Stay Informed and Stay Ahead: Research, December 24th, 2024

Assessing the Challenges and Opportunities in Sustainable Investing for Today’s Investors

On a foggy Thursday morning in San Francisco, the Yerba Buena Center was filled with a mix of familiar faces—venture capitalists, journalists, and startup founders. But what set this event apart was the unexpected presence of finance executives and risk managers, typically more skeptical of the Silicon Valley sheen. They were here for AI for Sustainable Futures, a conference that promised to explore whether AI could really solve the complex, often contentious world of ESG (Environmental, Social, and Governance) investing.

The keynote speaker, a young, confident Stanford PhD in physics, presented a vision of AI-driven ESG analysis that sounded almost utopian. Terms like “Revolutionary ESG Optimization” and “Real-Time Climate Impact Scoring” flashed across the screen, promising a new era of investment that would be both profitable and ethically sound. Yet, as the event progressed, it became clear that while the narrative was captivating, the reality was far more complex—and far from settled.

Key Data: The ESG Landscape

ESG, S&P 500, and Market Volatility Analysis

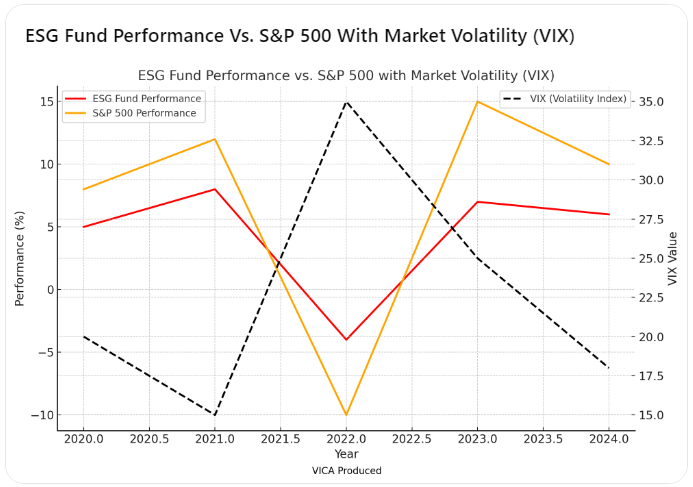

Chart 1: ESG Fund Performance vs. S&P 500 with Market Volatility (VIX)

Chart Insight: This chart compares the performance of ESG funds with the S&P 500, overlaid with market volatility (VIX). The data shows that ESG funds tend to underperform during periods of high volatility, as indicated by spikes in the VIX. While AI is touted as a potential solution for mitigating some of this risk, the underlying volatility of the market remains a significant challenge for ESG investments, especially in turbulent times.

Past Fund Performance vs. Market Benchmarks

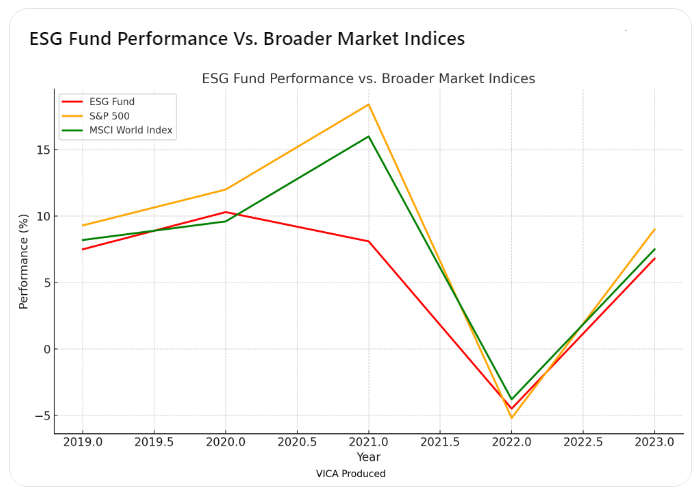

Chart 2: ESG Fund Performance vs. Broader Market Indices

Chart Insight: This chart illustrates the historical performance of ESG funds relative to broader market indices, like the S&P 500 and MSCI World Index. The data reveals that while ESG funds often underperform in strong market years, they tend to provide protection during downturns. This reinforces the idea that ESG funds can offer downside risk mitigation but may not always deliver the same high returns as traditional market benchmarks.

Looking at the historical performance of ESG funds, it’s clear that they often lag behind traditional market indices, like the S&P 500, in most years. In fact, ESG funds typically offer protection only during market downturns, where their conservative tilt helps minimize losses. AI is touted as a potential game-changer here, but whether it can fundamentally alter this trend is still uncertain.

The AI Hype: Too Good to Be True?

The young speaker continued, presenting a heatmap of “Climate Impact Zones” overlaid with portfolio allocations. The audience was impressed, some clearly ready to champion the AI revolution in ESG. But in the back, one finance professional could be heard quietly skeptical, questioning whether such a tool could actually be effective across industries that are notoriously inconsistent in their ESG reporting.

The promise of AI is appealing, but it remains unclear how much it can truly reshape the ESG landscape. The AI-driven ESG dashboard—promised as a tool for executives—looks sleek, but can it truly deliver the clarity it suggests? Theoretically, it could analyze large amounts of data and offer a holistic view of ESG performance. But in practice, the real question is whether the underlying data, which varies greatly across sectors, can provide actionable insights.

Simplified ESG Dashboard Illustration

This graphic visualizes a conceptual ESG analysis dashboard, showcasing the features such as a top navigation bar for sector and metric selection, a heatmap for ESG reporting inconsistencies, and a portfolio simulation tool. It highlights the potential of AI to provide clear, actionable insights for decision-makers. However, it also raises the question of how effectively these tools can be applied across industries with inconsistent data, challenging their true utility.

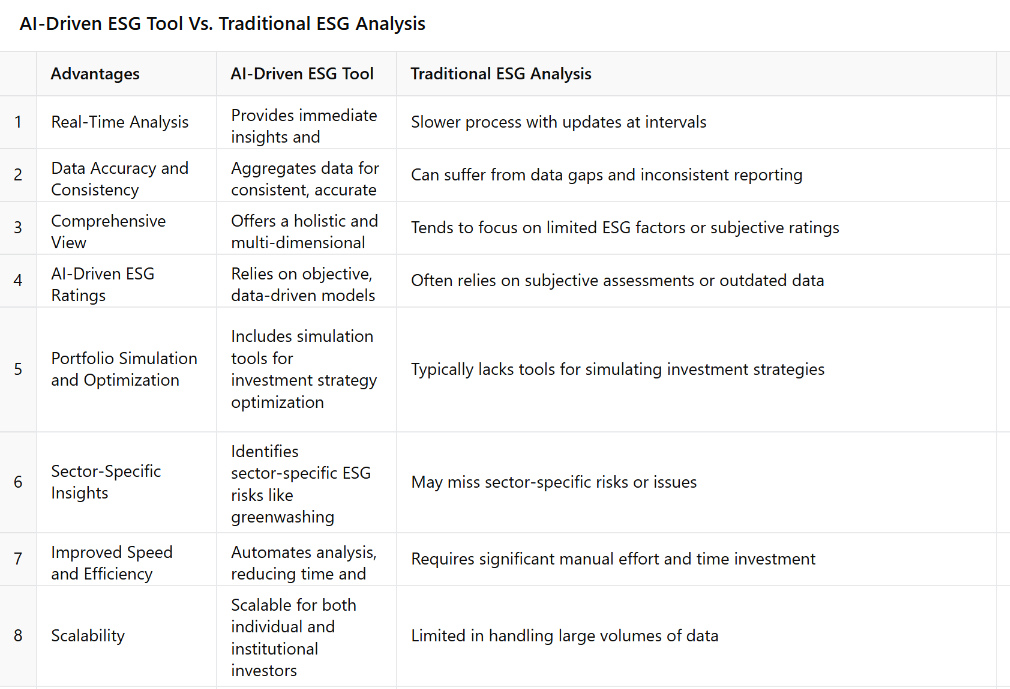

Risk Management: The View from Finance Teams

For finance professionals, the reality is more grounded. ESG isn’t a revolution—it’s a negotiation. The risks involved in ESG investing are real, and AI doesn’t provide an omniscient solution. While AI tools promise real-time transparency, the data they’re working with often lacks consistency and reliability. The narrative from the media doesn’t always match this reality, as they focus more on the promise of technology than the inherent challenges it faces in application.

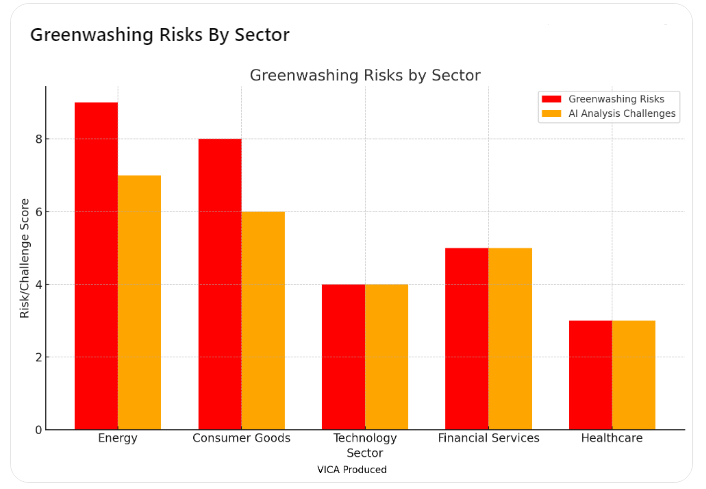

Greenwashing Risks by Sector

Chart 4: Greenwashing Risks by Sector

Chart Insight: This chart highlights the sectors most vulnerable to greenwashing, with higher risk scores in industries like Energy and Consumer Goods. These sectors often struggle with inconsistent ESG reporting, making it difficult for AI-driven tools to verify sustainability claims. The heatmap demonstrates how AI faces challenges in analyzing these sectors effectively, despite its potential for real-time insights. For investors, this means extra caution is needed when evaluating ESG claims, especially in sectors with high greenwashing risks.

Closing Thoughts: Media vs. Reality

As the conference wrapped up, the divide between media optimism and investor caution became clear. Journalists were eager to report on the AI revolution in ESG investing, while finance professionals remained focused on the practical issues—implementation costs, regulatory risks, and the ever-present concern of greenwashing. The media’s focus on the potential of AI often ignores the inherent limitations of the technology.

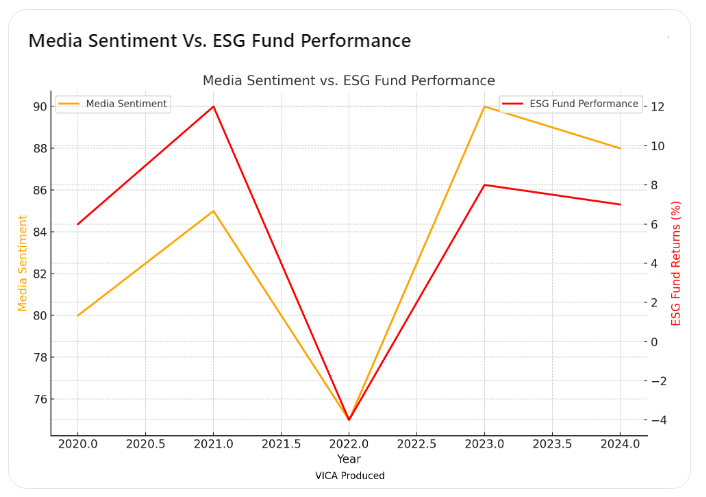

Chart 5: Media Sentiment vs. ESG Fund Performance

Chart Insight: This chart compares media sentiment with actual ESG fund returns. The data shows a clear disconnect between the two. Media sentiment often remains high, even during years when ESG funds underperform, as seen in 2022. This discrepancy highlights the gap between media narratives and real-world investment outcomes, suggesting that investors should approach ESG claims with a healthy degree of skepticism, relying on more than just media coverage when making decisions.

Recommendations for Investors

For investors, the key takeaway is clear: prioritize ROI and the fundamentals of sound investment strategy. While ESG-focused investments are attractive for their ethical appeal, they have not consistently outperformed traditional market indices. ESG funds tend to underperform during market upswings, though they may offer some downside protection during downturns. Investors should carefully assess the potential ROI of ESG strategies, factoring in both short-term volatility and long-term stability.

The risk of greenwashing remains a significant concern, particularly in sectors like energy and consumer goods. ESG claims must be scrutinized carefully, and real financial performance should be the guiding metric for any investment decision.

Investors should also consider market volatility—especially in the context of ESG investments—and how it impacts returns. Even if ESG narratives are positive, as the media often portrays them, the underlying market dynamics can have a much larger impact on performance.

In 2025 and beyond, the focus should remain on finding investments that deliver strong, reliable returns, regardless of the underlying ESG narrative. While aligning investments with ethical considerations is important, it should never come at the expense of solid ROI.