VICA Partners, June 9, 2025

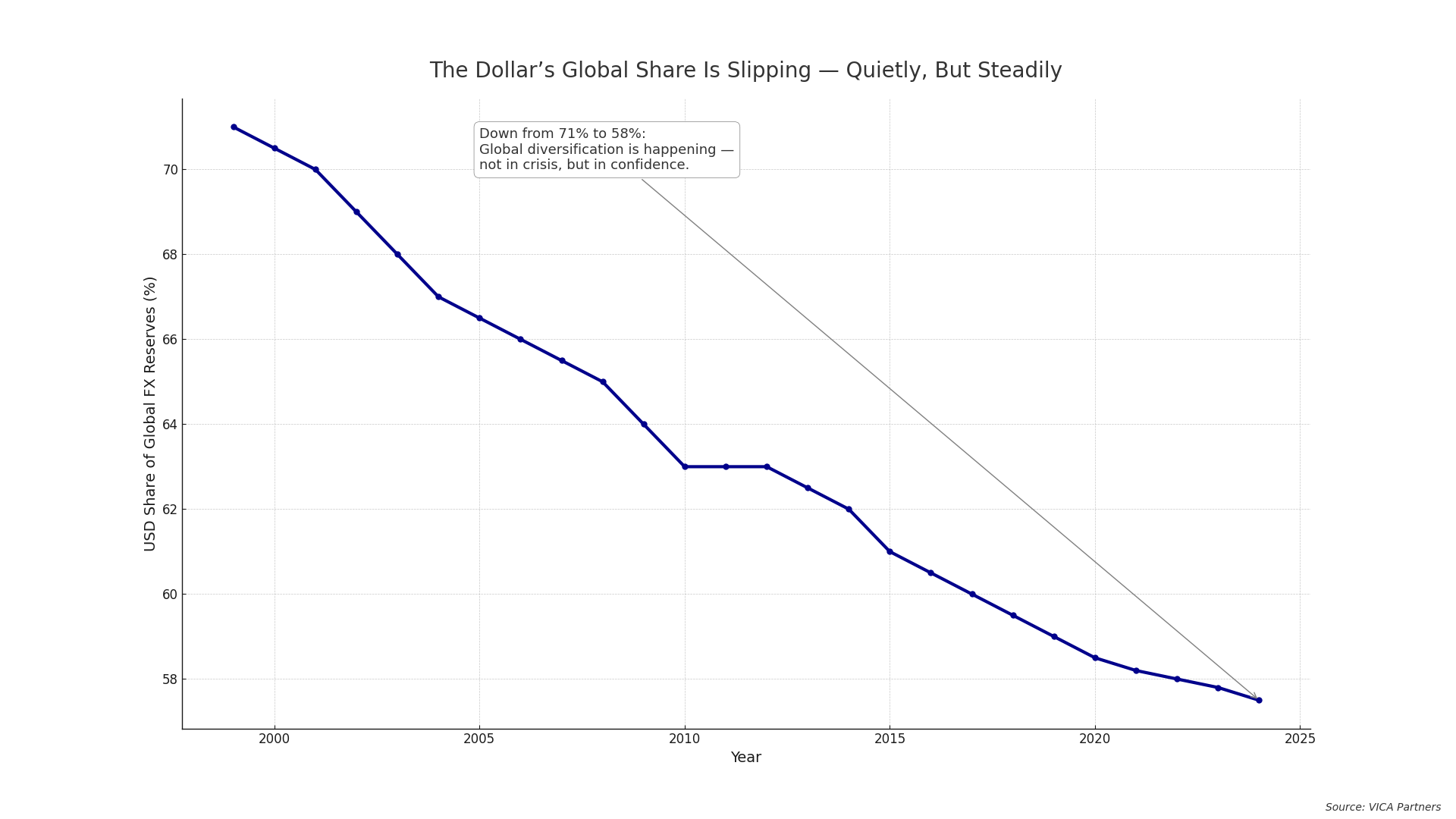

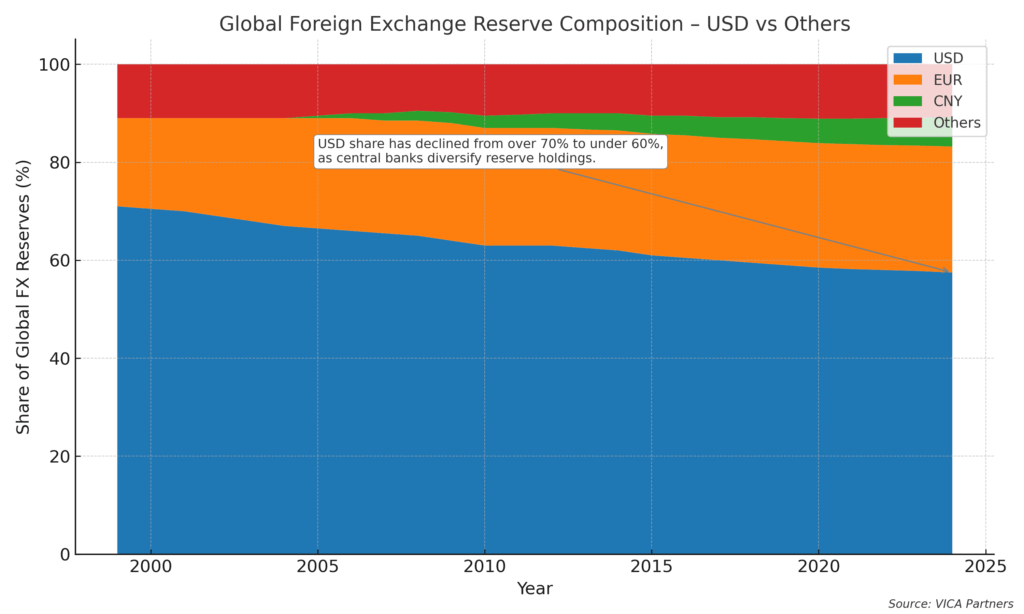

The dollar’s reserve share has slipped from 71% to 58%. This isn’t collapse — it’s erosion. The world diversifies against confidence, not currency.

The Familiar Warning — and the Flawed Assumption

A familiar argument is making the rounds again: that America’s persistent trade deficits will eventually bring the dollar to its knees. The premise is simple — the U.S. imports too much, exports too little, and borrows the difference. At some point, foreigners will grow tired of funding this imbalance, and the global financial system will pivot away from the dollar.

It’s a tidy story. And it’s wrong.

The U.S. trade deficit is not the issue. It never was. The true risk lies in assuming that the dollar’s strength is inevitable — regardless of policy volatility, fiscal drift, or institutional erosion. The danger isn’t collapse. It’s slow, quiet slippage — the kind that only becomes obvious when it’s too late to reverse.

Trade Imbalances Aren’t Fatal — But They Aren’t Free

America has been running trade deficits for decades while maintaining its status as the world’s financial anchor. That’s because global investors haven’t just been buying goods — they’ve been buying into the U.S. system: its legal framework, its innovation engine, its political stability.

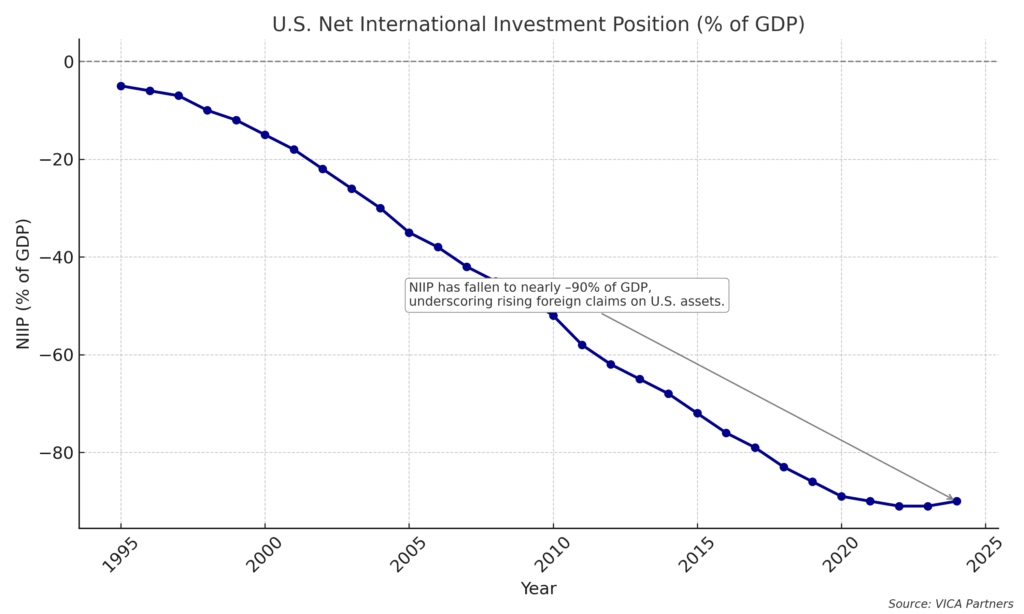

But persistent deficits still matter. They accumulate into something deeper: a growing pile of foreign claims on U.S. assets. This exposure is benign only as long as trust in the U.S. remains unshaken. The moment that trust starts to fray — the moment foreign capital senses institutional dysfunction — those inflows can slow or reverse.

America’s net external position has deteriorated to nearly –90% of GDP — a structural vulnerability that no reserve currency can ignore.

Confidence, Not Cash, Is the Anchor

The dollar’s strength has never just been about interest rates or trade flows. It’s about belief — the belief that the United States will manage its finances, honor its commitments, and behave like a predictable steward of global capital.

That belief is still intact. But it’s no longer unquestioned.

Recent swings in trade policy, proposals to penalize foreign investors, and fiscal brinksmanship in Washington all chip away at the core advantage the dollar holds: credibility.

What Actually Holds the Dollar Up

It’s tempting to credit U.S. tech giants or yield spreads for the dollar’s resilience. But those are transitory. The real foundation is institutional: contract enforcement, transparency, and the scale of U.S. capital markets.

Reserve currencies don’t fall when another one rises. They fall when the issuing country stops behaving like a safe store of value. The signs don’t begin with a crash. They begin with diversification.

The dollar’s share of global reserves has declined steadily — not because of crisis, but because of prudence. Reserve managers are quietly hedging against uncertainty.

This Is a Stewardship Test — Not a Currency War

There’s no urgent need to close the U.S. trade gap. But there is a critical need to reinforce the pillars that keep the dollar trusted: coherent policy, fiscal credibility, and legal predictability.

None of this requires a reinvention. It requires a return to seriousness — a recognition that the global financial system still runs through the U.S., and that such a privilege comes with expectations.

Conclusion: Strength Without Strategy Is Fragile

The dollar is not in decline — but the conditions that support it are quietly weakening. What’s eroding isn’t the currency. It’s the confidence behind it.

And in a reserve system built on belief, confidence is everything.