Stay Informed and Stay Ahead: Market Watch, August 9th, 2024.

Late-Week Wall Street Markets

Key Takeaways

- DOW, S&P 500 and NASDAQ gain. Real Estate/ Financials higher, Energy and Materials Lower. The top industry was Pharmaceuticals.

- On Thursday, Initial Jobless Claims were lower than expected, while Wholesale Inventories met the forecast calming market jitters.

- 1-Month Bill yield rose significantly. Commodity markets were mostly higher; crude oil, gold, and wheat gained, while silver and corn fell. Bitcoin USD gained 2.01% (+$1,198). ETFs: -1x Short VIX Futures ETF rose 12.60% on 6.8M volume.

Summary of Market Performance

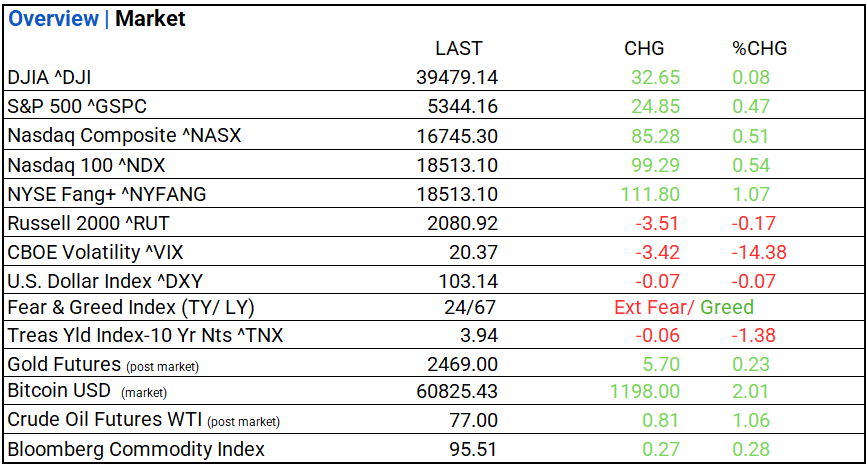

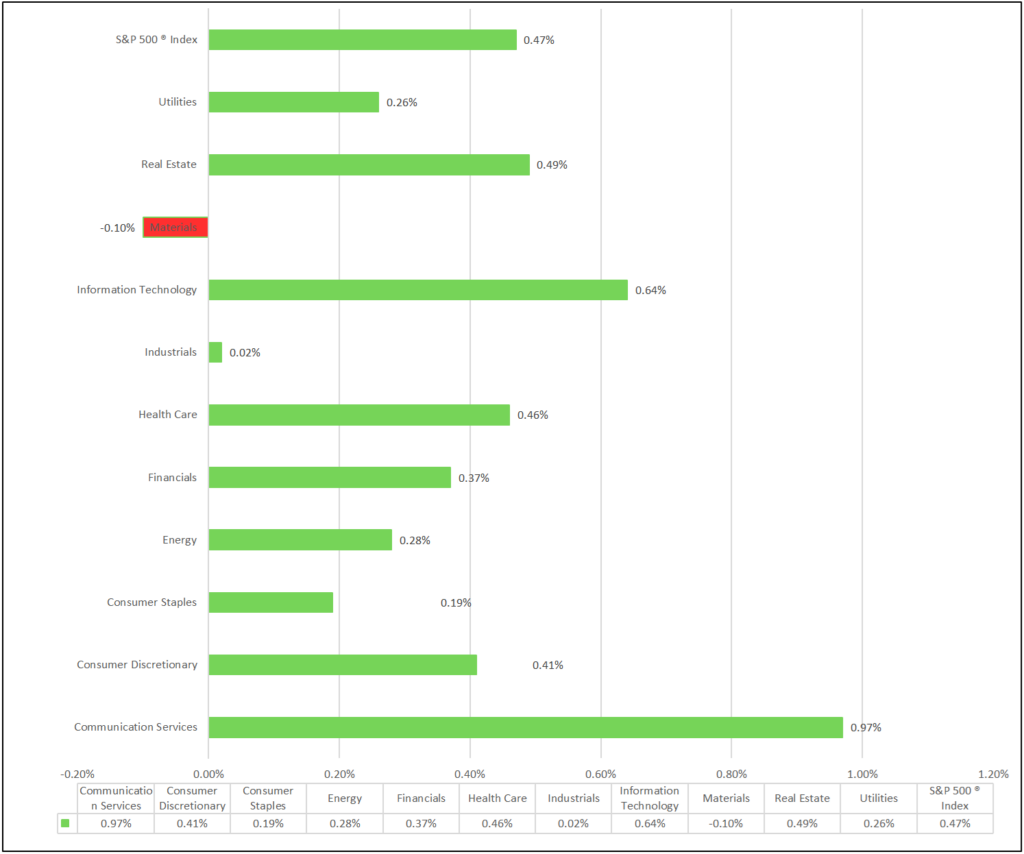

Indices & Sectors Performance:

- DOW, S&P 500 and NASDAQ rose, 10 of 11 S&P 500 sectors higher: Communication Services higher, Materials Lower. Top industries included Pharmaceuticals (+2.11%), Consumer Finance (+1.40%), and Technology Hardware, Storage & Peripherals (+1.36%).

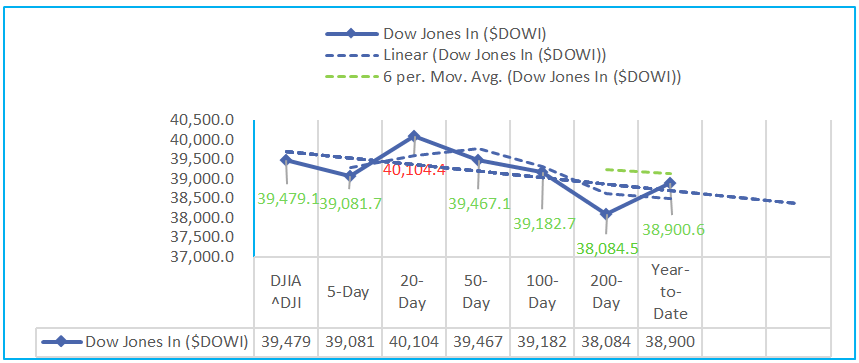

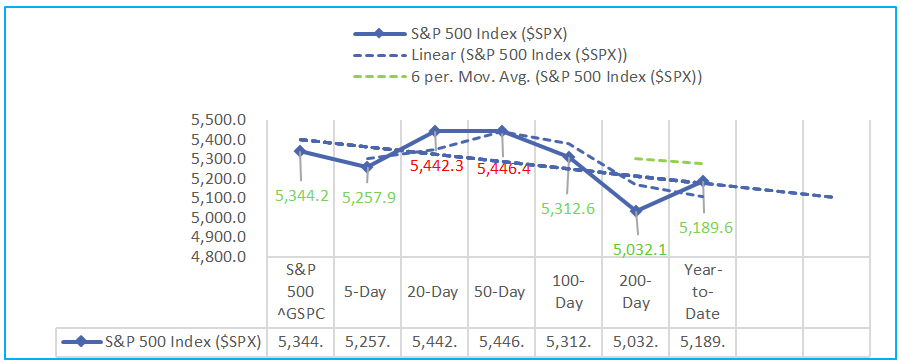

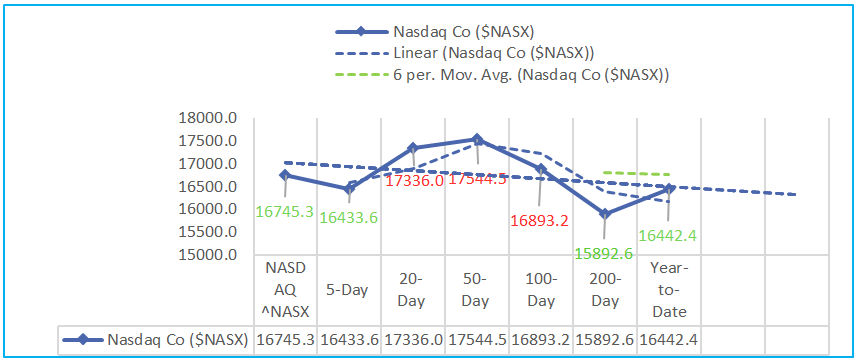

Chart: Performance of Major Indices

Moving Average Analysis:

S&P 500 Sectors:

- Among eleven sectors, 10 rise. Communication Services leading and Materials trailing.

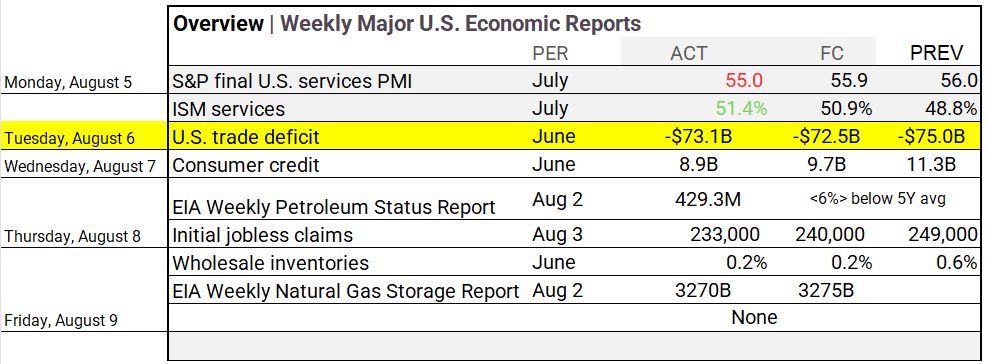

Economic Highlights:

- On Thursday, Initial Jobless Claims were lower than expected, while Wholesale Inventories met the forecast.

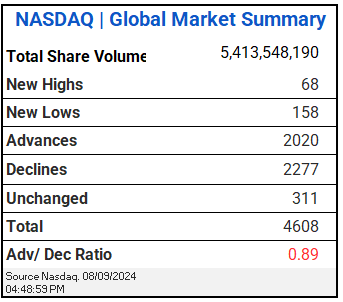

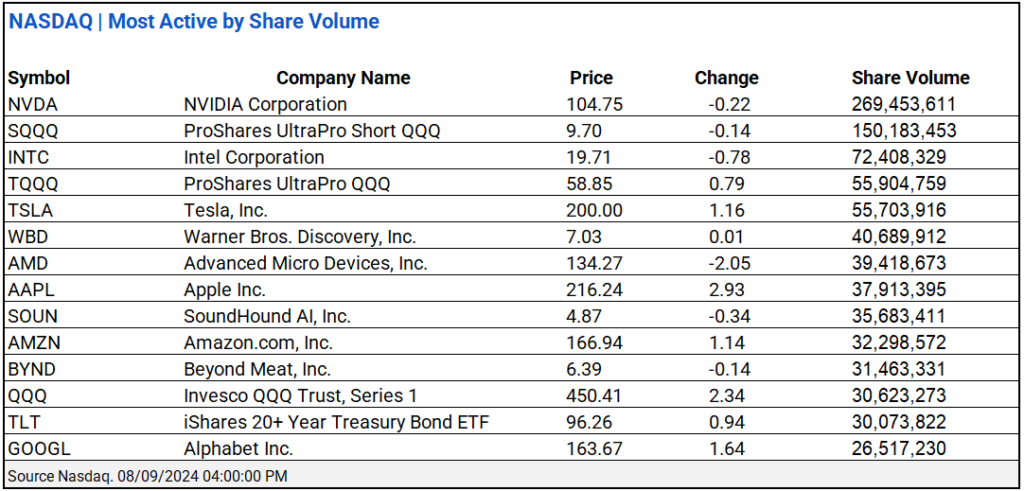

NASDAQ Global Market Update:

- NASDAQ total share volume was 5.41 billion, with an advance/decline ratio of 0.89, NVIDIA Corporation and ProShares UltraPro SQQQ led active trading.

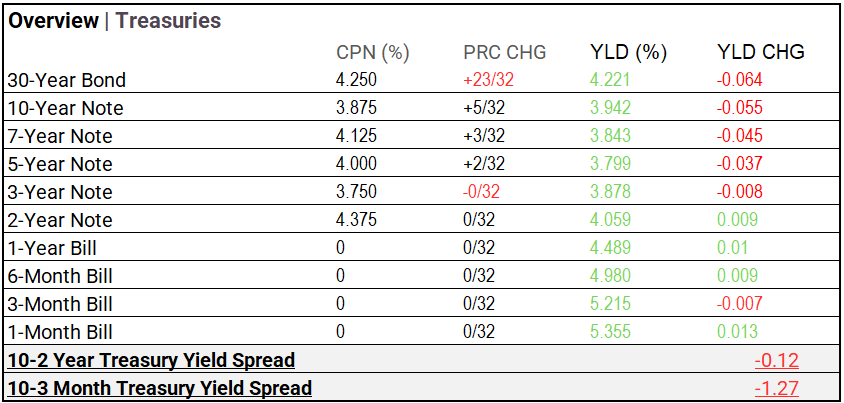

Treasury Markets:

- The yields on the 30-Year Bond, 10-Year Note, 7-Year Note, 5-Year Note, and 3-Month Bill all decreased, while the yields on the 3-Year Note, 2-Year Note, 1-Year Bill, 6-Month Bill, and 1-Month Bill increased. Notably, the 1-Month Bill yield saw a more significant rise compared to the other short-term yields, indicating a pronounced adjustment in the shortest segment of the yield curve today.

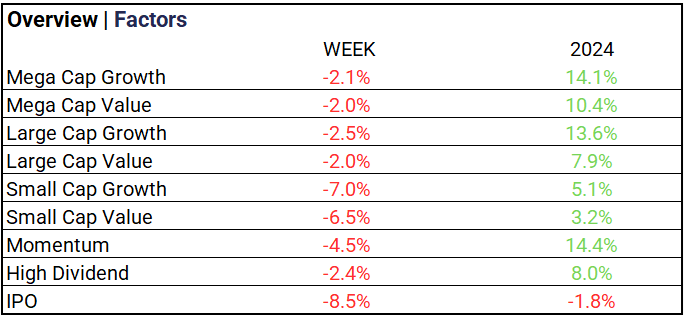

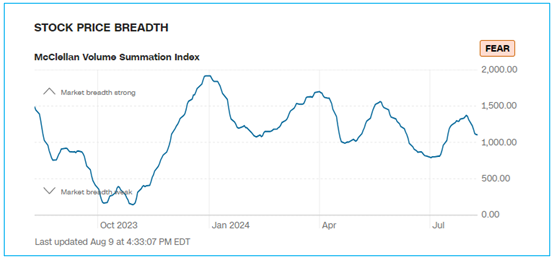

Market Factors:

- Mega Cap and Large Cap Value and Growth saw modest declines of 2-2.5%, while Small Caps and IPOs experienced significant losses, signaling increased market volatility and a shift away from riskier assets.

Currency & Volatility:

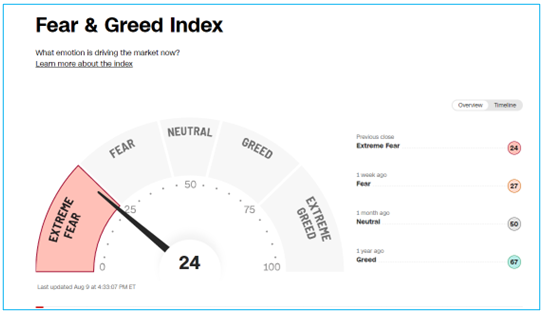

- The VIX saw a sharp drop, settling at 20.37 (-14.38%), while the Fear & Greed Index shifted from last year’s “Greed” to “Extreme Fear.”

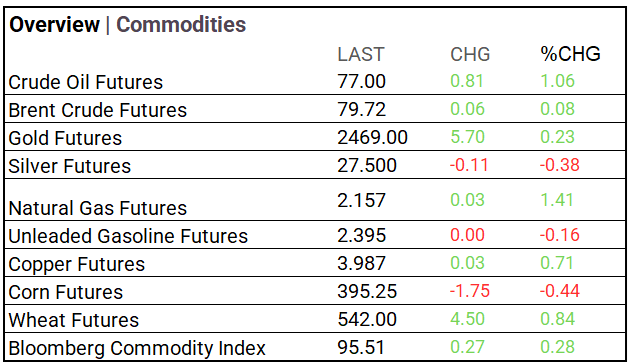

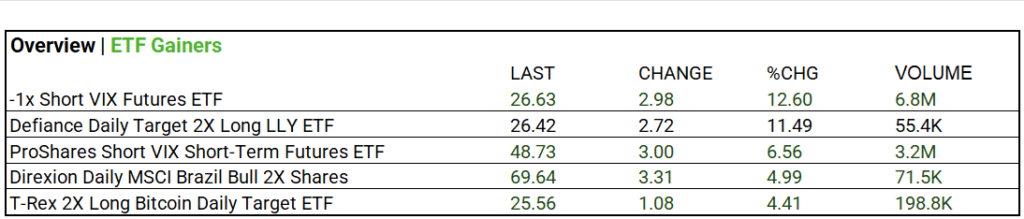

Commodities & ETFs:

- Commodity markets were mostly higher: crude oil, Brent, gold, natural gas, copper, and wheat rose, while silver, unleaded gasoline, and corn fell; the Bloomberg Commodity Index increased.

- ETFs: -1x Short VIX Futures ETF rose 12.60% on a volume of 6.8M while ProShares Short VIX Short-Term Futures ETF rose 6.56% on volume of 3.2M.

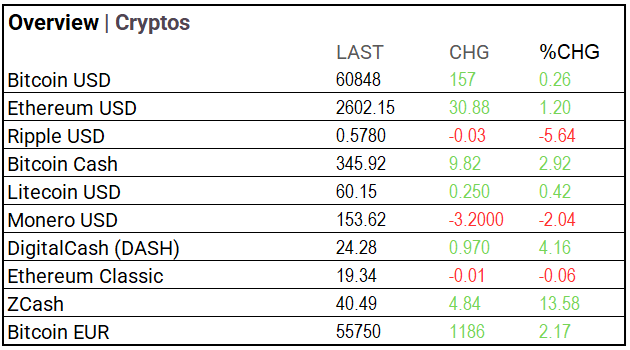

Cryptocurrency Update:

- Cryptocurrency markets were mixed: ZCash jumped 13.58%, Bitcoin EUR rose 2.17%, Ripple fell 5.64%, and Monero declined 2.04%. Bitcoin USD gained 2.01% (+$1,198) during the session.

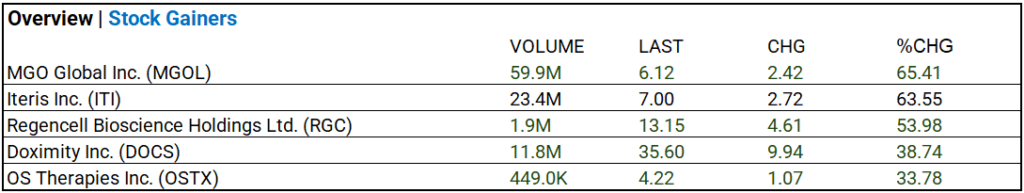

Stocks:

- MGO Global Inc. (MGOL) up 65.41% with a volume of 59.9 M.

Notable Earnings:

- Eli Lilly (LLY), Allianz ADR (ALIZY), Gilead (GILD), The Trade Desk (TTD), Datadog (DDOG), Expedia (EXPE) and Bridgestone ADR (BRDCY) beat; Petroleo Brasileiro Petrobras ADR (PBR), Cheniere Energy (LNG), Brookfield (BN), CRH (CRH), and Assicurazioni Generali ADR (ARZGY) miss.

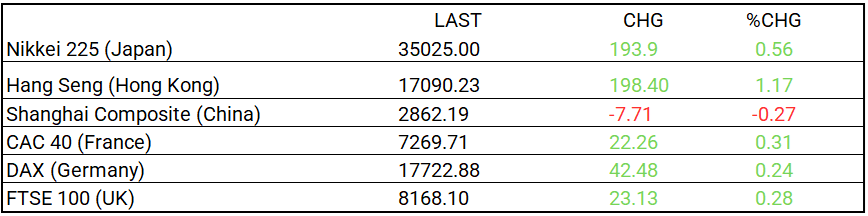

Global Markets Summary:

- Asia and Europe all up aside from the Shanghai Composite (China).

Strategic Investment Adjustments and Historical Market Trends

Key Takeaways

- Long-Duration Bonds: Focus on long-duration bonds, which benefit from rate cuts due to their inverse relationship with interest rates. Historically, a 1% rate cut can increase long-duration bond prices by 10-15%. As the Fed eases rates, their value rises since fixed payments become more attractive compared to new, lower-rate bonds.

- Nasdaq/Tech and Growth Industries: Stay the course with Nasdaq/Tech for long-term growth in semiconductors, aiming for a CAGR of 12-15%. Top CAGR growth industries include Technology (10-15%), Healthcare (8-12%), Renewable Energy (8-12%), E-commerce (10-15%), Fintech (9-13%), AI and Machine Learning (12-20%), and Cybersecurity (11-14%).

- Diversification: Diversify with Russell 2000 (small-cap) ETFs, which have historically returned about 8-10% annually, and bank index ETFs, which typically return around 6-8%, to manage risk. Real estate sectors, benefiting from lower rates, can add stability with average returns of 8-10%.

- Election Year Trends: Historically, election years bolster market growth due to heightened fiscal stimulus and increased investor optimism, with the S&P 500 averaging returns of about 6-7%. In the past 50 years, 78% of election years have seen positive market performance, driven by increased government spending and economic policy proposals.

Bonus advanced-market-insights-essentail-charting-strategies-for-investors

In the NEWS

Central Banking, Monetary Policy & Economics:

- Japan’s Central-Bank Chief Dogged by Painful History of Premature Moves – WSJ

- Fed Seen Rejecting Calls for Jumbo Rate Cut in Economist Survey – Bloomberg

Business:

- Netflix Taps CBS Sports to Produce Its Christmas NFL Games – WSJ

- China’s WeRide Seeks Up to $440 Million in US IPO, Placement – Bloomberg

- Hedge Funds Most Bearish on Commodities Since at Least 2011 – Bloomberg

China:

- Explainer | China inflation surprise ‘not a recovery in final demand’: 4 takeaways from July’s data – SCMP