Stay Informed and Stay Ahead: Market Watch, January 11th, 2024.

Market Highlights & Analysis: Indices, Sectors, and More…

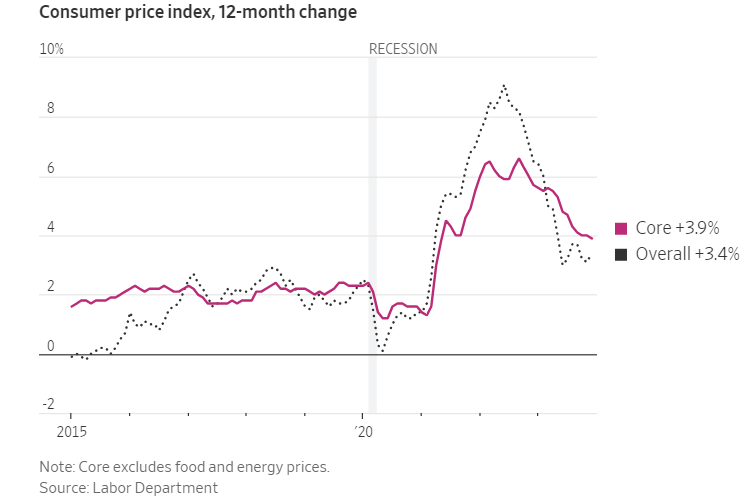

- Economic Data: Jobless claims beat forecasts at 202,000. Dec. CPI and Core CPI slightly exceed expectations, with YoY increases.

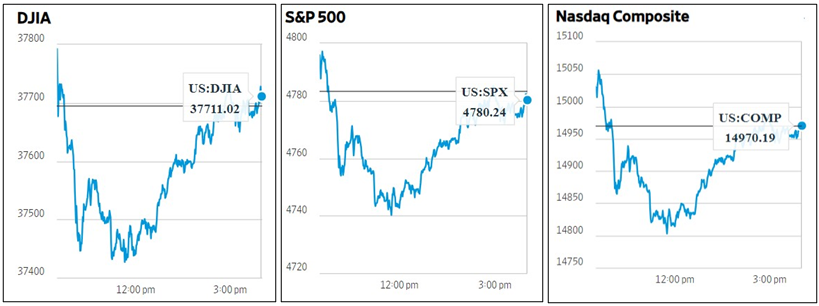

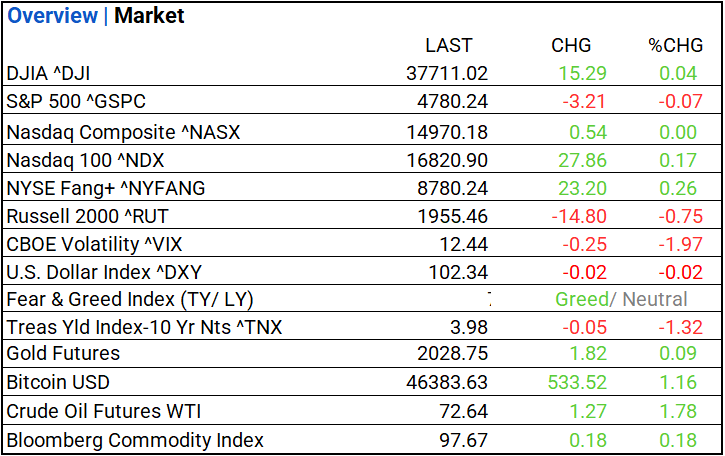

- Market Indices: DJIA (+0.04%), S&P 500 (-0.07%), Nasdaq Composite (+0.00%).

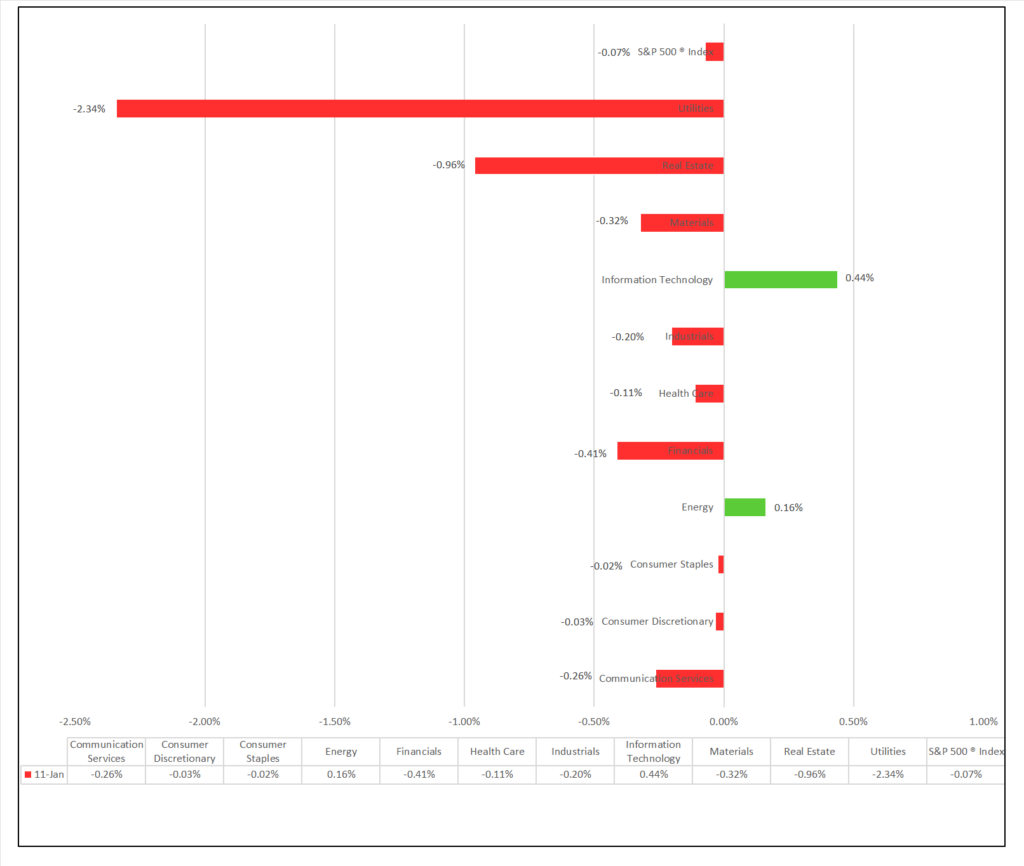

- Sector Performance: 9 of 11 sectors lower; Information Technology (+0.44%) leading, Utilities (-2.34%) lagging. Top industry: Personal Care Products (+1.35%).

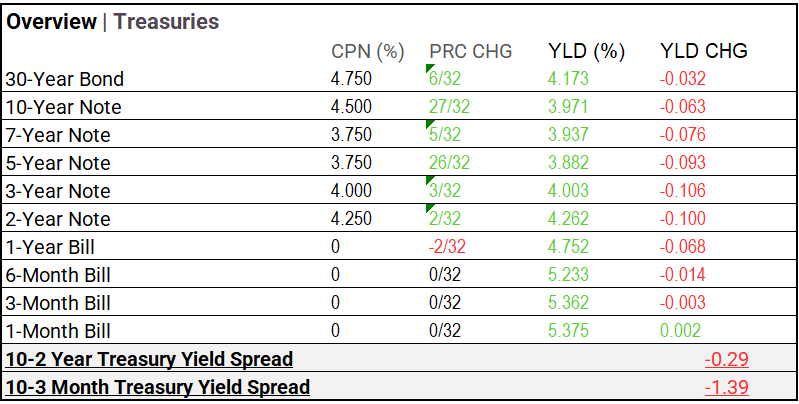

- Treasury Markets: Long-term bond yields experienced mixed movements, with the 30-Year Bond slightly increasing, while shorter-term maturities, including the 10-Year Note, exhibited modest declines.

- Commodities: Bitcoin ETF SEC approval sparks late rally, Gold retains gains, WTI Crude Oil up 1.78%, Bloomberg Commodity Index rises.

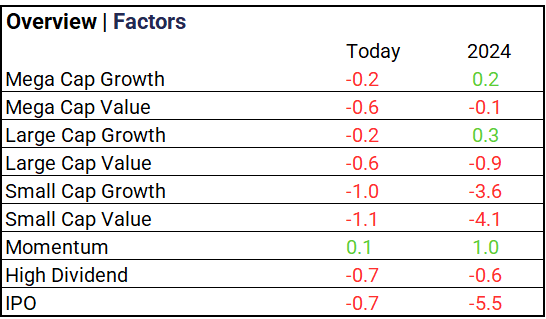

- Factors: Momentum up 0.1%, securing a +1.0% lead year-to-date (YTD).

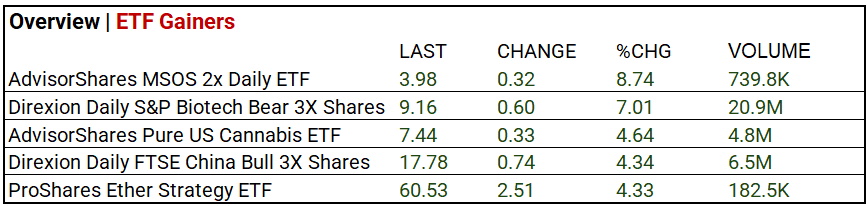

- ETFs: Cannabis AdvisorShares leads, while Direxion Daily FTSE China Bull 3X Shares rises with significant volume.

US Market Snapshot: Key Stock Market Indices:

- DJIA ^DJI: 37,711.02 (+15.29, +0.04%)

- S&P 500 ^GSPC: 4,780.24 (-3.21, -0.07%)

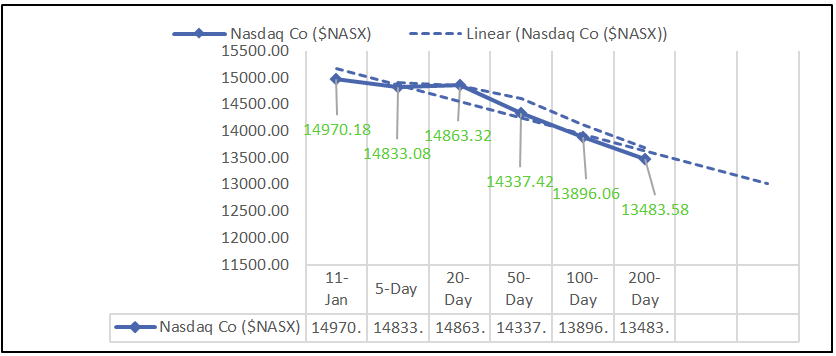

- Nasdaq Composite ^NASX: 14,970.18 (+0.54, 0.00%)

- Nasdaq 100 ^NDX: 16,820.90 (+27.86, +0.17%)

- NYSE Fang+ ^NYFANG: 8,780.24 (+23.20, +0.26%)

- Russell 2000 ^RUT: 1,955.46 (-14.80, -0.75%)

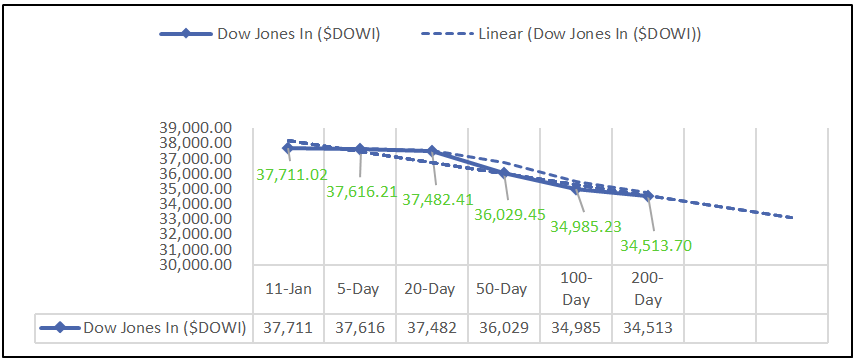

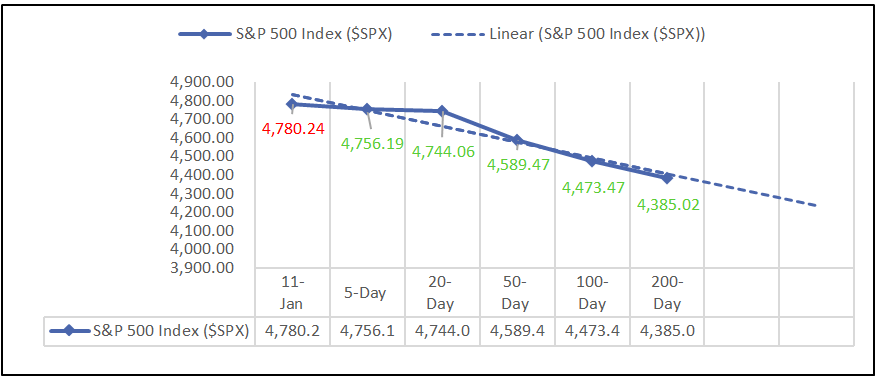

Moving Averages: DOW, S&P 500, NASDAQ:

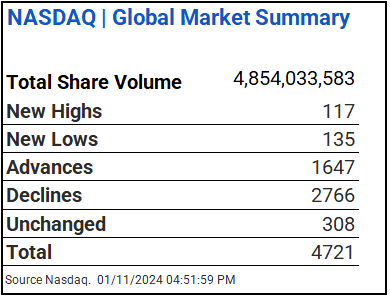

NASDAQ Global Market Summary:

Sectors:

- 9 of 11 sectors lower; Information Technology (+0.44%) leading, Utilities (-2.34%) lagging. Top industries: Personal Care Products (+1.35%), Entertainment (+1.30%), and Apparel & Luxury Goods (+1 .30%).

Factors:

- Momentum up 0.1%, securing a +1.0% lead year-to-date (YTD).

Treasury Markets:

- Long-term bond yields experienced mixed movements, with the 30-Year Bond slightly increasing, while shorter-term maturities, including the 10-Year Note, exhibited modest declines.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 102.34 (-0.02, -0.02%)

- CBOE Volatility ^VIX: 12.44 (-0.25, -1.97%)

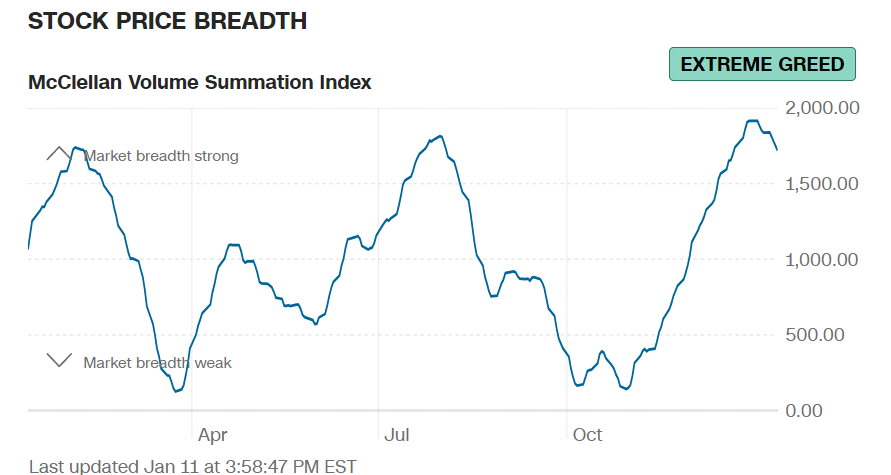

- Fear & Greed Index: 72/LY 54 (Greed/ Neutral)

Commodity Markets:

- Gold Futures: $2,028.75 (+$1.82, +0.09%)

- Bitcoin USD: $46,383.63 (+$533.52, +1.16%)

- Crude Oil Futures WTI: $72.64 (+$1.27, +1.78%)

- Bloomberg Commodity Index: 97.67 (+$0.18, +0.18%)

ETF’s:

- Cannabis is on the rise, with AdvisorShares MSOS 2x Daily ETF up 8.74% and AdvisorShares Pure US Cannabis ETF gaining 4.64% on a 4.8 million volume. Additionally, Direxion Daily FTSE China Bull 3X Shares shows strong performance, increasing by 4.34% with a significant 6.5 million volume.

US Economic Data:

- Initial Jobless Claims (Jan. 6): 202,000 (Forecast: 210,000, Previous: 203,000)

- CPI (Dec.): 0.3% (Forecast: 0.2%, Previous: 0.1%)

- Core CPI (Dec.): 0.3% (Forecast: 0.3%, Previous: 0.3%)

- CPI (Year-over-Year): 3.4% (Forecast: 3.2%, Previous: 3.1%)

- Core CPI (Year-over-Year): 3.9% (Forecast: 3.8%, Previous: 4.0%)

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT: Fast Retailing ADR (FRCOY), Infosys ADR (INFY).

- MISSED: Seven i ADR (SVNDY).

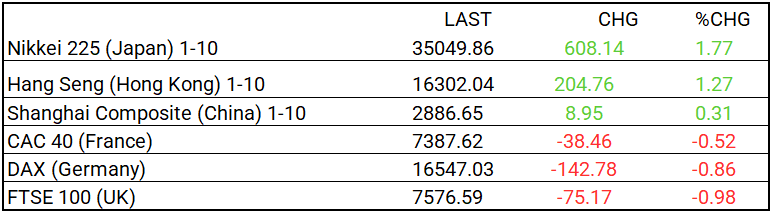

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): 35,049.86 (+608.14, +1.77%)

- Hang Seng (Hong Kong): 16,302.04 (+204.76, +1.27%)

- Shanghai Composite (China): 2,886.65 (+8.95, +0.31%)

- CAC 40 (France): 7,387.62 (-38.46, -0.52%)

- DAX (Germany): 16,547.03 (-142.78, -0.86%)

- FTSE 100 (UK): 7,576.59 (-75.17, -0.98%)

Central Banking and Monetary Policy, Noteworthy:

- Inflation Edged Up in December After Rapid Cooling Most of 2023 – WSJ

- Americans Begin to Believe Inflation Is Cooling – WSJ

- Lagarde Says ECB to Cut Rates When Sure Inflation Set for 2% – Bloomberg

- Why the Cost of Money Is About to Go Up – Bloomberg

Energy:

- Blockbuster Natural-Gas Merger Is Almost Too Perfect – WSJ

- A $290 Billion Investment Cements Natural Gas’s Relevance for Decades – Bloomberg

China:

- China’s car industry on a roll as production and sales hit all-time high in 2023 – SCMP