MARKETS TODAY March 23rd, 2023 (Vica Partners)

Good Afternoon,

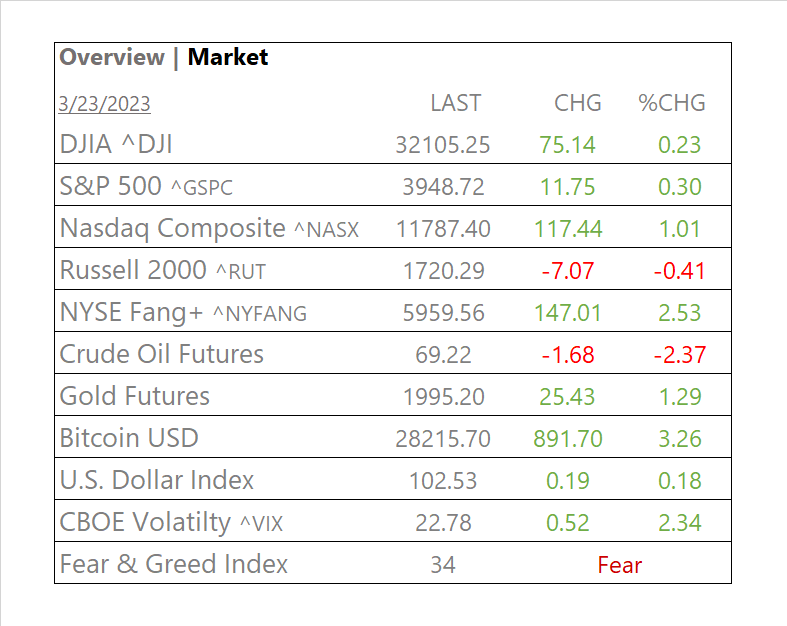

Yesterday, the US equity markets sold off sharply late in the trading session, during following Fed Chair Powell’s press conference (as he did not discuss ’23 rate cuts?). Following his speech, Treasury Secretary Yellen’s press release that the administration was not considering expanding the FDIC’s insurance limits renewing banking sector concerns. On the day, the S&P 500 closed down 1.65%, roughly on its 200d ma with yields declining across the curve. All 11 of the S&P 500 sectors were lower with Real Estate and Energy leading decliners. Oil futures were modestly up, Gold rose. Bitcoin pulled back and the USD Index dropped.

Overnight, Asian markets finished mixed with the Hang Seng gained 2.34% and the Shanghai Composite rose 0.64%. The Nikkei 225 lost 0.17%. European markets were also mixed this morning as the CAC 40 is up 0.18% while the DAX gains 0.06%. The FTSE 100 is off 0.50%. As for the US, S&P futures are were modestly higher, with strength in the mega-cap sector, Yields were flat, Metals markets mostly higher and Bitcoin up nicely.

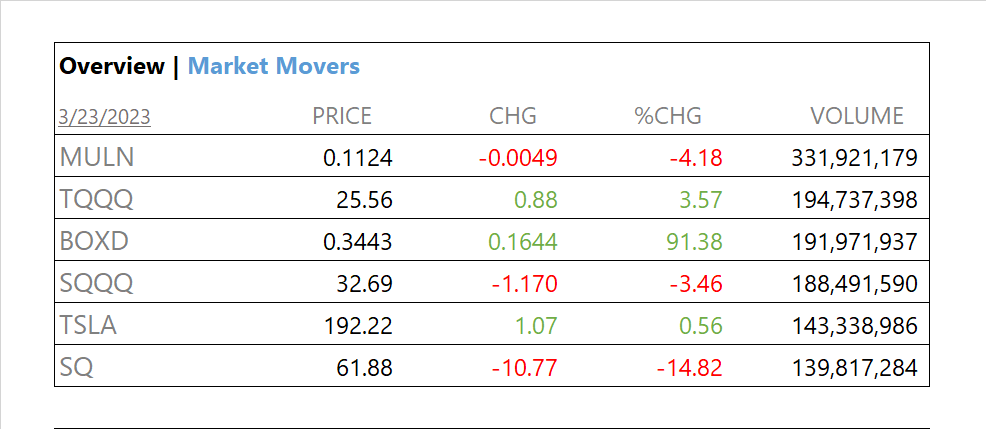

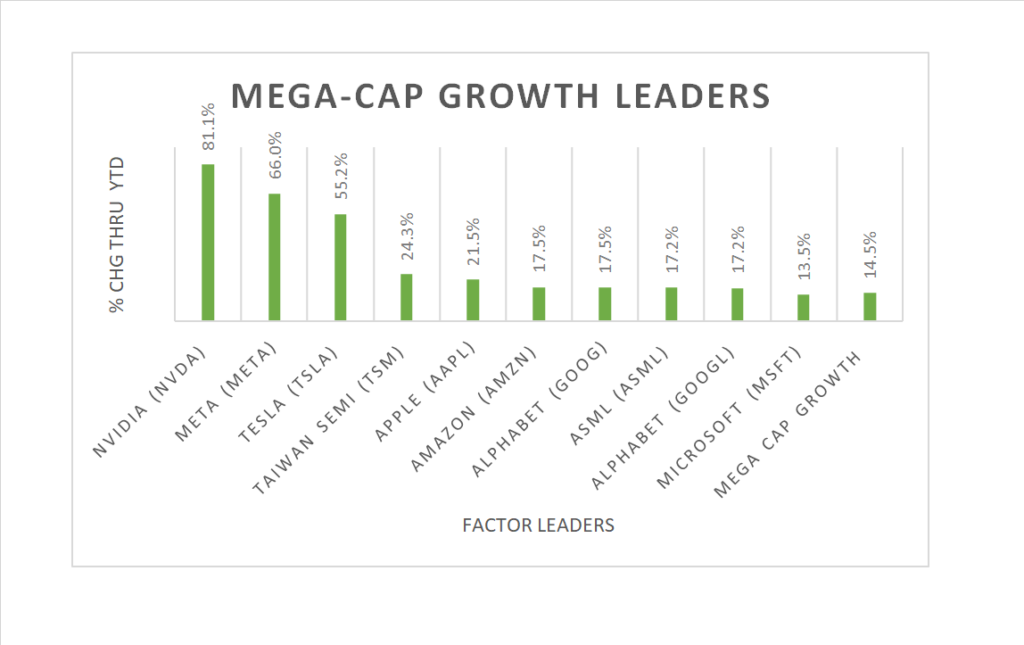

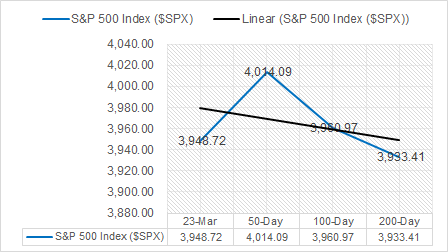

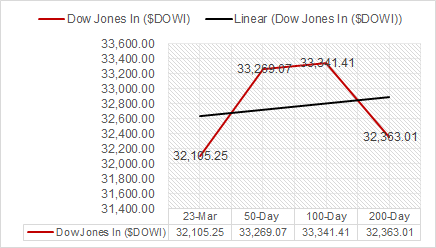

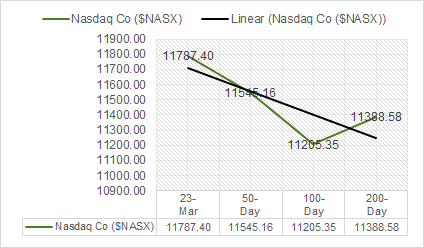

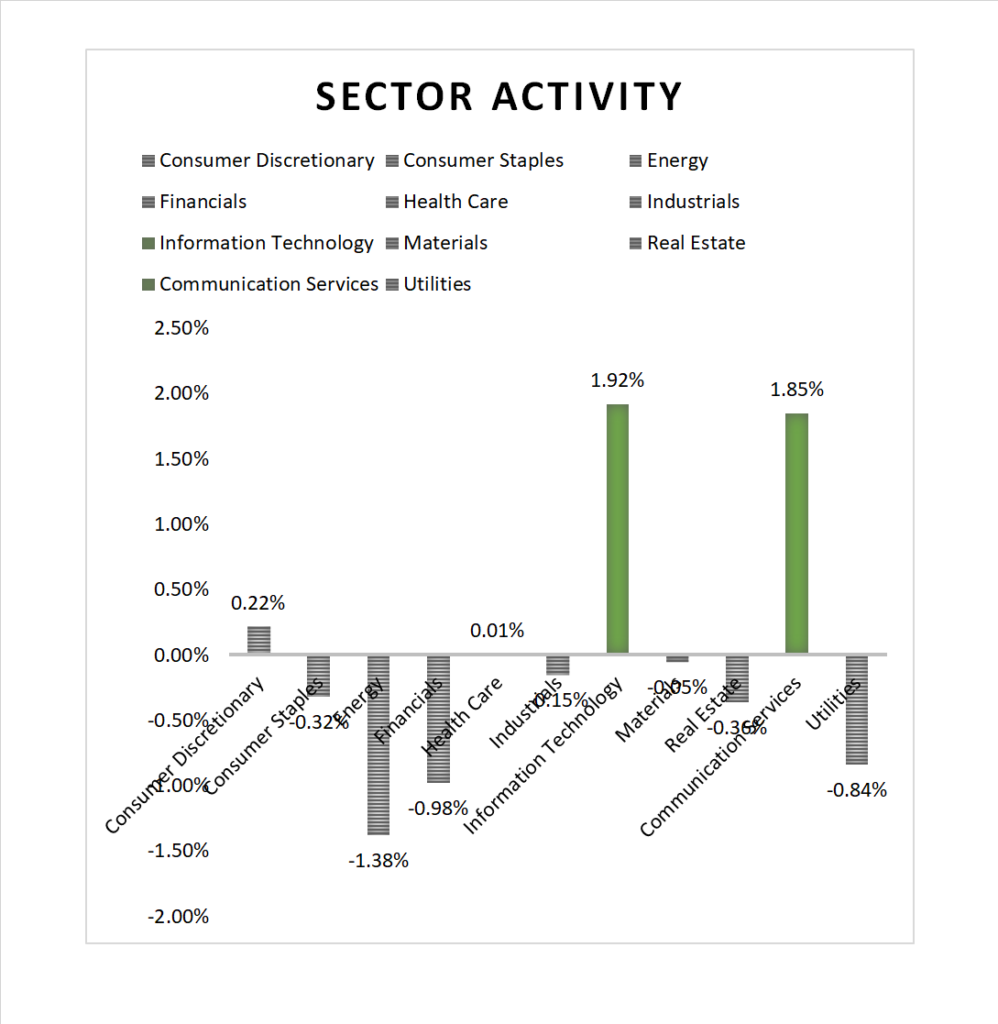

In US Markets today, Indices rally late ending higher, the S&P 500 closed at 3949, ahead of 200d ma. Tech leads with NY Fang+ up +2.5% on the day (mega cap chart below). 7 of 11 of the S&P 500 sectors were lower with Energy -1.38% and Financials -0.98% as the biggest decliners while Information Technology +1.92%, outperforms. Yields drop, Oil futures fall, USD Index up, Bitcoin top $28k again and Gold rises. Pro top – watch Copper and Lithium!

In economic news, Initial jobless claims data form the US labor markets indicate the labor market it still tight and housing market continues to decline (details below).

Takeaways

Equities rally late and hold gains

- Key Indices close moderately higher, Nasdaq and Fang+ lead

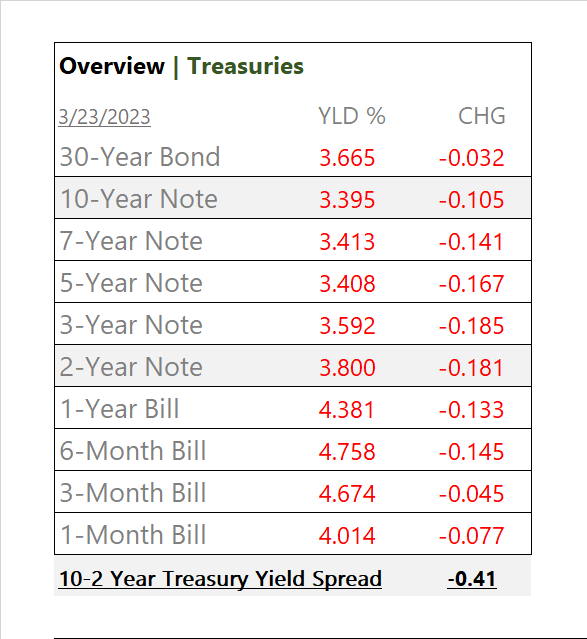

- Yields decline across the curve

- 7 of 11 of the S&P 500 sectors were lower/Energy, Financials underperform

- Fear & Greed index rating = 34/ Fear

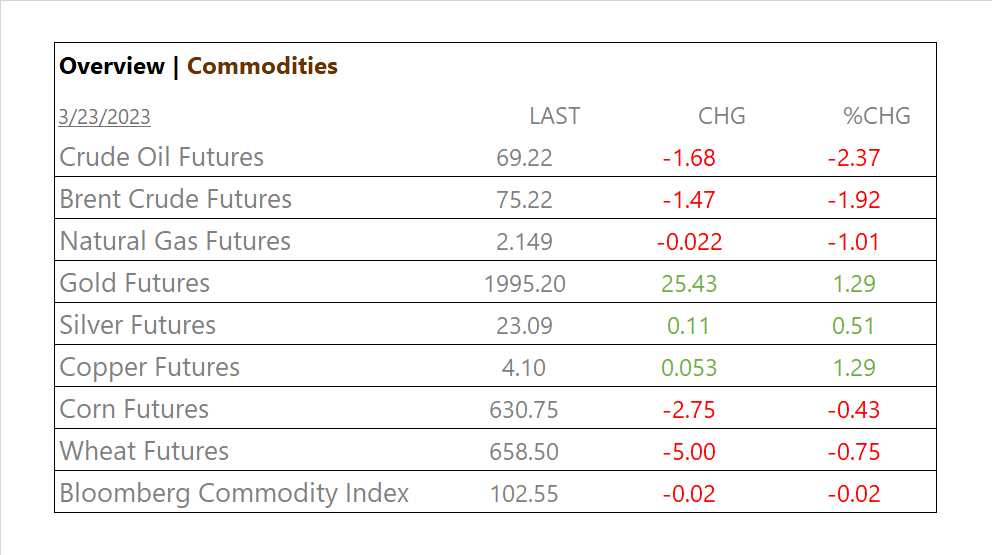

- Bloomberg Commodity Index, flat

- Crude Oil Futures sink

- Bitcoin regains +$28k

- Gold/ Silver, up

- USD Index, up

- Fed to release weekly Balance Sheet update

- Initial jobless claims data form the US labor markets indicate the labor market it still tight and housing market continues to decline

Last word, Tech, tech and more tech as mega cap growth continues drive the upside of the market. Who would have guesses that NVDA would be up +81% YTD even in the midst of a banking crises. Figure that investors are counting on AI in solving for future Banking policy and governance. Pro tip – use mega cap market momentum and ride the wave!

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 7 of 11 of the S&P 500 sectors were lower/Energy -1.38%, Financials -0.98% underperform/ Information Technology +1.92%, Communication Services +1.85% outperform

Commodities

US Treasuries

Economic Data

US

- Initial jobless claims; period March 18, act 191,000, fc 198,000, prev. 192,000

- Continuing jobless claims; period March 11, act 1.69m, – , prev. 1.68m

- New home sales; period Feb., act 640,000, fc 650,000, prev. 633,000

- Summary: Initial jobless claims 192,000 for the week ending March 18 unexpectedly came in better than the market expectation of 201,000 and continue indicate a tight labor market. Continuing jobless claims increased to 1.694m in the week ending March 11 from 1.68m in the previous week.

Tomorrow; Global flash U.S. PMI’s (important)

News

Company News/ Other

- TikTok congressional hearing: CEO Shou Chew grilled by US lawmakers – Reuters

- Yellen, caught between financial markets and US Congress, pleases neither – Reuters

Central Banks/Inflation/Labor Market

- Odds Improving for Congress to Strike a Deal on FDIC Cap, Key US Senator Says – Bloomberg

- Bank of England Raises Rates Again as Inflation Persists – NY Times

- Why the Fed’s Decision Matters for Biden – NY Times

China

- US ‘almost certain to sanction’ more Chinese firms after Xi-Putin meeting – South China Morning Post

Market Outlook and updates posted at vicapartners.com