Stay Informed and Stay Ahead: Market Watch, May 6th, 2024.

Wall Street Early Week Market Recap Edition

Market Highlights & Analysis: Indices, Sectors, and More…

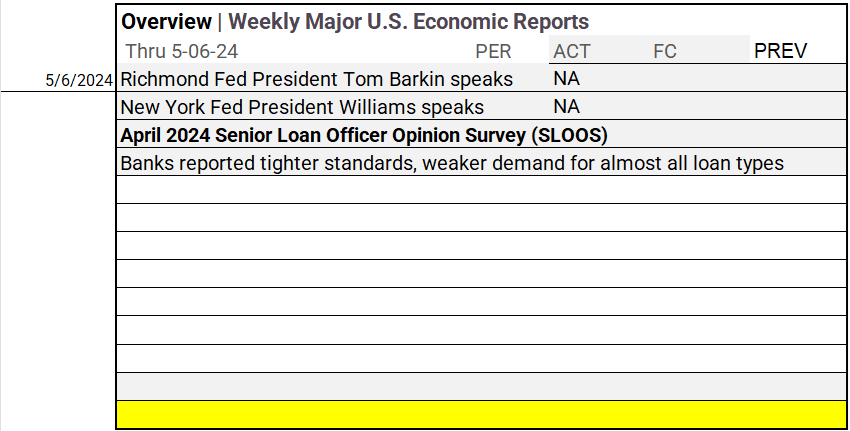

- Economic Data: Senior Loan Officer Opinion Survey (SLOOS) highlighted tightening standards and weaker loan demand across various loan types.

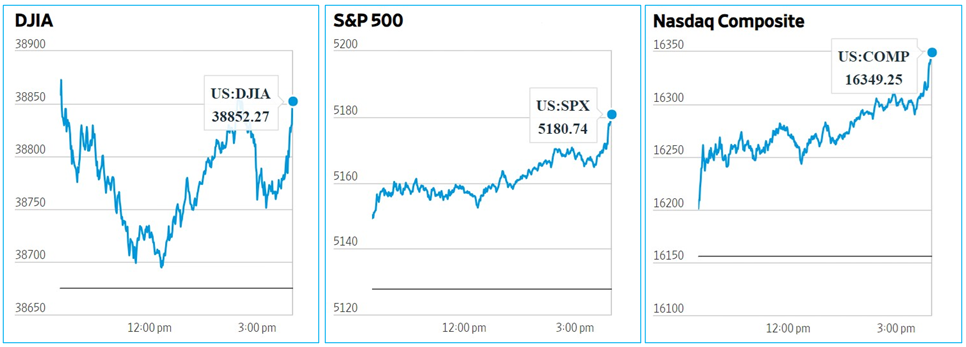

- Market Indices: DJIA (+0.46%), S&P 500 (+1.03%), Nasdaq Composite (+1.19%).

- Sector Performance: 10 of 11 sectors higher; Information Technology (+1.48%) leading, Real Estate (-0.02%) lagging. Top Industry: Construction & Engineering (+5.14%).

- Factors: Broad based gains with IPO and Small Caps leading.

- Treasury Markets: Bond yields mostly pullback, with the 2-year Note and 1-year Bill outperforming.

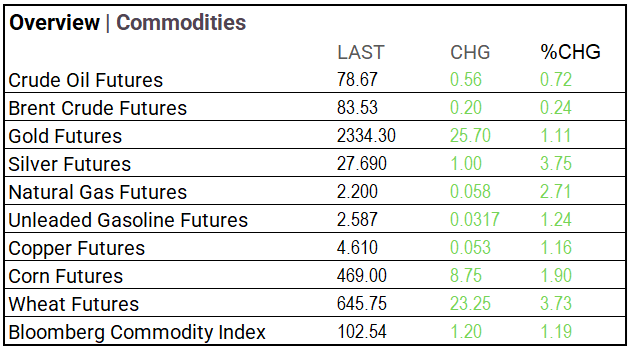

- Commodities: Wheat, Silver and Natural gas outperform.

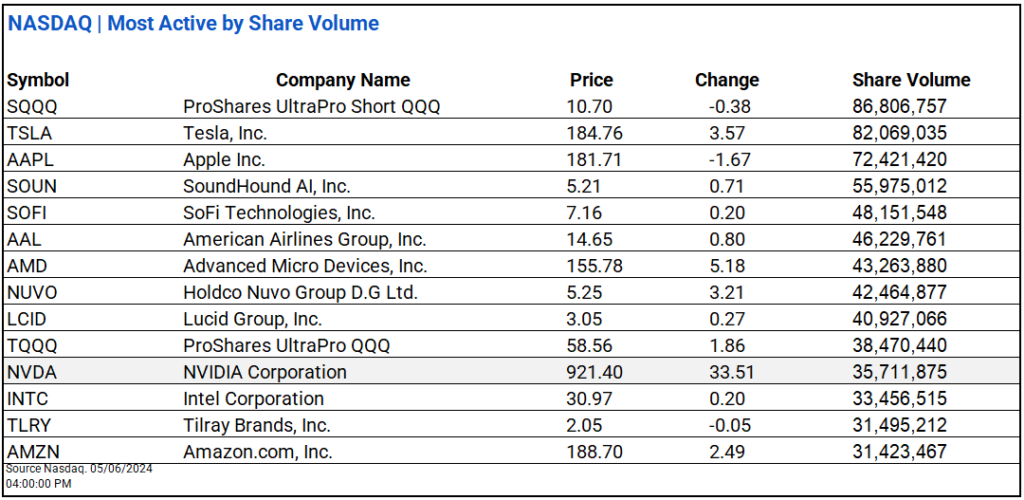

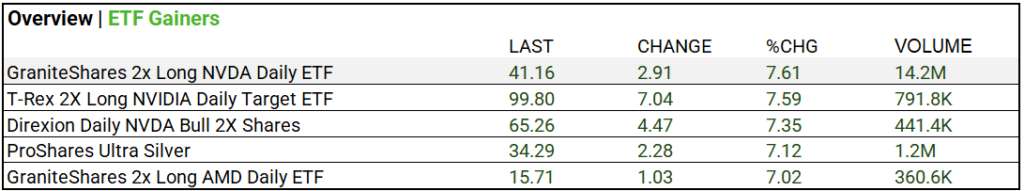

- ETFs: GraniteShares 2x Long NVDA Daily ETF (+7.61%) volume of 14.2M.

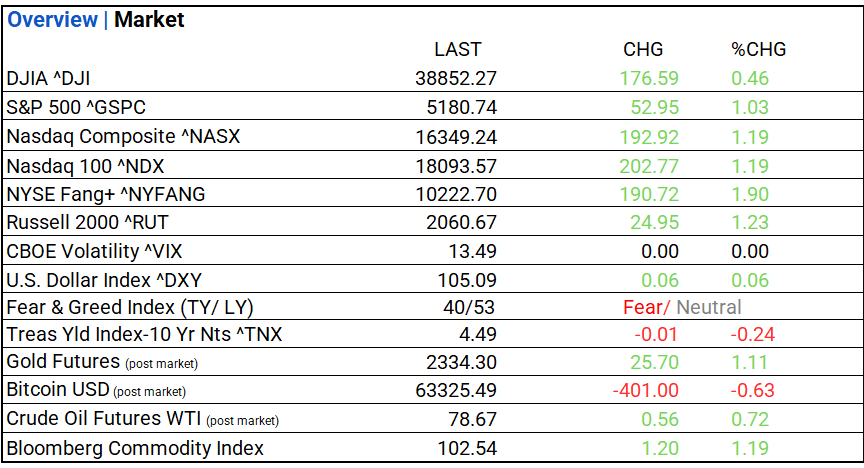

US Market Snapshot: Key Metrics:

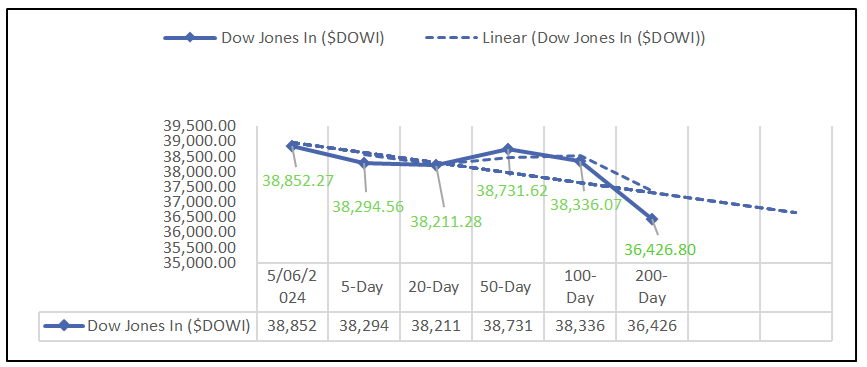

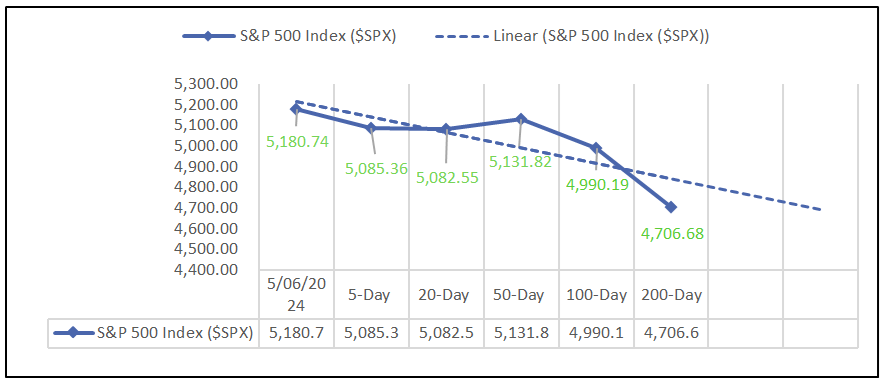

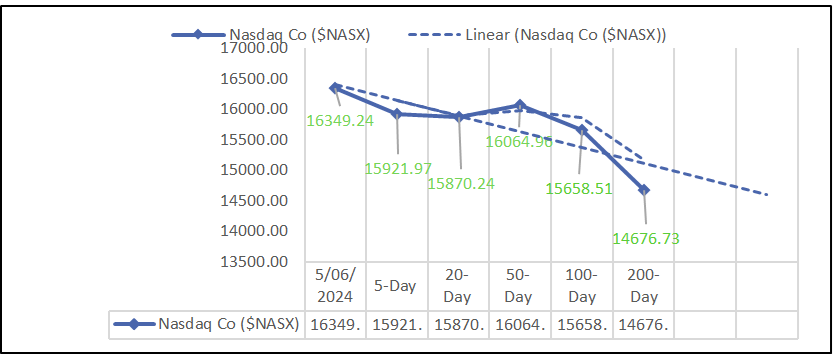

Moving Averages: DOW, S&P 500, NASDAQ:

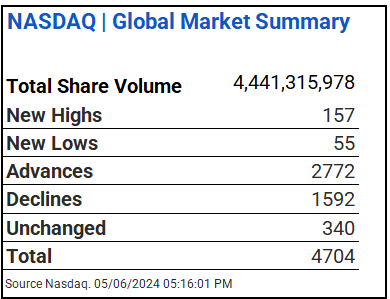

NASDAQ Global Market Summary:

Sectors:

- 10 of 11 sectors higher; Information Technology (+1.48%) leading, Real Estate (-0.02%) lagging. Top industries: Construction & Engineering (+5.14%), Passenger Airlines (+3.92%), and Automobile Components (+3.60%).

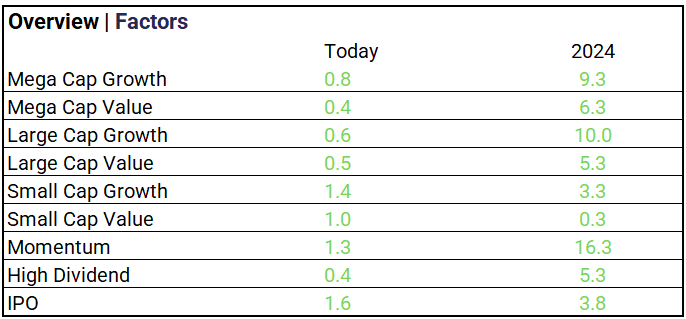

Factors:

- Broad based gains with IPO and Small Caps leading. Momentum stocks up 16.3% year-to-date.

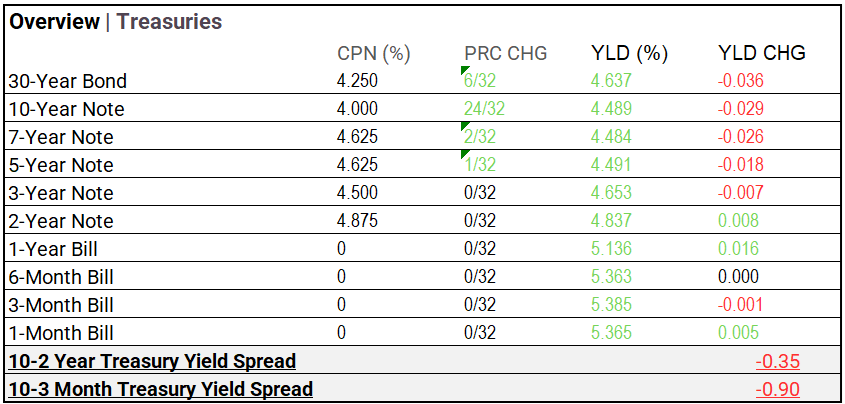

Treasury Markets:

- Bond yields mostly pullback, with the 2-year Note and 1-year Bill outperforming.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 105.09 (+0.06, +0.06%)

- CBOE Volatility ^VIX: 13.49 (-0.00, 0.00%)

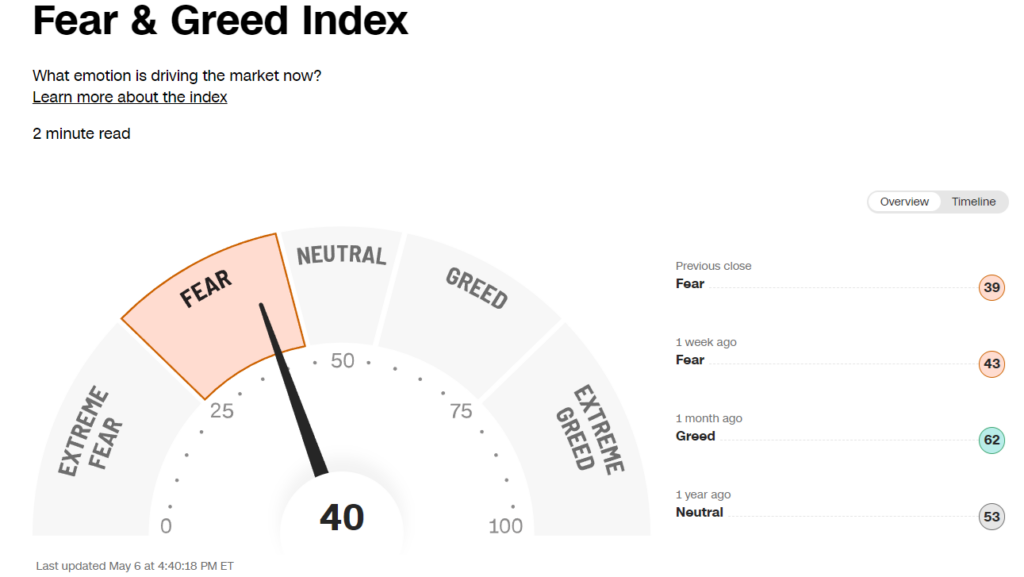

- Fear & Greed Index: 40/TY 53/LY (Fear/Neutral)

Commodity Markets:

ETF’s:

- Biggest volume gainer: GraniteShares 2x Long NVDA Daily ETF (+7.61%) volume of 14.2M.

US Economic Data:

- April 2024 Senior Loan Officer Opinion Survey (SLOOS). Banks reported tighter standards, weaker demand for almost all loan types.

Notable Earnings Today:

- BEAT: Vertex (VRTX), Simon Property (SPG), Williams (WMB), Fidelity National Info (FIS), IFF (IFF), Axon Enterprise (AXON).

- MISSED: Realty Income (O), Banco Bradesco (BBD), Symbotic (SYM), BioNTech (BNTX), Tyson Foods (TSN).

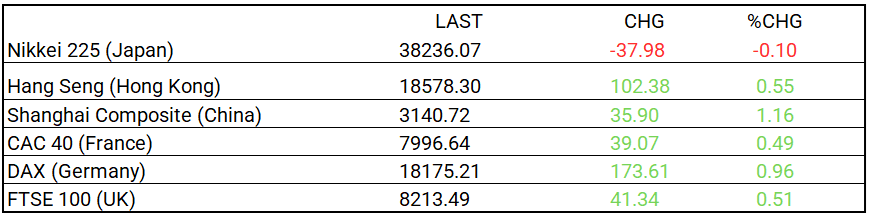

Global Markets Summary: Asian & European Markets:

Central Banking and Monetary Policy, Noteworthy:

- U.S. Jobs Growth Set to Slow, Conference Board Says – WSJ

- Fed Official Urges Patience on Inflation – Bloomberg

- US Economy Slows and Inflation Jumps, Damping Soft-Landing Hopes – Bloomberg

Energy:

- For AI, a Few Seconds of Power Becomes a Booming Business – WSJ

- Biden Rolls Out New Minimum Energy Standards for Affordable Housing – Bloomberg

China:

- Explainer | China’s economic recovery maintains momentum, but risks remain: 4 takeaways from April’s manufacturing, services data – SCMP