The Setup:

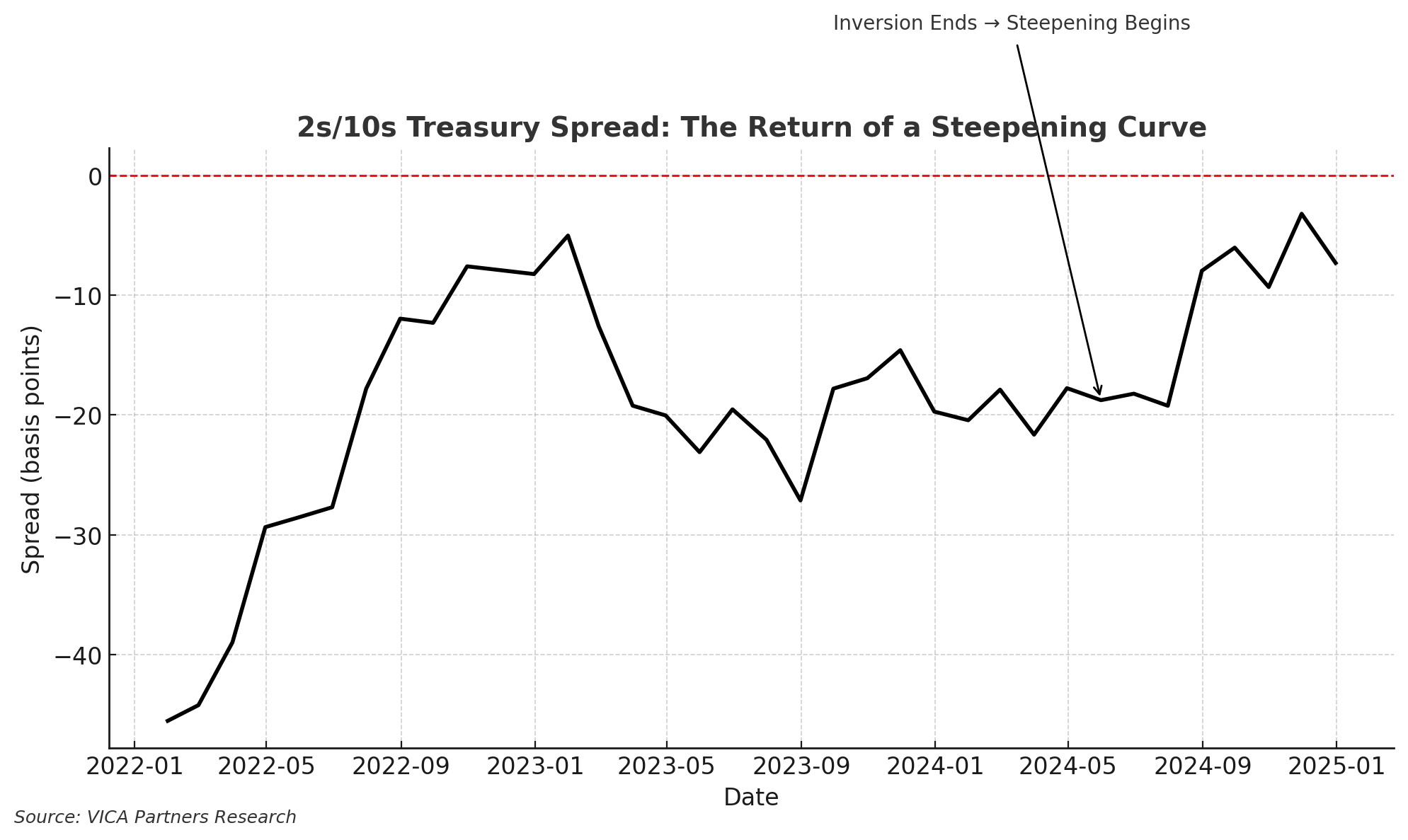

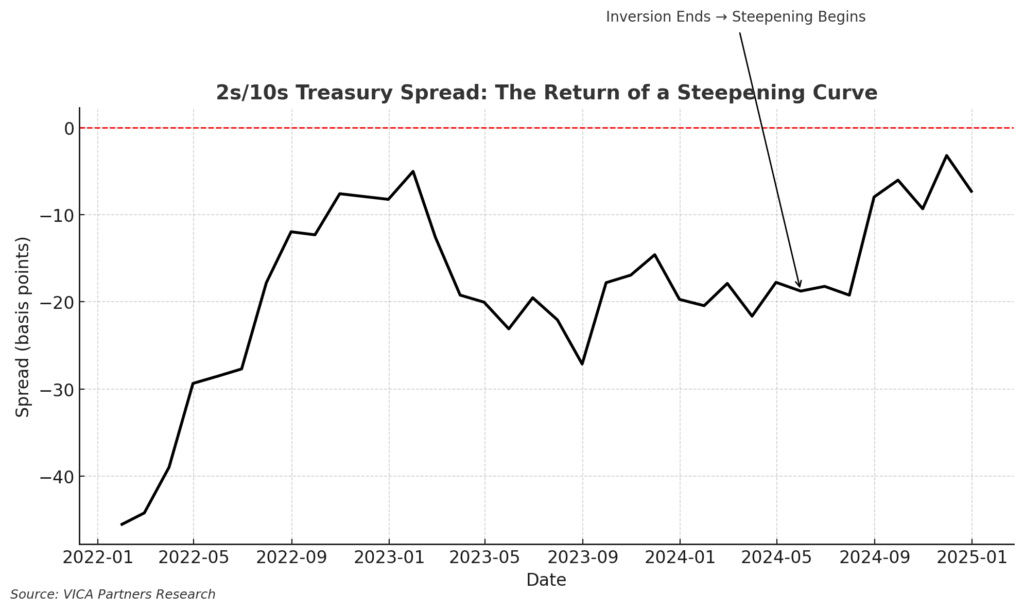

Long-term U.S. Treasury yields are rising sharply — not just as a headline, but as a structural pivot. After years of flat or inverted curves, we’re now entering a regime where longer-dated yields decisively outpace short-term rates. The 2s/10s spread is near its widest since 2022.

Insight:

The 2s/10s spread is quietly shifting from inversion to steepening — a foundational pivot that signals the return of time-based capital discipline.

This isn’t just about rates — it’s about the reawakening of real yield curves as allocators’ compass.

Why It Matters (Beyond Banks):

A steepening curve isn’t just good for lenders — it’s a macro cue for allocators. It implies capital is being repriced for time and risk. That means opportunity — and risk — is no longer front-loaded. For investors, it’s a green light to re-evaluate:

-

Duration Exposure: Locking in long-term fixed income yields at higher levels may become more attractive — especially as shorter-duration instruments start to underperform in relative terms.

-

Equity Sector Repositioning: A steeper curve traditionally favors capital-intensive and cyclical sectors. But in a high-volatility, policy-fragmented environment, conviction requires precision — not passive beta.

-

Credit Quality Compression: As rates rise and curves normalize, spreads in lower-rated credit could tighten before breaking. Knowing when to exit is as important as when to enter.

Capital Implication:

This is a reversion to a more “normal” curve — but the environment is anything but. Trade policy noise, deficit fears, and regulatory shifts complicate the macro picture. Yet for nimble investors, this steepening offers strategic windows: not just in bonds or bank stocks, but across capital structure plays.

Bottom Line:

The yield curve’s shift is a signal — not a headline. Ignore the banks. This is about capital rotation, duration risk, and selective opportunity. Steepening is the macro tell smart capital doesn’t ignore.