Stay Informed and Stay Ahead: Market Watch, June 5th, 2024.

Mid-Week Wall Street Market Digest

Three Key Takeaways

+NASDAQ and S&P 500 rose alongside DJIA; tech sector excelled while utilities underperformed; semiconductor industry was notable.

+In May, Services PMI® rose to 53.8%, private jobs increased, but manufacturing and hospitality hiring slowed.

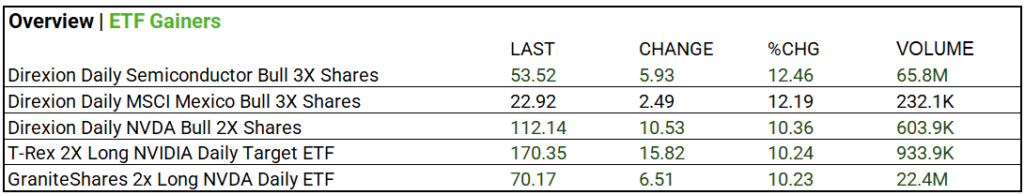

+ Semiconductor and NVIDIA leveraged ETFs gained significantly, notably Direxion Daily Semiconductor Bull 3X Shares, with high volumes.

Summary of Market Performance

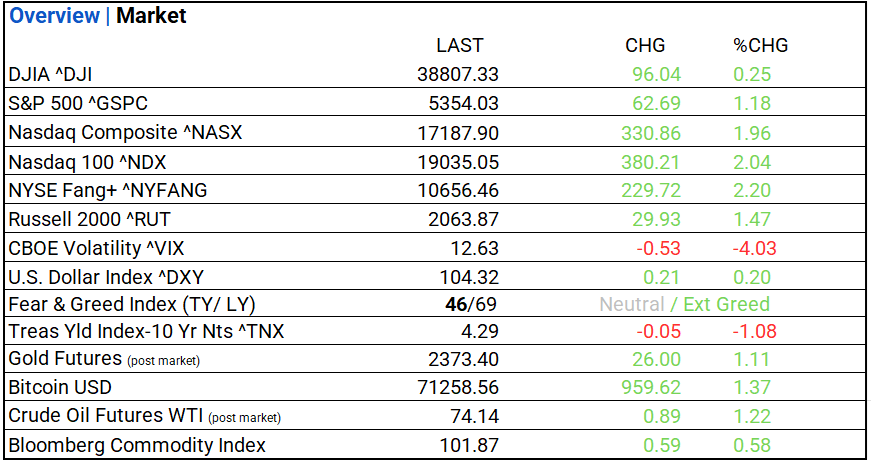

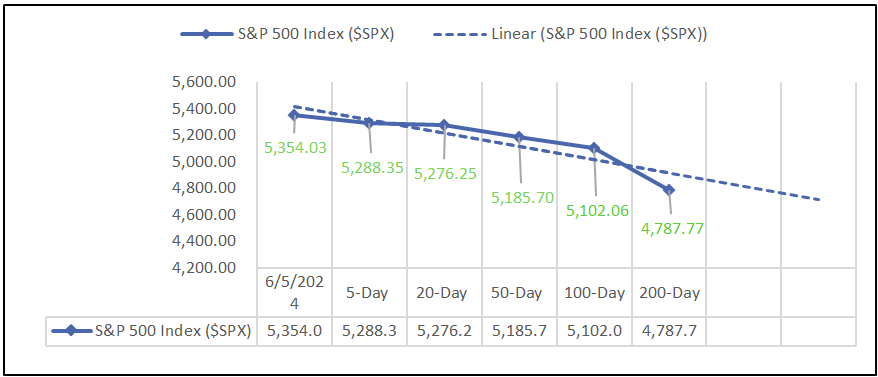

Indices & Sectors Performance:

- Major indices, NASDAQ, S&P 500 and DJIIA up.

- 7 of 11 sectors advancing: Tech outperforms, Utilities lags.

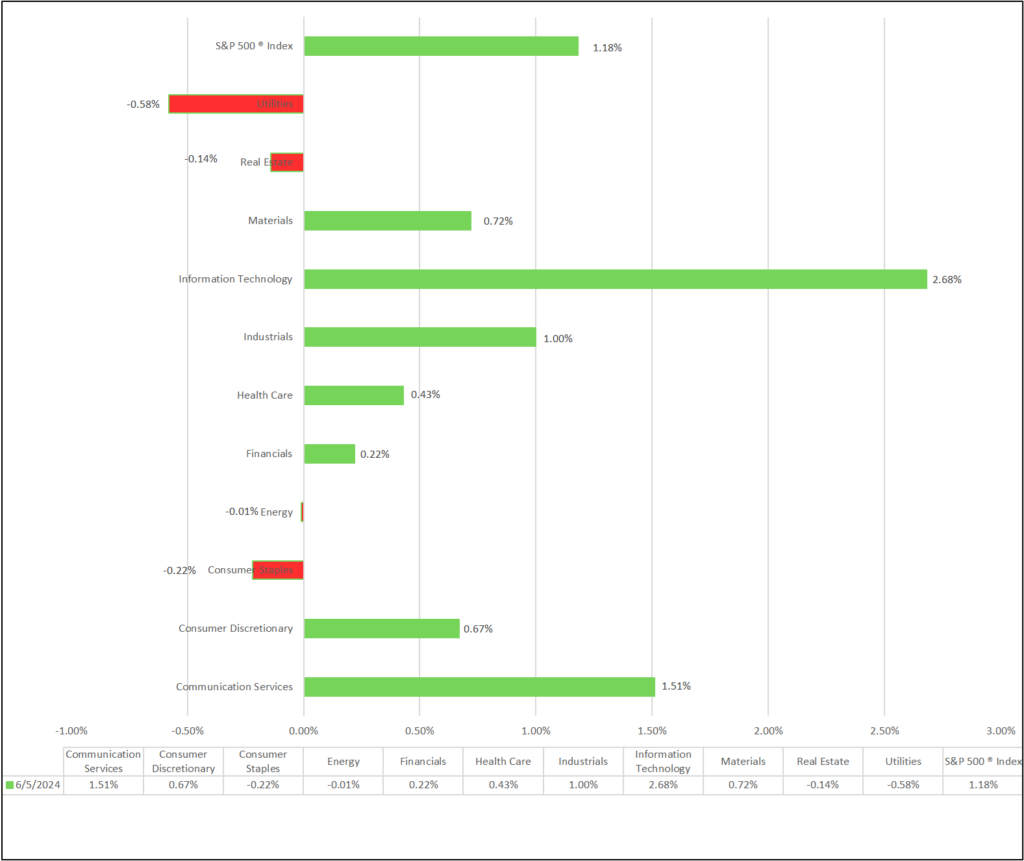

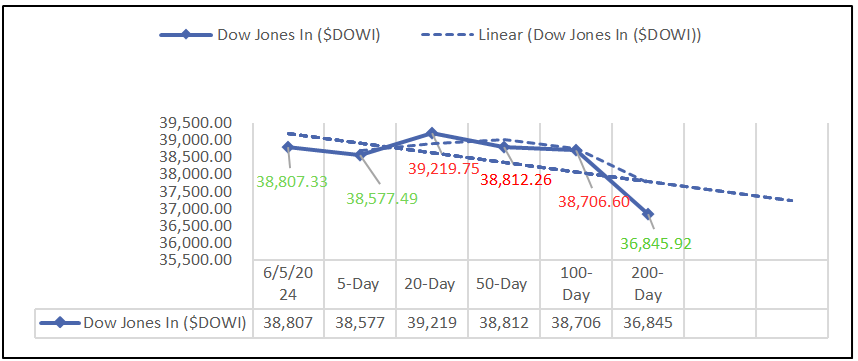

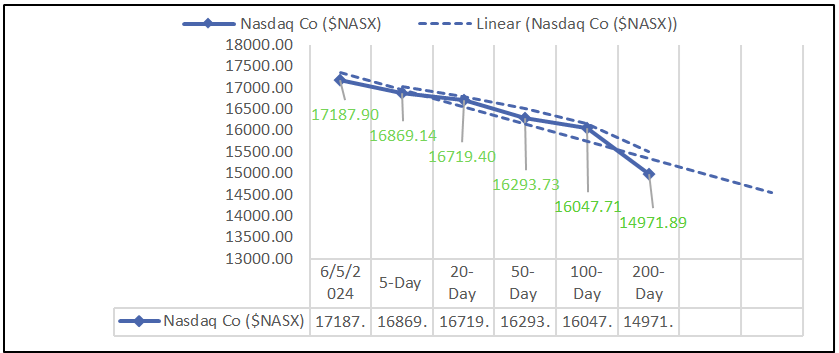

Chart: Performance of Major Indices

Moving Average Analysis:

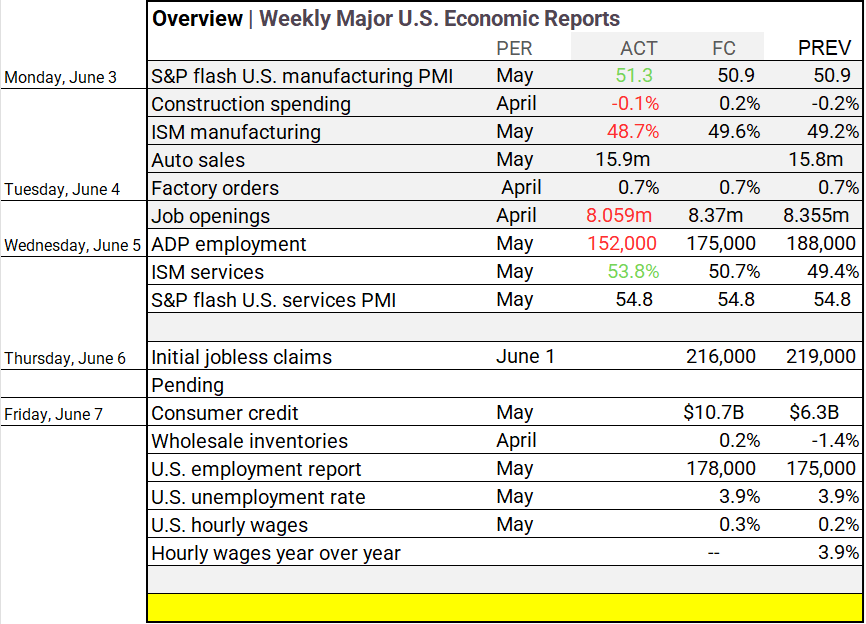

Economic Highlights:

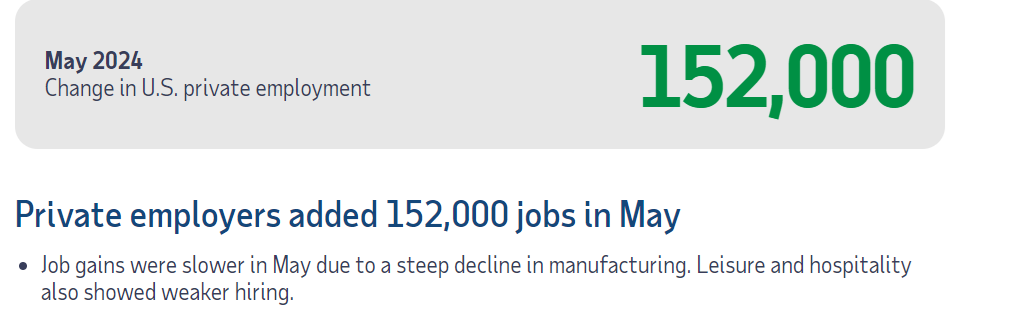

- In May, the Services PMI® rose to 53.8%, indicating growth, while private employers added 152,000 jobs, though gains slowed due to declines in manufacturing and weaker hiring in leisure and hospitality.

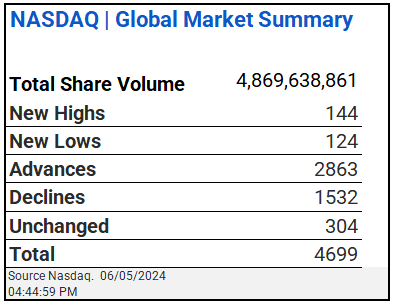

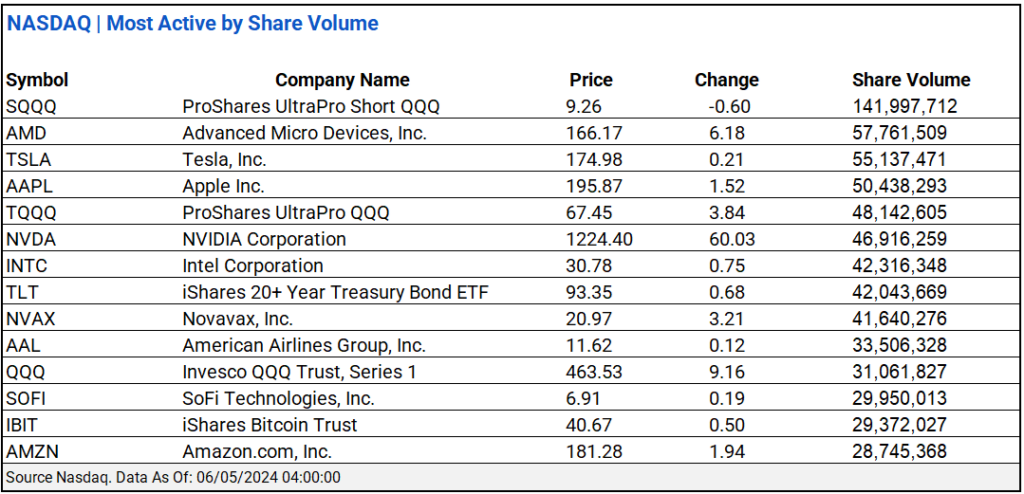

NASDAQ Global Market Update:

- Today’s Nasdaq data shows advancers outpacing decliners with a ratio of 1.869, indicating strong bullish sentiment.

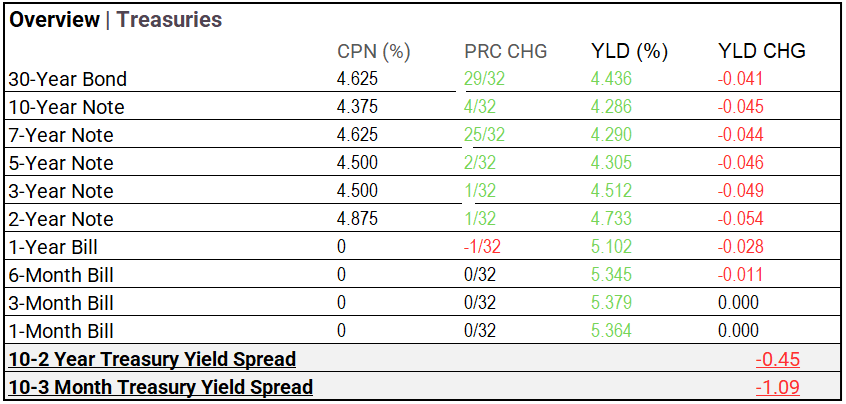

Treasury Markets:

- Yields on bonds and notes mostly decreased, with the 30-Year Bond yield at 4.436% and the 1-Month Bill yield steady at 5.364%.

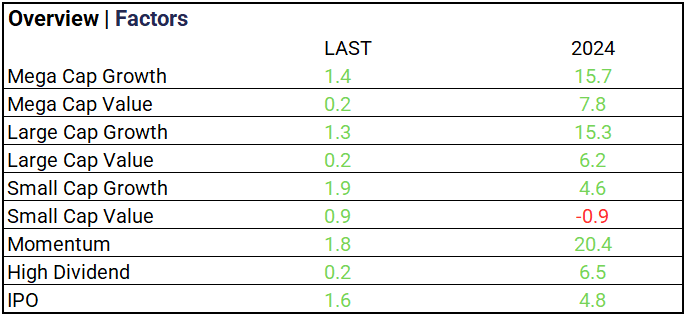

Market Trends:

- Growth stocks outperformed, with Small Cap Growth at 1.9%, while value stocks and dividends lagged at 0.2%.

Currency & Volatility:

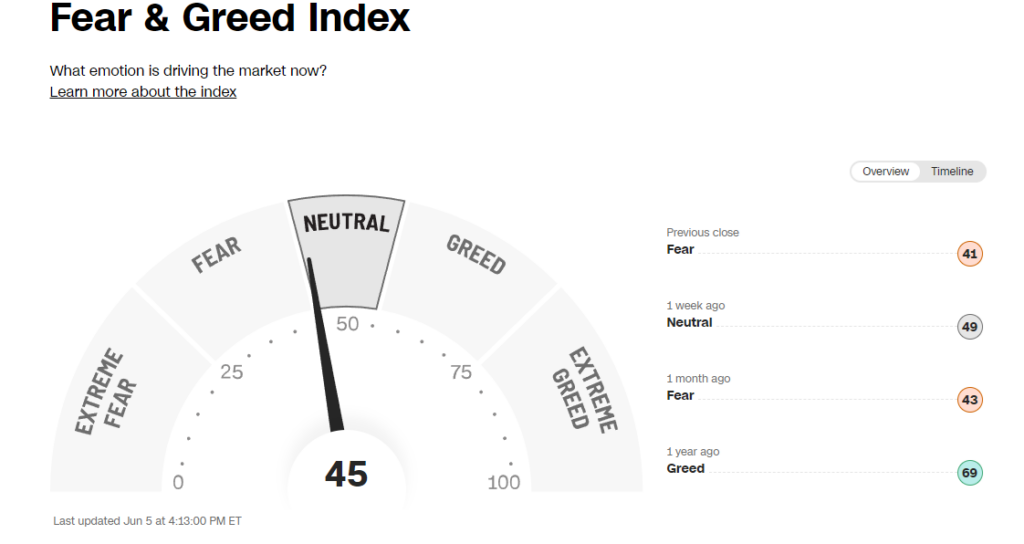

- The CBOE Volatility Index dropped 4.03% to 12.63, the U.S. Dollar Index rose 0.20%, and the Fear & Greed Index is neutral at 46.

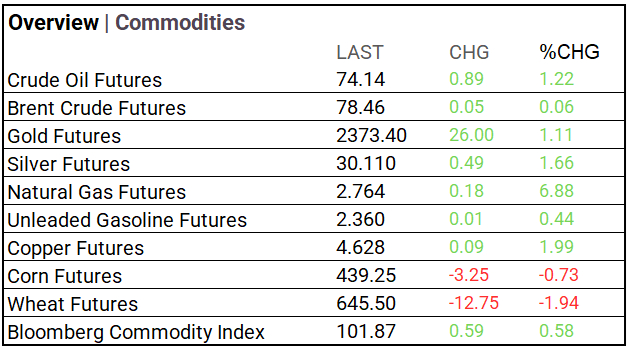

Commodities & ETFs:

- Natural gas futures surged 6.88%, while crude oil, gold, and silver futures also rose; corn and wheat futures declined.

- Semiconductor and NVIDIA leveraged ETFs saw significant gains, with Direxion Daily Semiconductor Bull 3X Shares up 12.46% and high trading volumes.

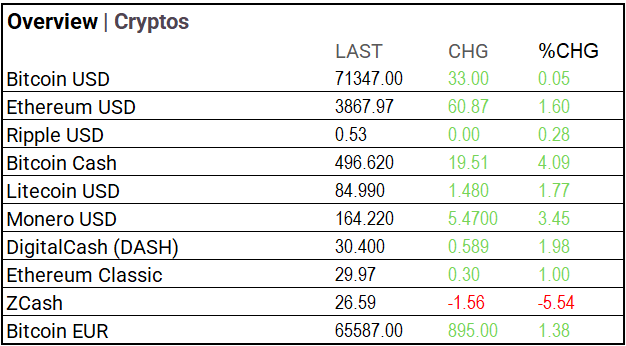

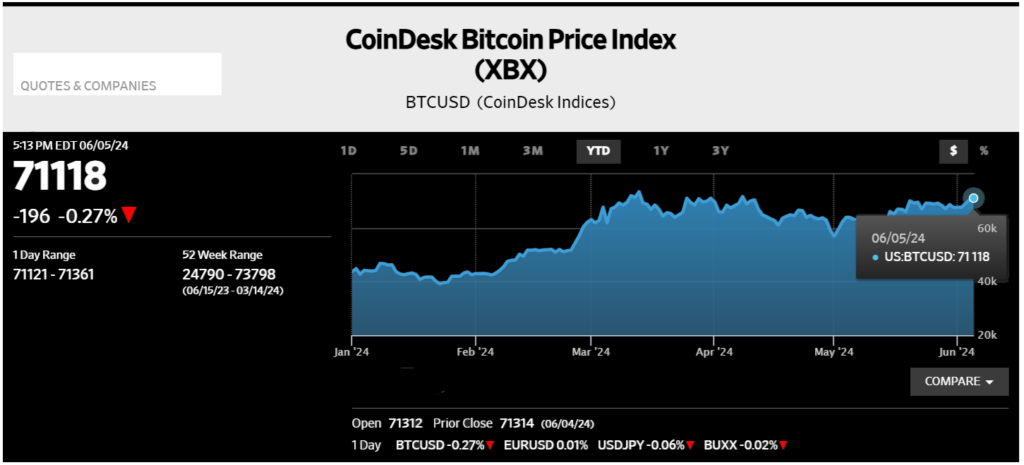

Cryptocurrency Update:

- Bitcoin rose 0.05% to $71,347, Ethereum increased 1.60%, and Bitcoin Cash jumped 4.09%, while ZCash dropped 5.54%.

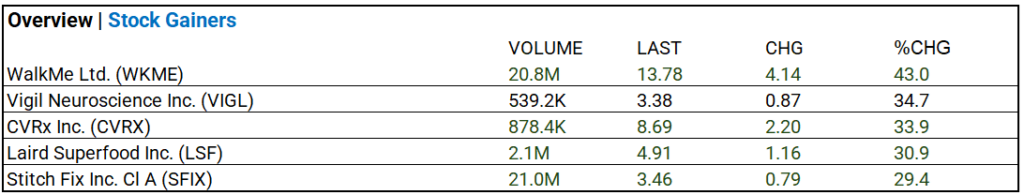

Stocks:

- WalkMe Ltd. surged 43% to $13.78 on high volume, with notable gains in Vigil Neuroscience, CVRx, Laird Superfood, and Stitch Fix.

Notable Earnings:

- CrowdStrike Holdings (CRWD), Hewlett Packard (HPE), Lululemon Athletica (LULU), and Campbell Soup (CPB) reported earnings that exceeded expectations.

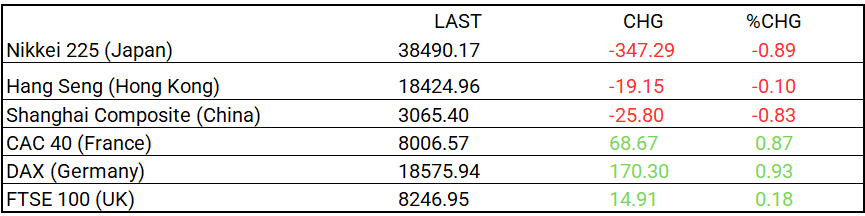

Global Markets Summary:

- European markets, represented by CAC 40, DAX, and FTSE 100, generally performed better than Asian markets.

In the NEWS:

Central Banking and Monetary Policy:

- Bank of Canada Cuts Rates to Become First G-7 Central Bank to Ease Policy – Wall Street Journal

- US Hiring Slows to Weakest Pace Since Start of Year in ADP Data – Bloomberg

Business:

- Five Below Cuts Outlook on Lower Consumer Base Spending Levels – Wall Steet Journal

- Lululemon Jumps After Raising Its Full-Year Profit Outlook – Bloomberg

China:

- Explainer | Warning sign for China’s economic growth? 4 takeaways from May’s PMI data – South China Morning Post