Stay Informed and Stay Ahead: Research, January 6th, 2025

Insights That Redefine Market Dynamics

The cybersecurity sector is no longer a support function; it now underpins competitive differentiation and profitability. For enterprises, it is increasingly essential for growth and operational security. In 2025, the sector faces growth driven by rising cyber threats, decentralized IT systems, and geopolitical risks. For CEOs and institutional investors, success in this evolving landscape requires granular insights into revenue drivers, profitability, and key growth areas.

As a partner to leading funds and executives, this analysis provides market-driven insights to support strategic decision-making. While this report reflects insights from ongoing projects, all data and recommendations shared adhere strictly to legal and ethical disclosure standards. By providing focused insights essential for market leadership, this article aims to guide executives in identifying and capturing emerging opportunities.

Key Subcategories Driving the $300 Billion Market

The cybersecurity sector is projected to exceed $300 billion in Total Addressable Market (TAM) by the end of 2025. Below are the six critical subcategories shaping the industry, with precise data points on revenue, margins, and strategic opportunities:

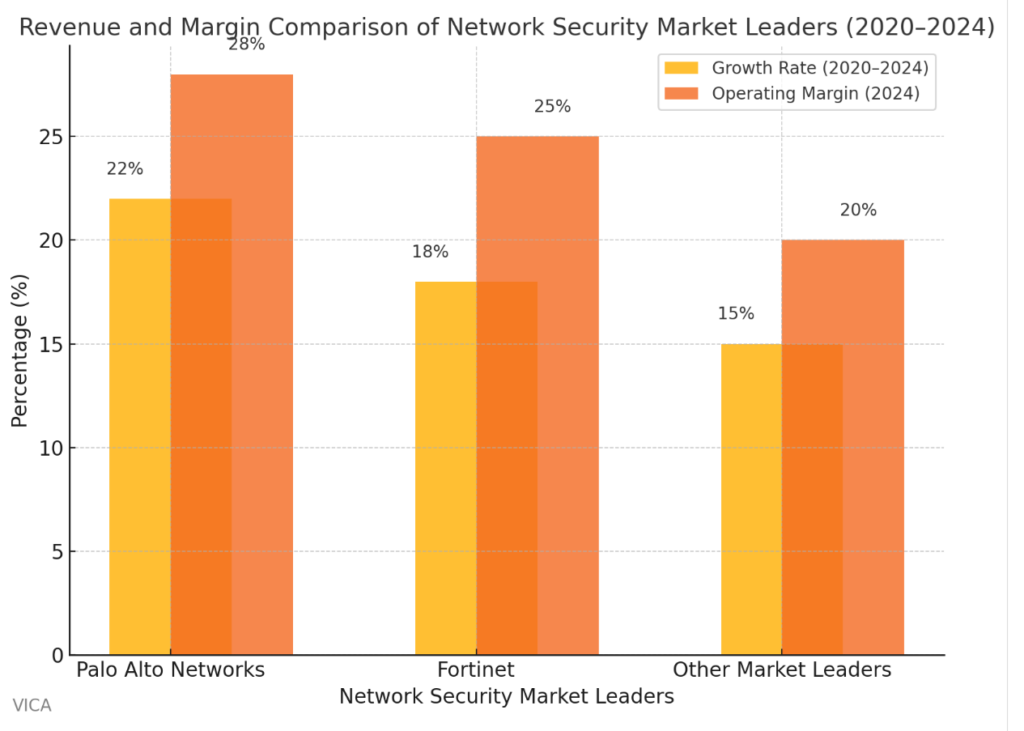

- Network Security

2024 Revenue: $25 billion

Operating Margins: 25–30%

- Key Insight: AI-powered intrusion prevention and next-generation firewalls (NGFWs) are redefining market standards. Companies excelling in automation and low-latency solutions will dominate. CEOs should prioritize investments in AI-driven threat detection systems capable of real-time anomaly analysis and automated incident response. Additionally, solutions with sub-millisecond latency for high-frequency data transfer, particularly in hybrid cloud environments, will be key differentiators.

- Market Leaders: Palo Alto Networks, Fortinet.

Illustration: Highlights opportunities in automation-focused solutions and low-latency platforms for hybrid environments.

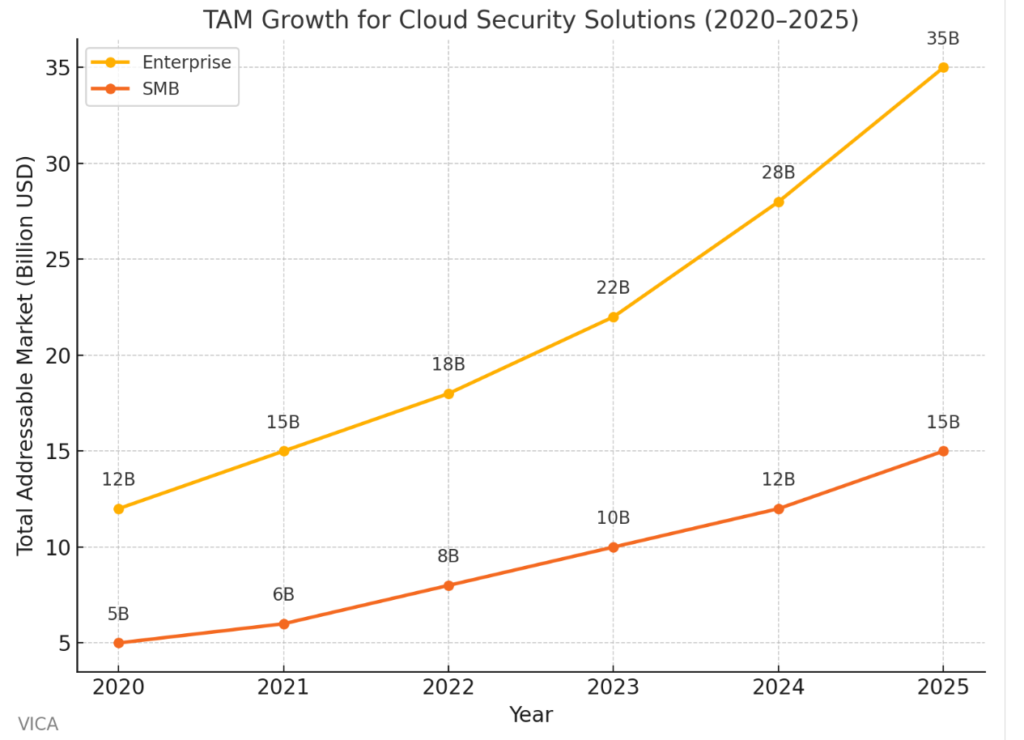

- Cloud Security

2024 Revenue: $22 billion

Operating Margins: 30–35%

- Key Insight: Hybrid cloud adoption and zero-trust architectures support enterprise growth by mitigating security risks, optimizing IT costs, and enabling scalable operations. Partnerships with AWS, Azure, and Google Cloud are key differentiators.

- Market Leaders: Zscaler, CrowdStrike.

Illustration: Demonstrates the growing demand for zero-trust solutions in hybrid cloud ecosystems.

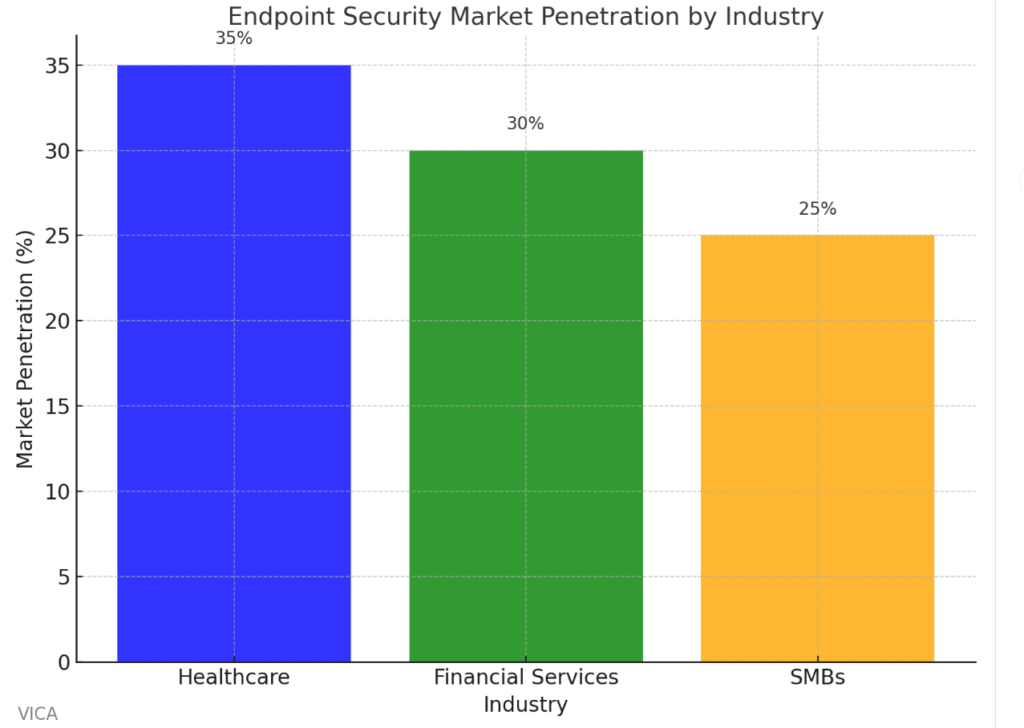

- Endpoint Security

2024 Revenue: $15 billion

Operating Margins: 20–25%

- Key Insight: Remote work and IoT proliferation are driving demand for integrated endpoint and cloud security solutions.

- Market Leaders: CrowdStrike, Microsoft.

Illustration: Highlights industries with the highest vulnerability to IoT-related threats and remote work risks.

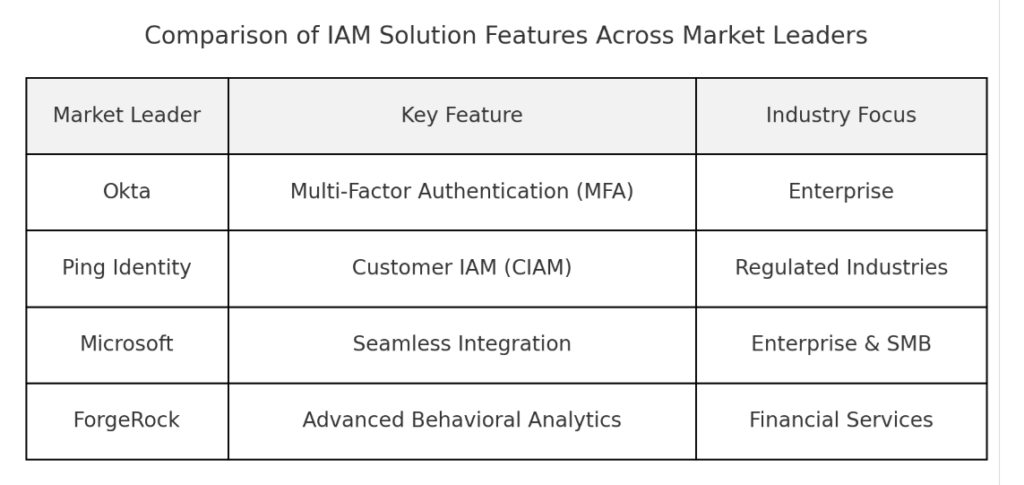

- Identity and Access Management (IAM)

2024 Revenue: $10 billion

Operating Margins: 20–22%

- Key Insight: Tightening regulatory frameworks demand IAM solutions with Single Sign-On (SSO), Multi-Factor Authentication (MFA), and behavioral analytics.

- Market Leaders: Okta, Ping Identity.

Illustration: Identifies the alignment between specific features and compliance with tightening regulations.

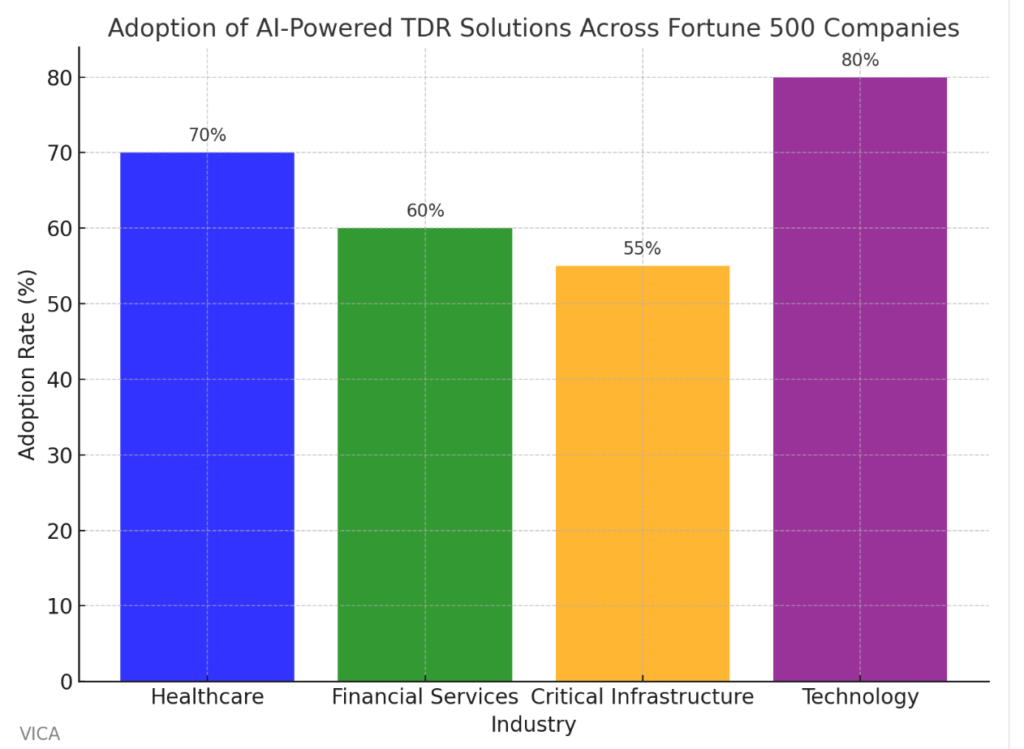

- Threat Detection and Incident Response (TDR)

2024 Revenue: $12 billion

Operating Margins: 25–28%

- Key Insight: AI and machine learning are pivotal for real-time threat mitigation. The next wave of growth will focus on incident response automation.

- Market Leaders: SentinelOne, FireEye (Mandiant).

Illustration: Shows which industries are investing most heavily in real-time threat detection to mitigate escalating risks.

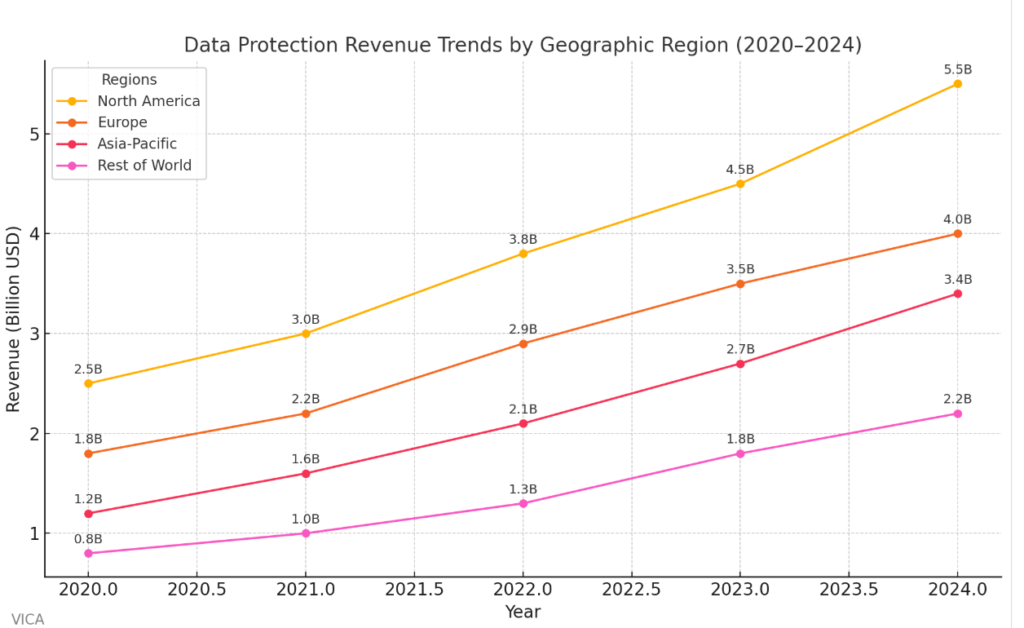

- Data Protection

2024 Revenue: $8 billion

Operating Margins: 28–30%

- Key Insight: Regulatory compliance (e.g., GDPR, CCPA) is accelerating demand for encryption, DLP, and backup solutions. Long-term contracts provide stable revenue streams.

- Market Leaders: Symantec, IBM.

Illustration: Highlights regulatory-driven demand in Europe and North America as key growth drivers.

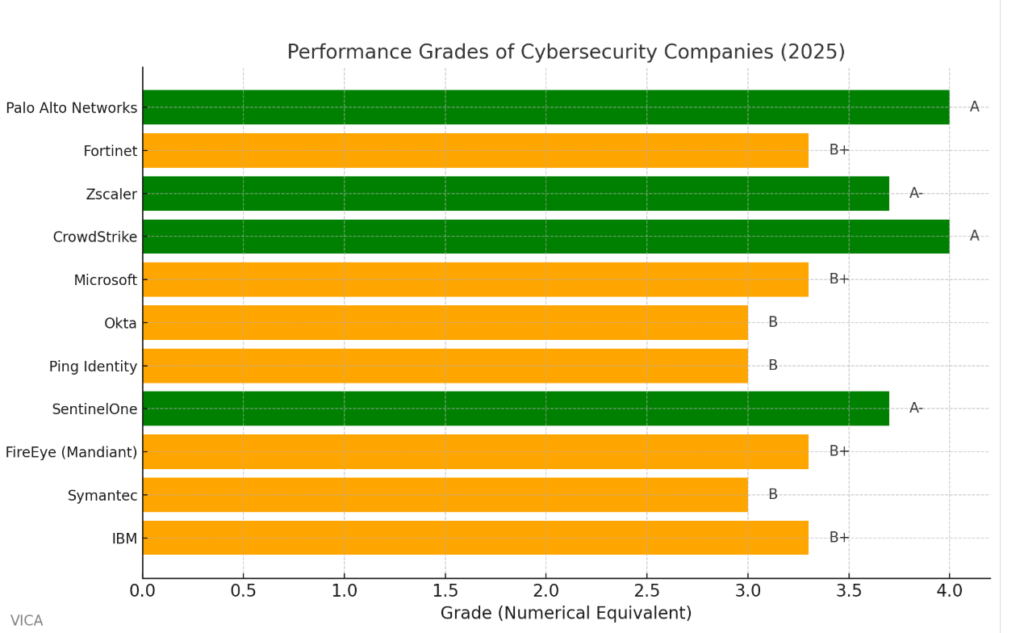

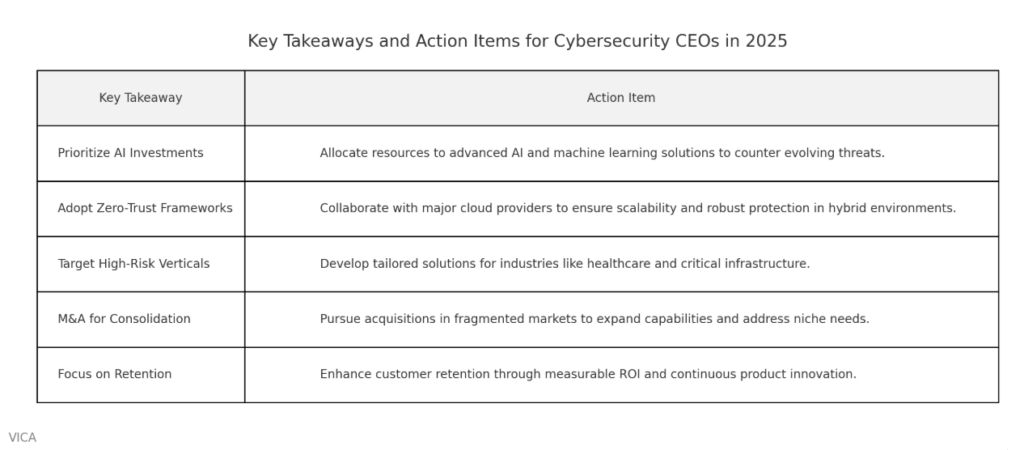

Strategic Recommendations for Cybersecurity CEOs

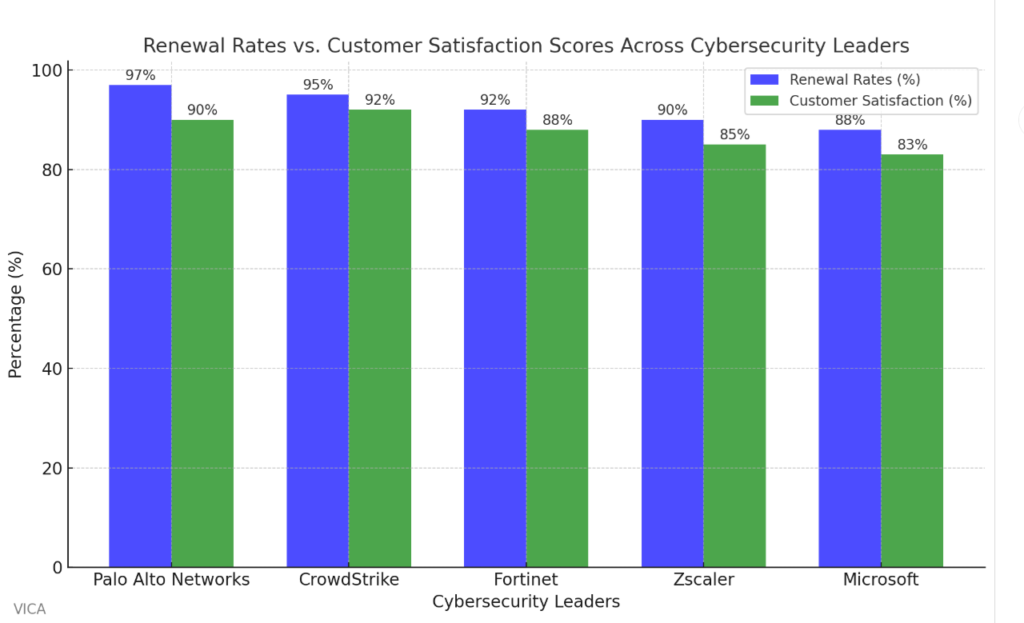

Illustration: Highlights how major players like Palo Alto Networks and CrowdStrike are leading the market, while others like Fortinet and Okta have room for improvement. This provides actionable insights for benchmarking and strategic positioning.

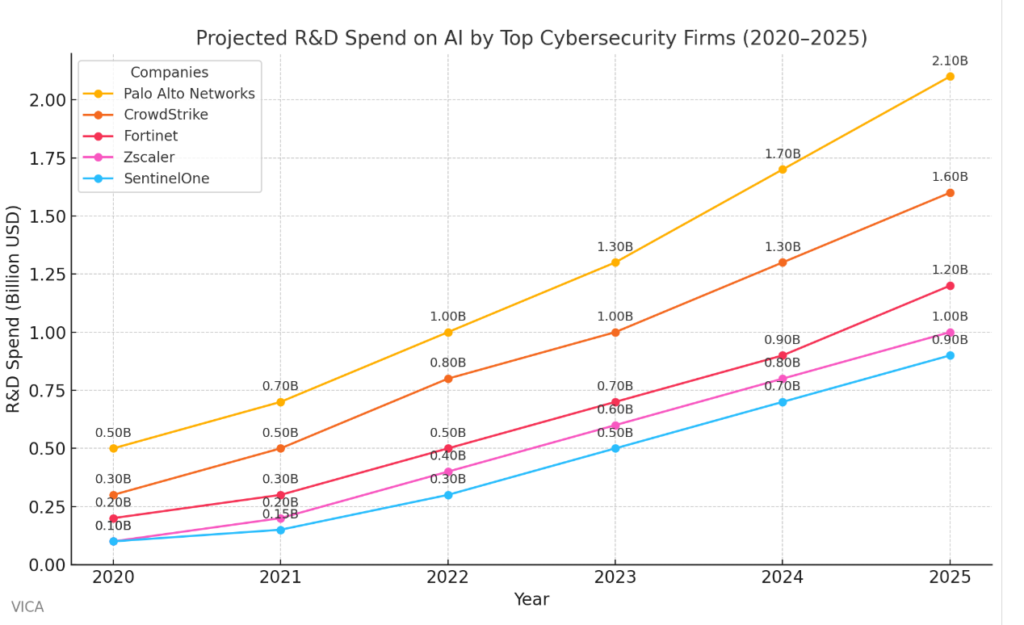

- Accelerate AI and Automation Investments

AI-driven threat detection and response capabilities are non-negotiable for competitive advantage. R&D budgets must prioritize machine learning algorithms tailored to specific verticals such as healthcare and critical infrastructure.

Illustration: Indicates the correlation between AI investments and competitive positioning in threat detection and automation.

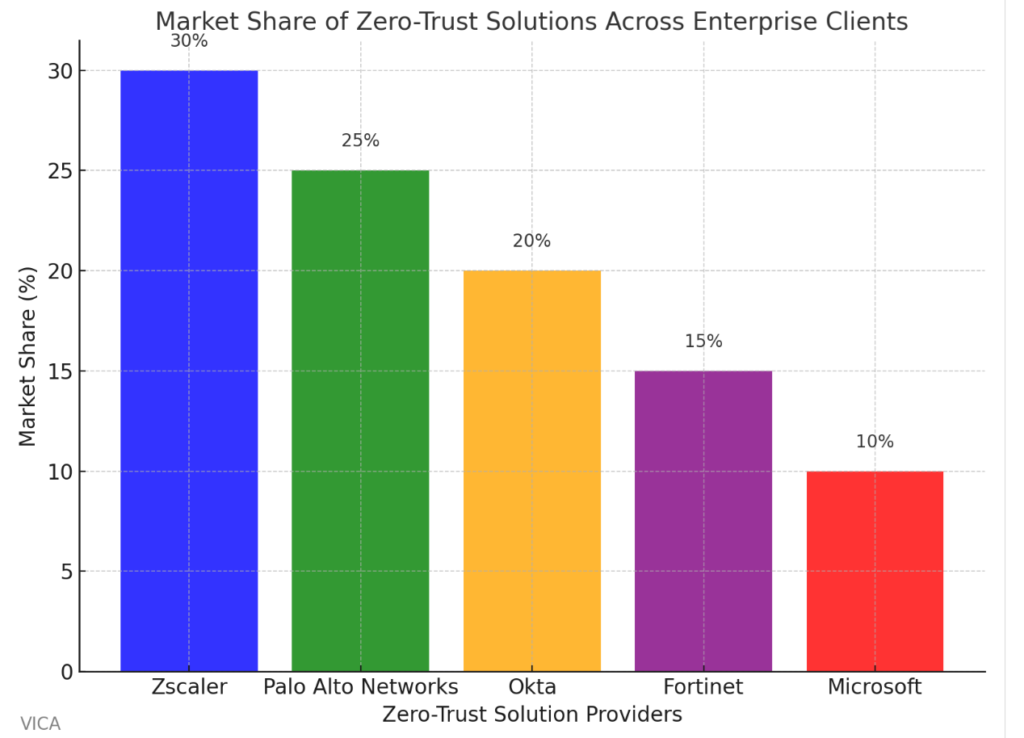

- Embrace Zero-Trust Frameworks

The shift to hybrid cloud environments is accelerating the adoption of zero-trust architectures. Partnerships with hyperscalers like AWS and Microsoft Azure will secure long-term market leadership.

Illustration: Highlights the competitive advantage of aligning with cloud providers to deliver scalable zero-trust frameworks.

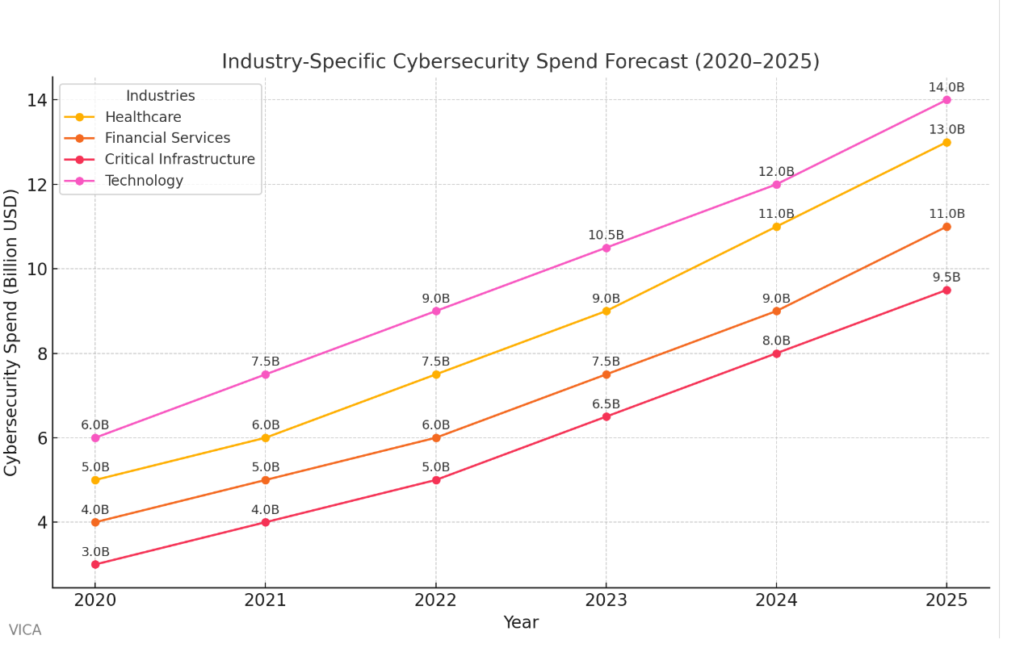

- Focus on High-Growth Verticals

Healthcare, financial services, and critical infrastructure represent underserved but high-risk markets. For example, the healthcare sector has seen a 125% rise in ransomware attacks over three years, while financial services face increasing regulatory demands and needs for real-time transaction security. Critical infrastructure, meanwhile, remains vulnerable to state-sponsored cyberattacks, underscoring the urgent need for tailored, robust solutions. Tailored solutions for these industries could generate exponential growth.

Illustration: Underscores the urgent need for tailored solutions in healthcare and critical infrastructure.

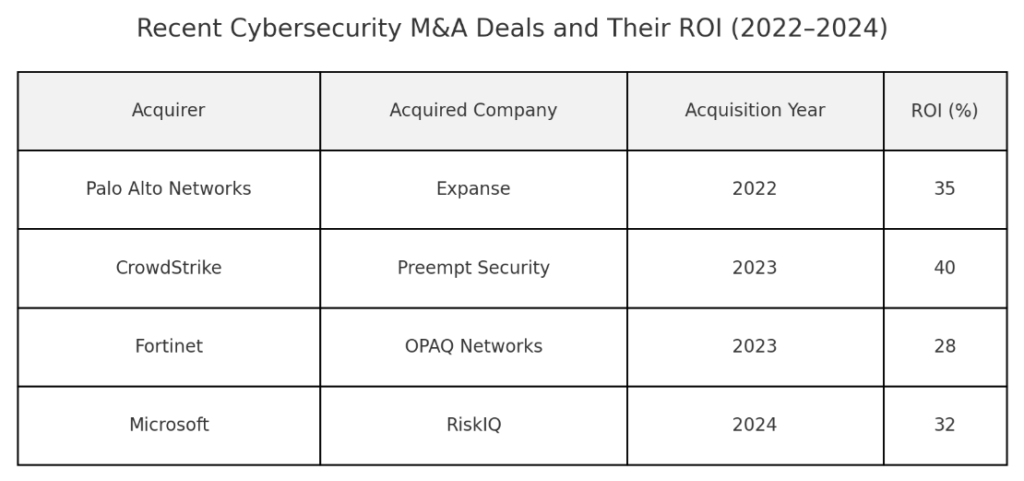

- Scale Through Acquisitions

Fragmented subcategories like CIAM, IoT security, and advanced data protection are ripe for consolidation. CEOs should prioritize acquisitions that strengthen existing product portfolios.

Illustration: Shows which acquisition strategies are delivering the highest returns in fragmented subcategories.

- Drive Customer Retention with Measurable ROI

Subscription-based revenue models with high renewal rates will be critical for sustained growth. For instance, CrowdStrike’s subscription-based Falcon platform boasts a 97% customer retention rate, driven by its continuous updates and integration across endpoints. This retention rate supports stable revenue growth, setting a standard for the industry. Companies that demonstrate clear cost savings or revenue generation for enterprise clients will lead the pack.

Illustration: Demonstrates the direct link between customer-centric models and sustained revenue growth.

Conclusion

2025 is a make-or-break year for cybersecurity companies aiming to capitalize on a $300 billion market opportunity. Firms like Palo Alto Networks, CrowdStrike, and Zscaler are redefining the competitive landscape with AI, automation, and zero-trust strategies.

To achieve market dominance, CEOs and institutional investors must execute three key steps: invest aggressively in disruptive innovation, forge strategic alliances with hyperscalers and niche players, and prioritize measurable ROI for enterprise clients to secure long-term growth. The companies that invest in these pillars will not only lead the sector but redefine its value proposition for years to come.

Illustration: Provides a concise roadmap for prioritizing high-ROI strategies in a competitive market.