Stay Informed and Stay Ahead: Market Watch, May 15th, 2024.

Wall Street Mid-Week Market Recap Edition

Market Highlights & Analysis: Indices, Sectors, and More…

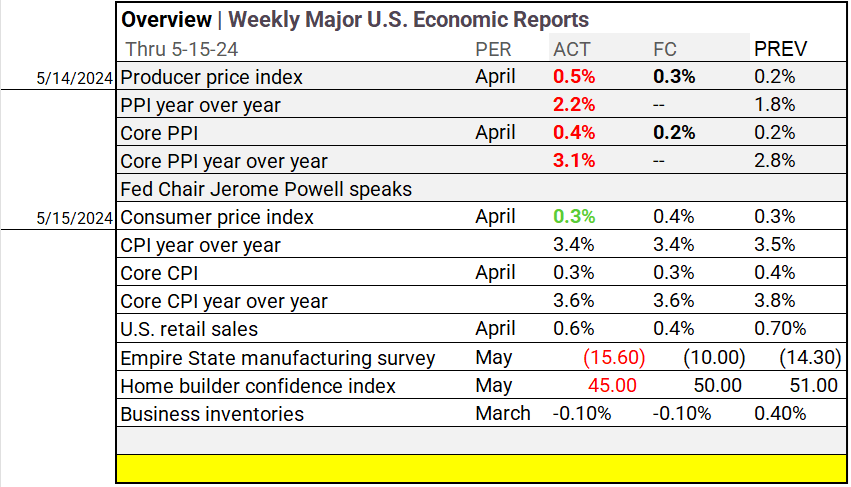

- Economic Data: Inflation data cools, Consumer price index beats and Core CPI on consensus.

- Market Indices: DJIA (+0.88%), S&P 500 (+1.17%), Nasdaq Composite (+1.40%).

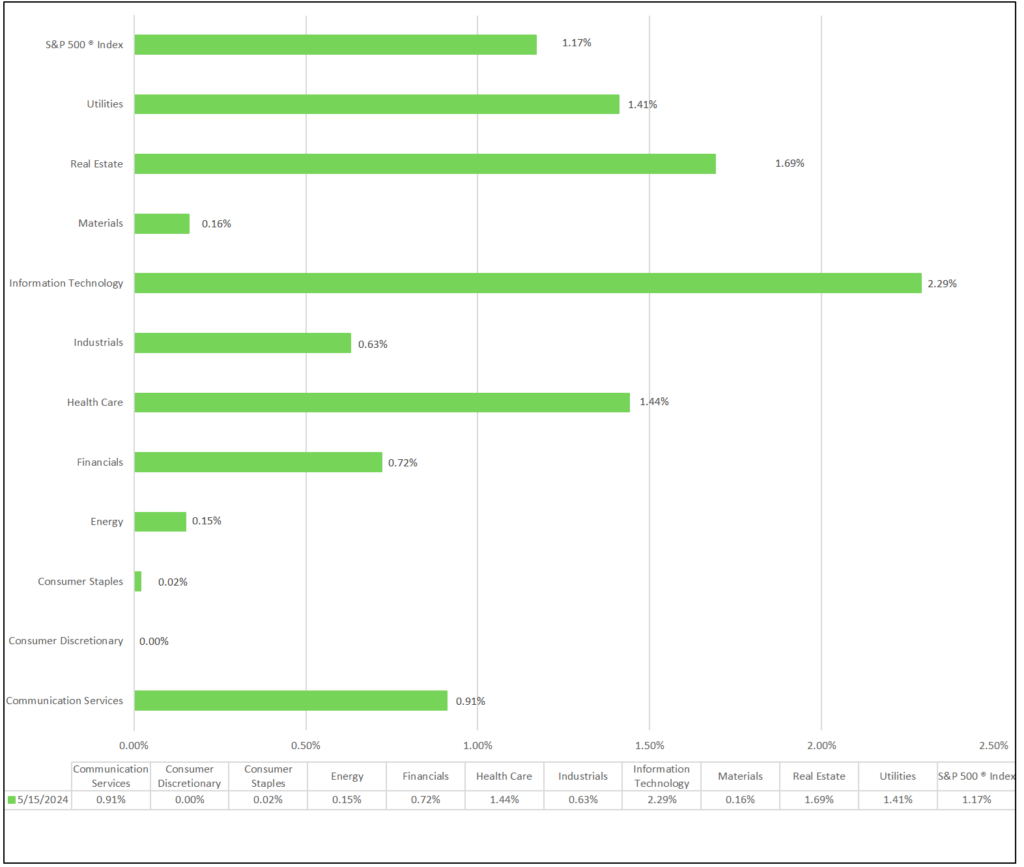

- Sector Performance: 10 of 11 sectors higher; Information Technology (+2.29%) leading, Consumer Discretionary (0.00%) lagging. Top industry: Independent Power and Renewable Electricity Producers (+5.35%).

- Factors: Broad based gains with Momentum and Growth leading.

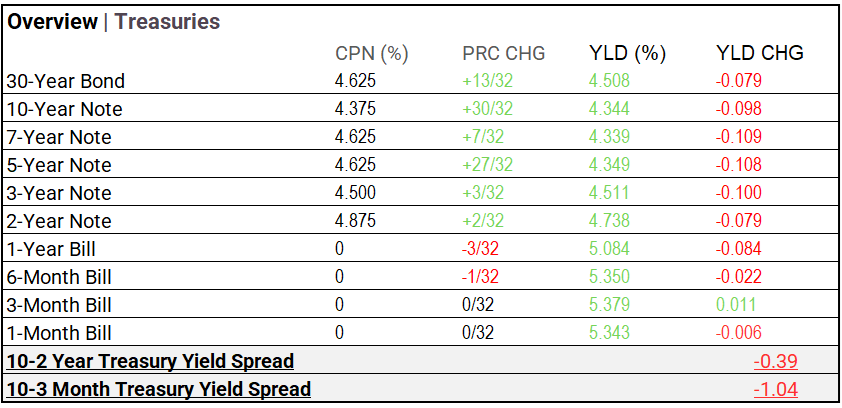

- Treasury Markets: Bond yields lower, Bills outperform.

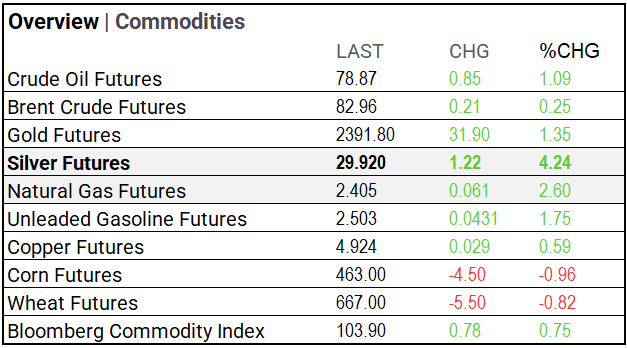

- Commodities: Silver, Natural and Unleaded gas outperform.

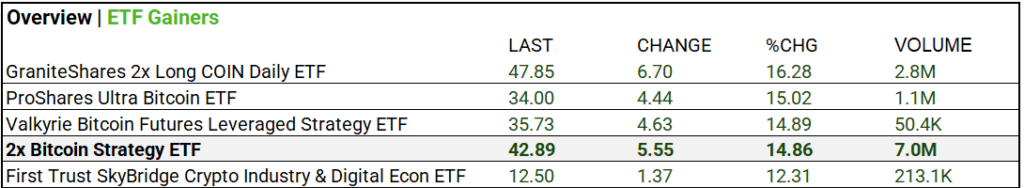

- ETFs: Bitcoin! 2x Bitcoin Strategy ETF (+14.86%) volume of 7.0M.

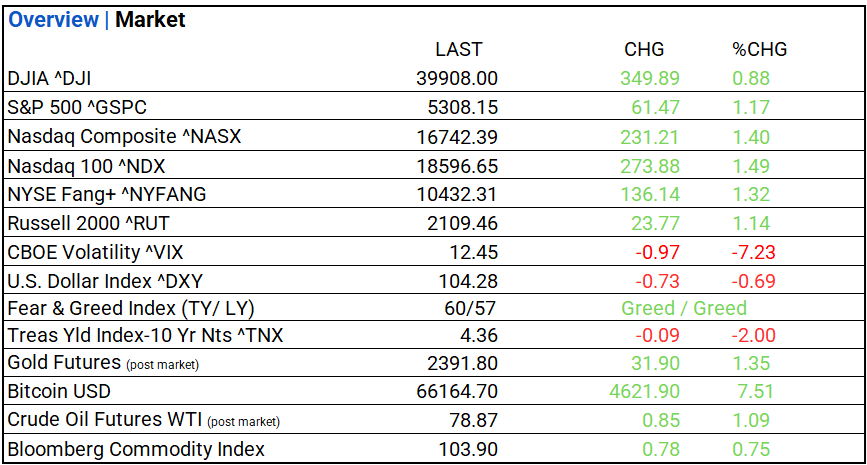

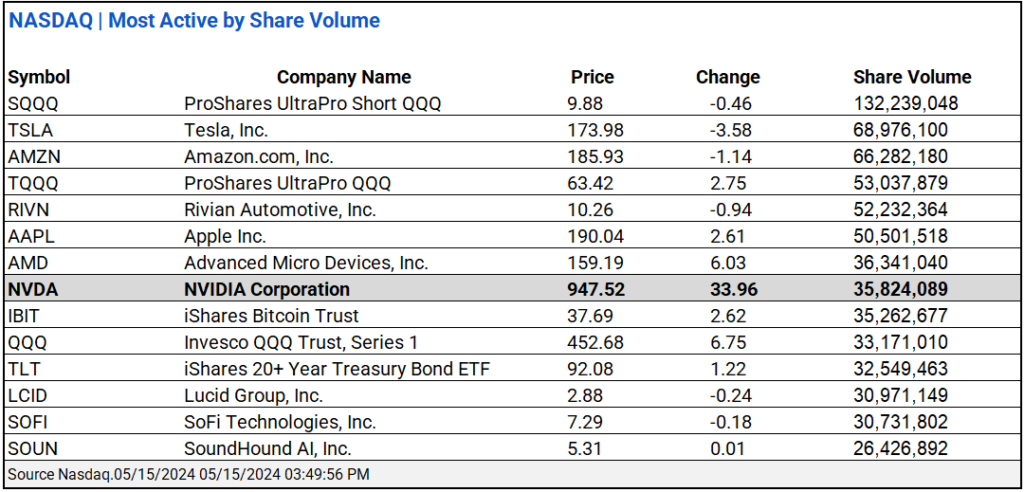

US Market Snapshot: Key Metrics:

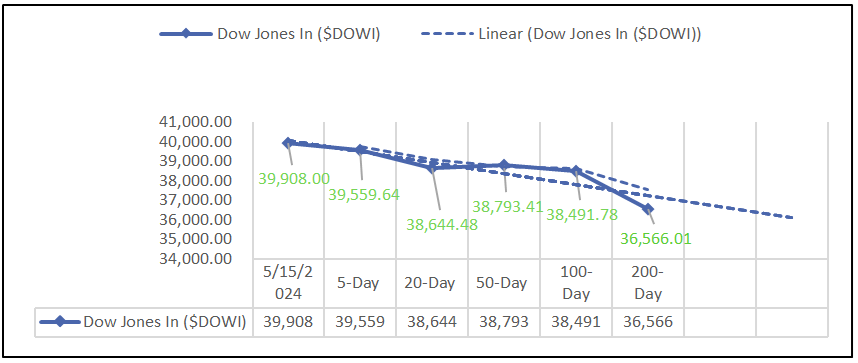

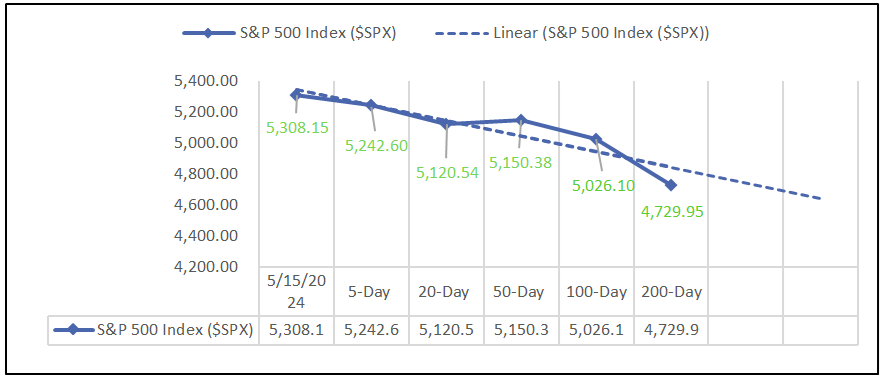

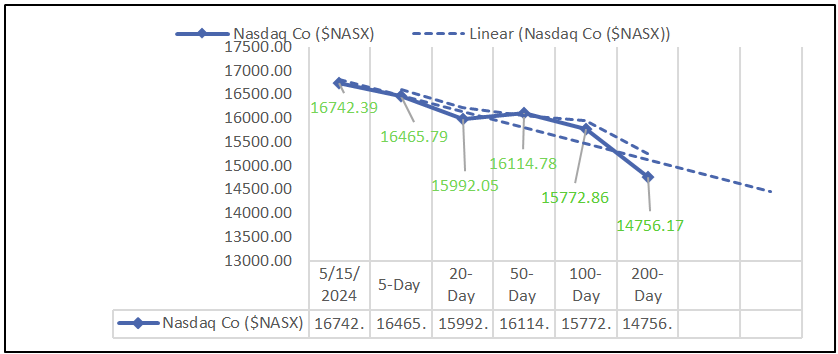

Moving Averages: DOW, S&P 500, NASDAQ:

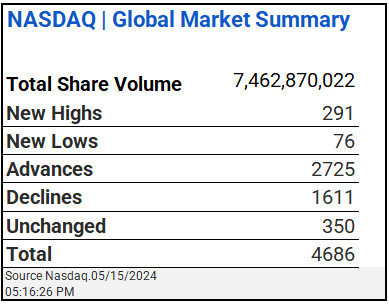

NASDAQ Global Market Summary:

Sectors:

- 10 of 11 sectors higher; Information Technology (+2.29%) leading, Consumer Discretionary (0.00%) lagging. Top industries: Independent Power and Renewable Electricity Producers (+5.35%), Household Durables (+4.34%), and Semiconductor & Semiconductor Equipment (+3.37%).

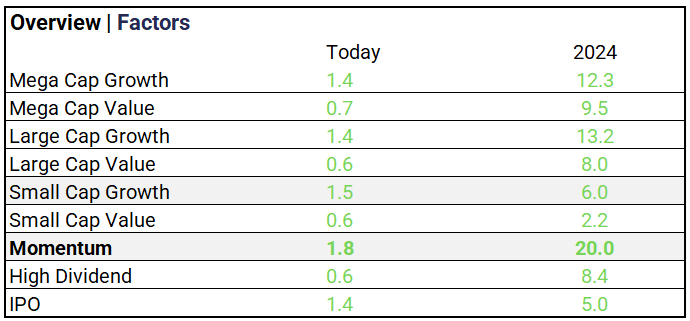

Factors:

- Broad based gains with Momentum and Growth leading. Momentum +20% YTD.

Treasury Markets:

- Bond yields lower, with the Bills outperforming.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 104.28 (-0.73, -0.69%)

- CBOE Volatility ^VIX: 12.45 (-0.97, -7.23%)

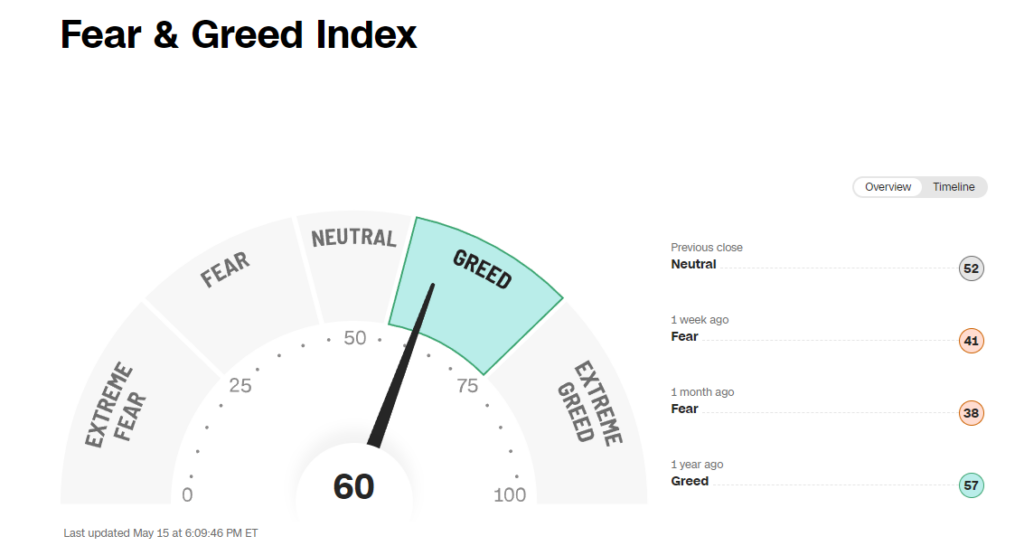

- Fear & Greed Index: 60/TY 57/LY (Greed/ Greed)

Commodity Markets:

ETF’s:

- Biggest volume gainer: 2x Bitcoin Strategy ETF (+14.86%) volume of 7.0M.

US Economic Data:

- Inflation data cools, Consumer price index beats and Core CPI on consensus.

Notable Earnings Today:

- BEAT: Cisco (CSCO), Allianz ADR (ALIZY), Merck ADR (MKKGY), Mizuho Financial ADR (MFG), EON SE (EONGY), Dynatrace Inc (DT), Monday.Com (MNDY), Commerzbank AG PK (CRZBY), Copa (CPA).

- MISSED: Mitsubishi UFJ Financial ADR (MUFG), Sumitomo Mitsui Financial ADR (SMFG), Hoya Corp (HOCPY), Industrias Penoles (IPOAF).

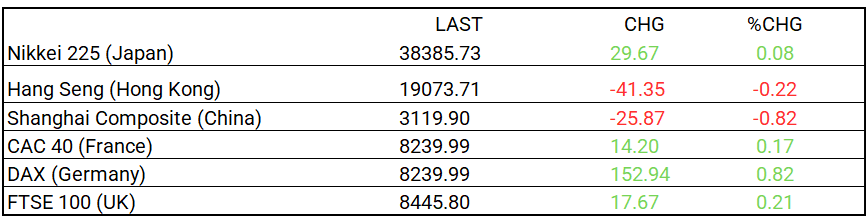

Global Markets Summary: Asian & European Markets:

Central Banking and Monetary Policy, Noteworthy:

- Inflation Eases as Core Prices Post Smallest Increase Since 2021 – WSJ

- Bernanke Says BOE Has Shown Interest in Idea of Rate Projections – Bloomberg

Energy:

- IEA Lowers 2024 Oil-Demand Growth Forecast on Slow Start of the Year – WSJ

- Biden’s China Tariffs Leave Space For Key Solar Machinery – Bloomberg

China:

- US tariffs on China: what’s the real impact, and what could happen next? – South China Morn Post