MARKETS TODAY March 27th, 2023 (Vica Partners)

Good Afternoon,

Last Week, The Fed, as expected raised rates by 25bps. Markets moved higher following but shortly pulled-back on news that no ’23 rate cuts were discussed. The S&P 500 closed <2.5%> off Friday session highs reversing most of the gains for the week.

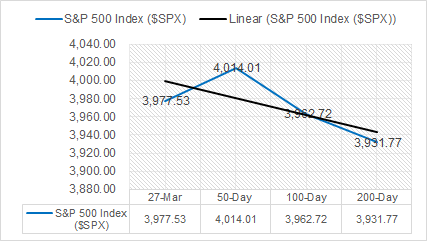

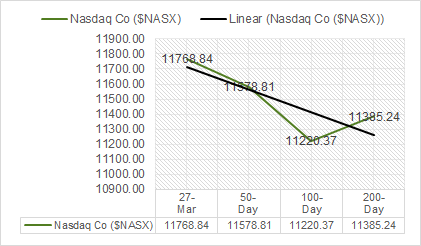

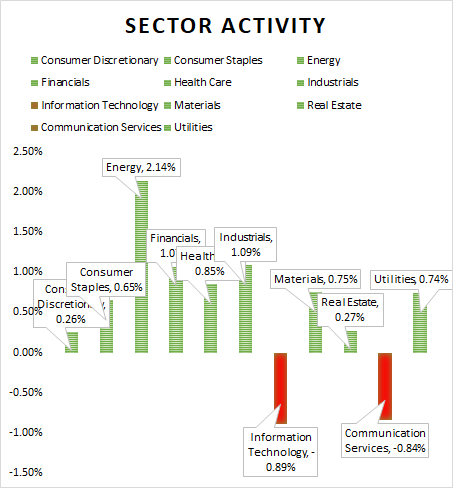

For the week the S&P 500 was up 1.5% with outperformance by the mega-caps. The NYSE FANG+ was +3%, and trading at February highs >30% YTD. Information Technology continued to outperform and Energy and Materials were both up >2% with Real Estate and Utilities both off by <1.5%>.

Overnight, Asian markets finished mixed as the Nikkei 225 gained 0.33%, while the Hang Seng led the Shanghai Composite lower. They fell 1.78% and 0.44% respectively.

Premarket, European markets finished higher today with shares in Germany leading the region. The DAX was up 1.14% while France’s CAC 40 up 0.90% and London’s FTSE 100 up 0.90%. Pre-Us market, the DOW and S&P futures were trading moderately at about .3% above fair value with the Nasdaq below.

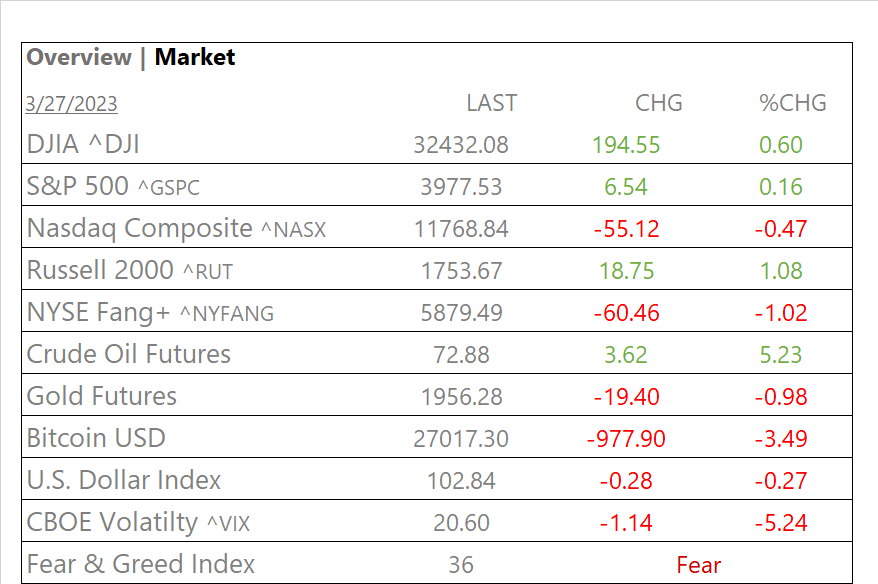

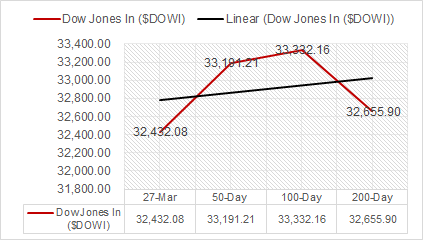

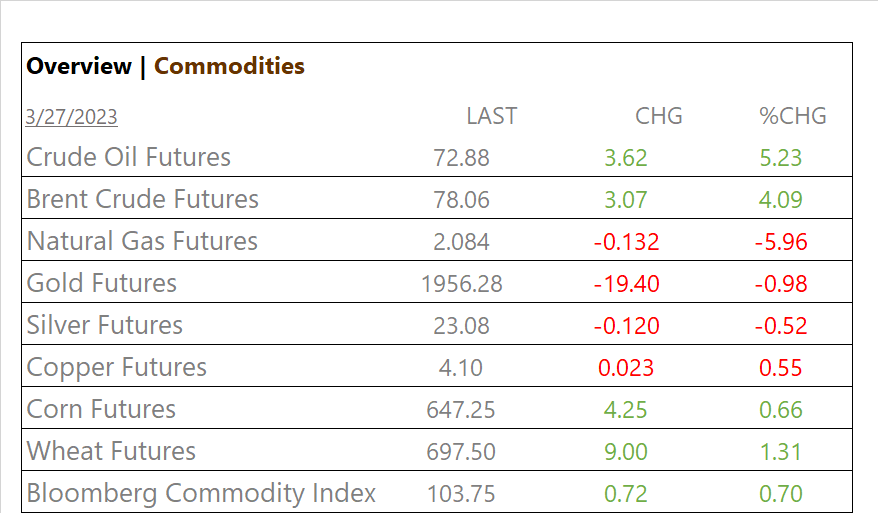

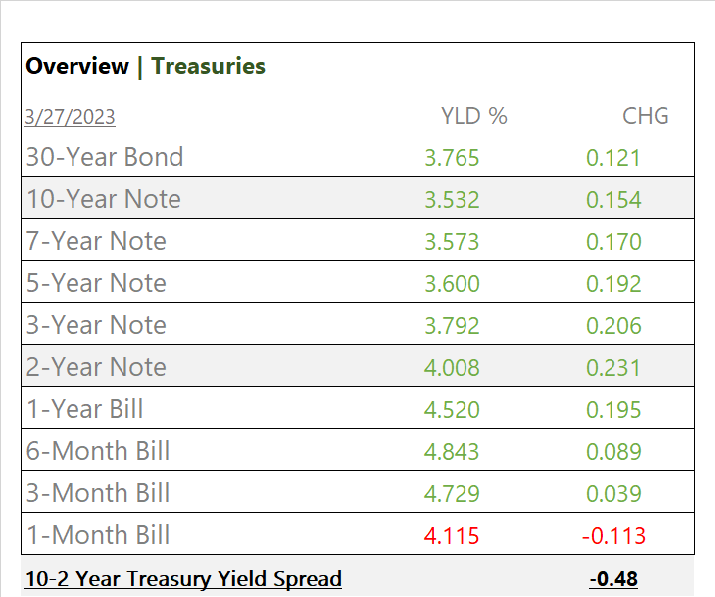

In US Markets today, Indices ended mixed Monday with DOW leading, closing at 32,432 and moving back towards its 200d ma (32,656). 9 of 11 of the S&P 500 sectors were higher/ Energy, Industrials and Financials were all up >2% while tech/ mega-cap-growth lagged. Yields rose sharply across the curve, while Oil futures jumped >4% and the Bloomberg Commodity Index was up. USD Index, Bitcoin and Gold all declined.

In economic news, the Dallas Fed Manufacturing Index declined in March missing analyst expectations while Dallas Fed Production Index improved. Congressional Hearings on failed banks begin tomorrow.

Takeaways

- Energy and Financials rally while Tech and Mega Caps drag

- SPDR S&P Bank ETF +2.2%

- Yields rise across the curve

- Key Indices close mixed, DOW and Russell 2000 lead

- 9 of 11 of the S&P 500 sectors were higher/ Energy, Industrials, Financials outperform

- Fear & Greed index rating moderating = 36/ Fear

- Bloomberg Commodity Index rises

- Crude Oil Futures rally >4%

- Bitcoin/ Gold down, USD Index down

Last word, US policy decisions have an effect on returns and volatility of stocks. Oddly enough, rulings and negative press can favor those that’s it’s levied against. Last Year the US administration went after Big Oil over high gas pump prices. Following the negative press and stock price volatility the sector went on to record breaking profits and ended +59%. In mid March ’23 fuel inventories have fallen again and this time by 4.587 million barrels. Watch for it… its coming!

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 9 of 11 of the S&P 500 sectors were higher. Energy +2.14%, Industrials +1.09% outperform/ Information Technology -0.89% and Communication Services -0.84% underperform.

Commodities

US Treasuries

Economic Data

US

- Dallas Fed; Dallas Fed Manufacturing Index declined from -13.5 to -15.7, missing analyst expectations. Dallas Fed Production Index improved from -2.8 to 2.5. The Dallas Fed Manufacturing Index has been in the negative for 11 months.

News

Company News/ Other

- First Citizens to Buy SVB After Biggest Failure Since 2008 – Bloomberg

- How First Republic’s courtship of the wealthy led to meltdown – Reuters

- Oil rises over $3 on Kurdistan export halt, banking optimism – Reuters

Central Banks/Inflation/Labor Market

- Eurozone Banks Cut Lending Even Before Latest Financial Turmoil – WSJ

- Fed’s Preferred Inflation Gauge Seen Staying Elevated – Bloomberg

China

- Jack Ma: Alibaba founder seen in China after long absence – BBC

Market Outlook and updates posted at vicapartners.com