MARKETS TODAY July 17th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished mixed, Hang Seng gained 0.33%, while China’s Shanghai Composite -0.87%, Japan’s Nikkei 225 -0.09% ended lower. European markets finished lower today with France’s CAC 40 is down 1.12%, London’s FTSE 100 off 0.38% and Germany’s DAX is lower by 0.23%. S&P futures opened trading at +0.1% above fair value.

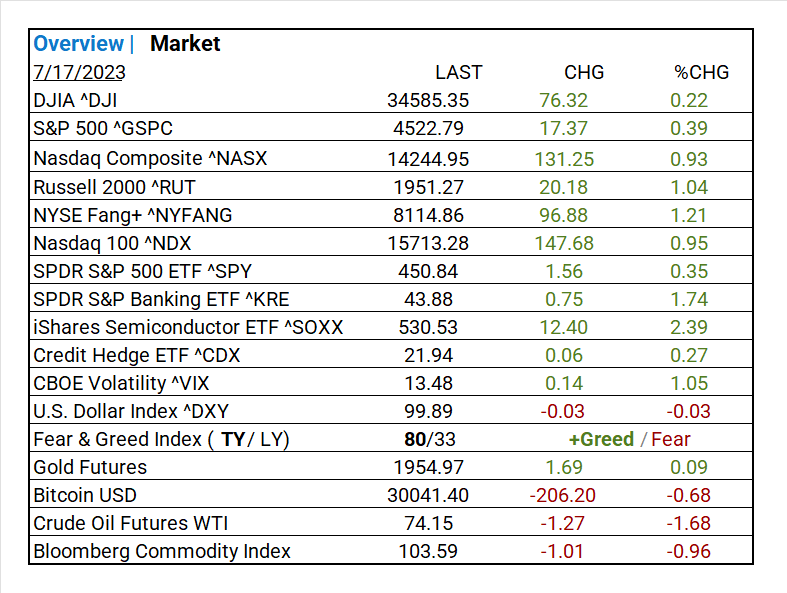

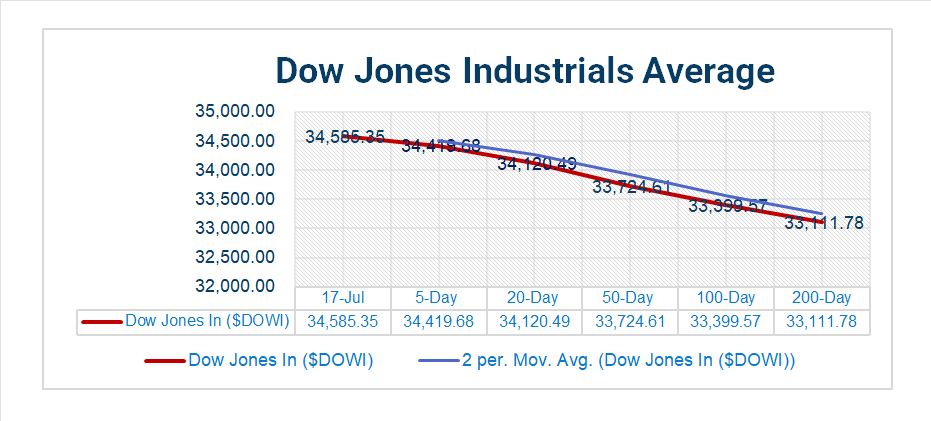

Today US Markets finished higher, S&P 500 +0.39%, DOW +0.22%, NASDAQ +0.93%. 6 of 11 S&P 500 sectors declining: Information Technology +1.33% outperforms/ Utilities -1.18% lags. On the upside, Nasdaq, NYSE Fang+, Semiconductor ETF ^SOXX, SPDR S&P Russell 2000 ^RUT , Banking ETF ^KRE, Sub Automobiles, Gold.

In economic news, Empire State Manufacturing Survey, general business conditions index declined. New orders were up, while inventories were down. Input and selling price increases continued to moderate. Firms expect conditions to improve, optimism neutral.

Takeaways

- Empire State Manufacturing Survey, Firms expect conditions to improve.

- Nasdaq+0.93%, NYSE Fang+1.21% lead the majors

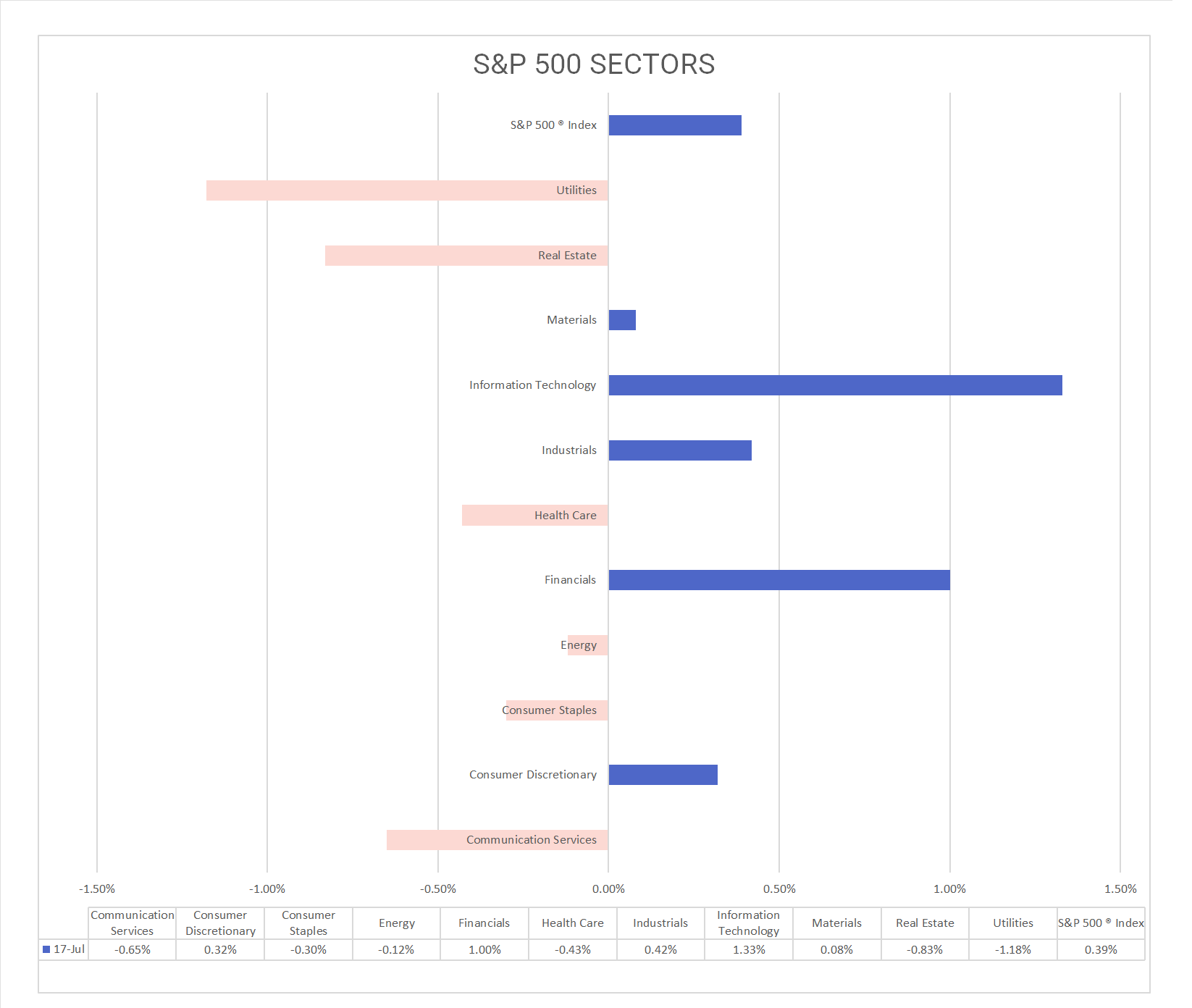

- 6 of 11 S&P 500 sectors declining: Information Technology +1.33% outperforms/ Utilities -1.18% lags.

- iShares Semiconductor ETF ^SOXX +2.39%

- Russell 2k +1.04%, SPDR S&P Banking ETF ^KRE +1.74%

- Factor/ Automobiles +2.18%,

- Gold moderate gain

- BIG Bank earning tomorrow/ Bank of America (BAC)BAK, Morgan Stanley (MS)

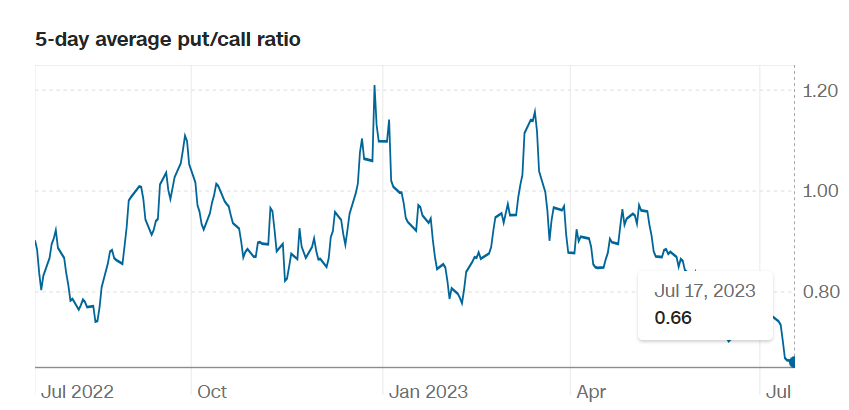

Pro Tip: When the Put/ Call option ratio is below 1 it’s a sign of market optimism.

Sectors/ Commodities/ Treasuries

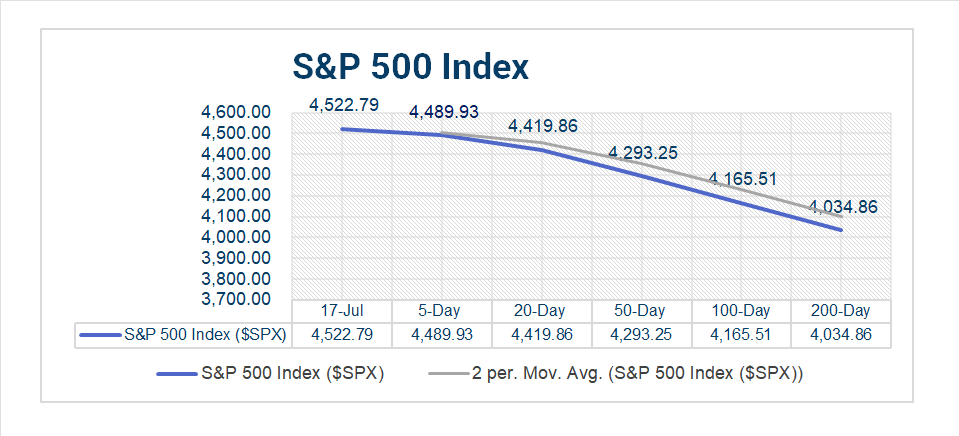

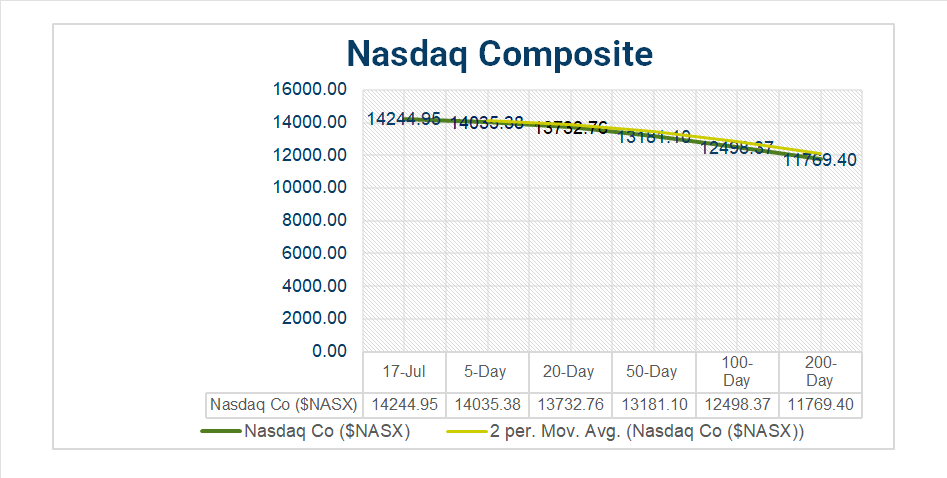

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 6 of 11 S&P 500 sectors declining: Information Technology +1.33% outperforms/ Utilities -1.18% lags.

- Information Technology/ Sub Semiconductor & Semiconductor Equipment +2.39%, Technology Hardware, Storage & Peripherals+1.68%. Others/ Sub Automobiles +2.18%, Banks +1.76%, Construction & Engineering +1.62%.

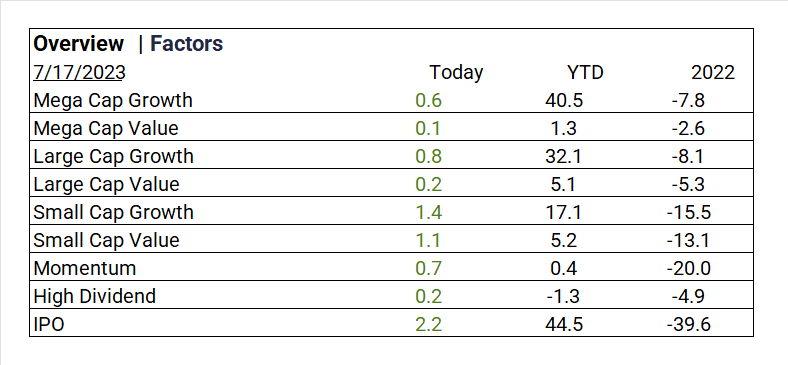

Factors

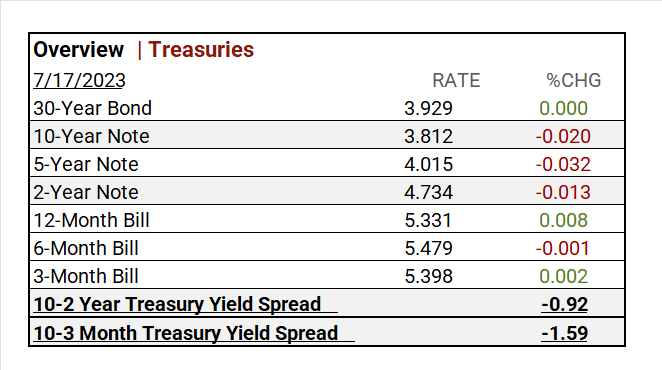

US Treasuries

Q2 ’23 Top Line Earnings Preview

- In Q1 ’23: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 S&P 500 EPS expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

- Expect lower Q1 revenues

- Call topics: economic uncertainty, aggregate demand, inventories, costs, roi

Notable Earnings Today

- +Beat: Axfood ADR (AXFOY), Washington Federal (WAFD)

- – Miss: Equity Lifestyle (ELS), FB Financial (FBK)

Economic Data

US

- Empire State manufacturing survey; period July, act 1.1, prior 6.6

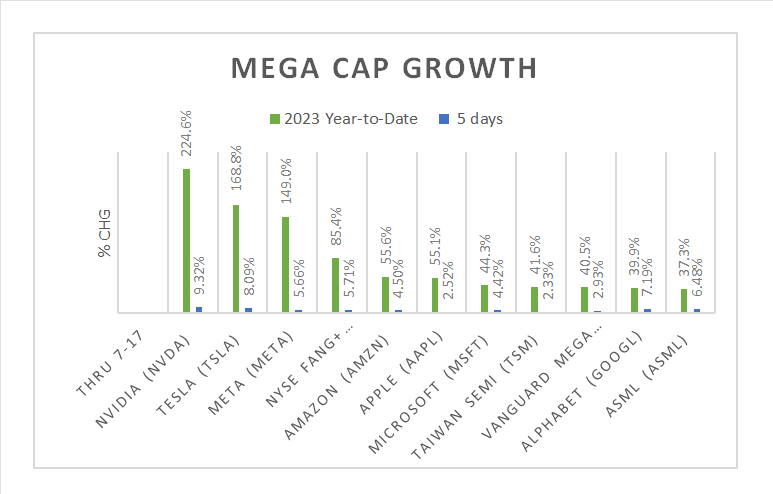

Vica Partner Guidance July ‘23: Mega and Large Cap Growth continues to look attractive in early Q3. Highlighting Metals & Mining, Semiconductor & Semiconductor Equipment, Construction Materials, Energy Services. Nasdaq 100^NDX <15,000 level is a buying opportunity. Undervaluation of Japanese equities, upside for Chinese Mega Cap Tech. Q3/4 2023/ credit default swap (CDS) will pick-up. Forward looking CAGR growth below.

We continue to emphasize business *quality and strength of balance sheet for all investments. * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom (AVGO), Sociedad Quimica y Minera (SQM).

News

Company News/ Other

- AT&T Shares Fall to Lowest Price Since 1993 – WSJ

- Ford Cuts Price of F-150 Lightning Electric Truck by Up to $10,000 – WSJ

Energy/ Materials

- Biden Deploys Pentagon to Beat Climate Change and China – Bloomberg

- The Shale Industry Is Dropping Drilling Rigs, Fast – WSJ

Central Banks/Inflation/Labor Market

- More Americans Are Getting Turned Down for Loans, Fed Data Shows – Bloomberg

- Pay Raises Are Finally Beating Inflation After Two Years of Falling Behind – WSJ

Asia/ China