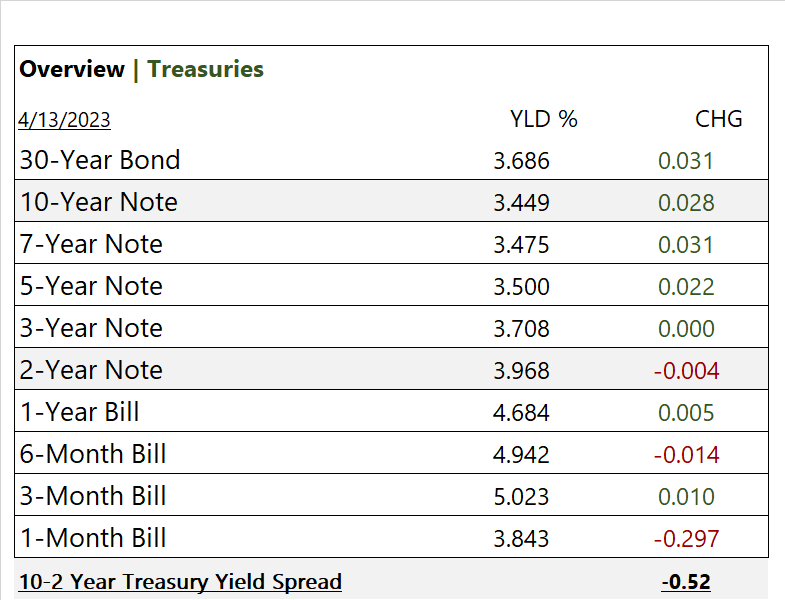

US Treasuries

Notable Earnings This Week (bold denotes today)

- + PriceSmart (PSMT), Greenbrier (GBX), Albertsons (ACI), Royal Gold (RGLD), Louis Vuitton ADR (LVMUY), Aeon ADR (AONNY), Fast Retailing ADR (FRCOY), Fastenal (FAST)

- – Tilray (TLRY), CarMax (KMX), Progressive (PGR), Infosys ADR (INFY), Delta Air Lines (DAL)

- * Strong support – Qualcomm (QCOM), Vale (VALE) , Infosys ADR (INFY)E), Rio Tinto (RIO), Analog Devices (ADI), Occidental Petroleum (OXY), Humana (HUM), Merck (MRK), OC (Owens Corning), Berkshire H (BRK-B), Canadian Imperial Bank (CM), Alpha Metallurgical Resources (AMR)

Economic Data

US

- Producer price index; period March, act -0.5, fc 0.0%. prev. 0.0%

- Core PPI, period March., act 0.1%, fc 0.3%. prev. 0.2%

- PPI year over year, period March, act 2.7%, fc 3.0%, prev. 4.9%

- Core PPI year over year, period March, act 3.6%, prev. 4.5%

- Initial jobless claims, period April 8, act 239,000, fc 235,000, prev. 228,000

- Continuing jobless claims, period April 1, act 1.81m, prev. 1.82 million

Summary – PPI weaker than expected. PPI MoM for March falling lower than expected, declining -0.5% below the 0% estimate. On an annual basis it declined to 2.7% vs 3% expected. Core PPI MoM was also lower coming in at -0.1% vs 0.3% estimate and down from 0.2% in February. US initial jobless claims 239K vs 235K expected, continuing jobless claims were 1810k vs 1814k.

News

Company News/ Other

- JPMorgan Leads Bank Earnings This Week As Balance Sheets, Guidance Key – Investors

- Delta Air offers bullish outlook on international travel demand – Reuters

- Lithium price free fall wipes out gains since November 2021 – Nikkei

Central Banks/Inflation/Labor Market

- Factbox: Wall St banks expect one more Fed rate-hike as recession looms – Reuters

- Fed’s Emergency Loans to Banks Fall For Fourth Straight Week – Bloomberg

China

- China’s exports rise unexpectedly, but economists warn of weakness ahead – Reuters